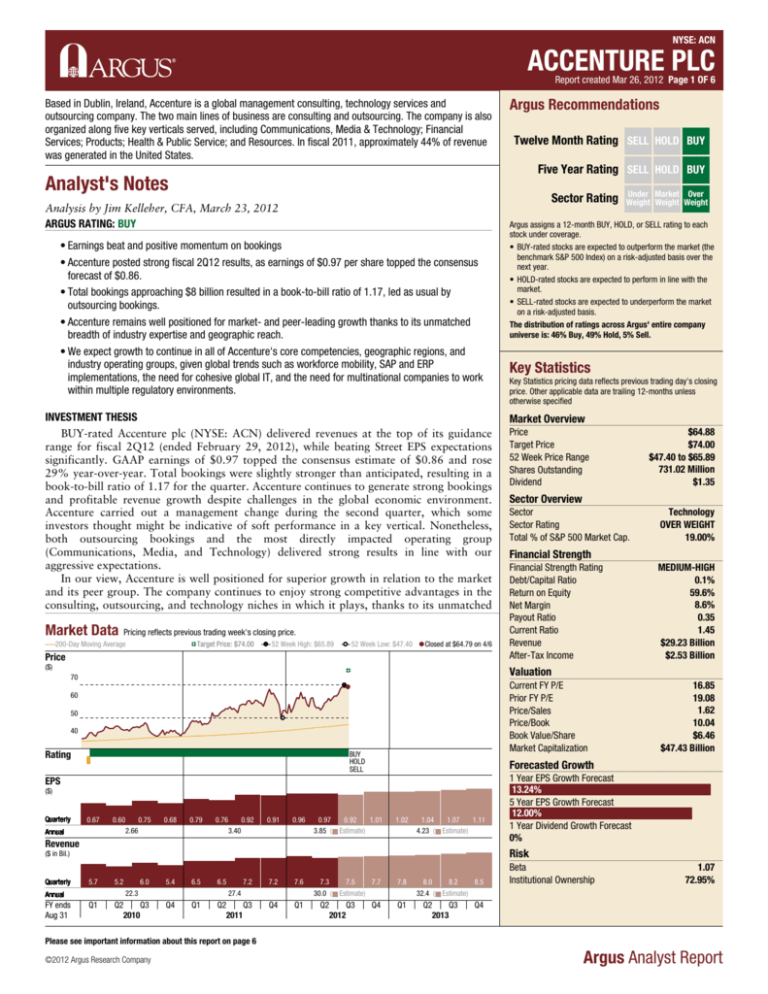

NYSE: ACN

ACCENTURE PLC

Report created Mar 26, 2012 Page 1 OF 6

Based in Dublin, Ireland, Accenture is a global management consulting, technology services and

outsourcing company. The two main lines of business are consulting and outsourcing. The company is also

organized along five key verticals served, including Communications, Media & Technology; Financial

Services; Products; Health & Public Service; and Resources. In fiscal 2011, approximately 44% of revenue

was generated in the United States.

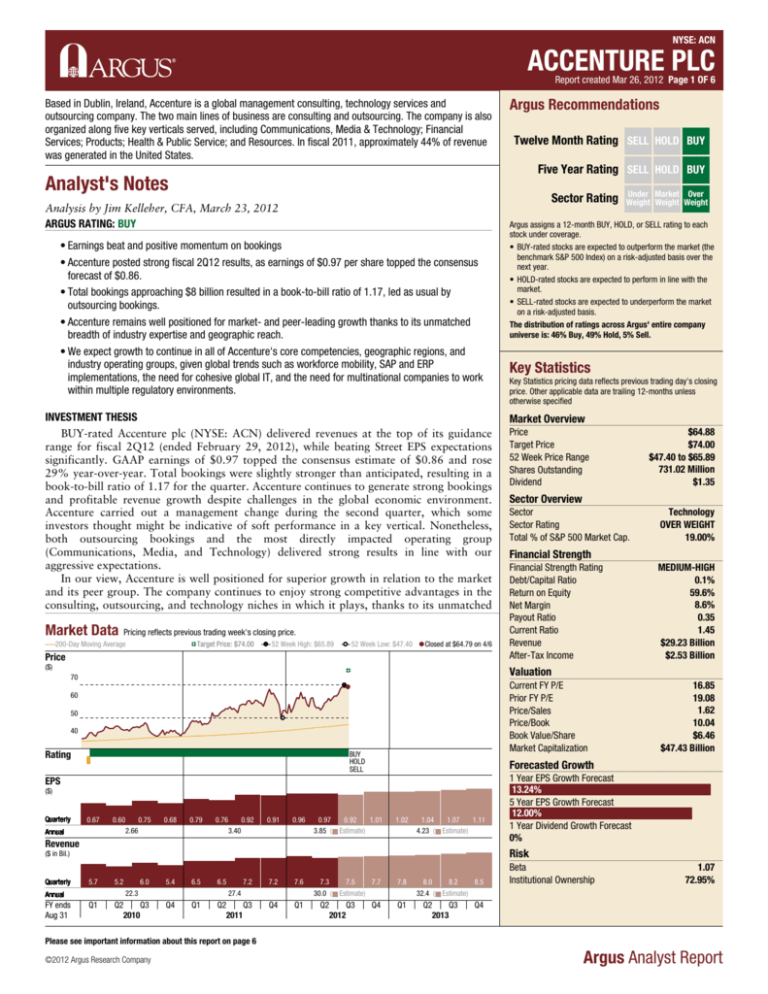

Argus Recommendations

Twelve Month Rating SELL HOLD BUY

Five Year Rating SELL HOLD BUY

Analyst's Notes

Sector Rating

Analysis by Jim Kelleher, CFA, March 23, 2012

ARGUS RATING: BUY

• Earnings beat and positive momentum on bookings

• Accenture posted strong fiscal 2Q12 results, as earnings of $0.97 per share topped the consensus

forecast of $0.86.

• Total bookings approaching $8 billion resulted in a book-to-bill ratio of 1.17, led as usual by

outsourcing bookings.

• Accenture remains well positioned for market- and peer-leading growth thanks to its unmatched

breadth of industry expertise and geographic reach.

• We expect growth to continue in all of Accenture's core competencies, geographic regions, and

industry operating groups, given global trends such as workforce mobility, SAP and ERP

implementations, the need for cohesive global IT, and the need for multinational companies to work

within multiple regulatory environments.

INVESTMENT THESIS

BUY-rated Accenture plc (NYSE: ACN) delivered revenues at the top of its guidance

range for fiscal 2Q12 (ended February 29, 2012), while beating Street EPS expectations

significantly. GAAP earnings of $0.97 topped the consensus estimate of $0.86 and rose

29% year-over-year. Total bookings were slightly stronger than anticipated, resulting in a

book-to-bill ratio of 1.17 for the quarter. Accenture continues to generate strong bookings

and profitable revenue growth despite challenges in the global economic environment.

Accenture carried out a management change during the second quarter, which some

investors thought might be indicative of soft performance in a key vertical. Nonetheless,

both outsourcing bookings and the most directly impacted operating group

(Communications, Media, and Technology) delivered strong results in line with our

aggressive expectations.

In our view, Accenture is well positioned for superior growth in relation to the market

and its peer group. The company continues to enjoy strong competitive advantages in the

consulting, outsourcing, and technology niches in which it plays, thanks to its unmatched

Market Data

Pricing reflects previous trading week's closing price.

200-Day Moving Average

Target Price: $74.00

52 Week High: $65.89

52 Week Low: $47.40

Closed at $64.79 on 4/6

Price

($)

50

40

Rating

BUY

HOLD

SELL

Key Statistics pricing data reflects previous trading day's closing

price. Other applicable data are trailing 12-months unless

otherwise specified

Market Overview

Price

Target Price

52 Week Price Range

Shares Outstanding

Dividend

$64.88

$74.00

$47.40 to $65.89

731.02 Million

$1.35

Sector Overview

Sector

Sector Rating

Total % of S&P 500 Market Cap.

Technology

OVER WEIGHT

19.00%

Financial Strength

Financial Strength Rating

Debt/Capital Ratio

Return on Equity

Net Margin

Payout Ratio

Current Ratio

Revenue

After-Tax Income

MEDIUM-HIGH

0.1%

59.6%

8.6%

0.35

1.45

$29.23 Billion

$2.53 Billion

($)

0.67

0.60

0.75

0.68

0.79

0.76

2.66

Annual

0.92

0.91

0.96

3.40

16.85

19.08

1.62

10.04

$6.46

$47.43 Billion

Forecasted Growth

EPS

0.97

0.92

1.01

3.85 ( Estimate)

1.02

1.04

1.07

1.11

4.23 ( Estimate)

Revenue

1 Year EPS Growth Forecast

13.24%

5 Year EPS Growth Forecast

12.00%

1 Year Dividend Growth Forecast

0%

Risk

($ in Bil.)

5.7

5.2

6.0

5.4

6.5

6.5

7.2

7.2

7.6

Q1

Q2

Q3

2010

Q4

Q1

Q2

Q3

2011

Q4

Q1

22.3

Annual

FY ends

Aug 31

Key Statistics

Current FY P/E

Prior FY P/E

Price/Sales

Price/Book

Book Value/Share

Market Capitalization

60

Quarterly

Argus assigns a 12-month BUY, HOLD, or SELL rating to each

stock under coverage.

• BUY-rated stocks are expected to outperform the market (the

benchmark S&P 500 Index) on a risk-adjusted basis over the

next year.

• HOLD-rated stocks are expected to perform in line with the

market.

• SELL-rated stocks are expected to underperform the market

on a risk-adjusted basis.

The distribution of ratings across Argus' entire company

universe is: 46% Buy, 49% Hold, 5% Sell.

Valuation

70

Quarterly

Under Market Over

Weight Weight Weight

27.4

7.3

7.5

7.7

30.0 ( Estimate)

Q2

Q3

2012

Q4

7.8

Q1

8.0

8.2

8.5

32.4 ( Estimate)

Q2

Q3

2013

Beta

Institutional Ownership

1.07

72.95%

Q4

Please see important information about this report on page 6

©2012 Argus Research Company

Argus Analyst Report

NYSE: ACN

ACCENTURE PLC

Report created Mar 26, 2012 Page 2 OF 6

Analyst's Notes...Continued

breadth of industry expertise and geographic reach. We expect

growth to continue in all of Accenture's core competencies,

geographic regions, and industry operating groups, given global

trends such as workforce mobility, SAP and ERP implementations,

the need for cohesive global IT, and the need for multinational

companies to work within multiple regulatory environments. We

reiterate our BUY rating on ACN to a 12-month target price of $74

(raised from $66).

RECENT DEVELOPMENTS

ACN is up 21% year-to-date as of 3/23/12. The stock rose

9.8% in 2011, consistent with outperformance among large-cap

technology companies relative to small and midcap names last year.

The Argus peer group of information processing hardware &

solutions companies declined 9.8% in 2011, versus a flat

performance in the S&P 500. In 2010, Accenture shares advanced

17%, compared with an 8% simple-average advance for the peer

group.

For fiscal 2Q12 (ended February 29, 2012), Accenture reported

revenue before reimbursements of $6.80 billion, up 12%

year-over-year (13% in local currency) and at the top end of the

guidance range of $6.5-$6.8 billion. Accenture surprised with

GAAP earnings of $0.97 per diluted share, up 29% year-over-year;

the Street had been looking for EPS in the $0.85-$0.86 range.

Accenture raised its full-year revenue growth guidance to

10%-12% in local currency from a prior 7%-10%. It also raised its

fiscal 2012 earnings forecast to $3.82-$3.90 per diluted share. By

way of background, Accenture in December 2011 projected

full-year 2012 earnings of $3.76-3.84 per diluted share, down from

initial guidance of $3.80-3.88 offered in September. The EPS

forecast was reduced because of macroeconomic challenges and a

negative 1% expected impact from foreign exchange; previously,

management had been modeling foreign exchange as a modest

positive.

In recasting its 2012 EPS guidance, Accenture continues to

expect a negative currency effect for the year, though this should be

outweighed by the higher revenue outlook. We also note that

Accenture tends to guide conservatively and then beat expectations.

During the post- release conference call, CEO Pierre Nanterme

attributed the strong revenue and profit performance to Accenture's

comprehensive offerings and integrated strategy, which 'resonates

with

clients.'

CFO

Pamela

Craig

stated

that

the

stronger-than-anticipated first half would enable Accenture to raise

its full-year financial targets.

In local currency, revenue grew in double digits in most

operating groups (industry verticals) and regions on a

year-over-year basis. In terms of the two main competencies, 2Q

outsourcing revenue of $3.02 billion rose 19% from last year and

1% sequentially. Consulting revenue of $3.78 billion rose 7.6%

from last year but declined 7.5% sequentially.

In 2Q12, Accenture reported new bookings of nearly $8 billion.

Consulting bookings of $4.05 billion rose 14% year-over-year,

Growth & Valuation Analysis

GROWTH ANALYSIS

($ in Millions, except per share data)

Revenue

COGS

Gross Profit

SG&A

R&D

Operating Income

Interest Expense

Pretax Income

Income Taxes

Tax Rate (%)

Net Income

Diluted Shares Outstanding

EPS

Dividend

GROWTH RATES (%)

Revenue

Operating Income

Net Income

EPS

Dividend

Sustainable Growth Rate

VALUATION ANALYSIS

Price: High

Price: Low

Price/Sales: High-Low

P/E: High-Low

Price/Cash Flow: High-Low

Financial & Risk Analysis

2007

21,453

15,411

6,041

3,522

—

2,493

-130

2,619

896

34

1,243

862

1.97

0.35

2008

25,314

18,128

7,186

4,151

—

3,012

-92

3,108

911

29

1,692

823

2.65

0.42

2009

23,171

16,330

6,841

3,948

—

2,644

-36

2,678

740

28

1,590

787

2.44

0.50

2010

23,094

15,843

7,251

4,326

—

2,915

-15

2,914

854

29

1,781

767

2.66

1.13

2011

27,353

18,966

8,387

4,915

—

3,470

-26

3,512

959

27

2,278

742

3.40

0.90

17.7

35.4

27.7

23.9

16.7

53.3

18.0

20.8

36.1

34.5

20.0

68.6

-8.5

-12.2

-6.0

-7.9

19.0

39.8

-0.3

10.2

12.0

9.0

125.0

43.5

18.4

19.1

27.9

27.8

-20.0

46.6

$44.03

$33.03

1.8 - 1.3

22.4 - 16.8

15.4 - 11.6

$43.04

$24.76

1.4 - 0.8

16.2 - 9.3

10.6 - 6.1

$43.33

$26.33

1.5 - 0.9

17.8 - 10.8

11.6 - 7.0

$51.43

$19.19

1.7 - 0.6

19.3 - 7.2

13.1 - 4.9

$63.66

$47.40

1.7 - 1.3

18.7 - 13.9

12.3 - 9.2

FINANCIAL STRENGTH

Cash ($ in Millions)

Working Capital ($ in Millions)

Current Ratio

LT Debt/Equity Ratio (%)

Total Debt/Equity Ratio (%)

RATIOS (%)

Gross Profit Margin

Operating Margin

Net Margin

Return On Assets

Return On Equity

RISK ANALYSIS

Cash Cycle (days)

Cash Flow/Cap Ex

Oper. Income/Int. Exp. (ratio)

Payout Ratio

2009

4,542

2,752

1.44

0.0

0.0

2010

4,838

2,996

1.46

0.1

0.1

2011

5,701

3,565

1.45

—

0.1

29.5

11.4

6.9

12.9

59.2

31.4

12.6

7.7

14.2

62.8

30.7

12.7

8.3

15.9

67.8

—

—

190.6

—

—

—

199.6

—

—

—

235.1

26.5

The data contained on this page of this report has been

provided by Morningstar, Inc. (© 2012 Morningstar, Inc.

All Rights Reserved). This data (1) is proprietary to

Morningstar and/or its content providers; (2) may not be

copied or distributed; and (3) is not warranted to be

accurate, complete or timely. Neither Morningstar nor its

content providers are responsible for any damages or

losses arising from any use of this information. Past

performance is no guarantee of future results. This data

is set forth herein for historical reference only and is not

necessarily used in Argus’ analysis of the stock set forth

on this page of this report or any other stock or other

security. All earnings figures are in GAAP.

Please see important information about this report on page 6

©2012 Argus Research Company

Argus Analyst Report

NYSE: ACN

ACCENTURE PLC

Report created Mar 26, 2012 Page 3 OF 6

Analyst's Notes...Continued

such as finance and health.

Internally, Accenture looks at the two broad categories of

outsourcing and consulting mainly in terms of bookings;

simultaneously, management looks at the operating groups in terms

of revenues. Revenues in Communications, Media & Technology

(CMT) of $1.48 billion were up 16% year-over-year (17% in local

currency). CFO Craig cited a contract in Europe that she said had a

'short-term' positive impact on revenue growth. Within CMT,

outsourcing demand was very strong and even improved

sequentially amid a slight sequential revenue decline. CMT

consulting growth was modest.

Products revenue of $1.59 billon was up 15% (16% in local

currency). Within Products, outsourcing was strong on a global

basis, driven by 'notably higher' technology outsourcing work

relative to last year. Strength in Product consulting demand was led

by the retail vertical; this helped offset pockets of weakness in

EMEA.

The Resources operating group posted revenue of $1.29 billion,

up 12% in local currency. Once again, strength was global, driven

by some 'priority' emerging markets. Strength in Resources

outsourcing was driven by flexible, cost-effective sourcing to meet

increased demand from existing operations. Consulting is being

driven by the need for short-term efficiencies.

Financial Services (FS) revenue was up 10% in local currency,

with outsourcing strong as clients focus on cost-takeout and

operating efficiency. Consulting growth was modest, and was led

while declining 4% sequentially. Outsourcing bookings of $3.89

billion were up 22% in dollars. Consulting book-to-bill improved

to 1.07 in 2Q12 from 1.03 in 1Q12. Outsourcing book-to-bill was

1.29 in 2Q12, up from 1.19 in 1Q12. Total book-to-bill rose to

1.17 in 2Q12 from 1.10 in 1Q12 and 1.15 in 2Q11. We note that

by their nature, outsourcing contracts tend to be multiyear and

longer in duration than consulting contracts, which sometimes run

for a year or less. Total contract value is reflected in bookings. On

that basis, consulting book-to-bill will usually lag outsourcing

book-to-bill.

Breaking out bookings by core competency, CEO Craig stated

that bookings in management consulting were strong. Growth was

driven by projects that deliver supply-chain cost savings as well as

those that enable 'large scale business transformation.' Bookings in

Technology consulting were driven by IT rationalization and data

center consolidation. The ongoing drivers in systems integration are

ERP (enterprise resource planning); cloud implementation, software

as a service (SaaS), social networking, enterprise mobility, and

analytics.

In terms of outsourcing, Accenture reported strong demand for

IT outsourcing, which is 'growing everywhere, even in Europe,'

according to the CEO. Companies utilizing Accenture's IT

outsourcing services are seeking to reduce and add higher

variability to their IT costs; virtualization is a key driver. In

business process outsourcing (BPO), Accenture reported strong

bookings in the Americas in particular, and within key verticals

Peer & Industry Analysis

Growth

FICO

P/E

ACN vs.

Market

ACN vs.

Sector

More Value

ADP

20

ACN vs.

Market

ACN vs.

Sector

More Value

More Growth

Price/Book

15

ACN vs.

Market

ACN vs.

Sector

FISV

Value

5

10

15

5-yr

Growth

Rate (%)

20.0

20.0

12.0

7.0

14.0

3.0

12.7

Current

FY P/E

19.8

18.8

16.9

20.0

13.4

22.3

18.5

Net

Margin

(%)

40.0

28.4

8.6

13.0

10.9

13.5

19.1

1-yr EPS

Growth

(%)

16.7

20.0

9.9

10.9

11.7

8.2

12.9

More Value

More Growth

More Value

More Growth

PEG

20

5-yr Growth Rate(%)

Market Cap

Ticker Company

($ in Millions)

V

Visa Inc

62,396

MA

MasterCard Inc

51,448

ACN Accenture PLC

47,429

ADP Automatic Data Processing Inc

26,977

FISV Fiserv Inc

9,599

FICO Fair Isaac Corp

1,563

Peer Average

33,235

More Growth

Price/Sales

V

MA

ACN

P/E

The graphics in this section are designed to

allow investors to compare ACN versus its

industry peers, the broader sector, and the

market as a whole, as defined by the Argus

Universe of Coverage.

• The scatterplot shows how ACN stacks up

versus

its

peers

on

two

key

characteristics: long-term growth and

value. In general, companies in the lower

left-hand corner are more value-oriented,

while those in the upper right-hand corner

are more growth-oriented.

• The table builds on the scatterplot by

displaying more financial information.

• The bar charts on the right take the

analysis two steps further, by broadening

the comparison groups into the sector

level and the market as a whole. This tool

is designed to help investors understand

how ACN might fit into or modify a

diversified portfolio.

Argus

Rating

BUY

BUY

BUY

BUY

BUY

HOLD

ACN vs.

Market

ACN vs.

Sector

5 Year Growth

ACN vs.

Market

ACN vs.

Sector

More Value

More Growth

Debt/Capital

ACN vs.

Market

ACN vs.

Sector

More Value

More Growth

Please see important information about this report on page 6

©2012 Argus Research Company

Argus Analyst Report

NYSE: ACN

ACCENTURE PLC

Report created Mar 26, 2012 Page 4 OF 6

Analyst's Notes...Continued

by insurance worldwide and Asian banks. This helped offset some

weakness in capital markets. Acquisitions contributed to FS

revenue, but also shaved margin. CEO Nanterme promised that FS

margins would tick back up.

Finally, the Health & Public Service (H&PS) operating group

posted 10% annual revenue growth in local currency. Growth once

again reflected 'very significant growth' in healthcare, with a

particular contribution from consulting in North America and

Asia. 'The repositioning of our Public Services business continues

to go well,' according to the CFO. Public Services actually posted

modest year-over-year growth in some regions, including

Asia-Pacific.

CFO Craig concluded her discussion of operating groups by

noting that both bookings and revenue reflect 'continuing strong

and more focused demand across the industries we serve.' We

believe that the H&PS vertical in particular is positioned for strong

growth as government spending recovers and more nations expand

healthcare coverage.

In terms of risks in the picture, in the middle of the quarter

Accenture announced that Kevin Campbell, formerly head of

Technology, had left the company and had been replaced by Marty

Cole. During Accenture's most recent investor day, Kevin Campbell

was highly visible, suggesting that he was positioned as a top

leader. His departure has led to concerns about the potential for

disappointment in IT outsourcing and the technology vertical.

Instead, IT outsourcing and the CMT vertical performed

impressively in the quarter.

We have spoken with Marty Cole in the past and have been

impressed with his vision for the technology business. We think

SVP Cole was instrumental in winning the Symbian business. While

the jury is still out on Symbian, this business was dying on the vine

at Nokia and now looks positioned for revival in the low end of

the smartphone market. In summary, we do not think the

Campbell-to-Cole transition represents significant risk.

Generally, Accenture's outsourcing business is growing faster

than its consulting business. This at least partly represents the

slower rate of growth in Europe. While European consulting trends

are uneven, with pockets of strength alternating with pockets of

weakness, the company also reports that outsourcing growth in

Europe is healthy.

CEO Nanterme stated that Accenture's 'gro wth strategy is

aligned with our clients.' While watching global trends carefully,

the company continues to view the overall macroeconomy as

conducive to further growth in Accenture's markets and businesses.

Most important, according to CEO Nanterme, the market forces

driving the need for large-scale transformation are intact.

EARNINGS & GROWTH ANALYSIS

Accenture reported 2Q12 revenue of $6.80 billion (net of

reimbursements), up 12% year-over-year (13% in local currency)

and down 3.8% sequentially. On a slightly less favorable mix,

reflecting relatively faster growth in outsourcing than in consulting,

GAAP gross margin declined to 31.1% in 2Q12 from 31.8% in

1Q12, and was down slightly from 31.7% in 2Q11. Operating

margin was13.1% in 2Q12, down from 13.9% in 1Q12, but up

from 12.7% a year earlier. Accenture posted earnings of $0.97 per

diluted share in 2Q12, compared to $0.96 per diluted share in

1Q12 and $0.75 in 2Q11.

For all of fiscal 2011, revenue totaled $25.5 billion, up 18.3%

from $21.6 billion in fiscal 2010. Fiscal 2011 EPS totaled $3.40

per diluted share, compared to $2.66 in fiscal 2010.

Management provided fiscal 3Q12 revenue guidance and fiscal

2012 revenue and EPS guidance. The company expects net revenue

of $7.05-$7.25 billion for fiscal 3Q12, which reflects the negative

3% penalty from foreign exchange.

For the full year, management continues to assume a 1%

penalty from foreign exchange. Accenture has increased its full-year

2012 revenue growth forecast to 10%-12% from a prior 7%-10%

(all revenue projections are in local currency). Given year-to-date

top-line growth of almost 14%, Accenture will require just 8%-9%

growth in 2H12 in order to grow 11% (the midpoint of the

guidance range) for the full year.

CFO Craig noted that Accenture is forecasting operating margin

of 13.7%-13.9% for FY12, up 10-30 basis points from fiscal 2011.

Based on the higher revenue outlook, Accenture now projects

full-year 2012 earnings of $3.82-3.90 per diluted share, up from a

prior forecast of $3.76-3.84 per diluted share offered in December

2011.

We are maintaining our FY12 earnings estimate of $3.85 per

diluted share, as the slightly more favorable outlook is muted by

higher tax assumptions in 2H12. We have trimmed our preliminary

forecast for fiscal 2013 to $4.23 per diluted share from an earlier

$4.27 (our initial forecast was $4.23). Our more conservative

outlook for FY13 is predicated on expectations that outsourcing

will continue to grow faster than consulting. Our long-term EPS

growth rate forecast is an annualized 12%.

FINANCIAL STRENGTH & DIVIDEND

We rate Accenture's financial strength as Medium-High. The

company, though not debt-free, has just $5.9 million in debt.

Cash and equivalents totaled $5.6 billion at the end of 2Q12,

up from $5.14 billion at the end of 1Q12. Cash was $5.7 billion at

the end of fiscal 2011. The decline in cash from 4Q11 to 1Q12

reflected payment of the semiannual dividend ($475 million) as

well as cash paid to repurchase shares. Cash was $4.8 billion at the

close of fiscal 2010.

Cash flow from operations was $1.33 billion in 1H12, up from

$707 million in the first half of fiscal 2011. Management projects

cash flow from operations of $3.65-$3.95 billion for all of fiscal

2012, along with capital expenditures of about $450 million.

Accenture intends to return $3 billion to shareholders during

2012, while reducing weighted-average shares by 2%. During

2Q12, Accenture repurchased 8.6 million shares for $460 million.

As of 2Q12, $5.5 billion remained in the repurchase authorization.

Accenture pays a semiannual dividend of $0.675 per common

share. The semiannual dividend is scheduled to be paid on May 15,

2012. The dividend provides a yield of about 2.1% at current

prices.

MANAGEMENT & RISKS

The CEO of Accenture is Pierre Nanterme, a 28-year veteran of

Accenture. He succeeded William D. Green, a 32-year veteran of

the company who is now chairman of the board. Pamela Craig,

another 20-year-plus veteran, is CFO. Other key executives include

Marty Cole, Group CEO of Technology; Mike Salvino, Group

CEO of Business Process Outsourcing; and Sander van't

Noordende, Group CEO of Management Consulting.

Risks to investing in Accenture include cyclicality in the

consulting business, which dropped sharply during the recession.

The company also has substantial exposure to Europe, which has

Please see important information about this report on page 6

©2012 Argus Research Company

Argus Analyst Report

NYSE: ACN

ACCENTURE PLC

Report created Mar 26, 2012 Page 5 OF 6

Analyst's Notes...Continued

been roiled by sovereign debt problems, and to the public sector,

which has downsized in response to reduced tax receipts.

Management reports that its European customers are generally

stable. Accenture also expects government purchases of consulting

services to be stable to higher in the coming quarters, as agencies

invest in technology to keep costs low.

The company's strength in outsourcing, which generates more

consistent revenue, helps to temper this volatility. Accenture's five

operating groups also provide diversification during periods of

weakness for any particular industry.

With low barriers to entry, the consulting business can be quite

competitive. IBM is a leading competitor. Hewlett-Packard's

acquisition of EDS positions that company in IT outsourcing and

consulting. McKinsey remains an industry force in consulting,

while India-based firms such as Infosys compete in IT outsourcing.

Accenture's assets are people, and it is engaged in a high

personnel-turnover business. Total headcount at the end of 2Q12

was 246,000. Attrition (excluding involuntary terminations) in the

latest quarter was 12%. Accenture plans to add about 60,000

employees in FY12.

five-year average P/E of 14.9. Although the shares are trading

above the five-year average on P/E, Accenture is more attractively

valued on other measures of historical comparable valuation. Given

the strong cash flow generation and revenue and bookings

momentum, our two- and three-stage discounted free cash flow

models produce a value well in excess of current prices. Our

calculated blended value for Accenture, which includes our

proprietary peer derived value measure, is in the high $70s and has

been rising steadily. Appreciation to our 12-month target price of

$74 (raised from $66), along with the 2.1% dividend yield, implies

a risk-adjusted total return exceeding 15%, in excess of our

forecast for the broad market.

On March 23, BUY-rated ACN closed at $64.88, up $1.36.

COMPANY DESCRIPTION

COMPANY DESCRIPTION

Based in Dublin, Ireland, Accenture is a global management

consulting, technology services and outsourcing company. The two

main lines of business are consulting and outsourcing. The

company is also organized along five key verticals served, including

Communications, Media & Technology; Financial Services;

Products; Health & Public Service; and Resources. In fiscal 2011,

approximately 44% of revenue was generated in the United States.

INDUSTRY

Our rating on the Technology sector is Over-Weight.

Technology lagged the broad market in 2010 and again in 2011.

Although technology has led the market early in 2012, sector

valuations remain attractive, while growth prospects remain highly

positive. For the long term, we expect the sector to increase its

weighting within the S&P 500 from the current 19%-20% level to

somewhere near 25%, based on positive company and sector

fundamentals. For individual companies, these include high cash

levels, low debt, and broad international business exposure. We

expect the entire sector to benefit from the transformative effects

generated by new developments in technology.

Positives in the picture for information processing & computing

companies include a second-stage PC and enterprise IT 'refresh'

cycle that is being driven by the pending Microsoft Windows 8

launch and Intel's 'Ivy Bridge' family of PC (second-generation

Core i) and server (Romley) processors. Server and Storage

providers stand to benefit from the battle among computing and

communications companies for dominance in the enterprise data

center, where virtualization and cloud enablement are prompting

market-share disruption.

Communications infrastructure players stand to gain from the

explosion in network traffic related to the rise of social networking

sites, high-bandwidth video on the network, and mobile data. No

single trend may be as transformative as the acceleration in mobile

broadband, driven by tablets and smartphones.

VALUATION

ACN shares currently trade at 16.7-times our fiscal 2012

forecast and at 15.2-times our fiscal 2013 projection, above the

Please see important information about this report on page 6

©2012 Argus Research Company

Argus Analyst Report

NYSE: ACN

METHODOLOGY & DISCLAIMERS

Report created Mar 26, 2012 Page 6 OF 6

About Argus

Argus Research, founded by Economist Harold Dorsey in 1934,

has built a top-down, fundamental system that is used by Argus

analysts. This six-point system includes Industry Analysis, Growth

Analysis, Financial Strength Analysis, Management Assessment,

Risk Analysis and Valuation Analysis.

Utilizing forecasts from Argus’ Economist, the Industry Analysis

identifies industries expected to perform well over the next

one-to-two years.

The Growth Analysis generates proprietary estimates for

companies under coverage.

In the Financial Strength Analysis, analysts study ratios to

understand profitability, liquidity and capital structure.

During the Management Assessment, analysts meet with and

familiarize themselves with the processes of corporate management

teams.

Quantitative trends and qualitative threats are assessed under

the Risk Analysis.

And finally, Argus’ Valuation Analysis model integrates a

historical ratio matrix, discounted cash flow modeling, and peer

comparison.

THE ARGUS RESEARCH RATING SYSTEM

Argus uses three ratings for stocks: BUY, HOLD, and SELL.

Stocks are rated relative to a benchmark, the S&P 500.

• A BUY-rated stock is expected to outperform the S&P 500 on

a risk-adjusted basis over a 12-month period. To make this

determination, Argus Analysts set target prices, use beta as the

measure of risk, and compare expected risk-adjusted stock

returns to the S&P 500 forecasts set by the Argus Market

Strategist.

• A HOLD-rated stock is expected to perform in line with the

S&P 500.

• A SELL-rated stock is expected to underperform the S&P 500.

Argus Research Disclaimer

Argus Research is an independent investment research provider and is not a member of the FINRA or the SIPC. Argus Research is not a registered broker dealer and does not have

investment banking operations. The Argus trademark, service mark and logo are the intellectual property of Argus Group Inc. The information contained in this research report is

produced and copyrighted by Argus, and any unauthorized use, duplication, redistribution or disclosure is prohibited by law and can result in prosecution. The content of this report

may be derived from Argus research reports, notes, or analyses. The opinions and information contained herein have been obtained or derived from sources believed to be reliable,

but Argus makes no representation as to their timeliness, accuracy or completeness or for their fitness for any particular purpose. This report is not an offer to sell or a solicitation of

an offer to buy any security. The information and material presented in this report are for general information only and do not specifically address individual investment objectives,

financial situations or the particular needs of any specific person who may receive this report. Investing in any security or investment strategies discussed may not be suitable for

you and it is recommended that you consult an independent investment advisor. Nothing in this report constitutes individual investment, legal or tax advice. Argus may issue or may

have issued other reports that are inconsistent with or may reach different conclusions than those represented in this report, and all opinions are reflective of judgments made on the

original date of publication. Argus is under no obligation to ensure that other reports are brought to the attention of any recipient of this report. Argus shall accept no liability for any

loss arising from the use of this report, nor shall Argus treat all recipients of this report as customers simply by virtue of their receipt of this material. Investments involve risk and an

investor may incur either profits or losses. Past performance should not be taken as an indication or guarantee of future performance. Argus has provided independent research

since 1934. Argus officers, employees, agents and/or affiliates may have positions in stocks discussed in this report. No Argus officers, employees, agents and/or affiliates may

serve as officers or directors of covered companies, or may own more than one percent of a covered company’s stock.

Morningstar Disclaimer

© 2012 Morningstar, Inc. All Rights Reserved. Certain financial information included in this report: (1) is proprietary to Morningstar and/or its content providers; (2) may not be

copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising

from any use of this information. Past performance is no guarantee of future results.

©2012 Argus Research Company

Argus Analyst Report