December 18, 2015

TOILETRIES/COSMETICS INDUSTRY

The Toiletries and Cosmetics Industry’s prospects have certainly improved of late. The group

seems poised for a solid performance in 2015, and

its Timeliness rank has improved since our September review and is now near the top third of the

97 industries under our review.

The Year Ahead

Over the last couple of years, the Timeliness rank of

this group slipped from the top 10% to the bottom 10%

among industries under our review. This came as no big

surprise, as we would not expect this traditionally ‘‘defensive’’ industry to do well during times when investors

are looking ahead to a recovering economy. Indeed,

economic growth typically prompts a shift in investor

interest to other areas that are growing more rapidly.

These companies tend to turn in relatively stable earnings performances in both good times and bad, due to the

general population’s routine use of their product lines.

When the economy is in recession mode, the lure of

steady and predictable earnings trends is somewhat

more compelling. Even with the recent volatility in the

overall market, the values of many of the issues under

our review have bounced back considerably from the

lows seen earlier in the year.

Current Trends

Although many of the more exclusive cosmetic brands

are only available in upscale department stores, distribution patterns may be changing. Notably, highergrowth distribution channels, such as the Internet,

infomercials, television home shopping, and independent retailers and spas, are making their mark, and we

would not be surprised to see more traditional brands

taking advantage of these avenues to boost top-line

growth.

Separately, the fastest-growing sectors of the Toiletries and Cosmetics Industry now include dermatological

skin care, men’s personal care, and products specifically

designed for ethnic groups. As such, it comes as no

surprise that many companies focus their R&D, as well

as advertising dollars, in specific market niches that

offer impressive growth potential.

Recent Developments

Coty, one of the world’s largest manufacturers, marketers, and distributors of women’s and men’s fragrances, cosmetics, and skin/body care products, is

poised to double in size. In early July, the company

announced that it had inked a definitive agreement to

merge The Procter & Gamble Company’s fine fragrance,

color cosmetics, and hair color businesses into Coty

through a tax-free Reverse Morris Trust transaction.

Post closing, P&G stockholders would own 52% of all

outstanding shares, with Coty’s existing shareholders

owning the balance of the combined company. We look

for the transaction to be finalized in the second half of

calendar 2016.

Revlon, which manufactures a variety of beauty products, including such brands as Revlon, Almay, SinfulColors, Pure Ice, Mitchum, Charlie, and Jean Nate,

certainly looks different than it did this time last year. In

October of last year, the company completed the acquisition of The Colomer Group, a beauty care company

that markets and sells nail and hair care products

primarily in salons and other professional channels, for

$665 million. Subsequently, early in the June quarter,

the company acquired CBBeauty, a U.K.-based global

1006

INDUSTRY TIMELINESS:

34 (of 97)

fragrance management company that distributes and

markets perfumes and beauty products.

Overseas Opportunities

The crucial factor here is the opportunity to build

businesses in emerging markets, where per capita incomes are on the rise, local goods are typically of lesser

quality, and usage of personal care items taken for

granted in the Western world is still sporadic at best. A

number of multinationals in this group have tapped into

huge countries, such as China, India, and Russia, where

they can also benefit from a gradual trading up among

the population to ever more sophisticated (and highermargined) offerings. There are hurdles and risks to

overcome, though, including volatile currency markets

(i.e. the recent rate fluctuations in Venezuela) and cultural differences. But these seem insignificant in comparison to the opportunities available to Avon, Elizabeth

Arden, and Estee Lauder.

New Product Development Is Key

A lackluster retail sector, an increasing reliance on

just-in-time inventory, a continued fight for shelf space

that requires significant marketing support, a more

value-oriented consumer, and the possibility of inroads

by private labels are some of the constraints under

which this industry is operating in the domestic marketplace, demonstrating that consumers are willing to pay a

premium for the quality associated with well-known

brand names. Therefore, they must continually improve

existing products and communicate the advantages to

consumers so that buyers will trade up. And they seem

to be doing just that, despite hefty price differentials.

New product activity is at an impressive level, boosting

volume and margins, thanks to a richer product mix.

Conclusion

This industry is a worthwhile choice for the next six to

12 months. However, many of the issues in this industry

have experienced a run up in value recently, and therefore only a couple still offer alluring appreciation potential through 2018-2020.

Kenneth A. Nugent

Toiletries/Cosmetics

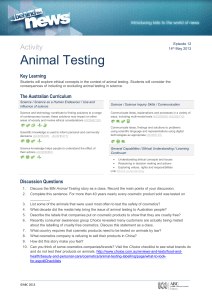

RELATIVE STRENGTH (Ratio of Industry to Value Line Comp.)

1200

1000

800

600

400

200

2 009

2 010

2 0 11

2 012

2 01 3

2 014

2 015

Index: June, 1967 = 100

© 2015 Value Line, Inc. All rights reserved. Factual material is obtained from sources believed to be reliable and is provided without warranties of any kind.

THE PUBLISHER IS NOT RESPONSIBLE FOR ANY ERRORS OR OMISSIONS HEREIN. This publication is strictly for subscriber’s own, non-commercial, internal use. No part

of it may be reproduced, resold, stored or transmitted in any printed, electronic or other form, or used for generating or marketing any printed or electronic publication, service or product.

To subscribe call 1-800-VALUELINE