What Causes Interest Rates to Rise?

W h at i f I n t e r e s t R at e s R i s e ?

A S p e c i a l C o m m e n t a r y S e r i e s

what causes interest rates to rise?

There’s no disputing that interest rates remain near historically low levels. Our economic forecasts suggest that rates will remain generally low for some time to come, but we do acknowledge there’s considerable risk that in the future interest rates will rise. It’s our philosophy, however, that financial markets don’t move without reason; in other words, being concerned that interest rates will rise simply because they’re at historical lows isn’t a valid argument. Instead of focusing on an assumption of higher rates that’s been wrong for several years now, we believe it’s more valuable to identify the reasons that interest rates could rise in the coming months and years.

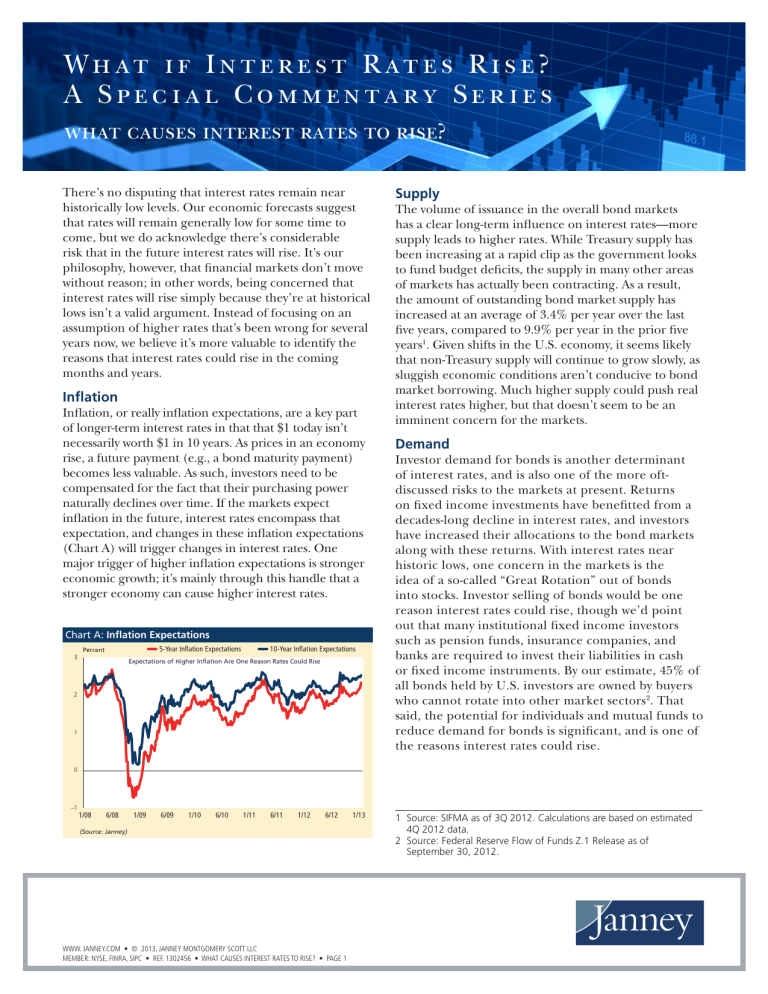

Inflation

Inflation, or really inflation expectations, are a key part of longer-term interest rates in that that $1 today isn’t necessarily worth $1 in 10 years. As prices in an economy rise, a future payment (e.g., a bond maturity payment) becomes less valuable. As such, investors need to be compensated for the fact that their purchasing power naturally declines over time. If the markets expect inflation in the future, interest rates encompass that expectation, and changes in these inflation expectations

(Chart A) will trigger changes in interest rates. One major trigger of higher inflation expectations is stronger economic growth; it’s mainly through this handle that a stronger economy can cause higher interest rates.

Chart A: Inflation Expectations

Percent

5-Year Inflation Expectations 10-Year Inflation Expectations

3

Expectations of Higher Inflation Are One Reason Rates Could Rise

2

1

Supply

The volume of issuance in the overall bond markets has a clear long-term influence on interest rates—more supply leads to higher rates. While Treasury supply has been increasing at a rapid clip as the government looks to fund budget deficits, the supply in many other areas of markets has actually been contracting. As a result, the amount of outstanding bond market supply has increased at an average of 3.4% per year over the last five years, compared to 9.9% per year in the prior five years 1 . Given shifts in the U.S. economy, it seems likely that non-Treasury supply will continue to grow slowly, as sluggish economic conditions aren’t conducive to bond market borrowing. Much higher supply could push real interest rates higher, but that doesn’t seem to be an imminent concern for the markets.

Demand

Investor demand for bonds is another determinant of interest rates, and is also one of the more oftdiscussed risks to the markets at present. Returns on fixed income investments have benefitted from a decades-long decline in interest rates, and investors have increased their allocations to the bond markets along with these returns. With interest rates near historic lows, one concern in the markets is the idea of a so-called “Great Rotation” out of bonds into stocks. Investor selling of bonds would be one reason interest rates could rise, though we’d point out that many institutional fixed income investors such as pension funds, insurance companies, and banks are required to invest their liabilities in cash or fixed income instruments. By our estimate, 45% of all bonds held by U.S. investors are owned by buyers who cannot rotate into other market sectors 2 . That said, the potential for individuals and mutual funds to reduce demand for bonds is significant, and is one of the reasons interest rates could rise.

0

–1

1/08 6/08

(Source: Janney)

1/09 6/09 1/10 6/10 1/11 6/11 1/12 6/12 1/13 1 Source: SIFMA as of 3Q 2012. Calculations are based on estimated

4Q 2012 data.

2 Source: Federal Reserve Flow of Funds Z.1 Release as of

September 30, 2012.

WWW. JANNEY.COM • © 2013, JANNEY MONTGOMERY SCOTT LLC

MEMBER: NYSE, FINRA, SIPC • REF. 1302456 • WHAT CAUSES INTEREST RATES TO RISE? • PAGE 1

Credit Quality

Just like corporations or individuals, nations (in this case, the U.S.) can only support so much debt for a given level of income. The U.S. government has been running deficits for a number of years now, and there’s a loud debate as to whether current measures to reduce the deficit will be effective in restoring balance. If

Congress is unable to adjust that balance over time, the markets will begin to demand higher interest rates to compensate for the risks the deficits are creating.

While a default by the U.S. government is very unlikely, it’s conceivable that, over time, Congress could look to “print” their way out of debt by issuing more dollar bills. Were this to occur in theory, inflation expectations would rise and trigger an increase in interest rates.

The good news is that when it comes to the U.S.’ credit quality and interest rates, studies indicate that there’s a lot of leeway as to how much debt a country can issue before its interest rates rise meaningfully.

Federal Reserve

We have thus far avoided discussion of the Federal

Reserve’s (Fed) ability to cause interest rates to rise. This is not an oversight; rather it’s an acknowledgement that the Fed’s influence in the fixed income markets is both unprecedented and somewhat opaque. Starting in the latter days of the 2008 financial crisis, the Fed began purchasing Treasuries, Agencies, and Mortgage-Backed

Securities (MBS) to support the financial system. Under the leadership of Ben Bernanke, these policies continued with further rounds of purchases begun in 2010 and

2012. As of February 2013, the Fed’s balance sheet (Chart

B)was just larger than $3.0 trillion, most of that amount invested in Treasuries and MBS. The Federal Reserve’s goal in adding these securities was to keep interest rates low by increasing bond market demand, to increase long run inflation expectations back to the 2% range from below that level, and to encourage investor risk taking.

Chart B: Federal Reserve Balance Sheet

3.5

Trillions of $ U.S.

Fed Balance Sheet Fed MBS Holdings Fed Treasury Holdings

The Fed Owns $1.0tln of MBS and $1.7tln of Treasuries

3.0

1.5

1.0

2.5

2.0

0.5

0

1/08 6/08 1/09 6/09

(Source: U.S. Federal Reserve)

1/10 6/10 1/11 6/11 1/12 6/12 1/13

By purchasing bonds, the Fed is increasing demand in the bond markets, but it is also pushing inflation expectations higher, which has a mixed impact on interest rates. It’s an irony of Fed policy that each time the Fed has announced a round of bond buying, interest rates have actually increased (Chart C)! At some point, the Fed will reduce or stop the rate of bond purchases and might consider selling some of their holdings. Doing either would likely cause an increase in real interest rates, but would also reduce inflation expectations slightly, meaning that, while interest rates would likely rise when the Fed stops buying, the increases would be muted somewhat. Keep in mind, also, that the bond markets already have a built-in assumption that the Fed will, at some point, slow its bond buying path and, more distantly, act to raise shortterm interest rates.

Chart C: Changes in 10yr Rates Around Fed Bond Buying

100

Basis Points

85 bps

80

60

43 bps

40

20 16 bps

11 bps

0

QE2

Nov 2010

(Source: Janney)

Operation Twist

Sept 2011

Operation Twist Extension

June 2012

QE3

Sept 2012

Conclusions

In conclusion, there are four major triggers that could cause interest rates to rise: higher inflation expectations, higher supply, lower demand, or changes in the Fed’s policy. To some degree, most of these come down to the potential for stronger economic growth, which could push inflation expectations upward, encourage investors to sell bonds to buy stocks, and get the Fed to stop its bond buying programs earlier than the markets anticipate. Our forecast is for growth to remain at around the 2% range in 2013. But the low level of returns available in the fixed income markets means that investors are and should be sensitive to the potential for rising interest rates, which could come via a range of these fundamental mechanisms.

This report is for informational purposes only and in no event should it be construed as a solicitation or offer to purchase or sell a security. The information presented herein is taken from sources believed to be reliable, but not guaranteed by Janney as to accuracy or completeness. Any issue named or rates mentioned are used for illustrative purposes only, and may not represent the specific features or securities available at a given time. For investment advice specific to your individual situation, or for additional information on this or other topics, please contact your Janney Financial Consultant and/or your tax or legal advisor.

WWW. JANNEY.COM • © 2013, JANNEY MONTGOMERY SCOTT LLC

MEMBER: NYSE, FINRA, SIPC • REF. 1302456 • WHAT CAUSES INTEREST RATES TO RISE? • PAGE 2