Certificate in International Cash Management (CertICM)

advertisement

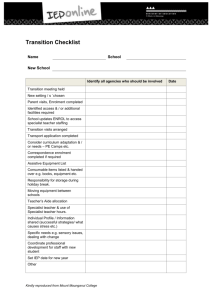

Certificates Certificate in International Cash Management (CertICM) CertICM is the only qualification that focuses exclusively on global cash management, and has been developed to assist understanding for both banks and corporate organisations. Course summary Structure Six study units Study time 200 study hours Duration A six month period with a compulsory five-day tuition school Who is it for? ■ Bank selection It is essential for anyone involved in cash management or a wider treasury role. ■ Treasury technology How is the course structured? ■ Spotlight on international systems You’ll complete the CertICM in six study units. Study unit 1: Reviewing the basics ■ Introduction to cash management Assessment A three-hour written exam ■ Important cash management concepts Costs South Africa £2520 (includes local taxes) ■ Introduction to working capital ■ Introduction to financial statements ■ Introduction to trade financing Study unit 2: The banking system Enrolment deadlines 15 March for South Africa School 29 July - 2 August 2013 ■ Introduction to banking ■ Basic banking services ■ Settlement and clearing systems ■ International payment vehicles ■ Foreign currency accounts “ I would definitely recommend the CertICM qualification to anyone who was thinking seriously about a career in treasury. It opens your eyes to so many aspects you might not even know on a daily basis ” Study unit 3: Liquidity management Find the full syllabus at www.treasurers.org/certicm What are the key benefits? ■ Understand international cash management from both a corporate and banking perspective ■ Appreciate the wider relevance of cash management to corporate treasury and international banking ■ Understand global money transmission techniques and the details of major clearing systems ■ Add real value when organising and negotiating international cash management arrangements ■ Acquire a suitable toolkit for practical international cash management ■ Cash flow forecasting ■ Short-term investment ■ Short-term borrowing Study unit 4: International cash management tools and techniques ■ Netting ■ Pooling and cash concentration ■ Efficient account structures ■ Risk management ■ Foreign exchange Upon completion, you will be able to use the designatory letters CertICM and join the CertICM faculty. For more about faculty membership, visit www.treasurers.org/membership Study unit 6: Spotlight on international systems Study unit 5: Organisation of the treasury function ■ Treasury structures ■ Tax and regulatory issues for treasury How do you study? CertICM is a distance learning programme combining self-study with a compulsory five-day tuition school. An integral part of the course, the compulsory five-day tuition school is taught by leading international cash management tutors. It incorporates case studies led by cash management practitioners and enables you to actively participate in finding solutions to typical cash management problems. Certificates: CertICM With your online study, you will have access to an electronic copy of the course material, a hard copy course manual, access to the e-learning website, practice examples, past exam papers and a forum to contact the tutor and other students in the study group. How long to complete the course? Each individual studying with the ACT must complete their course within a time limit. You will have two years (four exam sittings) to complete. Your first booked exam is the start of your time limit even if you then later choose to defer that exam. How much does it cost? The course costs: South Africa £2520 (includes local taxes) Enrolment deadlines 15 March for October examination How to enrol To enrol onto the CertICM course, you must complete and submit an enrolment form before the deadline. The enrolment form can be downloaded from www.treasurers.org/enrol. Completed enrolment forms can be emailed to enrolments@treasurers.org FAQ’s for further information For further information about enrolling onto and studying for an ACT qualification see frequently asked questions at www.treasurers.org/certicm This includes the course manual, access to the e-learning website, five-day tuition school and first exam entry. Students enrolling on professional qualifications are required to pay an annual student subscription fee of £134 on a pro-rata basis from the month of enrolment and thereafter a yearly subscription each May. Holders of CertICM can go forward to enrol onto the AMCT Diploma using this Certificate as one of the modules needed for completion. @ACTupdate www.facebook.com/actupdate www.treasurers.org/linkedin www.youtube.com/treasurersorg Shaping future finance