Gregory Bensen OpenIdeo.com Paper 3-23

advertisement

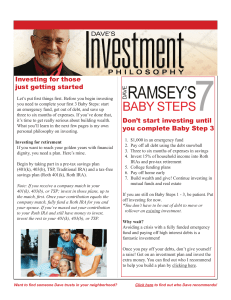

Gregory Bensen OpenIdeo.com Paper 3-23-15 How might we use the power of communities to financially empower those who need it most? When it comes to finances and improving communities, generalized support seems to be everywhere. And frankly, why shouldn’t it be? Who doesn’t think that improving local communities and helping those in need is a good idea? Yet, there seems to be a disconnect between ‘theory’ and action. For me, this is due in large part to how complex the issue is. To better improve most any community, we need to start with the least fortunate among us. Like the rest of us, they have dreams, goals, hopes and ambitions. Unlike the fortunate though, these are people who have no safety net. Worse yet, these people have no one to believe in them, no one willing to reach out, take a chance and make a difference. These people range greatly in age, race, religion, ethnic background and educational level. There is no one right answer, no singular idea which will fix everything overnight. In order to help change the financial position of everyone in our local and global communities, there needs to be a united movement. Local governments, along with the business both big and small in these communities, need to come together to work out a system of mutually beneficial practices and programs. These programs, ranging from education to credit building to private loans and more, must be easily and readily accessible to everyone. Personal finances, and the management of them, can be a very delicate subject. Money is something most every person worries about on a daily basis. The idea of financial security and stability seems nothing more than a myth for far too many people in today’s society. We can, and must, change this. In this paper, I hope to introduce a few simple ideas as to how we might start to approach this challenge. Education Financial education is almost nonexistent today, save for the small minority of people who get some accounting/finance coursework in college. As someone who has only recently taken interest in bettering my financial situation, I can easily and readily admit how terrifying and overwhelming it all is. From saving to investing, just learning the technical lingo can be enough to give you nightmares. Does that mean that we should just leave it alone then, instead trusting and paying others to handle it all for us? Hiring an accountant and financial advisor sure does seem like the simpler choice. But for those of us who might not meet account minimums when opening investment portfolios, or can’t afford to pay someone to do our taxes, where do we turn? More importantly though, at this point, is the question of what to do about it. In this case, education is not simply defined as going to school, attending class, taking tests and earning grades. Education here translates to real world skills and common knowledge. At its most basic level, investing is a relatively simple matter. It is really nothing more than putting away money, saving, for a later date in time. For me, this is where the big gap lies within today’s society, especially the younger generations. Our society is so focused and based around immediate returns and rewards. Our ability, as a society, to plan for the future seems to be a talent lost in the past. What needs to happen is large scale, nationwide financial education programs. These programs need to be sponsored, funded and run banks and financial institutions. The main idea would be to volunteer time in local communities, town centers, high schools, local businesses, churches, and so on, giving free seminars on the basics. These need to be free of charge, and presented without bias or pressure to invest. Information, when properly presented, can be all the wealth a person may need to change his/her circumstances. Implementing Change Change is not easy. Everyone knows that. Implementing change on a local, statewide, national and/or international level can be near impossible. The main challenge being “how do we get everyone to buy in?” In a world where personal gain and fortune has seemingly taken over from the ‘us for me’ mentality, how do we get people to really, truly start caring about the greater good again? Looking at the financial world from an outsider’s perspective, it seems very divided. There are two groups, those who can and do invest and save, and those who don’t or can’t. Speaking from personal experience, often the first step is not only the most challenging, but the most intimidating. For someone who barely survives day to day, paycheck to paycheck, the thought of preparing for the future can be almost laughable. This needs to change. One idea I have been mulling over recently has been ‘why are there not investment funds with no minimums?’ Personally, I would love to start investing and saving for my future. However, many investment firms have account minimums, or minimum starting amount. While I understand the existence of this, the practice almost immediately makes investing out of reach for millions of people. Acknowledging this, what do we do? An argument I can make is this; these financial institutions already make billions. So now, instead of continuing to pursue profit before all else, why not switch it up and try to give back? Why not start up a program where your main priority is investing in your community and helping improve the lives of others, for no other reason than it being the right thing to do? One idea, both realistic and immediately implementable, would be the institution of programs where people can invest with nothing more than loose pocket change. Instead of wondering if they will ever escape the day to day, they will now be given hope. Though pocket change may not seem consequential, it is the idea, the notion of finally being able to save which is the real value and wealth. For the banks and institutions, the idea here is quantity before quality. Since making a profit is still necessary, these institutions could charge a simple, flat 1% fee. Obviously, in order for this to work and be profitable, you would need hundreds and thousands of participants. Theoretically, the ideas of corporate and social responsibility and being ‘the good guy’ would be the basis of advertising and recruitment of customers. A second idea, and one I have seen before, would be to have banks offer a different type of basic service. The idea consists of having customers use their checking account/debit cards as prepaid credit cards. Obviously, there are numerous specifics that would need to be worked out. However, with the main goal here being the overall improvement of all customer credit ratings, the fees associated with these accounts would need to be flat, and not more than 1-2%. While this may seem much lower than some cards today, the goal again is quantity of customer. Again, the reward here, for the banks, is the recognition of being a socially respected company. This is a long term issue, and the rewards need to reflect that. All of a sudden, a community with an average credit rating of 700 can, and most likely will, see a tremendous economic boom, with people out shopping more, buying more, and even making big purchases such as cars and homes, thus doubling down on the investment in the local community. To finish this off, let me first say that these are some very rough, very basic ideas. The challenge of improving our communities is a tremendous undertaking. You can attack this from the very small, local community, all the way up to the global community. I believe that this is a very worthwhile project, and one that will have lasting effects on generations to come. The real challenge will be to see who is going to step it. All of the submissions here need help, need backing of some sort. It is my firm hope to see some sort of radical change take place in the very near future, before the inequality becomes any greater. And to those taking the time to read this paper, thank you very much.