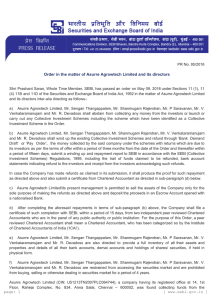

capital market

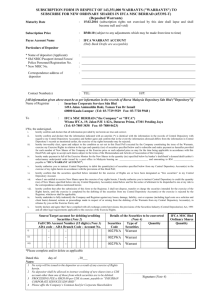

advertisement

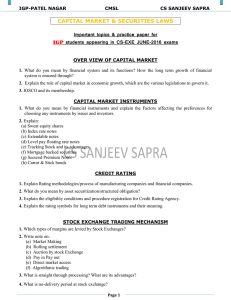

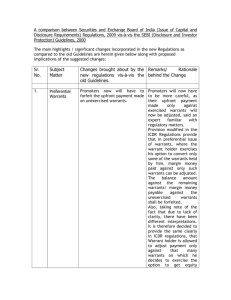

By Dr. Ajit Kumar AGM, MoF CAB, PUNE CAPITAL MARKET Definition- borrow/lend lond term capital fund Capital Market vs Bank Finance Advantages and Disadvantages Constituents of Indian capital Market 1.Government Security market-B.R.Act 2. Industrial Security market Segments of Security Market 1. Primary Market-helps in growth of economy 2. Secondary Market-does not help Primary market is also known as NIM Why Secondary market For the efficient growth of primary market, a sound secondary market is an essential requirement. It provides liquidity to the investors as also a high profit expectation. NIM can’t exist without SM. Stock Exchanges Subject to Govt supervision & control Total no. of stock exchanges –23 Two national stock exchanges 1.BSE 2.NSE BSE- estd. In 1857, in fact oldest in Asia NSE- set up in 1993, has 70% share of total trading Out of 21 Regional stock exchanges 15 stock exchanges reported NIL transaction. NSE is harbinger of reforms in capital market Who Regulates ? Stock market is regulated by SEBI under ‘Securities Contracts Regulation Act’ 1956 (SCRA) concurrently with GOI(MOF+MOC), RBI also has a regulatory role with regard to FII & FDI. SEBI was set up in 1988 but SEBI Act was passed in 1992. Prior to SEBI it was regulated by Controller of Capital Issues. Capital Market Instruments 1.Preference Share 2. Equity Share- min.25% public offer req for new issues for listing 3. Non-voting Equity share-Abid Hussain committee 4. Convertible Cumulative Preference Share 5. Company Fixed Deposit 6. Debenture & Bonds- issued under common seal of the company 7. Warrants-10 to30% above market price- sweeteners Methods of Marketing Securities I 1. Pure Prospectus Method-exclusively from general public, adv 2. Offer for Sale – sale to intermediaries at agreed price,adv 3. Private Placement – not more than 50, for listed,lockin5yr 4. Bought Out Deals- same as ppfor unlisted,lock in 18m,adv 5. Rights Issue- existing shareholders,only by listed companies 6. Bonus Issue- accumulated reserves and surplus of profits converted into paid-up capital.Free of charge. 7. Book Building Method- merchant banker-qualified institutional buyers,price bids,free to determine private placement & Methods of Marketing securities II 8. Stock Option Method (ESOP)- only for listed companies, with prior approval of shareholders through a special resolution. 9.Initial Public Offer (IPO)-1 time,unlisted only if net worth>3c,profit Under this method securities are issued to successful applicants on the basis of the order placed by them through their broker. Red herring clause- A preliminary prospectus (also known as red herring) often with words with letters which say it is preliminary and the price is not yet set. Green shoe option- additional subscription can be offered by the issuer (15%) Intermediaries of the Market Merchant Bankers/ Lead Managers- regulated by SEBI Registrars and share transfer agents Underwriters- CARE-a bank can’t uw > 15% of the issue, can’t uw >400 times of it’s net worth, underwriting is eligible for computation of capital market exposure. Bankers to Issue- certificate of registration from SEBI required Rating Agencies (CRISIL, ICRA, Fitch) Brokers & Sub-brokers- 9400 Broking outfits out of which 29 are foreign brokers Depositories Depositories-Depository Act –1996, It’s a company under the Companies Act 1956.We have multi depository system.Depository is a custodian where investors deposit their assets and it executes certain orders of the investorsNational Securities Depository Ltd.(NSDL), Centralised Depository Services Ltd. (CSDL) Depository Participants- It is base level branch of a bank or a non-bank maintaining deposit on behalf of investorstotal number 295. WHY EXPO0SURE NORMS Why limit on Capital Market Exposure?- Risk Why emphsis on CD ratio? Bank Finance- appraisal based/ merit based Capital Market – theoretically appraisal based but practically confidence based Bank in a position to monitor by way of post credit supervision, no such mechanism in case of capital market exposure.-guided by market perception and manipulation. Glass Steagall Act was enacted in USA after 1929 stock market crash. The bank was not allowed to take direct exposure in stock market. Banks were required to have a firewall between bank’s investment portfolio and others. Abolished during Reagan regime. Extant Exposure norms- India It’s time to say Thank You