Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

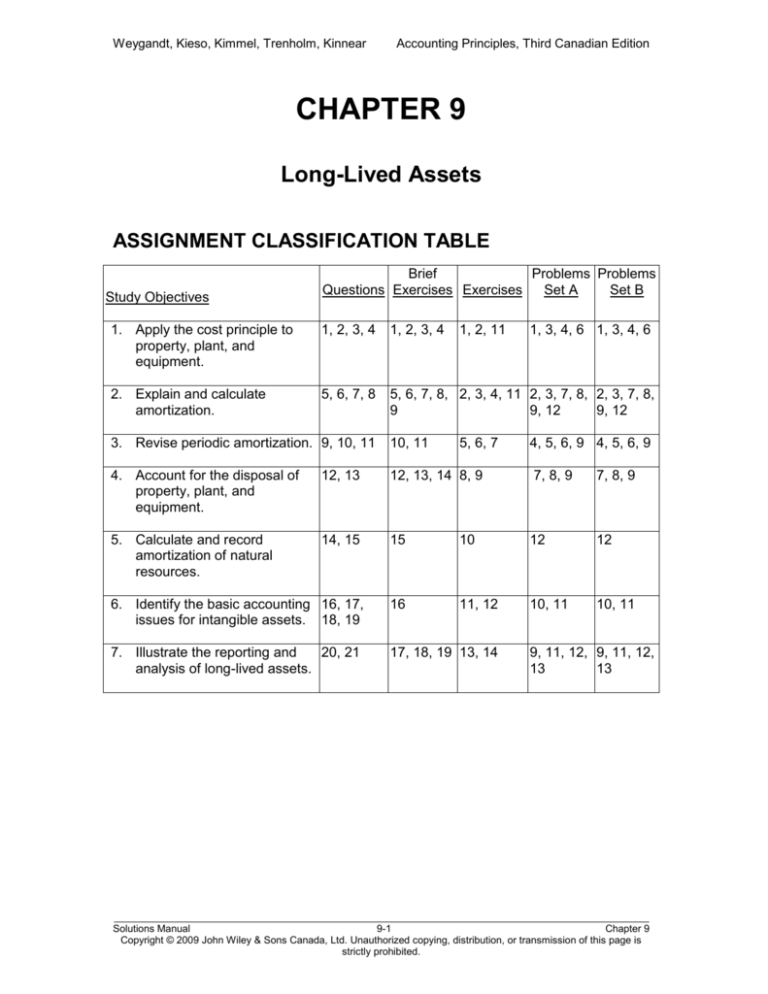

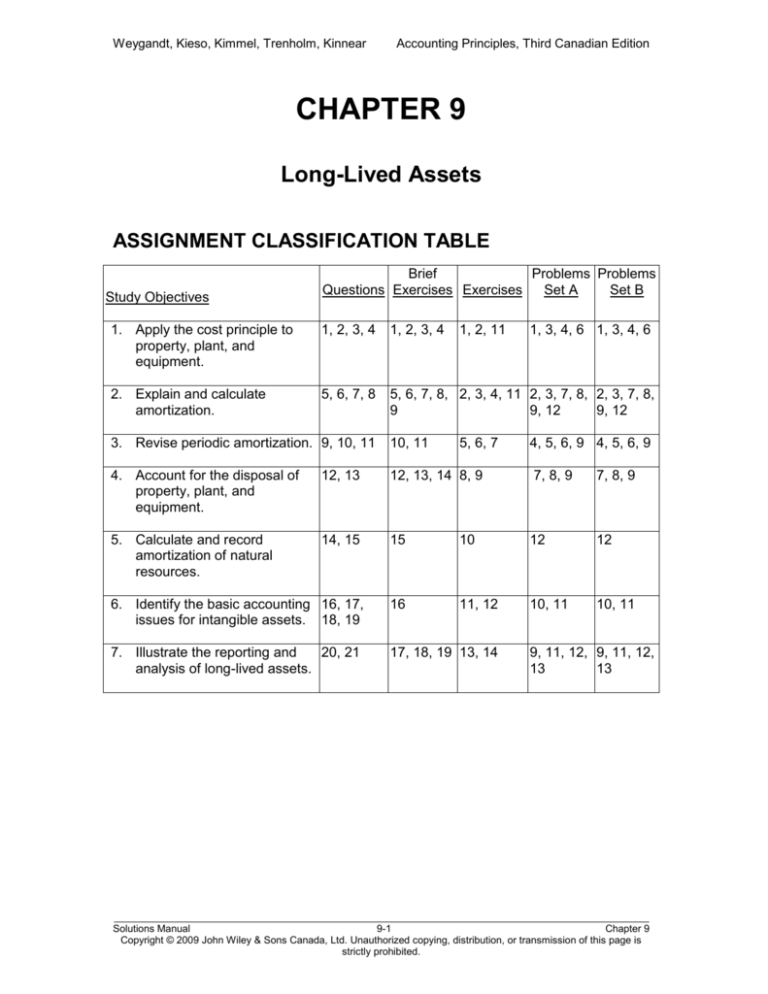

CHAPTER 9

Long-Lived Assets

ASSIGNMENT CLASSIFICATION TABLE

Study Objectives

Brief

Problems Problems

Questions Exercises Exercises

Set A

Set B

1. Apply the cost principle to

property, plant, and

equipment.

1, 2, 3, 4

1, 2, 3, 4

1, 2, 11

2. Explain and calculate

amortization.

5, 6, 7, 8

5, 6, 7, 8, 2, 3, 4, 11 2, 3, 7, 8, 2, 3, 7, 8,

9

9, 12

9, 12

5, 6, 7

1, 3, 4, 6 1, 3, 4, 6

3. Revise periodic amortization. 9, 10, 11

10, 11

4, 5, 6, 9 4, 5, 6, 9

4. Account for the disposal of

property, plant, and

equipment.

12, 13

12, 13, 14 8, 9

7, 8, 9

7, 8, 9

5. Calculate and record

amortization of natural

resources.

14, 15

15

10

12

12

6. Identify the basic accounting 16, 17,

issues for intangible assets. 18, 19

16

11, 12

10, 11

10, 11

7. Illustrate the reporting and

20, 21

analysis of long-lived assets.

17, 18, 19 13, 14

9, 11, 12, 9, 11, 12,

13

13

Solutions Manual

9-1

Chapter 9

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

ASSIGNMENT CHARACTERISTICS TABLE

Problem

Number

Description

1A

Record property transactions.

2A

Difficulty

Time

Level Allotted (min.)

Simple

20-30

Calculate partial period amortization.

Moderate

20-30

3A

Determine cost; calculate and compare amortization under

different methods.

Moderate

30-40

4A

Account for operating and capital expenditures and asset

impairments.

Moderate

20-30

5A

Record impairment and calculate revised amortization.

Moderate

20-30

6A

Record operating and capital expenditures and calculate

revised amortization.

Moderate

25-35

7A

Calculate and compare amortization and gain or loss on

disposal under straight-line and units-of-activity methods.

Moderate

30-40

8A

Record acquisition, amortization, and disposal of equipment.

Moderate

30-40

9A

Record property, plant, and equipment transactions; prepare

partial financial statements.

Complex

40-50

10A

Correct errors in recording intangible asset transactions.

Complex

25-35

11A

Record intangible asset transactions; prepare partial balance

sheet.

Moderate

30-40

12A

Record equipment and natural resource transactions; prepare Moderate

partial financial statements.

30-40

13A

Calculate ratios and comment.

Moderate

15-25

1B

Record property transactions.

Simple

20-30

2B

Calculate partial period amortization.

Moderate

20-30

3B

Determine cost; calculate and compare amortization under

different methods.

Moderate

30-40

4B

Account for operating and capital expenditures and asset

impairments.

Moderate

20-30

5B

Record impairment and calculate revised amortization.

Moderate

20-30

6B

Record operating and capital expenditures and calculate

revised amortization.

Moderate

25-35

Solutions Manual

9-2

Chapter 9

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

ASSIGNMENT CHARACTERISTICS TABLE (Continued)

Problem

Number

Description

Difficulty

Time

Level Allotted (min.)

7B

Calculate and compare amortization and gain or loss on

disposal under straight-line and double declining-balance

methods.

Moderate

30-40

8B

Record acquisition, amortization, and disposal of equipment.

Moderate

30-40

9B

Record property, plant, and equipment transactions; prepare

partial financial statements.

Complex

40-50

10B

Correct errors in recording intangible asset transactions.

Complex

25-35

11B

Record intangible asset transactions; prepare partial balance

sheet.

Moderate

30-40

12B

Record equipment and natural resource transactions; prepare Moderate

partial financial statements.

30-40

13B

Calculate ratios and comment.

15-25

Moderate

Solutions Manual

9-3

Chapter 9

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

BLOOM’S TAXONOMY TABLE

Correlation Chart between Bloom's Taxonomy, Study Objectives and End-ofChapter Exercises and Problems

Study Objective

1. Apply the cost

principle to property,

plant, and

equipment.

2. Explain and

calculate

amortization.

3. Revise periodic

amortization.

4. Account for the

disposal of property,

plant, and

equipment.

5. Calculate and record

amortization of

natural resources.

6. Identify the basic

accounting issues

for intangible assets.

7. Illustrate the

reporting and

analysis of long-lived

assets.

Broadening Your

Perspective

Knowledge Comprehension

Application

BE9-3

Q9-1

BE9-1

P9-3A

Q9-2

BE9-2

P9-4A

Q9-3

BE9-4

P9-6A

Q9-4

E9-1

P9-1B

E9-2

P9-3B

E9-11

P9-4B

P9-1A

P9-6B

Q9-6

Q9-5

BE9-5

P9-7A

Q9-7

BE9-6

P9-8A

BE9-7

Q9-8

P9-9A

BE9-8

P9-12A

BE9-9

P9-2B

E9-2

P9-3B

E9-3

P9-7B

E9-4

P9-8B

E9-11

P9-9B

P9-2A

P9-12B

P9-3A

Q9-9, Q9-10,

BE9-10 P9-6A

Q9-11

BE9-11 P9-9A

E9-5

P9-4B

E9-6

P9-5B

E9-7

P9-6B

P9-4A

P9-9B

P9-5A

Q9-12

Q9-13

BE9-12 P9-8A

BE9-13 P9-9A

BE9-14 P9-7B

E9-8

P9-8B

E9-9

P9-9B

P9-7A

Q9-14, Q9-15

BE9-15

E9-10

P9-12A

P9-12B

Q9-16, Q9-17,

BE9-16

Q9-18, Q9-19

E9-11

P9-11A

E9-12

P9-10B

P9-10A P9-11B

Q9-20,

Q9-21

BE9-18 P9-11A

BE9-17

BE9-19 P9-12A

E9-13

P9-9B

P9-9A

P9-11B

P9-12B

Continuing

Cookie Chronicle

BYP9-1 BYP9-2

BYP9-3

Analysis Synthesis Evaluation

E9-14

P9-13A

P9-13B

BYP9-4

BYP9-5

Solutions Manual

9-4

Chapter 9

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

ANSWERS TO QUESTIONS

1.

For long-lived assets, the cost principle means that cost consists of all

expenditures necessary to acquire the asset and make it ready for its

intended use. These costs are capitalized rather than expensed, because

they will provide benefits over future periods.

2.

All three amounts will be debited to the land account. The cost to

purchase the land and building as well as the cost to remove the building

is recorded in the land account. These costs are incurred to prepare the

land for its intended use. Since the old building is destroyed none of the

purchase cost is allocated to Buildings. As well, the costs to grade the

land are incurred to prepare the land for its intended use. Land will be

debited for $505,000 ($430,000 + $45,000 + $30,000).

3.

The cost principle has survived because it provides information that is

objective and verifiable, whereas market values are subjective and

changeable. In addition, if a company is not planning on selling the asset

the market value of the asset is not relevant.

4.

The purchase cost must be split between the land and building because

the building is amortized and the land is not. In addition, the cost of each

item will be necessary if the land, or the building, is later sold to determine

any gain or loss on disposal.

5.

The purpose of amortization is to allocate the cost of a long-lived,

amortizable asset over its useful life in a systematic way. Amortization

expense is matched to the revenues it has helped generate.

A common misunderstanding about amortization is that amortization

attempts to measure an asset’s market value or real value. There is no

attempt to measure the change in a long-lived asset’s real value because

long-lived assets are not held for resale. Another common

misunderstanding is that accumulated amortization results in the

accumulation of cash to purchase or replace the long-lived asset.

Accumulated amortization represents the total cost of the asset that has

been allocated to expense so far—it does not represent a cash fund.

6.

(a) Residual value is the expected cash value of the asset at the end of

its useful life. It is sometimes called salvage value or trade-in value.

Residual value is not amortized, since this is the amount expected to

be recovered at the end of an asset’s useful life.

Solutions Manual

9-5

Chapter 9

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

QUESTIONS (Continued)

Question 6 (Continued)

(b) Residual value is subtracted from cost to determine the amortizable

cost of the asset. Residual value limits the total value of amortization

that can be taken for all three methods of amortization. Amortization

will stop when the asset’s book value equals its expected residual

value.

In the straight-line and the units-of-activity methods of calculating

amortization, residual value is used in calculating the amortizable cost

per year or the amortizable cost per unit. Residual value is not used in

determining the amount that the declining-balance amortization rate is

applied to. Under all three methods net book value should never be

reduced below residual value. In other words, amortization stops

when the asset’s net book value is equal to its expected residual

value.

7.

Net book value is cost less accumulated amortization of an asset. Cost is

the same under each method of amortization. In the early years, net book

value will be less under the declining-balance method than under the

straight-line method. The units-of-activity method is unpredictable. In all

three methods, net book value at the end of the asset’s useful life, will be

equal to the asset’s residual value.

The amortization expense is constant under the straight-line method,

varies according to production under the units-of-activity method and

declines over time with the declining-balance method. In the early years

amortization expense will be higher under the declining-balance method

than the straight-line method. The units-of-activity method is

unpredictable.

Consequently, assuming no other changes, net income is constant under

the straight-line method, varies according to production under the units-ofactivity method, and increases over time with the declining-balance

method. In the early years, net income will be higher under the straightline method than the declining-balance method. It is unpredictable under

the units-of-activity method. All three methods will result in the same total

amortization expense over the asset’s useful life.

Solutions Manual

9-6

Chapter 9

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

QUESTIONS (Continued)

8.

Ralph’s plan will not work. For accounting purposes, a company should

choose the amortization method that best matches expenses to revenues.

For tax purposes income tax regulations require a company to use the

single declining-balance method. Amortization is calculated on a class basis

and a specified rate is specifically identified for specific types of classes of

assets.

9.

Operating expenditures are ordinary repairs made to maintain the operating

efficiency and expected productive life of the asset. Because they are

recurring expenditures and normally benefit only the current period, they are

expensed when incurred. Capital expenditures are additions and

improvements made to increase efficiency, productivity, or expected useful

life of the asset. Because they benefit future periods, capital expenditures

are debited to the asset account affected.

10. A permanent decline in the market value of a long lived asset is called an

impairment loss. It occurs when the market value of a long-lived asset falls

far below its book value and is not expected to recover, and the company

does not expect to recover the net book value from future cash flows. It

could occur when a machine has become obsolete or the market for a

product made by a machine becomes obsolete.

11. A revision of amortization is made in current and future years but not

retroactively. Amortization is based on the best available information at the

time the estimate was made. Continual restatement of prior periods would

adversely affect the reader's confidence in the financial statements; thus,

prior periods should not be restated if amortization is revised.

12. In a sale of property, plant or equipment, the net book value of the asset is

compared to the proceeds received from the sale. If the proceeds of the

sale exceed the net book value of the asset, a gain on disposal occurs. If

the proceeds of the sale are less than the net book value of the asset sold,

a loss on disposal occurs.

In an exchange a new asset is received in an exchange for the old asset

given up. If cash is part of the exchange and the amount is considered

significant it is considered a monetary exchange. The gain or loss is

calculated by comparing the fair value of the asset given up to its net book

value. The trade-in allowance on the asset given up is not relevant. If the

cash involved in the exchange is not significant—or if there is no cash—

then the exchange is considered a nonmonetary exchange. The gain or loss

is still calculated the same way unless the fair values of the assets cannot

be determined. In that case no gain or loss is recorded.

Solutions Manual

9-7

Chapter 9

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

QUESTIONS (Continued)

13.

The asset and related accumulated amortization should continue to be

reported on the balance sheet, without further amortization or adjustment,

until the asset is retired. Reporting the asset and related accumulated

amortization on the balance sheet informs the reader of the financial

statements that the asset is still being used by the company. However,

once an asset is fully amortized, no additional amortization should be

taken on this asset, even if it is still being used. In no situation can the

accumulated amortization exceed the cost of the asset.

14.

(a) The amortizable cost of a natural resource includes cost less residual

value. In calculating the amortization expense for natural resources,

the amortizable cost is expressed on a per unit basis, divided by the

total production or activity anticipated. The amortizable cost per unit is

then multiplied by the actual production output or activity sold for the

period.

(b) Amortization is initially recorded as a current asset, inventory,

because it is part of the cost of extracting the natural resource. The

amortization becomes part of the cost of goods sold when the

inventory is sold.

15.

The amortization of natural resources is recorded as inventory and not as

an expense because the resource extracted is expected to be sold. Until

the resource is sold, it has a future benefit and all the costs of obtaining

this resource are recorded as an asset, inventory. The cost is later

expensed, as cost of goods sold, when the extracted resource is sold.

16.

Intangible assets are rights, privileges and competitive advantages that

result from ownership of long-lived assets. They have a future benefit in

that they contribute to future revenue, however, they lack physical

existence or substance.

17.

Flin Company should amortize the patent over its 20 year legal life or its

useful life, whichever is shorter. Flin Company must consider when its

patent is likely to become ineffective at contributing to revenue and if this

will occur before the end of its legal life.

18.

Goodwill is the value of many favourable attributes that are intertwined in

a business enterprise. Goodwill can be identified only with the business as

a whole and, unlike other assets, cannot be sold separately. Goodwill can

only be sold if the entire business is sold.

Solutions Manual

9-8

Chapter 9

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

QUESTIONS (Continued)

19.

Research and development costs present several accounting problems. It

is sometimes difficult to assign the costs to specific projects, and there are

uncertainties in identifying the extent and timing of future benefits. As a

result, all research and some development costs are recorded as an

expense. Only certain development costs with reasonably assured future

benefits can be capitalized. This is intended to maintain the objectivity and

reliability of the financial statements.

20.

Property, plant, and equipment and natural resources are often combined

and reported in the balance sheet as “property, plant, and equipment” or

“capital assets”. Goodwill must be disclosed separately. Other intangibles

can be grouped under “intangible assets”. Amortization expense for the

period should also be disclosed either on the income statement or in the

notes to the financial statements. When impairment losses have occurred

they should be shown on a separate line on the income statement with the

details disclosed in a note.

The notes to financial statements should disclose the balance of the major

classes of amortizable assets and the amortization method(s) and rates

used. The book value of each major class of unamortized assets should

also be disclosed. Companies should also disclose their impairment policy

in the notes to the financial statements.

21.

The asset turnover and return on asset ratios show how effectively the

company uses its long-lived assets. The asset turnover shows the amount

of sales produced for each dollar invested in assets. It is calculated by

dividing net sales by average total assets. The return on assets measures

overall profitability. It is calculated by dividing net income by average total

assets.

Solutions Manual

9-9

Chapter 9

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

SOLUTIONS TO BRIEF EXERCISES

BRIEF EXERCISE 9-1

The cost of the land is $61,000 ($50,000 + $5,000 + $2,500 +

$3,500). The installation of the fence should be debited to Land

Improvements account.

BRIEF EXERCISE 9-2

The cost of the truck is $43,000 (cash price $41,750 + painting

and lettering $750 + installation of trailer hitch $500). The

expenditures for the insurance and the motor vehicle licence

are recurring and only benefit the current period. They should

be expensed and not added to the cost of the truck.

BRIEF EXERCISE 9-3

(a)

(b)

(c)

(d)

(e)

(f)

(g)

(h)

(i)

(j)

O

C

C

O

C

O

O

C

C

O

Solutions Manual

9-10

Chapter 9

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

BRIEF EXERCISE 9-4

Jan. 1

Land

[$400,000 x ($127,500 ÷ $425,000)] .... 120,000

Building

[$400,000 x ($255,000 ÷ $425,000)] .... 240,000

Equipment

[$400,000 x ($42,500 ÷ $425,000)] ...... 40,000

Cash ................................................

Mortgage Payable ($400,000 - $100,000)

100,000

300,000

BRIEF EXERCISE 9-5

Amortizable cost is $40,000 ($43,000 - $3,000). With a 4-year

useful life, annual amortization is $10,000 ($40,000 4). Under

the straight-line method, amortization is the same each year.

Thus, amortization expense is (a) $10,000 for each year of the

truck’s life and (b) $40,000 in total over the truck’s life.

BRIEF EXERCISE 9-6

The declining-balance rate is 50% (25% x 2) and this rate is

applied to net book value at the beginning of the year.

Amortization expense for each year is as follows:

(a)

Calculation

End of Year

NBV (Beg.

Amort.

Amort.

Accum. Net Book

Year of Year

X

Rate = Expense

Amort.

Value

$43,000

2008

$43,000

50%

$21,500

$21,500

21,500

2009

21,500

50%

10,750

32,250

10,750

2010

10,750

50%

5,375

37,625

5,375

2011

5,375

50%

2,375¹

40,000

3,000

¹Limited to the amount to reduce the net book value to the

residual value of $3,000

(b) Total amortization over the truck’s useful life is $40,000.

Solutions Manual

9-11

Chapter 9

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

BRIEF EXERCISE 9-7

Amortizable cost per unit:

($33,000 - $500) 325,000 km. = $0.10/km.

Annual amortization expense:

2007:

125,000 x $0.10 = $12,500

2008:

105,000 x $0.10 = $10,500

BRIEF EXERCISE 9-8

(a) Amortization expense for each year:

Calculation

Amortizable

Amort.

Year

Cost*

X

Rate =

Amort.

Expense

2008

2009

2010

2011

2012

$ 7,500

10,000

10,000

10,000

2,500

$40,000

40,000

40,000

40,000

40,000

25% x 9/12

25%

25%

25%

25% x 3/12

End of Year

Accum. Net Book

Amort.

Value

$43,000

$ 7,500

35,500

17,500

25,500

27,500

15,500

37,500

5,500

40,000

3,000

*Amortizable cost = $43,000 - $3,000

(b) Total amortization expense over the truck’s useful life is

$40,000. (See accumulated amortization at end of 2012

above)

Solutions Manual

9-12

Chapter 9

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

BRIEF EXERCISE 9-9

The double declining-balance rate is 50% (25% x 2) and this rate

is applied to net book value at the beginning of the year.

Amortization expense for each year is as follows:

(a)

Double Declining-Balance

Calculation

NBV (Beg.

Amort.

Year of Year

X

Rate =

Amort.

Expense

2008

2009

2010

2011

2012

$16,125

13,438

6,719

3,359

359¹

$43,000

26,875

13,437

6,718

3,359

50% x 9/12

50%

50%

50%

50%

End of Year

Accum. Net Book

Amort.

Value

$43,000

$16,125

26,875

29,563

13,437

36,282

6,718

39,641

3,359

40,000

3,000

¹ Limited to the amount to bring net book value to the residual

value of $3,000

(b) Total amortization expense over the truck’s useful life is

$40,000. (See accumulated amortization at end of 2012

above)

BRIEF EXERCISE 9-10

Loss on Impairment ...................................

Accumulated Amortization—Machinery

Calculation:

Net Book Value ($90,000 - $54,000) ...

Less: Market Value ............................

Impairment loss..................................

16,000

16,000

$36,000

20,000

$16,000

Solutions Manual

9-13

Chapter 9

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

BRIEF EXERCISE 9-11

Amortization expense from 2005 to 2007:

[($60,000 - $4,000) ÷ 7 years = $8,000]

2005

2006

2007

Total

$ 8,000

8,000

8,000

$24,000

Net book value, Jan. 1, 2008 ($60,000 - $24,000)........... $36,000

Add: Equipment up-grade .............................................

9,000

Less: Revised residual value ........................................

(3,000)

Remaining amortizable cost ...........................................

42,000

Remaining useful life (9 years - 3 years) ....................... ÷ 6 years

Revised annual amortization expense 2008 .................. $ 7,000

BRIEF EXERCISE 9-12

(a)

Accumulated Amortization—

Delivery Equipment ....................................

Delivery Equipment ...............................

41,000

(b) Accumulated Amortization—

Delivery Equipment ....................................

Loss on Disposal........................................

Delivery Equipment ...............................

38,000

3,000

41,000

Cost of delivery equipment ...................................

Less: Accumulated amortization ..........................

Net book value at date of disposal........................

Proceeds from sale ................................................

Loss on disposal ....................................................

41,000

$41,000

38,000

3,000

0

$ 3,000

Solutions Manual

9-14

Chapter 9

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

BRIEF EXERCISE 9-13

(a) Sept. 30

Amortization Expense

[($72,500 - $2,500) ÷ 5 x 9/12]......... 10,500

Accumulated Amortization

—Office Equipment ..................

10,500

(b) Sept. 30

Cash ................................................ 8,250

Accumulated Amortization—Office

Equipment¹ ..................................... 66,500

Gain on Disposal ......................

2,250

Office Equipment ......................

72,500

¹[($72,500 - $2,500) ÷ 60 months x 57 months] = $66,500

Cost of office equipment

$72,500

Less accumulated amortization

66,500

Net book value at date of disposal

6,000

Proceeds from sale

08, 8,250

Gain on disposal

$ 2,250

(c) Sept. 30

Cash ................................................ 4,500

Accumulated Amortization—Office

Equipment ....................................... 66,500

Loss on Disposal ............................

1,500

Office Equipment ......................

72,500

Cost of office equipment

$72,500

Less accumulated amortization

66,500

Net book value at date of disposal 6,000

Proceeds from sale

4,500

Loss on disposal

$ 1,500

Solutions Manual

9-15

Chapter 9

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

BRIEF EXERCISE 9-14

Jan. 7

Machinery (new) ............................

Accumulated Amortization

—Machinery ...................................

Loss on Disposal...........................

Machinery (old) .........................

Cash ($80,000 - $18,000)...........

76,000*

78,000

3,000**

95,000

62,000

*Consideration paid cash plus market value of old asset:

($62,000 + $14,000 = $76,000)

**Loss is the book value less the fair market value:

($95,000 - $78,000 - $14,000 = $3,000)

BRIEF EXERCISE 9-15

(a)

Amortizable cost

= $7,000,000 - $500,000

= $6,500,000

Amortizable cost per unit

= $6,500,000 ÷ 28,000,000 tonnes

= $0.2321 per tonne

Amortization cost for ore extracted in Year 1:

$0.2321 per tonne x 6,000,000 tonnes = $1,392,600

Aug.

31 Inventory .................................. 1,392,600

Accumulated Amortization .

1,392,600

Amortization to be included in cost of goods sold:

$0.2321 per tonne x 5,000,000 tonnes = $1,160,500

Amortization to be included in inventory:

$0.2321 per tonne x 1,000,000 tonnes = $232,100

Solutions Manual

9-16

Chapter 9

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

BRIEF EXERCISE 9-15 (Continued)

(b)

CUONO MINING CO.

Balance Sheet (Partial)

August 31, 2008

Assets

Current assets

Inventory ..................................................

$232,100*

Property, plant, and equipment

Ore mine ................................................... $7,000,000

Less: Accumulated amortization ........... 1,392,600 5,607,400

* Check ($1,392,600 - $1,160,500 = $232,100)

Solutions Manual

9-17

Chapter 9

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

BRIEF EXERCISE 9-16

(a)

2008

Jan.

2 Patents ....................................

Cash....................................

180,000

180,000

(b) Dec. 31 Amortization Expense

($180,000 10) ........................

18,000

Accumulated Amortization—

Patents ...............................

(c)

2009

Jan.

5 Patents ....................................

Cash....................................

(d) Original cost of patent: ..................................

Less: accumulated amortization ...................

Plus: Legal costs to defend ...........................

Remaining cost to be amortized ...................

Remaining useful life (10 years - 1 year) ......

Revised annual amortization expense 2009 .

18,000

9,000

9,000

$180,000

(18,000)

9,000

171,000

÷ 9 years

$ 19,000

BRIEF EXERCISE 9-17

(a)

(b)

(c)

(d)

(e)

(f)

(g)

I

PPE

NR

NA (current asset)

I

PPE

NA (current asset)

(h)

(i)

(j)

(k)

(l)

(m)

(n)

NA (income statement)

I

I

NA (current liability)

PPE

PPE

NR

Solutions Manual

9-18

Chapter 9

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

BRIEF EXERCISE 9-18

CANADIAN TIRE CORPORATION, LIMITED

Balance Sheet (Partial)

December 31, 2005

(in millions)

Property, plant, and equipment

Land ..............................................................

$ 700.5

Buildings ......................................................... $2,094.4

Less: Accumulated amortization ..................

704.4 1,390.0

Fixtures and equipment ................................. $528.4

Less: Accumulated amortization ..................

347.5

180.9

Leasehold improvements............................... $265.6

Less: Accumulated amortization ..................

91.3

174.3

Other property, plant, and equipment .........................

298.2

Total property, plant, and equipment

2,743.9

Intangible assets

Goodwill ......................................................................

Marks Work Wearhouse store brands and banners.

Marks Work Wearhouse franchise agreements ..........

Total intangible assets

$46.2

50.4

2.0

98.6

Solutions Manual

9-19

Chapter 9

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

BRIEF EXERCISE 9-19

($ in millions)

Return on assets

$283

[($2,785 + $2,661) ÷ 2]

= 10.39%

Asset turnover

$3,294

[($2,785 + $2,661) ÷ 2]

= 1.21 times

Solutions Manual

9-20

Chapter 9

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

SOLUTIONS TO EXERCISES

EXERCISE 9-1

(a)

Under the cost principle, the acquisition cost of a property,

plant, and equipment includes all expenditures necessary

to acquire the asset and make it ready for its intended use.

This includes not only the cost of acquisition, but any

freight, installation, testing, and similar costs to get the

asset ready for use. For example, the cost of factory

machinery includes the purchase price, freight costs paid

by the purchaser, insurance costs during transit, and

installation costs. Costs such as these benefit the life of

the factory machinery and not just the current period.

Consequently, they should be capitalized and amortized

over the machinery’s useful life.

Cost is measured by the cash paid in a cash transaction,

or by the cash equivalent price paid when noncash assets

are used in payment. The cash equivalent price is equal to

the fair market value of the asset given up. If that value is

not clearly determinable, the fair market value of the asset

received is used instead.

(b) 1. Delivery Equipment (or Vehicles)

2. Prepaid Insurance

3. Land

4. Land ($6,600 - $1,700 = $4,900)

5. Plant

6. Plant

7. Plant

8. Land improvements

9. Factory machinery

10. Factory machinery

Solutions Manual

9-21

Chapter 9

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

EXERCISE 9-2

(a)

Land

Building

Land Improvements

Appraised

Value

$366,000

192,000

42,000

$600,000

% of Total

61%

32%

7%

Cost Allocated

$353,800

185,600

40,600

$580,000*

*Total cost $75,000 (cash) + $500,000 (mortgage) + $5,000

(legal fees) = $580,000

(b) Land .........................................................

Land Improvements ................................

Building ....................................................

Cash ($75,000 + $5,000) ..........................

Mortgage Payable ...............................

(c)

353,800

40,600

185,600

80,000

500,000

Amortizable cost for the building is $165,600 ($185,600 –

$20,000). With a 40-year useful life, annual amortization

expense is $4,140 ($165,600 40).

Amortizable cost for the land improvements is $40,600.

With a ten year useful life, annual amortization expense is

$4,060 ($40,600 10).

Solutions Manual

9-22

Chapter 9

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

EXERCISE 9-3

(a)

(1) Straight-line

Calculation

Amortizable

Amort.

Year

Cost*

X

Rate =

Amort.

Expense

2007

2008

2009

2010

2011

$28,500

28,500

28,500

28,500

28,500

$142,500

142,500

142,500

142,500

142,500

20%

20%

20%

20%

20%

End of Year

Accum. Net Book

Amort.

Value

$164,500

$28,500

136,000

57,000

107,500

85,500

79,000

114,000

50,500

142,500

22,000

* $164,500 - $22,000 = $142,500

(2) Double Declining-Balance

Calculation

NBV (Beg.

Amort.

Year of Year

X

Rate =

Amort.

Expense

2007

2008

2009

2010

2011

$65,800

39,480

23,688

13,532¹

0

$164,500

98,700

59,220

35,532

22,000

40%

40%

40%

40%

40%

End of Year

Accum. Net Book

Amort.

Value

$164,500

$65,800

98,700

105,280

59,220

128,968

35,532

142,500

22,000

142,500

22,000

¹ Limited to the amount to bring net book value to the residual

value of $22,000

Solutions Manual

9-23

Chapter 9

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

EXERCISE 9-3 (Continued)

(a) (Continued)

(3)

Year

2007

2008

2009

2010

2011

Units-of-Activity

Calculation

Units of

Amort.

Activity X Cost/Unit* =

78,000

76,000

72,000

74,000

75,000

$0.38

0.38

0.38

0.38

0.38

Amort.

Expense

$29,640

28,880

27,360

28,120

28,500

End of Year

Accum. Net Book

Amort.

Value

$164,500

$29,640

134,860

58,520

105,980

85,880

78,620

114,000

50,500

142,500

22,000

*Amortizable cost per unit is $0.38 per kilometre:

[($164,500 – $22,000) 375,000 = $0.38]

(b) I recommend it use the units-of-activity method as it

results in the best matching of expense with revenue.

Solutions Manual

9-24

Chapter 9

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

EXERCISE 9-4

(a)

(1) Straight-line

Calculation

Amortizable

Amort.

Year

Cost*

X

Rate =

2007

2008

2009

2010

2011

$78,000

78,000

78,000

78,000

78,000

25%

25%

25%

25%

25%

End of Year

Amort.

Accum. Net Book

Expense

Amort.

Value

$86,000

$4,875** $4,875

81,125

19,500

24,375

61,625

19,500

43,875

42,125

19,500

63,375

22,625

14,625*** 78,000

8,000

*$86,000 - $8,000 = $78,000

**$19,500 x 3/12 = $4,875

***$19,500 x 9/12 = $14,625

(2)

Double Declining-Balance

Calculation

NBV (Beg.

Amort.

Year of Year

X

Rate =

2007

2008

2009

2010

2011

$86,000

75,250

37,625

18,812

9,406

50%

50%

50%

50%

50%

End of Year

Amort.

Accum. Net Book

Expense

Amort.

Value

$86,000

$10,750* $10,750

75,250

37,625

48,375

37,625

18,813

67,188

18,812

9,406

76,594

9,406

1,406** 78,000

8,000

*$86,000 x 50% x 3/12 = $10,750

**Limited to the amount to bring net book value to the residual

value of $8,000

Solutions Manual

9-25

Chapter 9

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

EXERCISE 9-4 (Continued)

(a) (Continued)

(3)

Year

2007

2008

2009

2010

2011

Units-of-Activity

Calculation

Units of

Amort.

Activity X Cost/Unit* =

500

2,800

2,900

2,600

1,300

$7.80

7.80

7.80

7.80

7.80

End of Year

Amort.

Accum. Net Book

Expense

Amort.

Value

$86,000

$3,900

$3,900

82,100

21,840

25,740

60,260

22,620

48,360

37,640

20,280

68,640

17,360

9,360** 78,000

8,000

*Amortizable cost per unit is $7.80/hour

[($86,000 – $8,000) 10,000 = $7.80]

**Limited to the amount to bring net book value to the residual

value of $8,000.

(b) Over the life of the asset, amortization expense will be the

same for all three methods.

(c)

Cash flow is the same under all three methods.

Amortization is an allocation of the cost of a long-lived

asset and not a cash expenditure.

Solutions Manual

9-26

Chapter 9

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

EXERCISE 9-5

Jan. 10

Apr. 8

Sep. 2

Nov. 1

Dec. 31

Building ...................................... 70,000

Cash.......................................

70,000

Repairs Expense ....................... 25,000

Cash.......................................

25,000

Equipment.................................. 22,500

Cash.......................................

22,500

Repairs Expense .......................

Cash.......................................

1,000

Loss on Impairment .................. 120,000

Accumulated Amortization—

Equipment .............................

[($500,000 - $150,000) - $230,000]

1,000

120,000

Solutions Manual

9-27

Chapter 9

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

EXERCISE 9-6

(a)

Current amortization

Building: ($800,000 – $40,000) ÷ 20 yrs

= $38,000 per year

Equipment: ($120,000 – $5,000) ÷ 5 yrs

= $23,000 per year

(b) Current ages

Building January 1998 to January 2008: 10 years

Equipment January 2006 to January 2008: 2 years

January 1, 2008

Cost .......................................................

Accumulated Amortization:

Building (10 x $38,000) ......................

Equipment (2 x $23,000) ....................

Net book value ......................................

Building Equipment

$800,000 $120,000

380,000

$420,000

46,000

$ 74,000

(c)

Type of Asset

Building

Net book value, 1/1/08

Less: Residual value

Revised amortizable cost

$420,000

62,000

$358,000

$74,000

3,600

$70,400

(25 - 10)

÷ 15 yrs

(4 - 2)

÷ 2 yrs

$23,867

$35,200

Divide by revised remaining

useful life, in years

Revised annual

amortization expense

Equipment

Solutions Manual

9-28

Chapter 9

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

EXERCISE 9-7

(a)

2007

June 30 Amortization Expense ...............

Accumulated Amortization

—Equipment .........................

[($30,000 - $4,000) ÷ 4 years]

(b) July

(c)

1 Equipment ($5,000 + $500) .......

Cash.......................................

2008

June 30 Amortization Expense ...............

Accumulated Amortization

—Equipment .........................

6,500

6,500

5,500

5,500

5,200

Net book value, July 1, 2007 ($30,000 - $6,500) .....

Add: New part ..........................................................

(d)

5,200

Less: Revised residual value ................................

Remaining amortizable cost ...................................

Remaining useful life (6 - 1) ....................................

Revised annual amortization expense ...................

$23,500

5,500

29,000

3,000

$26,000

÷ 5 years

$ 5,200

Cost ($30,000 + $5,500) ..........................................

Accumulated Amortization ($6,500 + $5,200) .......

Net book value June 30, 2008 ...............................

$35,500

11,700

$23,800

Solutions Manual

9-29

Chapter 9

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

EXERCISE 9-8

Jan. 2 Delivery Truck (New)

($6,500 + $33,000)* ............................. 39,500

Accumulated Amortization ................ 22,500

Loss on sale ....................................... 1,000

Delivery truck (Old) ........................

Cash ................................................

30,000

33,000

*Fair value of old truck $6,500 + cash $33,000

Mar. 31 Amortization Expense ........................

Accumulated Amortization

—Machinery ...................................

($62,000 ÷ 10 years x 3/12)

1,550

1,550

31 Accumulated Amortization

—Machinery [($62,000 ÷ 10 years) x

(9 years + 3 months)] ......................... 57,350

Loss on Disposal................................ 4,650

Machinery .......................................

Sept 1 Amortization Expense ........................

Accumulated Amortization ............

—Office Equipment .......................

($5,490 ÷ 3 years x 8/12)

62,000

1,220

1 Cash ....................................................

800

Accumulated Amortization

—Office Equipment ............................ 4,880

($5,490 ÷ 3 years x 2 years + 8 months)

Gain on Disposal ..........................

Office Equipment ...........................

1,220

190

5,490

Solutions Manual

9-30

Chapter 9

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

EXERCISE 9-9

(a)

(1)

(2)

Straight-line method: ($16,000 - $1,000) ÷ 4 years

= $3,750 per year or $7,500 for 2006 and 2007.

Double declining-balance method

DDB Rate: ¼ x 2 = 50%

2006: $16,000 x 50% = $8,000

2007: $16,000 - $8,000 = $8,000 x 50% = $4,000

Total amortization expense for 2006 and 2007 = $12,000

(b) (1)

Straight-line method

Proceeds - Net book value = Gain (loss)

[$5,000 - ($16,000 - $7,500)] = ($3,500)

(2)

Double declining-balance method

Proceeds - Net book value = Gain (loss)

[$5,000 - ($16,000 - $12,000) = $1,000

(c) The amount of the loss using the straight-line method is

$3,500. The amount of the gain using the double-decliningbalance method is $1,000. The amounts are not the same

because of the difference in the amortization expense

calculation on a year to year basis which impacts the net

book value of the asset which in turn impacts the gain or

loss on disposal.

If you consider, however, the total impact on net income

over the two year period the amounts are identical. Using

the straight-line method total amortization is $7,500 and

loss on disposal is $3,500 resulting in an $11,000 decrease

in net income over the two year period. Using the doubledeclining-balance method total amortization is $12,000 and

gain on disposal is $1,000. Overall effect on net income

using both methods over the two year period is an $11,000

decrease.

Solutions Manual

9-31

Chapter 9

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

EXERCISE 9-10

(a)

The units-of-activity method is recommended for

amortizing natural resources because it results in the best

matching of expense to revenues. It requires that an

estimate can be made of the total number of units that are

available to be extracted from the resource.

(b) Dec. 31 Inventory ($0.5375 x 100,000) ... 53,750

Accumulated Amortization—Mine

53,750

Amortizable cost $520,000 - $90,000 = $430,000

Amortizable cost per unit:

$430,000 ÷ 800,000 t = $0.5375 per tonne

(c)

PHILLIPS INC.

Income Statement (Partial)

Year Ended December 31, 2008

Cost of goods sold: (will include this amount plus other costs)

($0.5375 x 75,000 t) ..................................... $40,313

PHILLIPS INC.

Balance Sheet (Partial)

December 31, 2008

Assets

Current assets

Inventory ($53,750 - $40,313) .................................. $ 13,437*

Property, plant, and equipment

Ore mine ..................................................... $520,000

Less: Accumulated amortization .............. 53,750 466,250

*Check: 25,000** t unsold x $0.5375 = $13,437

**100,000 t extracted – 75,000 t sold = 25,000 t in inventory

Solutions Manual

9-32

Chapter 9

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

EXERCISE 9-11

1.

Amortization is the process of allocating the cost of a longlived asset to expense over the asset’s useful life. Because

the value of land generally does not decline with time and

usage, its usefulness and revenue producing ability does

not decline. In addition, the useful life of land is indefinite.

Therefore it would be incorrect for the student to amortize

the land. This is a violation of the matching principle.

2.

Goodwill is an intangible asset with an indefinite life.

According to generally accepted accounting principles,

goodwill is not amortized but reviewed annually for

impairment. If a permanent decline in value has occurred

the goodwill is written down and an impairment loss is

recorded on the income statement. Therefore, the

amortization entry should be reversed and no decline in

value recorded until an impairment in value occurs.

Recording amortization is a violation of the matching

principle.

3.

This is a violation of the cost principle. Because current

market values are subjective and not reliable, they are not

used to increase the recorded value of an asset after

acquisition. The appropriate accounting treatment is to

leave the building on the books at its zero book value.

Solutions Manual

9-33

Chapter 9

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

EXERCISE 9-12

(a)

Jan. 2 Patents .............................................

Cash .............................................

45,000

April 1 Trademark ........................................

Cash .............................................

325,000

July 1 Franchise .........................................

Cash .............................................

250,000

Sept. 1 Research Expense ..........................

Cash .............................................

185,000

45,000

325,000

250,000

185,000

(b)

Dec. 31 Loss on Impairment—Goodwill ......

Goodwill ......................................

85,000

31 Amortization Expense .................... 117,500

Accumulated Amortization—Patents

[($450,000 ÷ 5) + (45,000 ÷ 3)] .....

Accumulated Amortization—

Franchise [($250,000 ÷ 10) x 6/12]

85,000

105,000

12,500

Solutions Manual

9-34

Chapter 9

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

EXERCISE 9-13

(a)

Account

Accumulated Amortization

– Building

Accumulated Amortization

– Finite-Life Intangible

Assets

Accumulated Amortization

– Machinery and Equipment

Accumulated Amortization

– Other Property, Plant, and

Equipment

Accumulated Amortization

– Satellites

Accumulated Amortization

– Telecommunications

Assets

Amortization Expense

Buildings

Financial Statement

Balance Sheet

Cash and Cash Equivalents

Common Shares

Finite-Life Intangible Assets

Goodwill

Indefinite-Life Intangible

Assets

Land

Balance Sheet

Balance Sheet

Balance Sheet

Balance Sheet

Balance Sheet

Machinery and Equipment

Balance Sheet

Other Long-term Assets

Other Property, Plant, and

Equipment

Plant under Construction

Balance Sheet

Balance Sheet

Satellites

Balance Sheet

Telecommunications

Assets

Balance Sheet

Balance Sheet

Balance Sheet

Balance Sheet

Balance Sheet

Balance Sheet

Income Statement

Balance Sheet

Balance Sheet

Balance Sheet

Section

Property, Plant, and

Equipment

Intangibles

Property, Plant, and

Equipment

Property, Plant, and

Equipment

Property, Plant, and

Equipment

Property, Plant, and

Equipment

Operating Expenses

Property, Plant, and

Equipment

Current Assets

Shareholders’ Equity

Intangibles

Intangibles

Intangibles

Property, Plant, and

Equipment

Property, Plant, and

Equipment

Long-Term Assets

Property, Plant, and

Equipment

Property, Plant, and

Equipment

Property, Plant, and

Equipment

Property, Plant, and

Equipment

Solutions Manual

9-35

Chapter 9

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

EXERCISE 9-13 (Continued)

(b)

BCE Inc.

Balance Sheet (Partial)

December 31, 2005

(in millions)

Property, plant, and equipment

Land .............................................................................

Buildings ...................................................... $3,157

Less: Accumulated amortization ................

1,340

Plant under construction ............................

Machinery and equipment ........................... $6,273

Less: Accumulated amortization ................

3,685

Telecommunications assets ....................... $36,334

Less: Accumulated amortization ................ 24,144

Satellites ....................................................... $1,552

Less: Accumulated amortization ...............

404

Other Property, plant, and equipment ........

$200

Less: Accumulated amortization ...............

66

Total Property, plant, and equipment ...................

Intangible assets

Finite-life intangible assets ........................

$3,813

Less: Accumulated amortization ...............

1,574

Goodwill ......................................................................

Indefinite-life intangible assets .................................

Total intangible assets ..........................................

$

94

1,817

1,852

2,588

12,190

1,148

134

19,823

2,239

7,887

3,031

13,157

Solutions Manual

9-36

Chapter 9

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

EXERCISE 9-14

(a) (in thousands)

December 31, 2005

January 1, 2005

Asset

$206,674

$211,476

turnover [($308,226 + $300,152) ÷ 2] [($300,152 + $242,755) ÷ 2]

= 0.68 times

Return

on

assets

= 0.78 times

$8,097

$14,426

[($308,226 + $300,152) ÷ 2] [($300,152 + $242,755) ÷ 2]

= 2.7%

= 5.3%

(b) Sleeman’s asset turnover has decreased over the 2 years.

Net Revenues have decreased from $211,476 to $206,674

even though total assets have increased from $300,152 to

$308,226. Sleeman is operating less efficiently in the year

ended December 31, 2005 as compared to the year ended

January 1, 2005. Return on assets has decreased

significantly from 5.3% to 2.7%. The slight increase in total

assets from $300,152 to $308,336 has not generated an

increase in net income. In fact, net income has fallen from

$14,426 to $8,097.

Solutions Manual

9-37

Chapter 9

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

SOLUTIONS TO PROBLEMS

PROBLEM 9-1A

(a)

Feb.

7 Land ........................................... 275,000

Cash.......................................

Note Payable .........................

9 Land ...........................................

Cash......................................

5,500

5,500

15 Land ........................................... 15,000

Cash.......................................

17 Cash ...........................................

Land .......................................

Mar.

July

75,000

200,000

15,000

4,000

4,000

2 Building ...................................... 18,000

Cash.......................................

18,000

5 Building ...................................... 650,000

Cash.......................................

Note Payable .........................

170,000

480,000

31 Building ......................................

Cash.......................................

6,500

6,500

Aug. 22 Land Improvements .................. 12,000

Cash.......................................

Sept. 1 Prepaid Insurance .....................

Cash.......................................

12,000

2,500

Dec. 31 Interest Expense ....................... 17,500

Cash.......................................

2,500

17,500

Solutions Manual

9-38

Chapter 9

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

PROBLEM 9-1A (Continued)

(b)

Date

2008

Feb. 7

9

15

17

Date

2008

Mar. 2

July 5

31

Date

2008

Aug. 22

Explanation

Land

Ref.

Debit

Credit Balance

275,000

5,500

15,000

275,000

280,500

295,500

291,500

4,000

Explanation

Building

Ref.

Debit

Credit Balance

18,000

650,000

6,500

18,000

668,000

674,500

Land Improvements

Explanation

Ref. Debit

Credit Balance

12,000

12,000

The cost of land that will appear on Weisman’s December 31,

2008 balance sheet will be $291,500. The cost of building that

will appear on Weisman’s December 31, 2008 balance sheet will

be $674,500. The cost of land improvements that will appear on

Weisman’s December 31, 2008 balance sheet will be $12,000.

Solutions Manual

9-39

Chapter 9

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

PROBLEM 9-2A

(a)

Year

Calculation

Accumulated

Amortization

Dec. 31

MACHINE 1 – Straight-line Amortization

2006

2007

2008

($44,940* ÷ 7) x 10/12 = $5,350

$44,940 ÷ 7 = $6,420

$44,940 ÷ 7 = $6,420

$ 5,350

11,770

18,190

*$48,940 - $4,000 = $44,940

MACHINE 2 – Declining-balance Amortiation

2007

2008

$84,000 x 20%* x 4/12 = $5,600

($84,000 - $5,600) x 20% = $15,680

$ 5,600

21,280

*1/10 years = 10% x 2 = 20%

Solutions Manual

9-40

Chapter 9

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

PROBLEM 9-2A (Continued)

(b)

Year

Calculation

Accumulated

Amortization

Dec. 31

MACHINE 1

2006

2007

2008

($44,940* ÷ 7) x 1/2 = $3,210

$44,940 ÷ 7 = $6,420

$44,940 ÷ 7 = $6,420

$ 3,210

9,630

16,050

*$48,940 - $4,000 = $44,940

MACHINE 2

2007

2008

$84,000 x 20%* x 1/2 = $8,400

(84,000 - $8,400) x 20% = $15,120

$ 8,400

23,520

*1/10 years = 10% x 2 = 20%

(c)

It really doesn’t matter which policy Tarcher chooses in

terms of recording amortization in the year of acquisition,

as long as it follows the policy consistently. The same total

amortization will be recorded whether amortization is

recorded monthly, or semi-annually. Amortization is an

estimate only, in any case.

(d) The choice of the method to prorate amortization in the

period of acquisition will not affect amortization expense if

the units-of-activity method is used. Under this method,

amortization is a function of the units produced not the

time the machine is owned.

Solutions Manual

9-41

Chapter 9

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

PROBLEM 9-3A

(a)

Cost:

Cash price

Delivery costs

Installation and testing

Total cost

$180,000

1,000

3,200

$184,200

The one-year insurance policy is not included as it is an

operating expenditure, benefiting only the current period.

(b)

1.

STRAIGHT-LINE AMORTIZATION

Calculation

Amortizable

Amort.

Year

Cost

X

Rate =

2006

2007

2008

2009

2010

2011

$172,700*

172,700

172,700

172,700

172,700

172,700

20%** x 8/12

20%

20%

20%

20%

20% x 4/12

End of Year

Amort.

Accum. Net Book

Expense

Amort.

Value

$184,200

$23,027 $ 23,027

161,173

34,540

57,567

126,633

34,540

92,107

92,093

34,540

126,647

57,553

34,540

161,187

23,013

11,513

172,700

11,500

* Amortizable cost = $184,200 - $11,500 = $172,700

** 1 ÷ 5 years = 20%

Solutions Manual

9-42

Chapter 9

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

PROBLEM 9-3A (Continued)

(b) (Continued)

2.

DOUBLE DECLINING-BALANCE AMORTIZATION

Year

Calculation

NBV Beg.

Amort.

of Year

X

Rate =

2006

2007

2008

2009

2010

2011

$184,200

135,080

81,048

48,269

29,177

17,506

40%* x 8/12

40%

40%

40%

40%

40%

End of Year

Amort.

Accum. Net Book

Expense

Amort.

Value

$184,200

$49,120

$49,120

135,080

54,032

103,152

81,048

32,419

135,571

48,629

19,452

155,023

29,177

11,671

166,694

17,506

6,006** 172,700

11,500

* 1 ÷ 5 years = 20% x 2 = 40%

**Use the amount that makes net book value equal to residual

value

3.

UNITS-OF-ACTIVITY AMORTIZATION

Year

2006

2007

2008

2009

2010

2011

Calculation

Units of

Amort.

Activity X Cost/Unit* =

8,500

12,000

11,500

10,500

9,500

3,000

$3.14*

3.14

3.14

3.14

3.14

3.14

End of Year

Amort.

Accum. Net Book

Expense

Amort.

Value

$184,200

$26,690 $ 26,690

157,510

37,680

64,370

119,830

36,110

100,480

83,720

32,970

133,450

50,750

29,830

163,280

20,920

9,420

172,700

11,500

*Amortizable cost per unit:

($184,200 - $11,500) ÷ 55,000 units = $3.14

Solutions Manual

9-43

Chapter 9

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

PROBLEM 9-3A (Continued)

(c)

Double declining-balance amortization provides the

highest amount of amortization expense for 2006, thus

resulting in the lowest net income that year. Over the life

of the asset, all three methods result in the same total

amortization expense (equal to the amortizable cost).

(d) All three methods will result in the same cash flow in

2006 and over the life of the asset. Recording

amortization expense does not affect cash flow. There is

no Cash account involved in the entry to record

amortization

(Dr.

Amortization

Expense;

Cr.

Accumulated Amortization). It is only an allocation of the

capital cost to expense over an asset’s useful life.

(e)

Factors that should influence management’s choice of

the amortization method to use include the revenue

pattern of a specific asset, the productivity of the asset,

as well as the usage of the asset on a year over year

basis. If an asset generates revenue consistently over

time, then the straight-line method is most appropriate.

If an asset is more productive in its earlier years then

the declining-balance method is most appropriate. If

usage of an asset can be easily measured and usage is

very different year over year then the units-of-activity

method is the most appropriate.

Solutions Manual

9-44

Chapter 9

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

PROBLEM 9-4A

Feb. 12 Building ...................................... 120,000

Cash.......................................

Mar.

6 Maintenance Expense ...............

Cash......................................

120,000

7,500

7,500

Apr. 10 Furniture and Fixtures .............. 25,000

Cash.......................................

25,000

May 17 Machinery .................................. 35,000

Cash.......................................

8,000

June 28 Maintenance Expense ...............

Cash.......................................

5,000

5,000

July 20 Repairs Expense ....................... 10,000

Cash.......................................

Aug.

5 Training Expense ......................

Cash.......................................

1,600

1,600

Sep. 18 Machinery .................................. 80,000

Cash.......................................

Nov.

6 Prepaid Insurance .....................

Cash.......................................

10,000

80,000

4,600

Dec. 31 Loss on Impairment .................. 70,000

Accumulated Amortization—

Equipment .............................

[($400,000 - $150,000) - $180,000]

4,600

70,000

Dec. 31 No journal entry required. Once a permanent

impairment has been recorded, the value of an

asset is not adjusted for any recovery in value.

Solutions Manual

9-45

Chapter 9

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

PROBLEM 9-5A

(a)

Calculation

Amortizable

Amort.

Year

Cost

X

Rate =

2004

2005

2006

2007

$620,000*

620,000

620,000

620,000

12.5%

12.5%

12.5%

12.5%

End of Year

Amort.

Accum. Net Book

Expense

Amort.

Value

$650,000

$77,500 $ 77,500

572,500

77,500

155,000

495,000

77,500

232,500

417,500

77,500

310,000

340,000

* Amortizable cost = $650,000 - $30,000 = $620,000

** 1 ÷ 8 years = 12.5%

(b) Dec. 31 Loss on Impairment

220,000

Accumulated Amortization—

Equipment ............................

[($650,000 - $310,000) - $120,000]

220,000

(c)

Calculation

Amortizable

Amort.

Year

Cost

X

Rate =

2008

2009

$90,0002

90,000

50%3

50%

Amort.

Expense

$45,000

45,000

End of Year

Accum. Net Book

Amort.

Value

$530,000¹ $120,000

575,000

75,000

620,000

30,000

¹Accumulated Amortization = $310,000 end of year before Loss

on impairment + $220,000 Loss on Impairment

2

Amortizable cost = $120,000 - $30,000 = $90,000

3

1 ÷ 2 years remaining = 50%

(d) Accumulated amortization at the end of this equipment’s

useful life will be $620,000. Net book value at the end of this

equipment’s useful life will be the amount of residual value

which is $30,000.

Solutions Manual

9-46

Chapter 9

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

PROBLEM 9-6A

(a)

Calculation

Amortizable

Amort.

Year

Cost

X

Rate =

Amort.

Expense

2004

2005

2006

2007

$20,000

40,000

40,000

40,000

$200,000*

200,000

200,000

200,000

20%** x 6/12

20%

20%

20%

End of Year

Accum. Net Book

Amort.

Value

$220,000

20,000

200,000

60,000

160,000