Role Of Sebi in Investor's Protection

advertisement

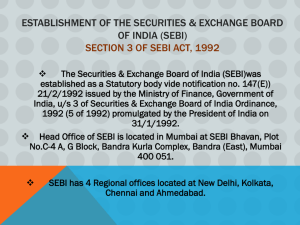

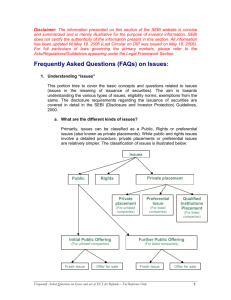

Prepared By:- Dr. Rajanikant Verma Sebi is the regulator for the Security market in India. In 1988 the Securities and Exchange Board of India (SEBI) was established by the Government of India through an executive resolution, and was subsequently upgraded as a fully autonomous body on April 12, 1992 the Securities and Exchange Board Of India was constituted. It was constitute in accordance with the provisions of the Securities and Exchange Board Of India. The basic functions of the Securities and Exchange Board of India is “…..to protect the interests of investors in securities and to promote the development of, and to regulate the securities market and for matters connected therewith or incidental thereto” The primary objective of SEBI is to promote healthy and orderly growth -of the securities market and secure investor protection. The objectives of SEBI are as follows: To protect the interest of investors, so that, there is a steady flow of savings into the capital market. To regulate the securities market and ensure fair practices. To promote efficient services by brokers, merchant bankers, and other intermediaries, so that, they become competitive and professional. The SEBI Act, 1992 has entrusted with two functions, they are Regulatory functions and Developmental functions • Regulation of stock exchange and self regulatory organizations. • Registration and regulation of stock brokers, sub-brokers, Registrars to all issues, merchant bankers, underwriters, portfolio managers etc. • Registration and regulation of the working of collective investment schemes including mutual funds. • Prohibition of fraudulent and unfair trade practices relating to securities market. • Prohibition of insider trading. • Regulating substantial acquisition of shares and takeover of companies. Promoting investor’s education. Training of intermediaries. Conducting research and publishing information useful to all market participants. Promotion of fair practices. Promotion of self regulatory organizations. • The SEBI Act provides for the establishment of a Statutory Board consisting of six members. The chairman and two members are to be appointed by the Central Government, one member to be appointed by the Reserve Bank and two members having experience of securities market to be appointed by the Central Government. • SEBI has divided the activities into four operational departments. They are primary market department, issue management and intermediary’s department, secondary market department and institutional department. Each department is headed by an Executive Director. Investors are the backbone of the securities market. They determine the level of activity in the securities market and the level of activity in the economy. Many investors may not possess adequate expertise/knowledge to take informed investment decisions. May not be aware of the complete risk-return profile of the different investment options. may not be fully aware of the precautions they should take while dealing with market intermediaries and dealing in different securities. They may not be familiar with the market mechanism and the practices as well as their rights and obligations. Securities Scam – Harshad Mehta (1991-92). Floating Companies Scam – C R Bhansali (1992-96) . Satyam – Ramalinga Raju (2009) – Around 12,000 Crores. Fake Stamp Fraud – Abdul Karim Telgi - Around 30,000 Crores . DSQ Software – Dinesh Dalmiya (2001) - Around 600 Crores . Security Market Awareness Campaign(SMAC) was started with a motto “An educated investor is a Protected investor.” Invest with Knowledge” was the message spread by this campaign. Workshops Advertisements Educative material All India Radio – Information provided through AIR Programs frequently. Specify the manner in which the matters relating to issue of capital, transfer of securities and other matters shall be disclosed by the companies. No company can make an issue of securities unless a draft prospectus has been filed with SEBI. The offer document, through which the securities are issued, is to be prepared strictly as per the requirements of SEBI Guidelines. No company shall make an issue of securities unless it has made an application for listing of securities at a stock exchange. No company can make public issue unless all existing shares must be fully paid. Name Of Grievances Can be taken up with In Case of Public issue: Delay in refund amount Interest on delayed amount SEBI Deptt. Of Company Affairs In Case of Listed Debentures Interest due Redemption proceeds Interest on delayed payment SEBI Deptt. Of Company Affairs Debentures Trustees In Case of Unlisted Debentures Deptt. Of Company Affairs In Case Of Units Of Mutual Funds SEBI In Case Of FD In banks and NBFCs RBI In Case Of FD in Companies Deptt. Of Company Affairs The Investor’s Education has also emerged as a crucial part of SEBI’s efforts to protect the interest of the investors in securities market. Some of the main features of this education program of SEBI may be summarized as follows: To receive the share certificates, on allotment or transfer as the case may be, in due time. To receive copies of the Director’s report, Balance Sheet and P&L A/c and the Auditor’s report. To participate and vote in General Meeting either personally or through proxies. To receive dividend in due time once approved in General Meeting. To receive corporate benefits like rights, bonus, etc once approved. To proceed against the company by way of civil or criminal proceedings. Besides the rights, the investors also have some responsibilities to discharge as follows: To remain informed. To be vigilant. To participate and vote in general meetings. To exercise his rights on his own or as a group. Refers to using the unpublished information about the performance or other matters of a company, in dealings with the securities of the company. If a director, an officer or any other employee of a company is having some information about the plans of company, which is not known to the world at large and uses that information with the intention of making gain, then it is termed as a Insider trading. As a part of investor’s protection, SEBI has taken necessary steps to prohibit insider trading by checking and curbing unhealthy and manipulative practices by persons who have more access than others to the information about the company. With this objective in mind, SEBI issued the SEBI(Prohibition and Insider Trading) Regulations, 1992 immediately after its corporation.