Peter Walsh_Medtronic_FINAL

advertisement

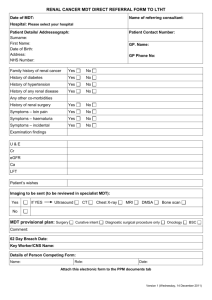

Medical Device Sector Overview Irish Medical Device Association (IMDA) December 12, 2013 Agenda / Contents • Medical Device Sector Overview • Manufacturing Strategies • Considerations for Irish Medical Device Sector 2 | MDT Confidential Market Overview • Market Size = $230B • Emerging Markets Annualized Growth = 13% to 15% • Developed Markets Annualized Growth = 2% to 3% • Total Market Growth = 3% to 4% • Annual Pricing = -3% to -5% Developed Markets YOY Growth = 2% to 3% • • • • US WECA Japan Asia Pac Emerging Markets = 15% Developed Markets = 85% EM YOY Growth = 13% to 15% • • • • • Greater China Latin America MEA CEE India 3 | MDT Confidential Market Dynamics and Business Strategies Market Dynamics • Increasing burden of chronic disease • Demographic shifts /aging of population • Broadening of stakeholder base • Increasing alignment of customers • Rising cost burdens • Payment reforms • Pressure on provider/payer economics • Rise in wealth in EM • Healthcare as government priority • Local competition Universal Healthcare Needs • Improve Clinical Outcomes • Expand Access • Optimize Cost & Efficiency Strategic Imperatives Globalization Economic Value 4 | MDT Confidential Changing Healthcare Environment has Created Uncertainty in MedTech Key Changes • Broader customer base – – • Evolving payment models – – • Purchase Decision: Shift from solely the physician to more stakeholders Physicians becoming employees of hospital systems Expanding time horizons: Shift from time of implant to episodes of care & disease management Increasing focus on quality of care Value starting to be measured – In healthcare, value comes over time, and was rarely measured in the past Current Impact: MedTech industry slow to adapt Increased pricing pressure Scrutiny on cost of technology Technology viewed as commoditized Slower MedTech market growth “In the middle of difficulty lies opportunity.” – Albert Einstein 5 | MDT Confidential Strategies to Address Healthcare Needs Universal HC needs Strategies New Therapies Improve clinical outcomes Globalization Expand access Economic Value Optimize cost and efficiency Develop new therapies and technologies to address unmet clinical needs and drive them to standard of care Develop tailored solutions to address market-specific needs and expand access in global markets Transform offerings and commercial models to deliver greater economic value and optimize healthcare delivery 6 | MDT Confidential Globalization Develop tailored solutions to address marketspecific needs and expand access in global markets Premium Local R&D and Local Manufacturing Value Underserved 7 | MDT Confidential MedTech Considerations • Current model is not sustainable • Focus on being part of the solution • New business models based on value measured over time • Greater accountability for the outcome not just the procedure • MedTech companies also as service providers • Need to reduce disparity of access • Develop tailored solutions based on local needs 8 | MDT Confidential Regulatory Bar Increasing 9 | MDT Confidential Increasing Enforcement Across Medical Device Industry; By FDA and Global Regulators Global FDA Warning Letters FDA Class I Recalls International FDA Warning Letters FDA 483 Findings By Major Category 10 | MDT Confidential MedTech Manufacturing Sector Perspective 11 | MDT Confidential INVESTMENTS MedTech Mfg Location Strategy Considerations (179 Plants) Medtronic (24) J & J (15) St. Jude (11) Abbott (10) Stryker (9) Boston (6) Zimmer (5) Edwards (2) England (3 Plants) Canada (2 Plants) Medtronic (1) Abbott (1) Ireland (12 Plant) Medtronic (1) J&J (1) Abbott (4) Boston (3) Stryker (2) Zimmer (1) Medtronic (1) J&J (1) United States (82 Plants) J&J (3) Medtronic (2) Sweden (1 Plant) Abbott (1) Germany (10 Plants) J&J (5) Stryker (3) Medtronic (1) Abbott (1) J&J (1) J&J (7) Medtronic (3) Stryker (2) Abbott (1) Zimmer (1) Edwards (1) Stryker (3) Medtronic (2) J&J (1) Zimmer (1) Mexico (5 Plants) Austria (1 Plant) Boston (2) Abbott (1) St. Jude (1) Costa Rica (4 Plants) Puerto Rico (13 Plants) Spain (1 Plant) Medtronic (1) St. Jude (1) Brazil (1 Plant) J&J (4) Stryker (2) Zimmer (2) Abbott (1) Medtronic (1) St. Jude (1) Abbott (1) Medtronic (3) Abbott (2) Stryker (2) Boston (1) St. Jude (2) J&J (1) Zimmer (1) Edwards (1) China (10 Plants) Switzerland (15 Plants) France (7 Plants) Edwards (1) Dominican Republic (1 Plant) Netherlands (2 Plants) J&J (2) Abbott (1) Growing Singapore China Malaysia Costa Rica Dominican Rep. India Italy (1 Plant) J&J (2) India (2 Plants) Medtronic (1) J&J (1) St. Jude (1) Israel (2 Plants) Malaysia (1 Plant) Note: Corporate Tax Rates for the eight leading MedTech multinationals is 19% to 24% (2012) Thailand (1 Plant) Medtronic (1) Edwards (1) Singapore (2 Plants) 12 | MDT Confidential Maintaining Ireland Puerto Rico Mexico Switzerland Brazil Thailand Netherlands Declining France Germany Sweden England Italy Austria Spain Israel Canada United States Direct Labor – Fully Loaded Rate $33.11 $35.00 $30.43 $30.00 $25.00 $20.00 $18.57 $15.00 $13.26 $8.81 $3.28 $4.47 $5.63 Mexico $5.00 $5.24 Malaysia $10.00 $6.73 Fully Loaded DL Rates - Base Rate - Employee Benefits - Worker Comp - All Other Fully loaded wage rate data includes 2012 rates for experienced operators at MedTech manufacturers 13 | MDT Confidential Ireland United States Puerto Rico Singapore Brazil China Costa Rica India $- Low Cost Country Labor – 2011 to 2020 Multinational Medical Device Manufacturers US / WE / Japan (%) = Low Cost Countries (%) = Tier 1 Medical Device Suppliers (Material is ~40% of LBM) 18 35 65 82 2011 2020 12 30 70 88 14 | MDT Confidential Medical Device Contract Manufacturing • Global Medical Device Market = $230B – Medical Device companies have significant capacity but need more low cost capacity for higher technology products Contract Mfg Market by Segment Contract Mfg = $30B (13%) 18 16 15.4 13.0 14 ($bn) 12 10 8 6 Device Mfg = $200B (87%) 4 1.7 2 0 Material Processing Electronics 15 | MDT Confidential Source: Visiongain 2011 Finished Products Key Considerations for Global Manufacturing Strategy • Corporate Tax Rates are approaching desired target (~20%) • Emphasis on maintaining tax rates while reducing labor and burden costs • Most companies have plans to rationalize their manufacturing • Single sourcing is now a much greater consideration • More recent large investments have been in low-cost and low-tax locations (e.g., Costa Rica, Malaysia) • Major focus on manufacturing presence and investment in BRIC countries • Acquisitions will continue adding capacity 16 | MDT Confidential Implications for Manufacturing Strategy 17 | MDT Confidential Implications for Manufacturing Strategy • How do we create sustainable and predictable manufacturing to achieve quality, regulatory ,cost and service objectives with capability to address headwinds and flexibility to respond to local manufacturing requirements in Emerging Markets • Key Considerations: – Strategy on local-for-local manufacturing – Consolidation and the creation of Centers of Excellence – Development of deep core competencies – Alignment and relationship between R&D centers and Manufacturing centers – Talent and cultural development 18 | MDT Confidential Manufacturing Network Optimization Plants Plant Network Optimization Business Focused Factories Shared Mfg Centers Shared Technology Centers Local for Local Mfg 19 | MDT Confidential Contract Mfg Partners Capability / Maturity Model HIGH • Deep technical capability; product line experts “BLACK HOLE” AVOID • Medium-to-high manufacturing capability • Drives some change and continuous improvement Strategic Importance of Market and Technology • Low-to-medium management and technical capability • Has developed enough process and technical knowledge to maintain operations • Relies on business unit direction and decisionmaking • Invests in people and process development • Needs business unit support for problem solving LOW STAGE #1 Implementer LOW • Contributor to product development STAGE #2 Contributor • Highly experienced and technically strong management team (cradle of global talent) • Leads process development and continuous improvement • Active part of PDP process • Site integrated across all functions; highly specialized • Is considered Best Practice in Manufacturing STAGE #3 Strategic Partner HIGH Site Capability / Competencies 20 | MDT Confidential Considerations for Irish Medical Device Sector • Need to maintain and leverage low tax status • Clearly define and understand what a Strategic Partner (Leader) means at a company and country level • Charter is a function of capability for strategically important markets • Pursue global best practice as a new target and reputation • Target core competencies both at a company and country level • Consider how Ireland can create more Shared Manufacturing Centers and Shared Technology Centers 21 | MDT Confidential Thank You 22 | MDT Confidential