Interest Rates - Savannah State University

advertisement

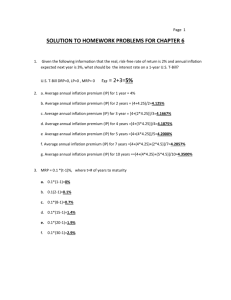

Chapter 5 The Cost of Money (Interest Rates) 1 Learning Outcomes Chapter 5 Describe the cost of money and factors that affect the cost of money. Describe how interest rates are determined. Describe a yield curve and discuss how a yield curve might be used to determine future interest rates. Discuss how government actions and general business activity affect interest rates. Describe how changes in interest rates (returns) affect the values of stocks and bonds. 2 Realized Returns (Yields) 3 Factors that Affect the Cost of Money Production opportunities Time preferences for consumption Risk Inflation 4 The Cost of Money What do we call the price, or cost, of debt capital? The Interest Rate What do we call the price, or cost, of equity capital? Return on Equity = Dividends + Capital Gains 5 Interest Rate Levels 6 Determinants of Market Interest Rates r RP DRP MRP = Quoted or nominal rate = Risk premium = Default risk premium = Maturity risk premium rRF = The quoted risk-free rate RP = DRP = LP = MRP LP = Liquidity premium 7 “Real” versus “Nominal” Rates r* = real risk-free rate. T-Bond rate if no inflation; 2% to 4%. r = any nominal rate. rRF = Rate on T-securities—risk-free. 8 Premiums Added to r* for Different Types of Debt IP DRP LP MRP = = = = Inflation premium Default risk premium Liquidity premium Maturity risk premium Short-Term (S-T) Treasury: only IP for S-T inflation Long-Term (L-T) Treasury: IP for L-T inflation, MRP Short-Term corporate: Short-Term IP, DRP, LP Long-Term corporate: IP, DRP, MRP, LP 9 The Term Structure of Interest Rates Term structure: the relationship between interest rates (or yields) and maturities A graph of the term structure is called the yield curve. 10 U.S. Treasury Bond Interest Rates on Different Dates 11 U.S. Treasury Bond Interest Rates on Different Dates (Yield Curves) 12 Three Explanations for the Shape of the Yield Curve Liquidity Preference Theory Expectations Theory Market Segmentation Theory 13 Liquidity Preference Theory Lenders prefer S-T securities because they are less subject to interest rate risk and are thus more easily bought or sold in the market. Thus, S-T rates should be low, and the yield curve should be slope upward. 14 Expectations Theory Shape of curve depends on investors’ expectations about future inflation rates. If inflation is expected to increase, S-T rates will be low, L-T rates high, and vice versa. Thus, the yield curve can slope up OR down. 15 Calculating Interest Rates Expectations Theory Step 1: Find the average expected inflation rate over years 1 to N: IPn = N ∑ INFLt t=1 N 16 Example: Inflation for Year 1 is 5%. Inflation for Year 2 is 6%. Inflation for Year 3 and beyond is 8%. r* = 3% MRPt = 0.1% (t-1) IP1 IP10 IP20 = 5%/ 1.0 = 5.00% = [ 5 + 6 + 8(8)] / 10 = 7.5% = [ 5 + 6 + 8(18)] / 20 = 7.75% Must earn these IPs to break even vs. inflation; these IPs would permit you to earn r* (before taxes). 17 Calculating Interest Rates Expectations Theory: Step 2: Find MRP based on this equation: MRPt = 0.1% (t - 1) MRP1 = 0.1% x 0 = 0.0% MRP10 = 0.1% x 9 = 0.9% MRP20 = 0.1% x 19 = 1.9% 18 Calculating Interest Rates Expectations Theory: Step 3: Add the IPs and MRPs to r*: rRFt = r* + IPt + MRPt Assume r* = 3%. 1-Yr: rRF1 = 3% + 5.0% + 0.0% = 8.0% 10-Yr: rRF10 = 3% + 7.5% + 0.9% = 11.4% 20-Yr: rRF20 = 3% + 7.75% + 1.9% = 12.7% 19 Market Segmentation Theory Borrowers and lenders have preferred maturities Slope of yield curve depends on supply and demand for funds in both the L-T and S-T markets (curve could be flat, upward, or downward sloping) 20 Other Factors That Influence Interest Rate Levels Federal Reserve Policy Federal deficits International Business (Foreign Trade Balance) Business Activity 21 Interest Rate Levels and Stock Prices The higher the rate of interest, the lower a firm’s profits Interest rates affect the level of economic activity, and economic activity affects corporate profits 22 The Cost of Money as a Determinant of Value 23