Investing for a secure future

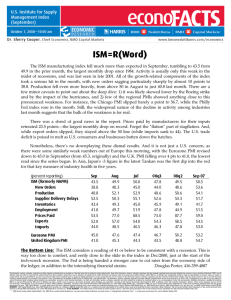

advertisement

Preparing for the Future W E LCO M E C A NAD Investing for a secure future We understand you’ve worked hard for your savings and want to make the most of them. When it comes to saving and investing your money to create a secure future for you and your family, you have a number of investment options available. And when choosing your investments, your decisions will be based on a few key factors: your financial objectives, timelines, priorities, and attitude toward risk. Your investor profile To invest successfully and comfortably, it’s important to first think about what you want to achieve and what kind of investor you are. If you’re new to investing, there are some questions you will want to answer to understand your investor profile. For example: • What kind of a saver are you? Would you rather set aside small amounts each month, or save larger amounts once or twice a year? • What are your savings objectives? Are you looking for long-term investing for retirement? Or is your goal something shorter-term, such as the purchase of a home or a car in the next few years? Your timeline is one of the biggest factors to consider when identifying your investment choices. • What is your attitude toward risk? Are you comfortable with investments that go up and down with the market or do you prefer more conservative investments that are less sensitive to fluctuations? Whatever your investor profile, there are a number of investment products available to meet your individual needs and help you achieve your savings goals. Popular investment options Guaranteed Investment Certificates (GICs) A GIC is a secure investment that guarantees 100% of the original amount you invest. The amount of the initial investment is known as the principal. Your money earns a set rate of interest for a specific term, making a GIC a risk-free investment. GICs are perfect if you’re a conservative investor, or if you’re looking to add balance to your investment portfolio. T O Saving and investing for the future is important both to newcomers and long-time citizens in Canada. For newcomers who are working to become established, this is very important. This fact sheet can help you learn about saving and investing for the future. A At BMO, we offer a range of terms, payment frequencies and rates – along with a bonus interest rate on GICs for newcomers, as part of our BMO NewStart™ program – so it’s easy to find a GIC option that meets your investment needs. To learn more about GICs, visit bmo.com/gic. Mutual funds A mutual fund is a pool of money that is invested by a professional money manager on behalf of a large group of people. Mutual funds are a popular way to invest because they are affordable and easy to buy and sell. Plus, because a mutual fund may include many different investment types, they are a great way to add diversity to your portfolio. At BMO, through our affiliate BMO Investments Inc., we offer a wide selection of professionally managed mutual funds that can easily meet your specific investment objectives and investor profile. To learn more about mutual funds, visit bmo.com/mutualfunds. Flexible, tax-free savings – the Tax-Free Savings Account A Tax-Free Savings Account (TFSA) is a good option for holding an emergency fund, or to save for travel, home renovations, your children’s education, or retirement. It’s also a great way to save without worrying about taxes eating away at your investment profits. What is a Tax-Free Savings Account? Like a Registered Education Savings Plan (RESP) or Registered Retirement Savings Plan (RRSP), a TFSA is not an investment in itself. Rather, it’s the account or “basket” in which you hold investments (such as GICs and Mutual Funds) for your savings. With a TFSA, you can contribute up to $5,500 per year and you are not taxed on any investment income you earn (hence the term “tax free”). Unlike RRSPs and RESPs, you don’t have to pay any tax when you withdraw money from your TFSA. If you have already maximized your RESP or RRSP contributions, or just want an extra bit of flexibility when it comes to your education or retirement savings, a TFSA can be a great choice. To learn more about Tax-Free Savings Accounts, visit bmo.com/tfsa. Make the most of your savings There are a few things you can do to build your savings wisely. • Make saving simple. Investing can be easy if you save small amounts regularly, and set up automatic transfers to your savings account(s). • Keep saving. It’s important to keep saving, even if your financial situation changes. Simply adjust your regular plan when needed, so you continue to build your savings. • Match your investment strategy to your profile. To invest successfully, you have to be comfortable with your decisions. Create a savings plan that fits your individual goals and priorities. • Regularly revisit your investment mix. Life rarely stays the same for long. Change can happen and your goals may shift. Take a look at your investments regularly to make sure they continue to meet your financial objectives. Get started If you’re just starting to invest in Canada, talk to a BMO Financial Planner* who can help you develop a plan to meet your investment objectives. Call us at 1-888-389-8030 to get immediate investing advice or to book an appointment to speak with us in person. You can also take the first step by trying our Investor Profiler Questionnaire. Simply visit bmoinvesting.com/investorprofiler to find out what kind of investor you are. * Financial Planners, Investment & Retirement are representatives of BMO Investments Inc, a financial services firm and separate legal entity from Bank of Montreal. ™ Trademark of Bank of Montreal. ® Registered trademark of Bank of Montreal.