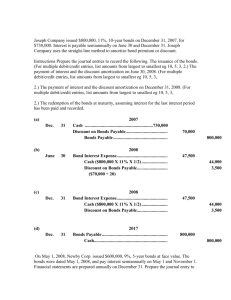

Chapter 14: Bonds

and Long-Term Notes

Part

P t 1 - Bonds

B d

Intermediate Accounting II

Dr. Chula King

© Dr. Chula King

All Rights Reserved

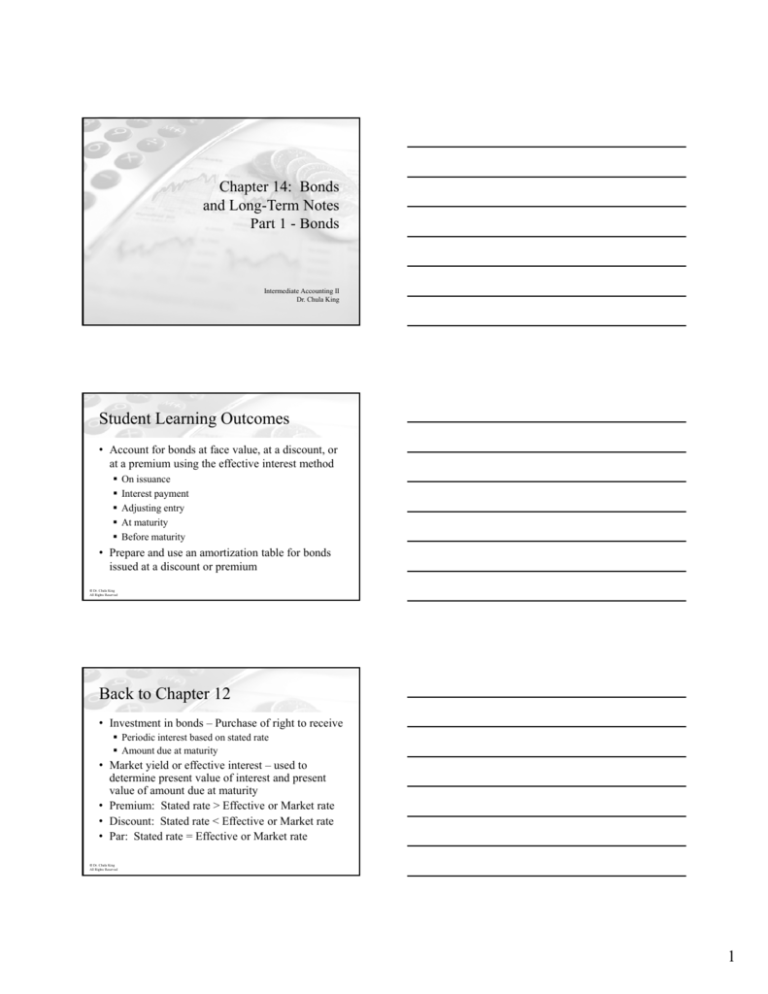

Student Learning Outcomes

• Account for bonds at face value, at a discount, or

at a premium using the effective interest method

On issuance

Interest payment

Adjusting entry

At maturity

Before maturity

• Prepare and use an amortization table for bonds

issued at a discount or premium

© Dr. Chula King

All Rights Reserved

Back to Chapter 12

• Investment in bonds – Purchase of right to receive

Periodic interest based on stated rate

Amount due at maturity

• Market yyield or effective interest – used to

determine present value of interest and present

value of amount due at maturity

• Premium: Stated rate > Effective or Market rate

• Discount: Stated rate < Effective or Market rate

• Par: Stated rate = Effective or Market rate

© Dr. Chula King

All Rights Reserved

1

Back to Chapter 12 (continued)

• Investor purchases bond: Held-to-Maturity,

Available for Sale, Trading

• Accounting Issues

Recording the Purchase

Recording receipt of interest and discount/premium

amortization

Recording adjusting entry related to interest accrual

and discount/premium amortization

Recording disposition of investment

Recognizing fair value (if available for sale or trading)

© Dr. Chula King

All Rights Reserved

Issuing Bonds

• Bond indenture – bond contract

• Promise to pay

Sum of money at designated maturity date

Periodic interest at specified rate on maturity

amount

• Paper certificate, typically $1,000 face value

• Interest usually paid semiannually

• Used when amount of capital needed is too

large for one lender to supply

© Dr. Chula King

All Rights Reserved

Valuation of Bonds Payable

• Selling price set by

Supply and demand of buyers and sellers

Relative risk

Market conditions

State of the economy

• Valued at present value of expected cash flows

Periodic cash interest, plus

Cash amount payable at maturity

Discounted at market or effective interest rate

© Dr. Chula King

All Rights Reserved

2

Interest

• Stated, coupon or nominal rate: Interest rate

printed on the bond – used to determine cash

interest

Bond issuer sets the rate

Stated as a percentage of the bond face value (par)

• Market rate or effective yield: Rate that

provides acceptable return on investment given

issuer’s risk and market conditions – used to

determine present value

© Dr. Chula King

All Rights Reserved

For Example

• On January 1, 20X1, Apex, Inc., issued $100,000 face

value, 10% bonds that pay interest semiannually on

June 30 and December 31. The bonds mature in 3

years on December 31, 20X3.

1/1/X1

6/30/X1

|

|

5,000

12/31/X1 6/30/X2

|

5,000

|

5,000

12/31/X2 6/30/X3

|

5,000

|

5,000

#4, 6 payments @ ?

Issue

Price

12/31/X3

|

5,000

100,000

#2, 6 periods @ ?

© Dr. Chula King

All Rights Reserved

Market Rate (effective) = 10%: Par

1/1/X1

6/30/X1

|

|

5,000

12/31/X1 6/30/X2

|

5,000

|

5,000

12/31/X2 6/30/X3

|

5,000

|

5,000

12/31/X3

|

5,000

100,000

#4, 6 payments @ 5%

25,378

25 378 = 5.07569

5 07569 x 5,000

5 000

100,000

#2, 6 periods @ 5%

74,622 = .74622 x 100,000

Cash

Bonds Payable

100,000

100,000

© Dr. Chula King

All Rights Reserved

3

Market Rate (effective) = 8%:

Premium

1/1/X1

6/30/X1

|

|

5,000

12/31/X1 6/30/X2

|

5,000

|

5,000

12/31/X2 6/30/X3

|

5,000

|

5,000

12/31/X3

|

5,000

100,000

#4, 6 payments @ 4%

26,211

26 211 = 5.24214

5 24214 x 5,000

5 000

105,242

#2, 6 periods @ 4%

79,031 = .79031 x 100,000

Cash

105,242

Premium on B/P

Bonds Payable

5,242

100,000

© Dr. Chula King

All Rights Reserved

Market Rate (effective) = 12%:

Discount

1/1/X1

6/30/X1

|

|

5,000

12/31/X1 6/30/X2

|

5,000

|

5,000

12/31/X2 6/30/X3

|

5,000

|

5,000

12/31/X3

|

5,000

100,000

#4, 6 payments @ 6%

24,587

24 587 = 4.91732

4 91732 x 5,000

5 000

95,083

#2, 6 periods @ 6%

70,496 = .70496 x 100,000

Cash

Discount on B/P

Bonds Payable

95,083

4,917

100,000

© Dr. Chula King

All Rights Reserved

Effective Interest Method

• Produces periodic interest expense based on a

constant percentage (effective rate) applied to the

carrying value of the bonds

• Interest Expense = Effective Interest Rate x

Carrying Value of Bonds at beginning of period

• Interest Paid = Stated Interest Rate x Face

Amount of Bonds

• Amortization = Interest Expense – Interest Paid

• Change in Carrying Value = Beginning of period

value ± Amortization

© Dr. Chula King

All Rights Reserved

4

Interest: Issued at Par

6/30/X1

Interest Expense

5,000

Cash

5,000

(10% x 100,000 x 6/12)

12/31/X1 Interest Expense

5,000

Cash

5,000

© Dr. Chula King

All Rights Reserved

Interest: Issued at Premium

Date

1/1/X1

6/30/X1

12/31/X1

6/30/X2

12/31/X2

6/30/X3

12/31/X3

Cash Interest

Effective

Premium Carrying Value/

@ 5%

Interest @ 4% Amortization

Balance

105,242

5,000

4,210

790

104,452

5,000

4,178

822

103,630

5,000

5 000

4,145

4 145

855

102,775

102 775

5,000

4,111

889

101,886

5,000

4,075

925

100,961

5,000

4,038

962

100,000

6/30/X1

Interest Expense

Premium on B/P

Cash

12/31/X1 Interest Expense

Premium on B/P

Cash

© Dr. Chula King

4,210

790

5,000

4,178

822

5,000

All Rights Reserved

Interest: Issued at Discount

Date

1/1/X1

6/30/X1

12/31/X1

6/30/X2

12/31/X2

6/30/X3

12/31/X3

6/30/X1

12/31/X1

© Dr. Chula King

All Rights Reserved

Cash Interest

Effective

Discount Carrying Value/

@ 5%

Interest @ 6% Amortization

Balance

95,083

5,000

5,705

705

95,788

5,000

5,747

747

96,535

5,000

5,792

792

97,327

5 000

5 792

97 327

5,000

5,840

840

98,167

5,000

5,890

890

99,057

5,000

5,943

943

100,000

Interest Expense

Discount on B/P

Cash

Interest Expense

Discount on B/P

Cash

5,705

705

5,000

5,747

747

5,000

5

Interest Payment Is Not at Year End

• On August 1, 20X1, Apex, Inc., issued

$100,000 face value, 10% bonds that pay

interest semiannually on January 31 and July

31.

31 The bonds mature in 3 years on July 31,

31

20X4.

• Effective Rate = 10%: Issue price = $100,000

• Effective Rate = 8%: Issue price = $105,242

• Effective Rate = 12%: Issue price = $95,083

© Dr. Chula King

All Rights Reserved

Interest: Issued at Par

12/31/X1 Interest Expense

4,167

Interest Payable

4,167

(10% x 100,000 x 5/12)

1/31/X2 Interest Expense *

833

Interest Payable

4,167

Cash

5,000

*(10% x 100,000 x 1/12)

© Dr. Chula King

All Rights Reserved

Interest: Issued at Premium

Date

8/1/X1

1/31/X2

7/31/X2

1/31/X3

7/31/X3

1/31/X4

7/31/X4

Cash Interest

Effective

Premium Carrying Value/

@ 5%

Interest @ 4% Amortization

Balance

105,242

5,000

4,210

790

104,452

5,000

4,178

822

103,630

5,000

4,145

855

102,775

5,000

4,111

889

101,886

5,000

4,075

925

100,961

5,000

4,038

962

100,000

12/31/X1 Interest Expense (4,210 x 5/6)

Premium on B/P (790 x 5/6)

Interest Payable (5,000 x 5/6)

1/31/X2 Interest Expense (4,210 x 1/6)

Interest Payable

Premium on B/P (790 x 1/6)

© Dr. Chula King

Cash

All Rights Reserved

3,508

658

4,166

702

4,166

132

5,000

6

Interest: Issued at Discount

Date

8/1/X1

1/31/X2

7/31/X2

1/31/X3

7/31/X3

1/31/X4

7/31/X4

12/31/X1

1/31/X2

© Dr. Chula King

All Rights Reserved

Cash Interest

Effective

Discount Carrying Value/

@ 5%

Interest @ 6% Amortization

Balance

95,083

5,000

5,705

705

95,788

5,000

5,747

747

96,535

5,000

5,792

792

97,327

5,000

5,840

840

98,167

5 000

5 840

98 167

5,000

5,890

890

99,057

5,000

5,943

943

100,000

Interest Expense (5,705 x 5/6)

Discount on B/P (705 x 5/6)

Interest Payable (5,000 x 5/6)

Interest Expense (5,705 x 1/6)

Interest Payable

Discount on B/P (705 x 1/6)

Cash

4,754

588

4,166

951

4,166

117

5,000

Extinguishment of Debt at Maturity

• Effective Interest Method

Premium amortization reduces interest expense

and reduces Carrying value, ultimately to par

Discount amortization increases interest expense

and increases Carrying value, ultimately to par.

• Therefore, at maturity, no gain or loss results

Bonds Payable

100,000

Cash

100,000

© Dr. Chula King

All Rights Reserved

Early Extinguishment of Debt

• Gain or loss is the difference between the cash

paid to retire the bonds and the carrying value

of the debt.

© Dr. Chula King

All Rights Reserved

7

For Example

• On January 1, 2013, Apex, Inc., called its

$100,000, 10% bonds for $102,000 when their

carrying amount was $97,358. The bonds were

issued previously at a price to yield 12%, and pay

interest semiannually on June 30 & December 31.

Bonds Payable

100,000

Loss on early retirement of bonds

4,462

Discount on B/P (100,000 – 97,538)

2,462

Cash

102,000

© Dr. Chula King

All Rights Reserved

The Next Step

• Part 2 – Long-term Notes

© Dr. Chula King

All Rights Reserved

8