DKS - University of Oregon Investment Group

advertisement

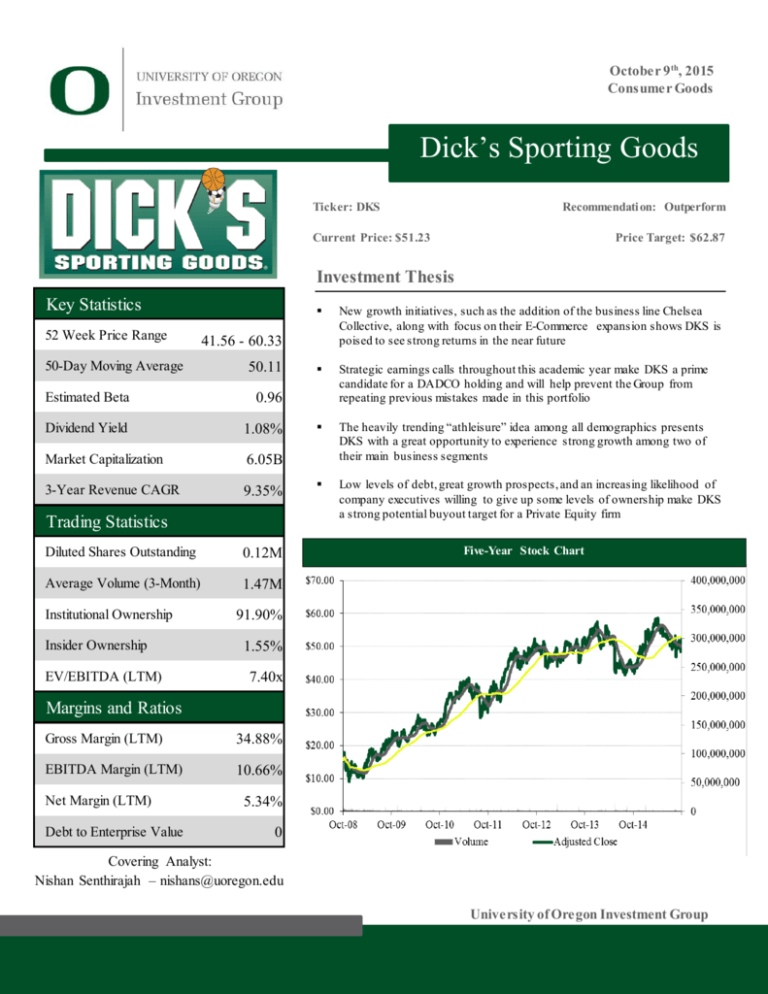

October 9 th, 2015 Consumer Goods Dick’s Sporting Goods Ticker: DKS Recommendati on: Outperform Current Price: $51.23 Price Target: $62.87 Investment Thesis Key Statistics 52 Week Price Range 50-Day Moving Average 50.11 0.96 Dividend Yield 1.08% Market Capitalization 6.05B 3-Year Revenue CAGR 9.35% Trading Statistics Diluted Shares Outstanding 0.12M Average Volume (3-Month) 1.47M Insider Ownership EV/EBITDA (LTM) New growth initiatives, such as the addition of the business line Chelsea Collective, along with focus on their E-Commerce expansion shows DKS is poised to see strong returns in the near future Strategic earnings calls throughout this academic year make DKS a prime candidate for a DADCO holding and will help prevent the Group from repeating previous mistakes made in this portfolio The heavily trending “athleisure” idea among all demographics presents DKS with a great opportunity to experience strong growth among two of their main business segments Low levels of debt, great growth prospects, and an increasing likelihood of company executives willing to give up some levels of ownership make DKS a strong potential buyout target for a Private Equity firm 41.56 - 60.33 Estimated Beta Institutional Ownership Five-Year Stock Chart 91.90% 1.55% 7.40x Margins and Ratios Gross Margin (LTM) 34.88% EBITDA Margin (LTM) 10.66% Net Margin (LTM) Debt to Enterprise Value 5.34% 0 Covering Analyst: Covering Analysts: Name Nishan Senthirajah – nishans@uoregon.edu University of Oregon Investment Group October 9 th, 2015 University of Oregon Investment Group Business Overview Dick’s Sporting Goods is the number one sporting goods retailer in the United Figure 1: Last 4 Years Store Count vs. Sq. Footage Growth States. They own and operate over 690 stores that are composed of industryspecific outlets, along with their typical retail store recognized by their company name. To complement their popular retail stores, DKS operates a strong E800 9.00% Commerce platform, contributing to their increased ranking among fortune 500 8.00% companies for the past 9 years. 700 7.00% 600 6.00% 500 5.00% 400 4.00% 300 3.00% 200 2.00% 100 1.00% - 0.00% 2010A 2011A 2012A 2013A 2014A Currently headquartered in Coraopolis, Pennsylvania, Dick’s Sporting Goods was originally founded in the small city of Binghamton, New York by Richard “Dick” Stack in 1948. Present day Chairman and CEO, Edward Stack succeeded his father in ownership of the company in 1984, when the found er chose to retire. Since that change in ownership, DKS has grown from 2 retail stores with an expanding product line, to its strong current day standing. Dick’s looks to give customers a seamless shopping experience, not only by carrying leading brands, but to offer a full array of products within each brand they carry. Thus is the reason they have focused, and been successful, in their operation of three core business segments. Business Segments Hardlines – 44% Source: UOIG Spreads Figure 2: DKS’s Business Segments Square Footage 1.00% DKS’s hardlines segment is composed of sports equipment that average consumer would purchase to use in their home. Things such as basketball hoops, soccer goals, footballs, baseball bats, etc; products that have always had a distinct popularity among consumers. Historically, this has been Dick’s strongest and largest business segment. However, as of late the big sporting goods retailer has shifted a larger focus towards apparel and footwear, catering to recent consumer trends. Apparel – 36% With the “athleisure” phase compounding in industry popularity as of late – particularly among females – DKS has been taking strong initiatives to stay with and try to push ahead of the industry curve. This has become their fastest growing core business segment over the last 4 years, and Dick’s is showing no signs of changing this trend anytime soon. Growth initiatives is this area can been seen by delegating more square footage to their apparel segment, and also the launch of their new outlet store, Chelsea Collective – to be examined in further depth later in this report. 19.00% 44.00% 36.00% Footwear – 19% Hardlines Apparel Footwear Source: UOIG Spreads Other Complementing apparel growth, DKS has also been putting a greater focus towards their footwear segment of business. Consumer trends – also particularly among females – indicate that a heavier amount of interest has been placed in athletic footwear above other styles. With Dick’s wide array of brand carryings and types of athletic footwear, they are able to attract a great amount of customers with this diverse product line. Such evidence can be seen in their consistent growth in this segment over the last 7 years. UOIG 2 October 9 th, 2015 University of Oregon Investment Group Industry Figure 3: Consumer Confidence Index 160 140 120 The sporting goods industry is highly dependent on consumer interest in sports, as with limited interest in sports there is going to be a minimal amount of people who would want to purchase any products pertaining to their activities. Because of this, industry performance can tend to be volatile, and companies with a small amount of product offerings and a shortage of store locations across certain regions can heavily struggle during certain cycles. 100 For a sporting goods retailer to maintain relevant during bear phases within the industry, they need to have a wide array of elements to their business, such as target outlet stores, a good E-Commerce presence, a wide array of product offerings within their actual business segments, popular and relevant sponsors, and/or varied geographic store locations. 80 60 40 20 0 Source: IBISWorld Figure 4: 2014 Top Retailers in the United States Rank 1 2 3 55 Company Wal-Mart Costco Kroger Dick's Sporting Goods Source: retailindustry.com Furthermore, one of the biggest factors in the success of sporting goods retailers is the popularity of their vendors. This provides an element of uncertainty to retailers, as they have absolutely no control over vendor activities. Their product offerings will not sell if their vendors do not have a good reputation among consumers; however their products will sell very well if their vendors are heavily trending. Industry Specific Metrics Sales per Square Foot Great analysis of a company’s revenue in the retail industry is quite dependent on their sales per square foot. This metric allows analysts to understand if a company is using their store space wisely and if they are consistently making improvements upon their utilization of such store space year after year. Same Store Sales This is a valuable metric to determine the growth of a company and how well a company is improving their performance in their stores year after year. In determining which metric to deeply analyze, between same store sales and sales per square foot, it is best to focus on which metric can be broken down into the smallest form. Figure 5: Percentage of People Who Play Sports in the U.S Macro Factors 25 The sporting goods industry is one that is highly dependent on the state of the economy. The external factors that have the strongest effect on it are touched on in further depth below. 20 15 Health Awareness and Fitness Interest 10 This factor has the most direct effect on the sporting goods industry as a whole. If people are health conscious and interested in exercise, sporting goods retailers are going to thrive as equipment, apparel, and/or footwear are essential in fitness activities. Fortunate enough for this industry, interest in health and exercise has been greatly increasing in recent years and this trend is expected to continue. Particular reasons for this trend include reports of high obesity rates and a great focus on promotions from popular professional sports teams and athletes. 5 0 Source: IBISWorld UOIG 3 October 9 th, 2015 University of Oregon Investment Group Per Capita Disposable Income Figure 6: Percentage Change in U.S Per Capita Disposable As the average consumer’s income increases, the more able they are to purchase Income 7 sporting goods. This simply means that demand for all sporting goods segments is driven by the relative income consumers can allocate towards such 6 expenditures. 5 Furthermore, with the current strong unemployment levels, the sporting goods industry is in a good position to keep its demand in relation to this critical macroeconomic factor. 4 3 2 Popular Age Demographic for Athletics 1 Historically, the most popular age demographic for all things related to athletics has been between 10 and 19. This number has seen a slight decline since the beginning of the new millennium, and is anticipated to have quite stagnant growth for the coming decade. 0 -1 -2 Source: IBISWorld Figure 7: Percentage Growth in U.S E-Commerce Sales 14 However, as general interest in athletics continues to rise, the significance of this specified age factor is anticipated to decline in relation to the sporting goods industry. Competition The sporting goods retail industry is quite specific and thus there are only a few popular companies who dominant the market share. 12 10 Companies in this industry are in high competition for a strong geographic presence. They all want the highest store count to increase their market share. It is who has the best resources, customer service, and popularity that will claim the majority of store locations, as they are all almost always in the hunt for similar or the same ones to satisfy a presence in the most regions. 8 6 4 2 0 Source: IBISWorld Figure 8: DKS Store Geographical Distribution To complement the factor of store count comes that of an E-Commerce presence. This ties directly into the popularity and reputation of a company, because online shopping is compounding in popularity in the present day, and thus making a great E-Commerce outlet of business essential if you want to maintain and/or gain customer loyalty in this industry. It is companies who do, that are usually first to claim the previously identified factor of competitive store locations, as they have a stronger revenue stream and thus the resources to open more stores. Strategic Positioning Diverse Geographic Presence The biggest factor in Dick’s Sporting Good’s expansion since its inauguration back 1948 has been their ability to focus on opening and increasing stores across all regions of the United States. They hold at least one location in all but one state, that being the non-contiguous state of Hawaii. DKS has had positive store count growth in over 90% of their years in business. Expansion on the West Coast Source: Dick’s Sporting Goods 10-K As noted in the beginning section of this report, Dick’s originally started their business in east coast state of New York. However, they have experienced their strongest growth in the past 10 years when they really started focusing their efforts UOIG 4 October 9 th, 2015 University of Oregon Investment Group Figure 9: Store Count of DKS’s Other Business Lines DKS's Specialty Stores Name # of Stores Golf Galaxy 78 on growing business in the west coast. This region of the U.S has and continues to offer DKS phenomenal opportunities for business, as the sporting popularity – from popular professional athletes, to college and professional teams, and the general popularity of sports – is huge. Also, there is the highest volume of square footage in this region, which has presented them with terrific opportunities to increase their store count. Even more, the west coast gives Dick’s direct access to their biggest vendor in Nike, as their global headquarters are located in this area of the country. Business Growth Strategies Increase in Business Lines Field and Stream 10 True Runner 3 Blue Sombrero 0 (Online Only) Aside from the common “Dick’s Sporting Goods” stores that are found across the country, DKS owns and operates a few other businesses. They have made a huge effort in expanding store count and presence in these lines to add an element of diversity and specification to their company. There are 5 other lines of business to Dick’s in total, these include: Golf Galaxy , Blue Sombrero, TrueRunner, Field and Stream, and the newest addition, Chelsea Collective. The first four mentioned in the previous sentence specialize in golf products, web design and management for youth and recreation needs, prime selection of premier footwear, clothing and accessories for the avid runner, and a variety of products for all outdoor activities, respectfully. The fifth and newest addition of business to DKS, Chelsea Collective specializes in fit and fashionable female apparel, footwear and accessories made for both athletics and leisure, and provides superior customer service in an attractive retail environment. Chelsea Collective Chelsea Collective 2 DKS recently launched an original brand, CALIA that is sponsored by Carrie Underwood, and to further show their initiative to putting a focus towards the female demographic, they decided to partner that idea with a line of business designated solely to that demographic, Chelsea Collective. Source: DKS 10-K Figure 10: Percentage of Women who Agree they Wear More Athletic Apparel for Leisure Now than 3 Years Ago 60% 50% 40% 30% 20% 10% 0% Gen. Y Gen X. Agree The one area of business that Dick’s Sporting Goods has been criticized for not putting a strong enough focus in, is all things female related. This is how the idea of Chelsea Collective came about. Boomers Disagree Source: Sports Apparel Survey Chelsea Collective is designed to be a specialty women’s fitness -and-lifestyle boutique. Dick’s goal with this business is to not only offer women great apparel, footwear and accessories, but to give them a great shopping experience. This includes superior customer service from product-knowledgeable employees, membership complementary Zumba and yoga classes, and an environment designed to attract female shoppers and convince them to come back. The stores feature large brands such as Nike and Under Armour, but also smaller niche brands like Lorna Jane, Spiritual Gangster, and DKS’s own CALIA. The main play with the launch of this business is for Dick’s to break into the heavily trending female “athleisure” segment, products that are of use to women for both athletics and leisure. Until quite recently, there has been very minimal focus on this area of consumer goods for all athletic retailers, but recent additions to the product lines of these major retailers are showing that is starting to change – DKS wanted to be one of these major retailers, and the only true sporting goods retailer, to enter that market. UOIG 5 October 9 th, 2015 University of Oregon Investment Group Figure 11: DKS’s E-Commerce Revenue Growth through Projection Period 30.00% 25.00% 20.00% 15.00% The only major player in this niche market has been Lululemon, but Chelsea Collective is trying to tap into their market share, make a name for themselves, and increase the awareness of Dick’s Sporting Goods. The first two locations of this specialized business line of DKS recently opened in Virginia and Pittsburg about a month ago, and management and industry analysts expect this specialized retailer to find success going forward. Furthermore, with that potential success in this area of business, Dick’s will experience strong top line growth, and have the resources to start expanding this niche sub-company of theirs further along the east coast and the rest of the United States. Enhanced E-Commerce Presence 10.00% While putting a large focus on expanding within their retail stores, Dick’s Sporting Goods is putting great effort to further develop their online presence so they can offer customers a seamless omni-channel shopping experience. 5.00% 0.00% Their E-Commerce segment as a whole has been the fastest growing part of DKS’s business for the past few years, and management expects it to stay that way for quite a few years to come. Their aim is to at least double their current ECommerce revenue by fiscal 2017. Source: UOIG Spreads Figure 12: E-Commerce vs. In-Store Revenue Growth through Projection Period 30.00% 25.00% 20.00% 15.00% To help reach this target, Dick’s is planning to bring all E-Commerce operations in-house. Currently, some of their online shopping elements are being handled externally by eBay, such as web store maintenance, customer service, and payment processing. By bringing these operations fully under their control, DKS will has easier access to their data, thus being able to build more cross -channel customer experiences, helping them increase their rapid online growth. DKS’s immediate plans for their E-Commerce growth are an increase in sitesearch functionality, increasing the volume of products available to customers online, and improving their E-Commerce mobile platform to better reach customers. Dick’s has great confidence they will succeed in these initiatives, thus enhancing their reputation as a great omni-channel retailer. 10.00% 5.00% 0.00% Management and Employee Relations E-Commerce In-Store Edward Stack – Chief Executive Officer Source: UOIG Spreads S Figure 13: DKS’s Equity vs. Debt Levels $7,000,000.00 $6,000,000.00 Mr. Stack has been the leader of Dick’s Sporting Goods since 1984, when he took over from his father, Richard “Dick” Stack, the founder of the company. He has been the face of DKS through their greatest growth stages, and is quite a knowledgeable guy in the area of sporting goods and retail. Just under a year ago, Dick’s was in preliminary talks with a Private Equity firm regarding a buyout plan. These discussions came to end after a couple weeks, the driving reason being that Stack did not want to give up so much ownership and voting rights, as this is essentially a passed down family company. However, Stack is 60 years old and while he does have some siblings (unknown if older or younger), he is divorced and has no children to pass this company along to. $5,000,000.00 $4,000,000.00 $3,000,000.00 $2,000,000.00 $1,000,000.00 $0.00 Equity Source: DKS 10-K Debt Furthermore, Stack’s Dick’s Sporting Goods was cited as one of Evercore’s top retail buyout targets because of their low debt levels, reasonable valuation, and growth prospects. Summing up, these factors are something to keep in mind in the analyzation of DKS. UOIG 6 October 9 th, 2015 University of Oregon Investment Group Management Guidance Figure 14: FY15 Guidance vs. Projections DKS has consistently beat management guidance on FCF, EPS, store count, and Guid. (Low) Guid. (High) UOIG Proj. in-store sales. DKS is closing in on the end on Q3 of FY15, the earnings call of which will be in mid-November. EPS In-Store Sales Store Count 3.10 6400 739 3.20 6700 742 3.38 6950 Dick’s expects to have opened approximately 45 new stores between FY14 and 744 FY15. The main goals going forward are not only to increase the store count of their standard “Dick’s Sporting Goods” store but to expand some of their other business lines, particularly Chelsea Collective. Management sees great growth opportunities in this niche area, which is why they decided to launch this branch of business. The first commentary of Chelsea Collective will be heard during their next earnings call in November. Source: DKS Earnings Call Figure 15: DKS 2-Year Return vs. Russell 2000 Moreover, DKS management is aiming to see large growth in their E-Commerce platform. Their goal with the initiatives in this element of their business is to be recognized by an increasing number of people as a great omni-channel retailer. Portfolio Strategy Dick’s Sporting Goods is being pitched solely to the DADCO Portfolio. Within this academic year, DKS will report earning three times: once in November at the end of Q3 of FY15 – when investors will have access to the first commentary on the launch of Chelsea Collective, once in February – at the end of FY15 when reports will be available on DKS’s holiday season performance, the anticipated further success of Chelsea Collective, and how well their E-Commerce platform has compared to the prior FY, and once in May at the end of Q1 of FY16 – when investors will be shown how DKS is performing on their then new FY goals. Source: Yahoo! Finance Figure 16: DADCO’s Current Holdings 10% Following the Group’s performance in the DADCO portfolio this past fiscal year, a common consensus was reached that its holdings we just kept in the portfolio for too long, and should have been removed after taking in their time-specific returns. The timing of this pitch presents the Group with an opportunity to not make that same mistake again, as DKS has three earnings calls within just over seven months, where their performance on new growth initiatives and popular seasonal shopping will be revealed. Great confidence in the positive results of these untapped growth initiatives does present a sizable element of risk, however that is something that the philosophy of the DADCO welcomes. 9% 11% 6% 64% Cash Tracker AMBA Come that time of year, the Group’s then newly recruited Junior Analysts will be beginning their presentations on updates of some of the Group’s current holdings. If the Group were to take in DKS this fall term, the perfect opportunity would be presented to determine if the company should be re-evaluated going into the summer after taking in their highly anticipated returns. Furthermore, the DADCO portfolio currently has over 60% of its value in the tracker, and only three holdings, one of which is being updated this fall term. Dick’s Sporting Goods is well poised to reach its market value within this coming academic year, thus achieving strong outperformance, something that the DADCO portfolio is in dire need of. MTZ SCTY Source: UOIG Portfolio Holdings UOIG 7 October 9 th, 2015 University of Oregon Investment Group Recent News Figure 17: Athletic Brands Popularity among College Athletes Dick’s Sporting Goods Opens First Two Prototype Stores of Chelsea Collective – A Store for Women August 18 th, 2015 Dick’s Sporting Goods Launch of the women’s “athleisure” products store has come to fruition, with their first two prototype stores opening on the east coast at Ross Park Mall in Pittsburg, Pennsylvania and Tysons Corner Center in Tysons Corner, Virginia. This boutique is designed solely for women and is expected to grow in this previously mentioned “athleisure trend.” This is DKS’s first entrance into this niche market; they are confident they will find success and start being able to expand into more locations across the country. 4% 7% 16% Catalysts Upside 73% Under Armour Nike Adidas Other Source: Huffington Post Figure 18: U.S Unemployment Rate Downside 12 10 8 6 4 The popularity of the Nike and Under Armour brands, DKS’s two largest vendors, along with their new original brand CALIA, will allow them continue growing their volume of customers and market share. Increase in health and fitness interests will provide DKS with an increased customer base and present them with resources to increase their store count across all regions to reach more consumers. Currently in the early stages of football season and the beginning of the basketball season on the horizon, demand in DKS’s products will start to see a strong increase in demand. With the “athleisure” concept heavily trending, DKS’s apparel and footwear offerings are seeing an increase in popularity to almost all demographics. DKS’s dependence on vendors for their product offerings could really hurt their top and bottom line if negative images were brought to them. Their dependence on consumer interests could hurt DKS if a large change in trends pertaining to all things athletics were to occur. A lack of availability in store sites could prevent DKS from maintainin g and increasing their growth in store count. Dependence on consumer disposable income would negatively affect DKS in every way if the macro economy took a turn for the worst and lay-offs for workers were imminent. Comparable Analysis – 20% 2 0 Source: IBISWorld Comparable companies to Dick’s Sporting Goods were mainly screened for similar business models, EBITDA and EPS growth rates, product offerings, store size, and size. For all companies ultimately decided upon, all are directly involved the athletic products and/or retail industry. Moreover, the Comparable Analysis was only weighted at 20% of the final valuation. The reason being is that DKS is in an extremely niche market, one of which they own the majority of the market share. Their added business lines UOIG 8 October 9 th, 2015 University of Oregon Investment Group further separates them for any direct competitors they may have, and makes them all the more likely to continue that trend in years to come. Figure 19: DKS vs. KSS Multiples 16.00x 14.00x 12.00x 10.00x 8.00x 6.00x 4.00x 2.00x 0.00x Cabela’s (CAB) – 25% “Cabela's, Inc. retails and markets hunting, fishing, camping and related outdoor merchandise. It offers products through its retail stores, the internet and regular and special catalog mailings. The company operates through three reportable segments: Retail, Direct and Financial Services.” – Yahoo! Finance Cabela’s was chosen based upon their similar business model and size, along with growth rates that are in close proximity to DKS’s. While they do not specialize in sporting goods retail, they have very similar store sizes and store layouts to DKS. Also, Cabela’s focus is all products outdoors, which is identical to one of DKS’s other business lines, Field & Stream. DKS KSS Source: Yahoo! Finance Figure 20: DKS vs. BGFV Multiples 16.00x 14.00x 12.00x 10.00x 8.00x 6.00x 4.00x 2.00x 0.00x Kohl’s (KSS) – 25% “Kohl's Corporation operates department stores in the United States. It offers private label, exclusive, and national brand apparel, footwear, accessories, beauty, and home products to children, men, and women customers. The company also sells its products online at Kohls.com and through mobile devices.” – Yahoo! Finance Kohl’s was chosen as a comparable company based upon their very similar business model to Dick’s. They operate as a retailer who focuses on appa rel, footwear, and accessories that cater to the same consumer base as DKS. Furthermore, their relatively similar growth rates make them a strong candidate for a comparable company. Big Five Sporting Goods (BGFV) – 20% DKS BGFV Source: Yahoo! Finance Figure 21: DKS vs. NKE Multiples 35.00x 30.00x 25.00x 20.00x 15.00x 10.00x 5.00x 0.00x “Big 5 Sporting Goods Corporation operates as a sporting goods retailer in the western United States. The company offers athletic shoes, apparel, and accessories, as well as a selection of outdoor and athletic equipment for team sports, fitness, camping, hunting, fishing, tennis, golf, winter and summer recreation, and roller sports.” – Yahoo! Finance Big Five Sporting Goods is the closest direct competitor to DKS. Their business models are practically identical as they sell very similar products to the same demographics. The biggest reason why BGFV was not given a higher weighting is that they are substantially smaller in size compared to DKS. Adding on to that, they do not have any other business lines within their company and their store count is much less than that of DKS’s. Nike (NKE) – 15% “NIKE, Inc., together with its subsidiaries, designs, develops, markets, and sells athletic footwear, apparel, equipment, and accessories for men, women, and kids worldwide.” – Yahoo! Finance DKS NKE Nike made for a good selection as a comparable company as their products are those that are most commonly found in a Dick’s Sporting Goods Store. They are a huge element to DKS’s success, for if their products are thriving then so will DKS’s and vice versa. Moreover, their growth rates are relatively in line to Dick’s . Source: Yahoo! Finance UOIG 9 October 9 th, 2015 University of Oregon Investment Group Under Armour (UA) – 15% Figure 22: DKS’s Hardlines Square Footage Projections 15,500,000 15,000,000 14,500,000 14,000,000 13,500,000 13,000,000 12,500,000 12,000,000 “Under Armour, Inc., together with its subsidiaries, develops, markets, and distributes branded performance apparel, footwear, and accessories for men, women, and youth primarily in North America, Europe, the Middle East, Africa, the Asia-Pacific, and Latin America.” – Yahoo! Finance Similar to Nike, Under Armour is a good candidate for a comparable company because their products can be found throughout any Dick’s Sporting Goods Store. They recently overtook Adidas as the number two athletic apparel company in the world and are thus getting an increased amount of exposure in DKS. While there growth rates are higher than those of Dick’s, they are relatively close in size and cater to the same demographics. Discounted Cash Flow Analysis – 80% Source: UOIG Spreads Figure 23: DKS’s Apparel Square Footage Projections 40,000,000 35,000,000 30,000,000 25,000,000 20,000,000 15,000,000 10,000,000 5,000,000 - Revenue Model The revenue model for DKS was broken down into the square footage of their three in-store business segments to arrive at their sum and then E-Commerce percentage of revenue followed. Complementing the total square footage was average sale per square foot to arrive at the total in-store revenue, and then adding on E-Commerce revenue derived the total revenue. Hardlines Square Footage Historically, hardlines has been the largest segment of business for DKS. Recent fiscal years’ performances however, have indicated that is starting to change. The demand for sporting goods equipment is slowly declining, as consumers are opting to go to more communal places, like gyms and parks, as such equipment is rather expensive. For this reason of lacking demand of these products, hardlines square footage received negative growth rates in the model going forward. Apparel Square Footage Source: UOIG Spreads Figure 24: DKS’s Total In-Store vs. E-Commerce Sales 14,000,000.00 12,000,000.00 10,000,000.00 8,000,000.00 6,000,000.00 4,000,000.00 2,000,000.00 - This core segment of DKS’s business has been receiving the highest growth over the past few years, and is now closing in on the hardlines segment for the highest percentage of total square feet. Demand for athletic apparel has been experiencing solid growth over the past couple years, particularly in DKS’s largest vendors Nike and Under Armour, and thus Dick’s as well. Apparel ties directly in to the “athleisure” trend that is consuming most demographics, and thus percentage of apparel square feet is receiving the highest growth rates in the model. Footwear Square Footage Similar to the apparel segment, footwear has been experiencing strong growth in recent years, due in large part to an increase in demand from the “athleisure” trend. Almost every single person in the United States owns some sort of pair of athletic shoes, and there is a good chance that a majority of that population got them at DKS. Footwear is anticipated to maintain strong growth rates going forward and thus the percent of square feet reserved for this segment is receiving positive growth rates in all projected years. In-Store E-Commerce Source: UOIG Spreads E-Commerce Tracing back through historicals, E-Commerce sales has been the smallest percentage of revenue by a substantial margin. However, in recent years this UOIG 10 October 9 th, 2015 University of Oregon Investment Group $15,000,000.00 segment has been experiencing very high growth rates, due in large part to the general popularity of online shopping. Moreover, with the added focus that DKS in putting to their E-Commerce presence, this element of revenue is receiving strong growth rates going forward, slowing becoming a larger percentage of total revenue. $10,000,000.00 Cost of Goods Sold Figure 25: DKS’s Revenue & COGS $20,000,000.00 $5,000,000.00 Cost of goods sold are projected out as a percentage of revenue and are very close to the historical averages, as they have been extremely consistent. There are not any cost cutting factors that currently seem prevalent, and thus none are resembled in this line item’s projections. $0.00 Revenue Beta COGS Source: UOIG Projections DKS’s beta was composed of a combination of the 3 Year Daily an d 5 Year Daily averages regressed against the S&P 500, along with a weighting for the 3 Year Daily Vasicek against comps. The 3 and 5 Year Daily averages were used as they are a strong representation of how DKS reacts to the market. Vasicek against comps was given a small weighting due to some of DKS’s current growth initiatives to make themselves more versatile within their industry. Figure 26: Final Beta Beta SE Weighting 1 Year Daily 0.97 0.10 0.00% 3 Year Daily 0.97 0.07 60.00% 5 Year Daily 1.07 0.30 20.00% 3 Year Daily Vasicek - Comps 0.83 0.07 20.00% Dick's Sporting Goods Beta 0.96 0.14 100.00% Operating Expenses Selling, General & Administrative Historical percentages showed that SG&A expenses stayed fairly consistent as a percentage of revenue. Going forward into its projections, they stayed in line with the historical average, and were slowly trended down into the terminal year. Depreciation & Amortization Source: UOIG Spreads DKS’s Depreciation and Amortization was projected off of the period’s Beginning PP&E. Projections were based off of the historical average and kept consistent all the way through to the terminal year. Figure 27: DKS’s SG&A vs. Revenue Growth $4,000,000.00 14.00% $3,500,000.00 12.00% $3,000,000.00 10.00% $2,500,000.00 8.00% $2,000,000.00 6.00% $1,500,000.00 4.00% $500,000.00 2.00% $0.00 0.00% 2010A 2012A 2014A 2016E 2018E 2020E 2022E 2024E $1,000,000.00 Source: UOIG Spreads Interest Expense Historical percentages show that interest expense stayed very consistent as a percentage of revenue, particularly in the past few years. It was therefore kept at that consistent percentage all the way through to the terminal year. Capital Expenditures DKS’s Capital Expenditures essentially come from all things related to store openings that are not covered in their Capital Lease Obligations. This figure has been trending up as a percentage of revenue, and it can be assumed to be from their increase in store openings. For this reason, Capital Expenditures are a projected to trend up as there is anticipation of a continued increase in store openings. Tax Rate The tax rate was based off of a blend in historical average and management guidance. DKS will not experience too much volatility within their company operations, as their business model does not indicate that it would be expected. Therefore, the tax rate is kept at a consistent 35% starting in the projection period and going through to the terminal year. UOIG 11 October 9 th, 2015 University of Oregon Investment Group Net Working Capital Figure 28: DKS’s Net Working Capital vs. Revenue Growth $1,000,000.00 14.00% $900,000.00 12.00% $800,000.00 10.00% $700,000.00 $600,000.00 8.00% $500,000.00 6.00% $400,000.00 $300,000.00 4.00% $200,000.00 2.00% $100,000.00 $0.00 0.00% Net Working Capital Revenue Growth Source: UOIG Spreads Most items in the Working Capital Model were projected off of Days Outstanding. Larger volume line items are analyzed further below, but all other smaller items were projected at a consistent rate through till the terminal year. Furthermore, DKS’s projected Current Ratios stayed relatively in line with their historicals. Accounts Receivable Accounts Receivable Days Outstanding stay consistent throughout the projection period till the terminal year. This implies the assumption DKS will have a consistent collection period. Inventory Days Outstanding in Inventory are slightly decreasing till the terminal year, thus showing the assumption that DKS’s turnover ratio will slowly be improving. This is something that Dick’s has had success with in the past, and as their growth initiatives continue to increase their popularity of themselves and their products, this is a very viable assumption. Accounts Payable Accounts Payable Days Outstanding is slightly decreasing through till the terminal year. This is under the slight assumption that DKS may launch more original brands if the success of CALIA continues, thus slowly lowering their dependency on vendors going forward. Recommendation Figure 29: DKS’s Final Valuation Final Price Target Weighting Implied Price DCF 80.00% 60.20 Forward Comps 20.00% 73.57 Implied Price 62.87 Current Price 51.23 Undervalued 22.73% With strong growth initiatives, such as the addition of the Chelsea Collectiv e specialty boutique and the increased focus on their E-Commerce operations, set to come to fruition this coming fiscal year, DKS is poised to find a great return in the near future. Furthermore, with three earnings calls in just over seven months, DKS makes a prime DADCO portfolio holding for the Group’s current fiscal year. With an 80% weighting of DCF and a 20% weighting of comparable analysis, an undervaluation of just over 22% is derived. From this indication of outperformance, a strong BUY is recommended for Dick’s Sporting Goods to help get the DADCO portfolio back on track after its uncharacteristic performance this past year. Source: UOIG Spreads UOIG 12 October 9 th, 2015 October 9 th, 2015 University of Oregon Investment Group Appendix 1 – Relative Valuation Comparables Analysis DKS Dick's Sporting Goods ($ in thousands) Stock Characteristics Current Price Beta CAB KSS Cabela's Kohl's BGFV Big Five Sporting Goods NKE UA Nike Under Armour Max $123.19 1.15 Min $10.17 0.63 Median $46.49 0.96 Weight Avg. $58.36 0.85 $51.23 0.96 25.00% $44.98 0.96 25.00% $46.49 0.63 20.00% $10.17 0.69 15.00% $123.19 0.97 15.00% $99.86 1.15 Size Short-Term Debt Long-Term Debt Cash and Cash Equivalent Non-Controlling Interest Preferred Stock Diluted Basic Shares Market Capitalization Enterprise Value 475,934.00 4,651,000.00 5,924,000.00 4,543.00 0.00 860,966.79 106,062,498.86 101,403,041.86 560.00 0.26 6,800.00 0.00 0.00 22,378.81 227,592.54 295,892.54 110,000.00 1,079,000.00 593,200.00 0.00 0.00 199,965.79 9,296,409.53 12,650,409.53 178,148.50 2,107,137.79 1,450,090.00 681.45 0.00 233,963.96 22,319,142.17 23,155,019.91 560.00 5,627.00 123,220.00 0.00 0.00 125,457.69 6,427,197.51 6,310,164.51 475,934.00 3,071,031.00 477,600.00 0.00 0.00 72,010.00 3,239,009.80 6,308,374.80 110,000.00 4,651,000.00 1,407,000.00 0.00 0.00 199,965.79 9,296,409.53 12,650,409.53 1,200.00 73,900.00 6,800.00 0.00 0.00 22,378.81 227,592.54 295,892.54 181,000.00 1,079,000.00 5,924,000.00 4,543.00 0.00 860,966.79 106,062,498.86 101,403,041.86 28,500.00 0.26 593,200.00 0.00 0.00 215,661.53 21,535,959.99 20,971,260.24 Growth Expectations % Revenue Growth 2015E % Revenue Growth 2016E % EBITDA Growth 2015E % EBITDA Growth 2016E % EPS Growth 2015E % EPS Growth 2016E 25.68% 24.02% 22.07% 26.92% 15.95% 31.48% 1.34% 1.58% 0.85% 1.58% 1.30% 8.72% 9.72% 9.49% 9.32% 13.14% 6.60% 14.33% 9.12% 8.49% 9.24% 11.50% 7.06% 15.62% 10.38% 7.05% 0.96% 9.31% 5.20% 10.90% 12.42% 9.95% 8.22% 13.14% 6.60% 14.33% 1.34% 1.58% 0.85% 1.58% 2.83% 8.72% 3.89% 3.25% 10.42% 7.55% 1.30% 15.38% 7.03% 9.03% 10.48% 15.14% 15.95% 13.75% 25.68% 24.02% 22.07% 26.92% 13.68% 31.48% Profitability Margins Gross Margin EBIT Margin EBITDA Margin Net Margin 45.61% 13.51% 14.97% 11.22% 31.55% 2.80% 5.00% 1.52% 31.94% 8.70% 13.45% 5.21% 36.34% 8.75% 11.68% 5.47% 34.88% 8.19% 10.66% 5.34% 41.84% 8.64% 11.86% 5.21% 31.68% 8.70% 13.45% 4.02% 31.94% 2.80% 5.00% 1.52% 45.61% 13.51% 14.97% 11.22% 31.55% 12.17% 14.08% 7.85% $33,000.00 0.56 7.82 753.37 $1,680.00 0.00 0.01 29.72 $3,410.00 0.25 1.50 141.09 $8,311.00 0.29 2.76 283.61 $3,320.00 0.00 0.01 241.62 $2,090.00 0.56 7.82 216.94 $3,410.00 0.38 1.85 753.37 $1,680.00 0.25 1.50 29.72 $33,000.00 0.01 0.27 141.09 $11,000.00 0.00 0.03 92.82 $31,111,000.00 $14,191,000.00 $4,202,000.00 $4,656,000.00 $3,490,000.00 $963,000.00 $999,400.00 $319,200.00 $28,020.00 $49,930.00 $15,170.00 $26,650.00 $7,253,000.00 $2,288,000.00 $883,000.00 $1,021,000.00 $569,000.00 $440,891.00 $11,685,730.00 $4,448,690.00 $1,266,479.00 $1,617,136.00 $853,459.00 $463,202.75 $7,521,751.13 $2,623,274.27 $616,090.76 $802,163.33 $401,806.83 $320,876.60 $3,824,000.00 $1,600,000.00 $330,500.00 $453,400.00 $199,300.00 $440,891.00 $19,101,000.00 $6,052,000.00 $1,662,000.00 $2,569,000.00 $767,000.00 $685,000.00 $999,400.00 $319,200.00 $28,020.00 $49,930.00 $15,170.00 $26,650.00 $31,111,000.00 $14,191,000.00 $4,202,000.00 $4,656,000.00 $3,490,000.00 $963,000.00 $7,253,000.00 $2,288,000.00 $883,000.00 $1,021,000.00 $569,000.00 $213,000.00 3.26x 9.17x 24.13x 21.78x 504.31x 37.85x 0.30x 0.93x 7.61x 4.92x 6.71x 12.12x 1.65x 3.94x 19.09x 13.91x 25.95x 16.25x 1.56x 4.14x 15.97x 12.24x 138.31x 20.33x 0.84x 2.41x 10.24x 7.87x 13.11x 16.00x 1.65x 3.94x 19.09x 13.91x 504.31x 16.25x 0.66x 2.09x 7.61x 4.92x 6.71x 12.12x 0.30x 0.93x 10.56x 5.93x 12.71x 15.00x 3.26x 7.15x 24.13x 21.78x 27.46x 30.39x 2.89x 9.17x 23.75x 20.54x 25.95x 37.85x Credit Metrics Interest Expense Debt/EV Leverage Ratio Interest Coverage Ratio Operating Results Revenue Gross Profit EBIT EBITDA Net Income Capital Expenditures Multiples EV/Revenue EV/Gross Profit EV/EBIT EV/EBITDA EV/(EBITDA-Capex) Market Cap/Net Income = P/E Multiple EV/Revenue EV/Gross Profit EV/EBIT EV/EBITDA EV/(EBITDA-Capex) Market Cap/Net Income = P/E Price Target Current Price Undervalued Implied Price 94.45 87.51 79.35 79.21 531.52 65.11 $73.57 51.23 43.61% Weight 0.00% 0.00% 0.00% 60.00% 0.00% 40.00% UOIG 13 October 9 th, 2015 October 9 th, 2015 University of Oregon Investment Group Appendix 2 – Discounted Cash Flows Valuation Discounted Cash Flow Analysis ($ in thousands) Total Revenue % YoY Growth Cost of Goods Sold % Revenue Gross Profit Gross Margin Selling General and Administrative Expense % Revenue Depreciation and Amortization % Beginning PP&E Pre-Opening Expenses % Revenue Earnings Before Interest & Taxes % Revenue Interest Expense % Revenue Other (Income) Expense % Revenue Earnings Before Taxes % Revenue Less Taxes (Benefits) Tax Rate Net Income Net Margin Add Back: Depreciation and Amortization Add Back: Interest Expense*(1-Tax Rate) Operating Cash Flow % Revenue Current Assets % Revenue Current Liabilities % Revenue Net Working Capital % Revenue Change in Working Capital Capital Expenditures 2010A 2011A $4,871,492.00 2012A $5,211,802.00 $5,836,119.00 2013A 2014A $6,213,173.00 2015E $6,814,479.00 2016E $7,521,751.13 2017E $8,052,095.31 2018E $8,637,210.32 2019E $9,363,255.66 2020E $10,277,094.41 2021E $11,403,224.47 2022E $12,622,376.90 2023E $13,947,052.23 2024E $15,375,568.69 $16,903,997.94 10.39% 6.99% 11.98% 6.46% 9.68% 10.38% 7.05% 7.27% 8.41% 9.76% 10.96% 10.69% 10.49% 10.24% 9.94% $3,312,068.00 $3,500,340.00 $3,873,860.00 $4,114,295.00 $4,548,382.00 $4,898,476.86 $5,394,903.85 $5,873,303.02 $6,367,013.85 $6,988,424.20 $7,811,208.76 $8,646,328.18 $9,553,730.78 $10,455,386.71 $11,494,718.60 67.99% 67.16% 66.38% 66.22% 66.75% 65.12% 67.00% 68.00% 68.00% 68.00% 68.50% 68.50% 68.50% 68.00% 68.00% $1,559,424.00 $1,711,462.00 $1,962,259.00 $2,098,878.00 $2,266,097.00 $2,623,274.27 $2,657,191.45 $2,763,907.30 $2,996,241.81 $3,288,670.21 $3,592,015.71 $3,976,048.72 $4,393,321.45 $4,920,181.98 $5,409,279.34 32.01% 32.84% 33.62% 33.78% 33.25% 34.88% 33.00% 32.00% 32.00% 32.00% 31.50% 31.50% 31.50% 32.00% 32.00% $1,129,293.00 $1,148,268.00 $1,297,413.00 $1,386,315.00 $1,502,089.00 $1,632,407.52 $1,811,721.44 $1,943,372.32 $2,106,732.52 $2,302,069.15 $2,554,322.28 $2,827,412.43 $3,110,192.65 $3,428,751.82 $3,769,591.54 23.18% 22.03% 22.23% 22.31% 22.04% 21.70% 22.50% 22.50% 22.50% 22.40% 22.40% 22.40% 22.30% 22.30% 22.30% $110,394.00 $116,581.00 $125,096.00 $154,928.00 $179,431.00 $186,072.57 $213,872.26 $231,893.13 $250,839.16 $272,188.23 $296,106.47 $324,444.96 $356,327.66 $392,973.08 $433,348.81 16.12% 15.89% 15.28% 16.40% 16.68% 14.95% 15.50% 15.50% 15.50% 15.50% 15.50% 15.50% 15.50% 15.50% 15.50% $10,488.00 $14,593.00 $16,076.00 $20,823.00 $30,518.00 $29,340.02 $31,403.17 $39,731.17 $44,007.30 $49,330.05 $55,875.80 $63,111.88 $71,129.97 $79,952.96 $89,591.19 .22% .28% .28% .34% .45% .39% .39% .46% .47% .48% .49% .50% .51% .52% .53% $330,225.00 $461,206.00 $555,826.00 $578,458.00 $615,095.00 $616,090.76 $663,000.92 $548,910.69 $682,677.43 $763,742.88 $797,462.76 $887,303.23 $997,931.11 $1,178,410.04 $1,295,930.18 6.78% 8.85% 9.52% 9.31% 9.03% 8.19% 8.23% 6.36% 7.29% 7.43% 6.99% 7.03% 7.16% 7.66% 7.67% 14,016.00 13,868.00 6,034.00 2,929.00 3,215.00 3,431.71 3,673.67 3,940.63 4,271.88 4,688.80 5,202.59 5,758.81 6,363.18 7,014.92 7,712.25 .29% .27% .10% .05% .05% .05% .05% .05% .05% .05% .05% .05% .05% .05% .05% (2,278.00) (13,874.00) (4,555.00) (12,224.00) (5,170.00) (2,388.54) (2,556.95) (1,015.32) (1,100.66) (1,208.09) (1,340.46) (1,483.78) (1,639.49) (1,807.42) (1,987.09) (.05%) (.27%) (.08%) (.20%) (.08%) (.03%) (.03%) (.01%) (.01%) (.01%) (.01%) (.01%) (.01%) (.01%) (.01%) 318,487.00 461,212.00 554,347.00 587,753.00 617,050.00 615,047.59 661,884.20 545,985.38 679,506.21 760,262.16 793,600.64 883,028.19 993,207.43 1,173,202.54 1,290,205.02 6.54% 8.85% 9.50% 9.46% 9.05% 8.18% 8.22% 6.32% 7.26% 7.40% 6.96% 7.00% 7.12% 7.63% 7.63% 115,434.00 168,120.00 199,116.00 208,509.00 211,816.00 213,240.76 231,659.47 191,094.88 237,827.18 266,091.76 277,760.22 309,059.87 347,622.60 410,620.89 451,571.76 36.24% 36.45% 35.92% 35.48% 34.33% 34.67% 35.00% 35.00% 35.00% 35.00% 35.00% 35.00% 35.00% 35.00% 35.00% $203,053.00 $293,092.00 $355,231.00 $379,244.00 $405,234.00 $401,806.83 $430,224.73 $354,890.50 $441,679.04 $494,170.41 $515,840.41 $573,968.32 $645,584.83 $762,581.65 $838,633.26 4.17% 5.62% 6.09% 6.10% 5.95% 5.34% 5.34% 4.11% 4.72% 4.81% 4.52% 4.55% 4.63% 4.96% 4.96% 110,394.00 116,581.00 125,096.00 154,928.00 179,431.00 186,072.57 213,872.26 231,893.13 250,839.16 272,188.23 296,106.47 324,444.96 356,327.66 392,973.08 433,348.81 8,935.97 8,812.87 3,866.65 1,889.92 2,111.38 2,241.92 2,387.89 2,561.41 2,776.72 3,047.72 3,381.68 3,743.23 4,136.07 4,559.70 5,012.96 $322,382.97 $418,485.87 $484,193.65 $536,061.92 $586,776.38 $590,121.32 $646,484.88 $589,345.03 $695,294.92 $769,406.36 $815,328.56 $902,156.51 $1,006,048.55 $1,160,114.43 $1,276,995.03 6.62% 8.03% 8.30% 8.63% 8.61% 7.85% 8.03% 6.82% 7.43% 7.49% 7.15% 7.15% 7.21% 7.55% 7.55% 1,564,330.00 1,868,393.00 1,595,889.00 1,620,071.00 1,850,384.00 1,844,617.83 1,928,806.83 2,059,054.30 2,225,248.25 2,428,350.70 2,672,965.67 2,949,313.46 3,239,728.28 3,548,807.63 3,868,152.01 32.11% 35.85% 27.35% 26.07% 27.15% 24.52% 23.95% 23.84% 23.77% 23.63% 23.44% 23.37% 23.23% 23.08% 22.88% 848,543.00 940,146.00 1,000,768.00 1,002,047.00 1,118,833.00 1,354,833.62 1,469,762.60 1,592,847.90 1,726,468.91 1,890,182.91 2,100,299.47 2,324,428.00 2,561,825.12 2,792,097.96 3,054,570.90 17.42% 18.04% 17.15% 16.13% 16.42% 18.01% 18.25% 18.44% 18.44% 18.39% 18.42% 18.42% 18.37% 18.16% 18.07% $715,787.00 $928,247.00 $595,121.00 $618,024.00 $731,551.00 $489,784.20 $459,044.23 $466,206.41 $498,779.35 $538,167.79 $572,666.19 $624,885.47 $677,903.16 $756,709.67 $813,581.11 14.69% 17.81% 10.20% 9.95% 10.74% 6.51% 5.70% 5.40% 5.33% 5.24% 5.02% 4.95% 4.86% 4.92% 4.81% $289,101.00 $212,460.00 ($333,126.00) $22,903.00 $113,527.00 ($241,766.80) ($30,739.97) $7,162.17 $32,572.94 $39,388.45 $34,498.40 $52,219.27 $53,017.69 $78,806.51 $56,871.44 159,067.00 201,807.00 219,026.00 285,668.00 349,007.00 320,876.60 330,135.91 354,125.62 388,575.11 426,499.42 478,935.43 530,139.83 592,749.72 653,461.67 726,871.91 % Revenue 3.27% 3.87% 3.75% 4.60% 5.12% 4.27% 4.10% 4.10% 4.15% 4.15% 4.20% 4.20% 4.25% 4.25% 4.30% Acquisitions - - 31,986.00 - - - - - - - - - - - - % Revenue - - .55% - - - - - - - - - - - - Unlevered Free Cash Flow Discounted Free Cash Flow -$125,785.03 $4,218.87 $566,307.65 $227,490.92 $124,242.38 $511,011.51 $347,088.94 $228,057.23 $274,146.87 $303,518.50 $301,894.73 $319,797.41 $360,281.14 $427,846.25 $493,251.68 491,242.36 308,344.47 187,227.43 207,988.43 212,799.85 195,601.39 191,479.20 199,351.01 218,773.59 233,080.53 UOIG 14 October 9 th, 2015 October 9 th, 2015 University of Oregon Investment Group Appendix 3 – Revenue Model Total Store Square Footage ($ in thousands) Hardlines Square Footage % Growth % of Total Square Footage Apparel Square Footage % Growth % of Total Square Footage Footware Square Footage % Growth % of Total Square Footage Other Square Footage % Growth % of Total Square Footage Total Store Square Footage % Growth 2010A 13,462,681 (1.37%) 52.00% 7,508,034 8.07% 29.00% 4,660,159 17.37% 18.00% 258,898 4.33% 1.00% 25,889,771 4.33% 2011A 13,798,070 2.49% 50.00% 8,002,881 6.59% 29.00% 5,243,267 12.51% 19.00% 275,961 6.59% 1.00% 27,596,140 6.59% 2012A 13,906,235 .78% 47.00% 9,763,952 22.01% 33.00% 5,621,669 7.22% 19.00% 295,877 7.22% 1.00% 29,587,733 7.22% 2013A 13,913,455 .05% 44.00% 11,067,521 13.35% 35.00% 6,324,298 12.50% 20.00% 316,215 6.87% 1.00% 31,621,488 6.87% 2014A 15,068,189 8.30% 44.00% 12,328,519 11.39% 36.00% 6,506,718 2.88% 19.00% 342,459 8.30% 1.00% 34,245,885 8.30% 2015E 15,020,317 (.32%) 40.74% 14,582,802 5.00% 39.55% 6,896,153 5.99% 18.71% 368,319 7.55% 1.00% 36,867,592 7.66% 2016E 15,170,521 1.00% 39.36% 15,749,427 8.00% 40.86% 7,240,961 5.00% 18.79% 384,894 4.50% 1.00% 38,545,802 4.55% 2017E 15,018,815 (1.00%) 37.40% 17,166,875 9.00% 42.75% 7,566,804 4.50% 18.85% 400,289 4.00% 1.00% 40,152,784 4.17% 2018E 14,793,533 (1.50%) 35.19% 18,883,563 10.00% 44.92% 7,945,144 5.00% 18.90% 420,304 5.00% 1.00% 42,042,544 4.71% 2019E 14,534,646 (1.75%) 32.79% 20,960,754 11.00% 47.29% 8,382,127 5.50% 18.91% 443,421 5.50% 1.00% 44,320,948 5.42% 2020E 14,243,953 (2.00%) 30.26% 23,476,045 12.00% 49.87% 8,885,055 6.00% 18.87% 470,026 6.00% 1.00% 47,075,079 6.21% 2021E 13,923,465 (2.25%) 27.93% 26,058,410 11.00% 52.27% 9,373,733 5.50% 18.80% 500,578 6.50% 1.00% 49,856,185 5.91% 2022E 13,644,995 (2.00%) 25.90% 28,664,251 10.00% 54.41% 9,842,419 5.00% 18.68% 528,109 5.50% 1.00% 52,679,775 5.66% 2023E 13,406,208 (1.75%) 24.16% 31,244,034 9.00% 56.30% 10,285,328 4.50% 18.53% 555,835 5.25% 1.00% 55,491,405 5.34% 2024E 13,205,115 (1.50%) 22.68% 33,743,556 8.00% 57.95% 10,696,741 4.00% 18.37% 582,237 4.75% 1.00% 58,227,649 4.93% Total Stores ($ in thousands) Total Store Square Footage % Growth Average Square Feet per Store % Growth Total Stores % Growth 2010A 25,889,771 4.33% 49,313.85 1.35% 525 2.94% 2011A 27,596,140 6.59% 49,190.98 (.25%) 561 6.86% 2012A 29,587,733 7.22% 49,230.84 .08% 601 7.13% 2013A 31,621,488 6.87% 49,254.65 .05% 642 6.82% 2014A 34,245,885 8.30% 49,345.66 .18% 694 8.10% 2015E 36,867,592 7.66% 49,521.30 .36% 744 7.27% 2016E 38,545,802 4.55% 49,620.34 .20% 777 4.34% 2017E 40,152,784 4.17% 49,595.53 (.05%) 810 4.22% 2018E 42,042,544 4.71% 49,590.57 (.01%) 848 4.72% 2019E 44,320,948 5.42% 49,491.39 (.20%) 896 5.63% 2020E 47,075,079 6.21% 49,342.91 (.30%) 954 6.53% 2021E 49,856,185 5.91% 49,145.54 (.40%) 1,014 6.33% 2022E 52,679,775 5.66% 48,998.11 (.30%) 1,075 5.98% 2023E 55,491,405 5.34% 48,900.11 (.20%) 1,135 5.55% 2024E 58,227,649 4.93% 48,851.21 (.10%) 1,192 5.04% Total In-Store Revenue ($ in thousands) Total Store Square Footage % Growth Average Sales per Square Foot % Growth Total In-Store Revenue % Growth % of Total Revenue 2010A 25,890 4.33% 185 4.52% 4,789,608 7.20% 98.32% 2011A 2012A 2013A 2014A 27,596 6.59% 187 1.08% 5,160,478 7.74% 99.02% 29,588 7.22% 193 3.21% 5,710,432 10.66% 97.85% 31,621 6.87% 186 (3.63%) 5,881,597 3.00% 94.66% 34,246 8.30% 185 (.54%) 6,335,489 7.72% 92.97% 2015E 36,868 7.66% 189 2.02% 6,958,353 9.83% 92.51% 2016E 38,546 4.55% 191 1.00% 7,347,847 5.60% 91.25% 2017E 40,153 4.17% 193 1.25% 7,749,857 5.47% 89.73% 2018E 42,043 4.71% 196 1.50% 8,236,318 6.28% 87.96% 2019E 44,321 5.42% 199 1.75% 8,834,614 7.26% 85.96% 2020E 47,075 6.21% 203 2.00% 9,571,274 8.34% 83.93% 2021E 49,856 5.91% 207 1.75% 10,314,119 7.76% 81.71% 2022E 52,680 5.66% 210 1.50% 11,061,730 7.25% 79.31% 2023E 55,491 5.34% 213 1.25% 11,797,769 6.65% 76.73% 2024E 58,228 4.93% 215 1.00% 12,503,305 5.98% 73.97% Total Revenue ($ in thousands) Total In-Store Revenue % Growth % of Total Revenue Total eCommerce Revenue % Growth % of Total Revenue Total Revenue % Growth 2010A 4,789,607.64 14.25% 98.32% 81,884.37 15.00% 1.68% $4,871,492.00 10.39% 2011A 5,160,478.18 7.74% 99.02% 51,323.82 (37.32%) .98% $5,211,802.00 6.99% 2012A 5,710,432.47 10.66% 97.85% 125,686.53 144.89% 2.15% $5,836,119.00 11.98% 2013A 5,881,596.77 3.00% 94.66% 331,576.23 163.81% 5.34% $6,213,173.00 6.46% 2014A 6,335,488.73 7.72% 92.97% 478,990.27 44.46% 7.03% $6,814,479.00 9.68% 2015E 6,958,352.50 9.83% 92.51% 563,398.62 17.62% 7.49% $7,521,751.13 10.38% 2016E 7,347,847.02 5.60% 91.25% 704,248.28 25.00% 8.75% $8,052,095.31 7.05% 2017E 7,749,857.49 5.47% 89.73% 887,352.83 26.00% 10.27% $8,637,210.32 7.27% 2018E 8,236,317.56 6.28% 87.96% 1,126,938.10 27.00% 12.04% $9,363,255.66 8.41% 2019E 8,834,613.64 7.26% 85.96% 1,442,480.77 28.00% 14.04% $10,277,094.41 9.76% 2020E 9,571,273.90 8.34% 83.93% 1,831,950.57 27.00% 16.07% $11,403,224.47 10.96% 2021E 10,314,119.18 7.76% 81.71% 2,308,257.72 26.00% 18.29% $12,622,376.90 10.69% 2022E 11,061,730.07 7.25% 79.31% 2,885,322.15 25.00% 20.69% $13,947,052.23 10.49% 2023E 11,797,769.22 6.65% 76.73% 3,577,799.47 24.00% 23.27% $15,375,568.69 10.24% 2024E 12,503,304.59 5.98% 73.97% 4,400,693.35 23.00% 26.03% $16,903,997.94 9.94% UOIG 15 October 9 th, 2015 October 9 th, 2015 University of Oregon Investment Group Appendix 4 – Working Capital Model Working Capital Model ($ in thousands) Total Revenue Current Assets Accounts Receivable Days Sales Outstanding A/R % of Revenue Inventory Days Inventory Outstanding % of Revenue Prepaid Expenses Days Prepaid Expense Outstanding % of Revenue Income Taxes Receivable Days Outstanding % of Revenue Deferred Income Taxes % of Revenue Total Current Assets % of Revenue Long Term Assets Net PP&E Beginning Capital Expenditures Acquisitions Depreciation and Amortization Net PP&E Ending Total Current Assets & Net PP&E % of Revenue Current Liabilities Accounts Payable Days Payable Outstanding % of Revenue Accrued Expenses Days Charges Outstanding % of Revenue Income Taxes Payable Days Taxes Outstanding % of Revenue Deferred Revenue % of Revenue Current Portion of Long Term Debt % of Revenue Total Current Liabilities % of Revenue 2010A 2011A 2012A 2013A 2014A 2015E 2016E 2017E 2018E 2019E 2020E 2021E 2022E 2023E 2024E $4,871,492.00 $5,211,802.00 $5,836,119.00 $6,213,173.00 $6,814,479.00 $7,521,751.13 $8,052,095.31 $8,637,210.32 $9,363,255.66 $10,277,094.41 $11,403,224.47 $12,622,376.90 $13,947,052.23 $15,375,568.69 $16,903,997.94 34,978.00 2.62 .72% 896,895.00 67.20 18.41% 58,394.00 6.44 1.20% 9,050.00 0.68 .19% 18,961.00 .39% $1,018,278.00 20.90% 38,338.00 2.68 .74% 1,014,997.00 71.08 19.47% 64,213.00 6.70 1.23% 4,113.00 0.29 .08% 12,330.00 .24% $1,133,991.00 21.76% 34,625.00 2.17 .59% 1,096,186.00 68.56 18.78% 73,838.00 6.96 1.27% 15,737.00 0.98 .27% 30,289.00 .52% $1,250,675.00 21.43% 60,779.00 3.58 .98% 1,232,065.00 72.58 19.83% 99,386.00 8.84 1.60% 7,275.00 0.43 .12% 38,835.00 .63% $1,438,340.00 23.15% 80,292.00 4.30 1.18% 1,390,767.00 74.49 20.41% 91,267.00 7.32 1.34% 14,293.00 0.77 .21% 51,586.00 .76% $1,628,205.00 23.89% 98,671.22 4.79 1.31% 1,569,769.44 76.17 20.87% 108,179.54 8.06 1.44% 11,872.74 0.58 .16% 56,124.89 .75% $1,844,617.83 24.52% 93,501.11 4.25 1.16% 1,650,019.53 75.00 20.49% 117,921.40 8.00 1.46% 11,000.13 0.50 .14% 56,364.67 .70% $1,928,806.83 23.95% 100,295.48 4.25 1.16% 1,758,120.68 74.50 20.36% 128,378.21 8.00 1.49% 11,799.47 0.50 .14% 60,460.47 .70% $2,059,054.30 23.84% 109,024.21 4.25 1.16% 1,898,303.89 74.00 20.27% 139,550.99 8.00 1.49% 12,826.38 0.50 .14% 65,542.79 .70% $2,225,248.25 23.77% 119,664.80 4.25 1.16% 2,069,497.09 73.50 20.14% 153,170.94 8.00 1.49% 14,078.21 0.50 .14% 71,939.66 .70% $2,428,350.70 23.63% 132,414.49 4.25 1.16% 2,274,413.62 73.00 19.95% 170,736.80 8.00 1.50% 15,578.18 0.50 .14% 79,822.57 .70% $2,672,965.67 23.44% 146,972.88 4.25 1.16% 2,507,184.45 72.50 19.86% 189,508.56 8.00 1.50% 17,290.93 0.50 .14% 88,356.64 .70% $2,949,313.46 23.37% 162,397.18 4.25 1.16% 2,751,199.34 72.00 19.73% 209,396.84 8.00 1.50% 19,105.55 0.50 .14% 97,629.37 .70% $3,239,728.28 23.23% 179,030.59 4.25 1.16% 3,011,926.47 71.50 19.59% 229,159.16 8.00 1.49% 21,062.42 0.50 .14% 107,628.98 .70% $3,548,807.63 23.08% 196,289.59 4.25 1.16% 3,279,190.86 71.00 19.40% 251,250.68 8.00 1.49% 23,092.89 0.50 .14% 118,327.99 .70% $3,868,152.01 22.88% 684,886.00 159,067.00 110,394.00 733,559.00 $1,751,837.00 35.96% 733,559.00 201,807.00 116,581.00 818,785.00 $1,952,776.00 37.47% 818,785.00 219,026.00 31,986.00 125,096.00 944,701.00 $2,195,376.00 37.62% 944,701.00 285,668.00 154,928.00 1,075,441.00 $2,513,781.00 40.46% 1,075,441.00 349,007.00 179,431.00 1,245,017.00 $2,873,222.00 42.16% 1,245,017.00 320,876.60 186,072.57 1,379,821.03 $3,224,438.86 42.87% 1,379,821.03 330,135.91 213,872.26 1,496,084.68 $3,424,891.51 42.53% 1,496,084.68 354,125.62 231,893.13 1,618,317.18 $3,677,371.48 42.58% 1,618,317.18 388,575.11 250,839.16 1,756,053.13 $3,981,301.38 42.52% 1,756,053.13 426,499.42 272,188.23 1,910,364.31 $4,338,715.01 42.22% 1,910,364.31 478,935.43 296,106.47 2,093,193.27 $4,766,158.93 41.80% 2,093,193.27 530,139.83 324,444.96 2,298,888.14 $5,248,201.60 41.58% 2,298,888.14 592,749.72 356,327.66 2,535,310.20 $5,775,038.48 41.41% 2,535,310.20 653,461.67 392,973.08 2,795,798.79 $6,344,606.42 41.26% 2,795,798.79 726,871.91 433,348.81 3,089,321.89 $6,957,473.90 41.16% 446,511.00 49.21 9.17% 279,284.00 30.78 5.73% 0.00 0.00% 121,753.00 2.50% 995.00 .02% $848,543.00 17.42% 510,398.00 53.22 9.79% 264,073.00 27.54 5.07% 29,484.00 3.07 .57% 128,765.00 2.47% 7,426.00 .14% $940,146.00 18.04% 507,247.00 47.79 8.69% 269,900.00 25.43 4.62% 68,746.00 6.48 1.18% 146,362.00 2.51% 8,513.00 .15% $1,000,768.00 17.15% 562,439.00 50.03 9.05% 265,040.00 23.58 4.27% 19,285.00 1.72 .31% 154,384.00 2.48% 899.00 .01% $1,002,047.00 16.13% 614,511.00 49.31 9.02% 283,828.00 22.78 4.17% 47,698.00 3.83 .70% 172,259.00 2.53% 537.00 .01% $1,118,833.00 16.42% 751,246.80 55.98 9.99% 383,622.06 28.58 5.10% 40,057.41 2.98 .53% 179,235.25 2.38% 672.09 .01% $1,354,833.62 18.01% 810,709.60 55.00 10.07% 412,724.89 28.00 5.13% 44,220.52 3.00 .55% 201,302.38 2.50% 805.21 .01% $1,469,762.60 18.25% 878,588.36 54.75 10.17% 449,323.73 28.00 5.20% 48,141.83 3.00 .56% 215,930.26 2.50% 863.72 .01% $1,592,847.90 18.44% 950,691.11 54.50 10.15% 488,428.46 28.00 5.22% 52,331.62 3.00 .56% 234,081.39 2.50% 936.33 .01% $1,726,468.91 18.44% 1,038,690.45 54.25 10.11% 536,098.29 28.00 5.22% 57,439.10 3.00 .56% 256,927.36 2.50% 1,027.71 .01% $1,890,182.91 18.39% 1,152,473.42 54.00 10.11% 597,578.81 28.00 5.24% 64,026.30 3.00 .56% 285,080.61 2.50% 1,140.32 .01% $2,100,299.47 18.42% 1,273,260.66 53.75 10.09% 663,279.97 28.00 5.25% 71,065.71 3.00 .56% 315,559.42 2.50% 1,262.24 .01% $2,324,428.00 18.42% 1,400,341.36 53.50 10.04% 732,888.94 28.00 5.25% 78,523.81 3.00 .56% 348,676.31 2.50% 1,394.71 .01% $2,561,825.12 18.37% 1,518,179.44 53.00 9.87% 802,057.06 28.00 5.22% 85,934.69 3.00 .56% 384,389.22 2.50% 1,537.56 .01% $2,792,097.96 18.16% 1,656,684.17 52.75 9.80% 879,377.38 28.00 5.20% 94,219.00 3.00 .56% 422,599.95 2.50% 1,690.40 .01% $3,054,570.90 18.07% UOIG 16 October 9 th, 2015 University of Oregon Investment Group October 9 th, 2015 Appendix 5 – Discounted Cash Flows Valuation Assumptions Discounted Free Cash Flow Assumptions Tax Rate 35.00% Terminal Growth Rate Risk Free Rate 3.00% 2.01% Terminal Value Beta 12,258,731 0.96 PV of Terminal Value Market Risk Premium % Equity Considerations 3,904,219 6.45% Sum of PV Free Cash Flows 99.90% Firm Value 3,654,245 7,558,465 % Debt 0.10% Total Debt Cost of Debt 3.67% Cash & Cash Equivalents CAPM 8.22% Market Capitalization WACC 8.21% Fully Diluted Shares Terminal Risk Free Rate 2.85% Implied Price 60.20 Terminal CAPM 9.06% Current Price 51.23 Terminal WACC 9.05% Undervalued 17.50% Considerations 6,187 123,220 7,552,278 125,458 Implied Price Terminal Growth Rate Avg. Industry Debt / Equity 31.37% Final Price Target Avg. Industry Tax Rate 21.36% Current Reinvestment Rate 69.24% Reinvestment Rate in Year 2020E 41.44% Implied Price 62.87 Implied Return on Capital in Perpetuity 7.24% Current Price 51.23 Terminal Value as a % of Total 51.7% Undervalued 22.73% Implied 2015E EBITDA Multiple 9.4x Implied Multiple in Year 2024E 2.3x Free Cash Flow Growth Rate in Year 2024E 13% Weighting Implied Price DCF 80.00% 60.20 Forward Comps 20.00% 73.57 UOIG 17 October 9 th, 2015 October 9 th, 2015 University of Oregon Investment Group Appendix 6 –Sensitivity Analysis Implied Price Undervalued/(Overvalued) Terminal Growth Rate 60 2.0% 2.5% 3.0% 3.5% 4.0% 0 2.3% 2.3% 3.0% 3.8% 4.5% 0.76 70.20 74.07 78.75 84.52 91.83 1.16 (9.74%) (9.74%) (5.55%) (0.40%) 6.06% 0.86 62.09 64.94 68.33 72.40 77.40 1.06 (0.59%) (0.59%) 4.81% 11.58% 20.31% 0.96 55.52 57.68 60.20 63.17 66.72 1.06 50.12 51.79 53.70 55.91 58.52 1.16 45.61 46.91 48.39 50.08 52.04 Adjusted Beta Adjusted Beta Terminal Growth Rate 0.96 10.41% 10.41% 17.50% 26.61% 38.71% 1.06 (0.59%) (0.59%) 4.81% 11.58% 20.31% 1.16 (9.74%) (9.74%) (5.55%) (0.40%) 6.06% Implied Price Undervalued/(Overvalued) Terminal Growth Rate 60 2.3% 2.3% 3.0% 3.8% 4.5% 0 2.3% 2.3% 3.0% 3.8% 4.5% 0.28 13.98 13.98 14.28 14.68 15.20 0.28 (72.72%) (72.72%) (72.12%) (71.35%) (70.32%) 0.18 24.37 24.37 25.36 26.64 28.35 0.18 (52.44%) (52.44%) (50.49%) (47.99%) (44.67%) 0.08 56.07 56.07 59.66 64.26 70.39 0.08 9.44% 9.44% 16.45% 25.44% 37.40% 0.18 24.37 24.37 25.36 26.64 28.35 0.18 (52.44%) (52.44%) (50.49%) (47.99%) (44.67%) 0.28 13.98 13.98 14.28 14.68 15.20 0.28 (72.72%) (72.72%) (72.12%) (71.35%) (70.32%) WACC WACC Terminal Growth Rate Implied Price Undervalued/(Overvalued) Terminal Growth Rate 60 2.3% 2.3% 3.0% 3.8% 4.5% 0 2.3% 2.3% 3.0% 3.8% 4.5% 0.55 56.57 56.57 60.21 64.87 71.07 0.55 10.42% 10.42% 17.52% 26.62% 38.73% 0.45 56.57 56.57 60.20 64.87 71.07 0.45 10.42% 10.42% 17.51% 26.62% 38.72% 0.35 56.56 56.56 60.20 64.86 71.06 0.35 10.41% 10.41% 17.50% 26.61% 38.71% 0.45 56.57 56.57 60.20 64.87 71.07 0.45 10.42% 10.42% 17.51% 26.62% 38.72% 0.55 56.57 56.57 60.21 64.87 71.07 0.55 10.42% 10.42% 17.52% 26.62% 38.73% Tax Rate Tax Rate Terminal Growth Rate UOIG 18 University of Oregon Investment Group October 9 th, 2015 October 9 th, 2015 Appendix 8 – Sources About Retailing Bloomberg CNNMoney Dick’s Sporting Goods 10-K Dick’s Sporting Goods Earnings Call Dick’s Sporting Goods Investor Relations Factset Finviz Google Finance Huffington Post IBISWorld MarketWatch Statista Seeking Alpha Yahoo! Finance UOIG 19