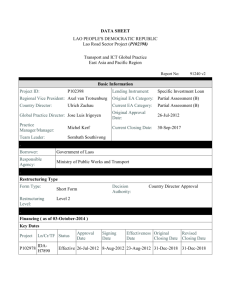

strategic restructuring - Chapin Hall at the University of Chicago

advertisement