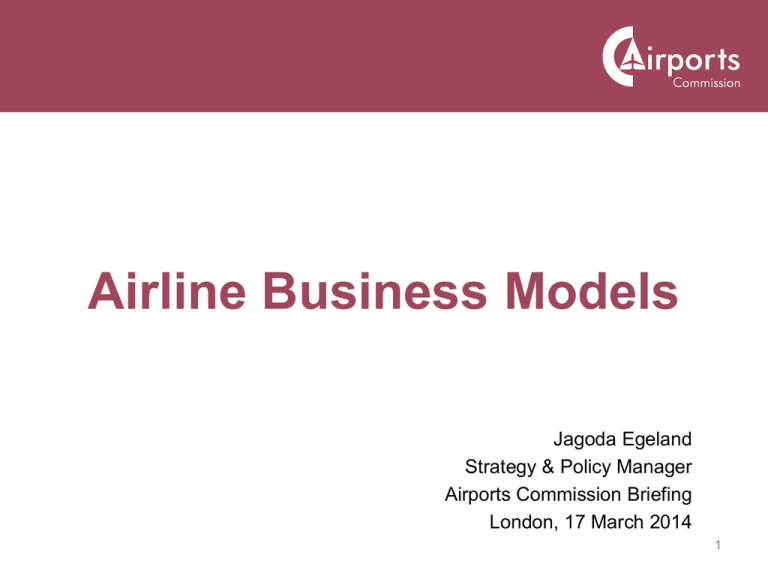

Airline-business-models

advertisement

Airline Business Models Jagoda Egeland Strategy & Policy Manager Airports Commission Briefing London, 17 March 2014 1 The global aviation sector: Two parallel trends • Consolidation, partnership & network integration (legacy carriers) • Budget travel, mostly offered by new entrants (low-cost carriers = LCCs) 2 Legacy carriers vs. low-cost carriers Legacy carriers Low-cost carriers Hub-and-spoke networks Point-2-point connections on the thickest or previously unserved routes A range of different aircraft (from 737 to A380) Small, efficient aircraft (737, A320) Based at hub airports, often close to large agglomerations Based at primary or secondary airports Branding, extensive route network, loyalty programmes Affordability, availability at secondary airports Short-haul and long-haul Predominantly short-haul Business and leisure Predominantly leisure 3 Currently, the three major alliances hold over half of global seat capacity… 4 …but most growth over recent years has been due to LCC expansion Passengers at UK airports by ELFAA membership, 1990-2012 Source: DfT analysis based on CAA airport statistics 5 This picture is constantly changing The AC is looking into factors that are driving that change • Regulation • New aircraft technology • Behaviour of aviation users 6 Regulation: Further consolidation or further expansion of LCCs? • Will restrictions on foreign ownership of airlines be relaxed over time and hence strengthen the alliances? • A global EU-US Open Skies agreement will be a chance for low-cost carriers to expand? 7 New aircraft technology: A long-haul low-cost revolution? • Will Boeing 787 and Airbus A350 facilitate low-cost dominance in the long-haul market or will they simply reconfirm the position of legacy carriers? Source: Norwegian Air Shuttle, n Magazine, March 2014. 8 Why LCCs may not want to fly long-haul? Low-cost carriers’ input-cost edge is larger for short-haul flights than for long-haul ones Source: McKinsey Quarterly, Budget carriers face difficult odds moving into the most profitable sector of the airline industry. 9 Will LCCs and legacy carriers reach into each other’s business models? • Business travel with LCCs • Asian consumer will dominate route networks in 2030 • Self-connecting • LCC model predominantly on short-haul and the thickest longhaul routes • Legacy carrier model serving the majority of long-haul connections10 The AC is looking into potential scenarios for each short-listed scheme • What will the potential airport charges be? – How affordable is the proposal to airlines? – New entrants? • What kind of airline business models could different levels of charges attract? – Scenarios and their plausibility – What is the potential competitive impact on the UK airport system in each case? – What connectivity can potentially be delivered? 11 Airline Business Models Jagoda Egeland Strategy & Policy Manager Airports Commission Briefing London, 17 March 2014 12