Seminar Outline - College of Business Administration @ Kuwait

advertisement

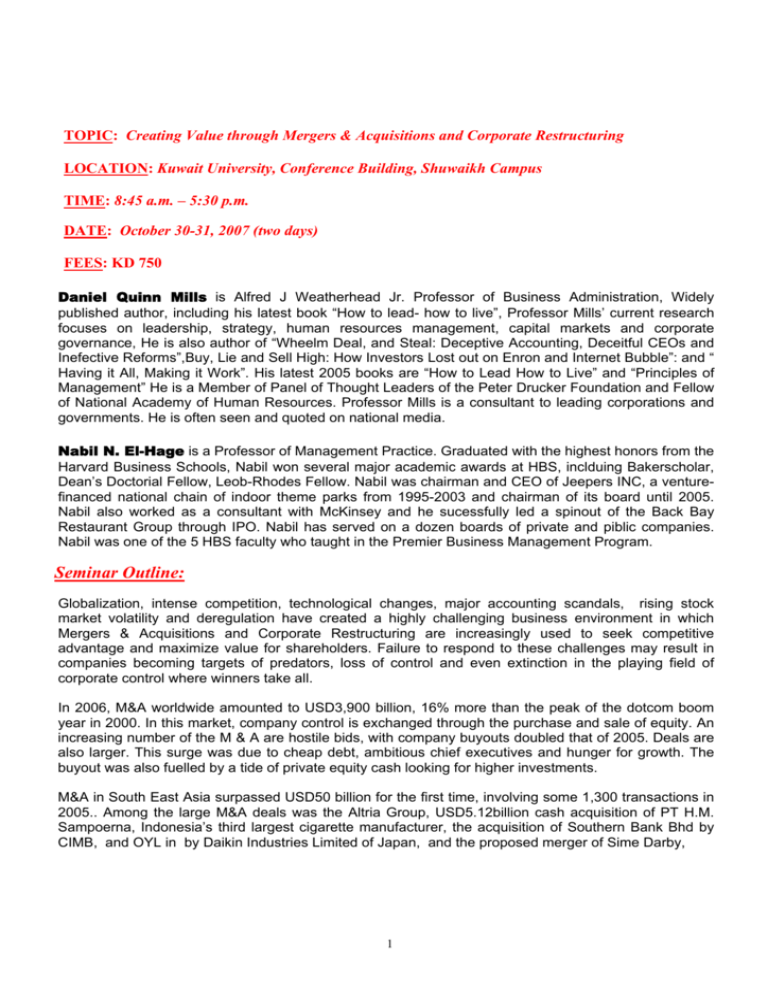

TOPIC: Creating Value through Mergers & Acquisitions and Corporate Restructuring LOCATION: Kuwait University, Conference Building, Shuwaikh Campus TIME: 8:45 a.m. – 5:30 p.m. DATE: October 30-31, 2007 (two days) FEES: KD 750 Daniel Quinn Mills is Alfred J Weatherhead Jr. Professor of Business Administration, Widely published author, including his latest book “How to lead- how to live” , Professor Mills’current research focuses on leadership, strategy, human resources management, capital markets and corporate governance, He is also author of “Wheelm Deal, and Steal: Deceptive Accounting, Deceitful CEOs and Inefective Reforms” ,Buy, Lie and Sell High: How Investors Lost out on Enron and Internet Bubble” : and “ Having it All, Making it Work” . His latest 2005 books are “How to Lead How to Live”and “Principles of Management”He is a Member of Panel of Thought Leaders of the Peter Drucker Foundation and Fellow of National Academy of Human Resources. Professor Mills is a consultant to leading corporations and governments. He is often seen and quoted on national media. Nabil N. El-Hage is a Professor of Management Practice. Graduated with the highest honors from the Harvard Business Schools, Nabil won several major academic awards at HBS, inclduing Bakerscholar, Dean’s Doctorial Fellow, Leob-Rhodes Fellow. Nabil was chairman and CEO of Jeepers INC, a venturefinanced national chain of indoor theme parks from 1995-2003 and chairman of its board until 2005. Nabil also worked as a consultant with McKinsey and he sucessfully led a spinout of the Back Bay Restaurant Group through IPO. Nabil has served on a dozen boards of private and piblic companies. Nabil was one of the 5 HBS faculty who taught in the Premier Business Management Program. Seminar Outline: Globalization, intense competition, technological changes, major accounting scandals, rising stock market volatility and deregulation have created a highly challenging business environment in which Mergers & Acquisitions and Corporate Restructuring are increasingly used to seek competitive advantage and maximize value for shareholders. Failure to respond to these challenges may result in companies becoming targets of predators, loss of control and even extinction in the playing field of corporate control where winners take all. In 2006, M&A worldwide amounted to USD3,900 billion, 16% more than the peak of the dotcom boom year in 2000. In this market, company control is exchanged through the purchase and sale of equity. An increasing number of the M & A are hostile bids, with company buyouts doubled that of 2005. Deals are also larger. This surge was due to cheap debt, ambitious chief executives and hunger for growth. The buyout was also fuelled by a tide of private equity cash looking for higher investments. M&A in South East Asia surpassed USD50 billion for the first time, involving some 1,300 transactions in 2005.. Among the large M&A deals was the Altria Group, USD5.12billion cash acquisition of PT H.M. Sampoerna, Indonesia’s third largest cigarette manufacturer, the acquisition of Southern Bank Bhd by CIMB, and OYL in by Daikin Industries Limited of Japan, and the proposed merger of Sime Darby, 1 Guthrie and Golden Hope in Malaysia and the acquisition of PBB Oils by Wilmar Limited in Singapore..Middle east has started seeing a significant growth in this field and offers greater deal flow opportunities in the future. Corporate restructuring is the process by which a firm renegotiates the contracts, claims, commitments, obligations and promises - both written and unwritten - that it has entered into with its various constituencies, in order to create and/or preserve significant value. "Value" is broadly defined to include the interests of stockholders, creditors, employees, suppliers, customers, governments and communities. Opportunities to create value through corporate restructuring can arise for a variety of reasons, including changes in technology or regulation, heightened competition, taxes, shifts in interest rates and foreign exchange rates, as well as unsound business practices. Benefits for Participants: Participants will take away the following: For M&A • Motivation and rationale for M&A • Target identification and selection • Valuation and risk assessment • Deal structuring • Growth through M&A • Deal integration • Making M&A work • Mistakes to avoid in M&A For Corporate Restructuring • How restructuring creates value • Techniques of restructuring • Restructuring vehicles, approaches and possible outcomes • Dealing with creditors, bankers, shareholders and employees • The best option for restructuring a company and possible outcomes • Measuring the potential value and benefits from restructuring Type of Attendance: Expected participants include the following: • General Manager/DGM/AGM • Vice President, Corporate Finance • Merchant/Investment/Commercial Bankers • Corporate Finance Consultants • Stockbrokers • Officials of other Financial Institutions • Officials of Regulatory Agencies of Financial Institutions • Public sector officials responsible for economic regulation 2 PROGRAM CONTENT AND ORGANIZATION Registration: 8.15-8.45am Tea break: 10.30-10.45am; 3.15-3.3Opm Lunch: 12.30-1.3Opm Timetable: Day 1 Mergers & Acquisitions Session 1: Target Identification Selection and Risk Assessment Case: Adecco SA’s Acquisition of Olsten Corp. This case helps us to identify and select a target for M & A and evaluate the risks associated with it. Cross-border tax issues are also considered. Session 2: Deal Evaluation and Structuring Case: Science Technology Co. This case explores a strategic fit and the potential target’s value to the acquirer. The implications of not consummating an acquisition are also assessed. Session 3: Growth through M&A and Deal Integration Case: Arrow Electronics - The Schweber Acquisition This is a case about a company that grew from a totally unknown to be the leading electronic component distributor in the US, mostly via acquisitions. The Company got acquisitions down to total science, and has become masters at integrating their targets into their own organization Session4: Making M&A work Case: The Royal Bank of Scotland: Master of Integration. This case describes the strategic rationale for the acquisition of Nat West by Royal Bank of Scotland and how the integration of the two banks was successfully accomplished, in contrast to the usual high failure rate of acquisitions. The case provides important lessons on how to make M&A integration work. Day 2 Corporate Restructuring Session 5: Tax implication of Hiving off an Investment Case: Seagate Technology Buyout In the middle of the tech bubble, Seagate found itself trading at a discount of what management felt was its fair value. In fact, Seagate held shares of Veritas, a company it has previously backed, worth more than the value of Seagate itself. A simple sale of the Veritas shares would trigger a major tax liability. How should Seagate maximize firm’s value? Session 6 Investing in a Financially Distressed Company Case: Williams 2002 The Williams Companies, a highly diversified energy conglomerate, found itself in deep financial distress, to the point where it was not clear the company could survive. Nearly a $1 billion cash infusion was required immediately or the company would have to seek bankruptcy protection. Berkshire Hathaway, the legendary investor Warren Buffet’s company, made a bailout proposal. We study the terms of Buffet’s proposal and decide whether Williams should accept it. We also explore what management actions led to Williams’distress in the first place. 3 Session 7 Restructuring Balance sheet and Greater Leverage Case: Debt Policy at UST, Inc. UST, (ex United States Tobacco) is one of the most profitable companies in the world. Can it do even better by restructuring its balance sheet and taking on more leverage? Session 8: Leveraged Buyout, Recapitalization and Restructuring Case: Flagstar Co, Inc. A large restaurant chain undergoes a leveraged buyout and subsequent recapitalization. Financial and operating problems at the company force it to consider various restructuring options, including a "prepackaged" Chapter 11 exchange offer to its public bondholders MODE OF LEARNING This program is designed to take participants away from their daily work and put them in a stimulating learning environment led by world-renowned educators from Harvard Business School. The primary mode of learning is the case study method ,supplemented by lectures. Each of the case studies provides participants the opportunity to explore a wide variety of real-life business situations. Peer-group interaction is a key element in the learning process. The program is structured to promote dynamic exchange among a diverse group of leaders and executives. The process produces a rich pool of knowledge and allows participants to share their professional experience, challenge and motivate one another and provoke new ways of thinking. The ultimate goal is for participants to be able to directly apply their new found knowledge, skills, and strategies within their respective work environment. To maximize benefits from the program, it is important that participants read the cases, think about the discussion questions and participate in class. If you are interested, please contact at: Tel: 965-4988375/6 Fax: 965-4827312 Email: ESU@cba.edu.kw 4