Product highlights

The FTSE Infrastructure Index Series

Defining infrastructure

FTSE Russell’s infrastructure definition

Features

In terms of listed equities, FTSE Russell defines core infrastructure as

companies which own, operate, manage or maintain physical structures or

networks used to process or move goods, services, information, people,

energy and/or life essentials.

•FTSE’s Infrastructure Index Series include

only publicly listed infrastructure, in order

to guarantee transparency and investability.

FTSE Russell expands this definition to include companies which provide the

conveyance of goods, services, people and/or life essentials, as well as the

critical materials and support for construction and maintenance of networks

and structures. They also provide voice and data communications services.

This expanded definition is used to define companies whose businesses are

infrastructure-related.

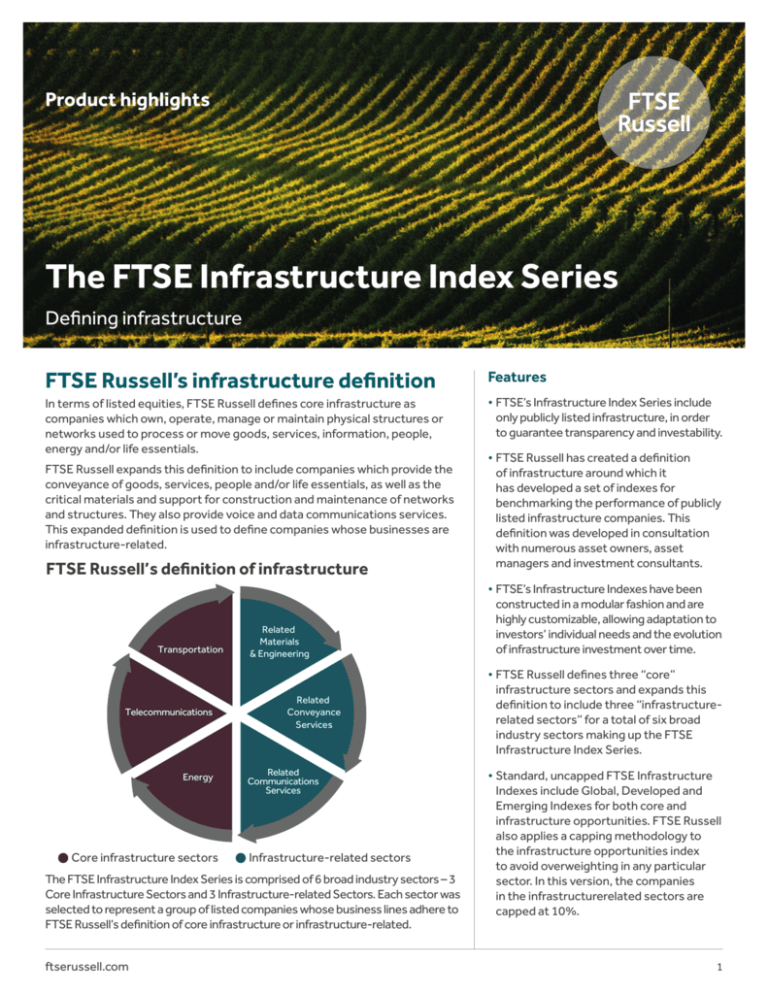

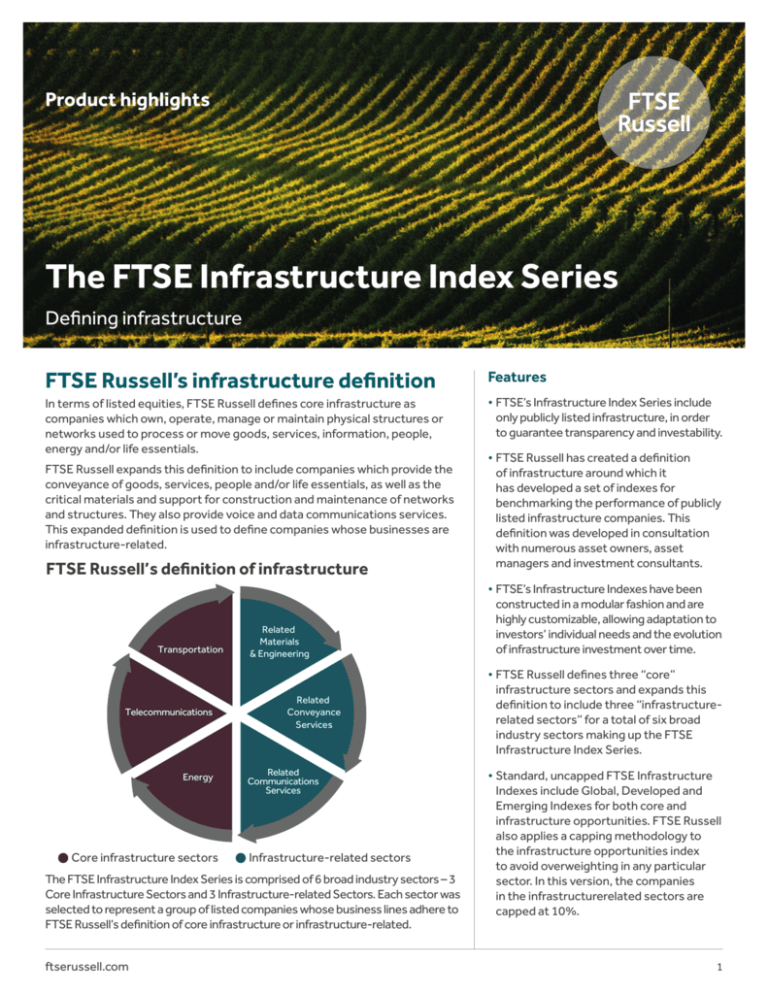

FTSE Russell’s definition of infrastructure

Transportation

Telecommunications

Energy

Core infrastructure sectors

Related

Materials

& Engineering

Related

Conveyance

Services

Related

Communications

Services

Infrastructure-related sectors

The FTSE Infrastructure Index Series is comprised of 6 broad industry sectors – 3

Core Infrastructure Sectors and 3 Infrastructure-related Sectors. Each sector was

selected to represent a group of listed companies whose business lines adhere to

FTSE Russell’s definition of core infrastructure or infrastructure-related.

ftserussell.com

•FTSE Russell has created a definition

of infrastructure around which it

has developed a set of indexes for

benchmarking the performance of publicly

listed infrastructure companies. This

definition was developed in consultation

with numerous asset owners, asset

managers and investment consultants.

•FTSE’s Infrastructure Indexes have been

constructed in a modular fashion and are

highly customizable, allowing adaptation to

investors’ individual needs and the evolution

of infrastructure investment over time.

•FTSE Russell defines three “core”

infrastructure sectors and expands this

definition to include three “infrastructurerelated sectors” for a total of six broad

industry sectors making up the FTSE

Infrastructure Index Series.

•Standard, uncapped FTSE Infrastructure

Indexes include Global, Developed and

Emerging Indexes for both core and

infrastructure opportunities. FTSE Russell

also applies a capping methodology to

the infrastructure opportunities index

to avoid overweighting in any particular

sector. In this version, the companies

in the infrastructurerelated sectors are

capped at 10%.

1

The FTSE Infrastructure Index Series

Core Infrastructure Sectors

FTSE’s Core Infrastructure Sectors comprise listed

companies that own, operate, manage or maintain a

particular network, structure or facility. These are “nuts and

bolts” constituents whose revenue from operations is similar

to a stable, annuitized cash flow over a relatively long period.

Such companies are typically involved in the construction,

maintenance and/or operation and usage of conduits,

thoroughfares and networks. Revenue from these businesses

often has an element of inflation-linking built in. Long-term

projects may include features to accommodate future price

increases of material and labor. Long-term concessions to

operate or maintain a road, bridge, tunnel or light railway may

accommodate toll and fare increases over time, as necessary.

Port operation and management companies will have some

portion of their revenue linked to usage fees of port facilities.

These companies provide exposure to the infrastructure

asset class, with lower volatility in their returns and

cash flows.

Transportation Core Infrastructure – Companies that

own, operate, manage or maintain roads, bridges, tunnels,

(freight) railway lines, waterways, ports, airports, terminals

and depots. This Sector includes local commuter rail lines

as well as urban mass transit lines, regional light rail and

monorail systems, where the majority of usage is for regular

commutation to and from work.

The FTSE Transportation Core Infrastructure Subsectors

are Railroads; Roads, Bridges & Tunnels; Airports; Other

Ports & Terminals; Commuter Rail & Light Rail; Other

Commuter Transportation.

Freight railway companies which own or manage the

track and/or rightof- way are represented by the

Railroads Subsector.

Companies that are responsible for bridge and tunnel

construction and toll plaza operations, roadway maintenance,

capital infrastructure improvements, toll collection, etc. and

which provide these services via long-term concessions,

are included in the Roads, Bridges & Tunnels Subsector, the

Airports Subsector and the Other Ports & Terminals Subsector.

Within the Commuter Rail & Light Rail Subsector and the

Other Commuter Transportation Subsector are companies

with concessions to operate urban mass transit or local

commuter rail and bus lines, light rail or monorail systems or,

at least part of whose business includes the exclusive right

to collect fares and/or undertake activities and commercial

development of such commuter lines.

Energy Core Infrastructure – Companies that own, operate,

manage or maintain oil, gas or water-supply pipelines or

electricity transmission networks. Companies providing gas

Product highlights

FTSE Russell

and water to regions, cities and neighborhoods via pipelines

and conduits are included. Those with a presence in more than

one energy industry are part of the Multiutilities Subsector.

Core energy companies include utilities and energy

generators as long as they can be shown to operate or own

an economically significant portion of the distribution grid.

Pure electricity generators (e.g. owners or operators of

single, or groups of, power plants) are not included, unless it

can be shown that they also operate or own an economically

significant portion of the local grid to which they contribute

their power.

A key aspect of FTSE’s definition of energy/utilities is the

focus on regulated utilities. Utilities are included if it can be

identified that they are regulated by local, state or regional

governments or agencies. Typically, the regulating body

allows the utility to earn a minimum rate of return. To that

end, the utility is able to pass along some portion of its

conventional fuel costs (i.e. fossil fuels, nuclear or hydro) to

consumers in the form of higher rates, thereby mitigating

the commodity price risk and the volatility of operating

cash flows. This is easier to do with utilities in the U.S.

than it is with utilities in other countries. Outside the U.S.,

regulation may or may not specify a minimum rate of return

and it is more difficult to determine if regulation allows

commodity price risk to be passed along. The result will be

that some large, integrated utilities are not included in the

infrastructure index.

This definition of energy/utilities mitigates the impact from

this sector on the overall index characteristics.

These are the criteria for conventional electricity companies.

For the present, companies generating power via wind, solar,

hydrogen, ethanol or other alternative energy sources, or

which do not have any rights of control over portions of the

transmission grid, are excluded.

The FTSE Energy Core Infrastructure Subsectors

are Gas Distribution; Pipelines; Water; Multiutilities;

Conventional Electricity.

Telecommunications Core Infrastructure – Companies

that own, operate, manage or maintain fixed line telephony

and data networks or, that own, manage, operate or lease

transmission lines or towers to others. Also included

are companies that own, operate, manage or maintain

wireless transmission towers (or, who lease them to others)

and companies that own, operate, manage or maintain

transmission satellites (or, who lease them to others).

Companies providing voice and data communications

are included only if they have control over economically

significant portions of the distribution/transmission network.

The FTSE Telecommunications Core Infrastructure

Subsectors are Fixed Line Networks; Mobile Networks.

2

The FTSE Infrastructure Index Series

Infrastructure-related Sectors

FTSE’s Infrastructure-related Sectors comprise listed

companies that are considered to be part of a country’s

infrastructure because they utilize infrastructure facilities

but do not own, operate, manage or maintain them.

These companies are involved in transportation along the

established infrastructure network, are businesses that

support the construction of infrastructure facilities or are

those that provide voice and data services to end-users.

These companies provide broad, diversified exposure to the

infrastructure asset class, with potentially higher returns,

which are of particular interest to retail investors.

Infrastructure-related Conveyance Services – Companies

that operate passenger rail services, passenger or freight

airlines, bus services, ferries, passenger or bulk container

shipping, trucking or delivery services.

FTSE Russell defines conveyance services as companies that

move goods and people from one place to another. A conduit

or thoroughfare is necessary but not sufficient for a country’s

social and economic development. An unused road generates

no income on its own. Once the conveyance service (trucking,

airlines, container shipping, etc.) is included, commerce

can take place. These businesses represent “everyday

infrastructure” that the average person would equate with

economic development.

It should be noted that the passenger conveyances included in

this sector are not the same as the commuter transportation

included in the Transportation Core Infrastructure Sector. The

difference is subtle, as the same physical rolling stock that

transports working people (i.e. commuters) to and from their

jobs also carry tourists around a city and residents to leisure

activities on weekends. However, a system’s typical pattern

of usage will be considered when making the determination

between commuter and general passenger activity.

The FTSE Infrastructure-Related Conveyance Services

Subsectors are Delivery Services; Marine Transportation;

Trucking; Airlines; Passenger Conveyances.

Infrastructure-related Materials & Engineering – Companies

that provide support services and materials to builders of

infrastructure facilities (e.g. ports, roads, bridges, tunnels,

etc.). These services and materials include surveying

and engineering, cement, concrete asphalt, iron, steel

and aluminum.

Product highlights

FTSE Russell

Materials and engineering are necessary inputs into the

construction of infrastructure facilities and those facilities

cannot be created without them. Projects can have a long

construction timeframe and an even longer maintenance

timeframe. Companies providing materials and services

to these projects can reasonably be expected to receive

long‑term revenue.

While it is not always possible to determine that a company

providing the materials listed above is actually providing them

for an infrastructure project, FTSE makes the presumption

that such companies are engaged in these projects unless

evidence is found to the contrary. It is less detrimental to

include all such companies, on the assumption that at least

some of them must be providing materials for infrastructure

projects, than it is to exclude all of them until direct evidence

can be found from the financial statements that the materials

are, in fact, being used on infrastructure projects.

The FTSE Infrastructure-Related Materials & Engineering

Subsectors are Cement, Concrete & Asphalt; Surveying,

Engineering & Logistics; Iron & Steel; Aluminum.

Infrastructure-related Communications Services –

Companies that provide general voice and data services to

consumers. The rationale used for the other infrastructurerelated sectors applies to Telecommunications as well. Some

companies own or operate the physical network. Others lease

capacity on the network to provide services to consumers.

The large national, regional and global telecoms companies,

who may not necessarily control the network but who utilize

it, would be included in this Sector.

Not all information that is transmitted contributes to the

orderly working and advancement of civil society. However,

there is clearly a societal and economic impact from the wide

availability of mobile communication and internet services

to the masses. For an individual company, one cannot

disaggregate the value of casual phone calls from those of

more societal import. The sheer availability of all forms of

electronic communication must be taken as a whole. We

recognize that impact by including this sector and subsector

within the index series.

The FTSE Infrastructure-Related Communications

Services Subsector is FTSE Infrastructure-Related

Communications Services.

3

FTSE Russell

The FTSE Infrastructure Index Series

Index series design

Summary & conclusion

FTSE calculates infrastructure indexes across global, developed and

emerging markets. The FTSE Global Core Infrastructure Index Series is

comprised of companies from the core sectors which generate a minimum

of 65% of their revenue from infrastructure. The FTSE Global Infrastructure

Opportunities Indexes offer a broader exposure to infrastructure

by combining companies from core and 20% of their revenue from

infrastructure. Finally, the FTSE Global Infrastructure Indexes add a 10%

cap to constituents from the infrastructure-related sectors. This helps to

mitigate the risk of being overweight in a particular sector.

•Government investment in infrastructure

likely to continue to support growing

populations and remain globally

competitive.

Any of FTSE’s Infrastructure Indexes can be customized in terms of region,

revenue threshold or capping factor to meet specific requirements.

FTSE Global Infrastructure Index

•Listed infrastructure provides a

reasonable proxy exposure for unlisted

infrastructure and benefits from

transparent, market-based pricing.

•Definitions of infrastructure vary widely.

FTSE offers a modular, customizable

approach to accommodate broad and

narrow definitions.

10% adjustment

factor to

infrastructurerelated

sectors

FTSE Developed Infrastructure Index

FTSE Emerging Infrastructure Index

FTSE Global Infrastructure Opportunities Index

FTSE Developed Infrastructure Opportunities Index

FTSE Emerging Infrastructure Opportunities Index

FTSE Global Core

Infrastructure Index

FTSE Developed Core

Infrastructure Index

FTSE Emerging Core

Infrastructure Index

Infrastructure-related

Conveyance Services

Infrastructure-related

Communications Services

Infrastructure-related

Materials & Engineering

Telecommunications Core Infrastructure

Energy Core

Infrastructure

Transportation Core

Infrastructure

i Source: The Wall Street Journal Digital Network, Market Watch, September 26th, 2011 (http://

www.marketwatch.com/story/infrastructure-spending-will-create-jobs-geithner-2011-09-26)

ii Source: Morgan Stanley – “Brazil Infrastructure, Paving the Way”, May 5th, 2010 and APE/

BNDES (http://www.morganstanley.com/views/perspectives/pavingtheway.pdf)

Product highlights

4

The FTSE Infrastructure Index Series

FTSE Russell

For more information about our indexes, please visit ftserussell.com.

© 2015 London Stock Exchange Group companies.

London Stock Exchange Group companies includes FTSE International Limited (“FTSE”), Frank Russell Company (“Russell”),

MTS Next Limited (“MTS”), and FTSE TMX Global Debt Capital Markets Inc (“FTSE TMX”). All rights reserved.

“FTSE®”, “Russell®”, “MTS®”, “FTSE TMX®” and “FTSE Russell” and other service marks and trademarks related to the FTSE or

Russell indexes are trademarks of the London Stock Exchange Group companies and are used by FTSE, MTS, FTSE TMX and

Russell under licence.

All information is provided for information purposes only. Every effort is made to ensure that all information given in this

publication is accurate, but no responsibility or liability can be accepted by the London Stock Exchange Group companies nor

its licensors for any errors or for any loss from use of this publication.

Neither the London Stock Exchange Group companies nor any of their licensors make any claim, prediction, warranty or

representation whatsoever, expressly or impliedly, either as to the results to be obtained from the use of the FTSE Russell

Indexes or the fitness or suitability of the Indexes for any particular purpose to which they might be put.

The London Stock Exchange Group companies do not provide investment advice and nothing in this document should be

taken as constituting financial or investment advice. The London Stock Exchange Group companies make no representation

regarding the advisability of investing in any asset. A decision to invest in any such asset should not be made in reliance on any

information herein. Indexes cannot be invested in directly. Inclusion of an asset in an index is not a recommendation to buy, sell

or hold that asset. The general information contained in this publication should not be acted upon without obtaining specific

legal, tax, and investment advice from a licensed professional.

No part of this information may be reproduced, stored in a retrieval system or transmitted in any form or by any means,

electronic, mechanical, photocopying, recording or otherwise, without prior written permission of the London Stock Exchange

Group companies. Distribution of the London Stock Exchange Group companies’ index values and the use of their indexes to

create financial products require a licence with FTSE, FTSE TMX, MTS and/or Russell and/or its licensors.

The Industry Classification Benchmark (“ICB”) is owned by FTSE. FTSE does not accept any liability to any person for any loss

or damage arising out of any error or omission in the ICB.

Past performance is no guarantee of future results. Charts and graphs are provided for illustrative purposes only. Index returns

shown may not represent the results of the actual trading of investable assets. Certain returns shown may reflect backtested performance. All performance presented prior to the index inception date is back-tested performance. Back-tested

performance is not actual performance, but is hypothetical. The back-test calculations are based on the same methodology

that was in effect when the index was officially launched. However, back-tested data may reflect the application of the index

methodology with the benefit of hindsight, and the historic calculations of an index may change from month to month based

on revisions to the underlying economic data used in the calculation of the index.

Product highlights

5

FTSE Russell

The FTSE Infrastructure Index Series

About FTSE Russell

FTSE Russell is a leading global provider of benchmarking, analytics and data

solutions for investors, giving them a precise view of the market relevant to

their investment process. A comprehensive range of reliable and accurate

indexes provides investors worldwide with the tools they require to measure

and benchmark markets across asset classes, styles or strategies.

FTSE Russell index expertise and products are used extensively by

institutional and retail investors globally. For over 30 years, leading asset

owners, asset managers, ETF providers and investment banks have chosen

FTSE Russell indexes to benchmark their investment performance and create

ETFs, structured products and index-based derivatives.

FTSE Russell is focused on applying the highest industry standards in index

design and governance, employing transparent rules-based methodology

informed by independent committees of leading market participants.

FTSE Russell fully embraces the IOSCO Principles and its Statement of

Compliance has received independent assurance. Index innovation is

driven by client needs and customer partnerships, allowing FTSE Russell to

continually enhance the breadth, depth and reach of its offering.

FTSE Russell is wholly owned by London Stock Exchange Group.

For more information, visit www.ftserussell.com.

To learn more, visit www.ftserussell.com; email index@russell.com, info@ftse.com;

or call your regional Client Service Team office:

EMEA

North America

Asia-Pacific

+44 (0) 20 7866 1810

+1 877 503 6437

Hong Kong +852 2164 3333

Tokyo +81 3 3581 2764

Sydney +61 (0) 2 8823 3521

Product highlights

6