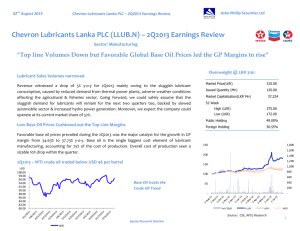

Chevron Lubricants Lanka PLC - Asha Phillip Securities Ltd.

advertisement

21st March 2013 Chevron Lubricants Lanka PLC – Corporate Update Asha Phillip Securities Ltd Chevron Lubricants Lanka PLC (LLUB.N) @ LKR217/“The Leader in the Lubricant Market “ Sector: Manufacturing LONG TERM ACCUMILATION Chevron Lubricants Lanka PLC is the market leader in Sri Lankan Lubricant market with nearly 57% market share in a highly competitive lubricant industry. We expect the Company top lines to grow by 16.26% in FY2013E while accelerating the after tax profit by 8.13% under the backdrop of aggressive penetration in export market coupled with local consumption driven through infrastructure projects. Growth is further accelerated by the expected capacity enhancement which will drive the company to serve the more profitable export segment, which currently tax at a concessionary 12%. We further expect LLUB to maintain a 60% dividend payout ratio for FY2013E and FY2014E and gradually accelerate the same to 90% by FY2016E. Therefore, we are optimistic on the long term growth prospects of the company while assigning a LONG TERM BUY recommendation. Equity Research Division 1 21st March 2013 Asha Phillip Securities Ltd Chevron Lubricants Lanka PLC – Corporate Update INVESTMENT RATIONALE o o Undisputed Leader with a Renowned Global Brand Market Price(LKR) 217.00 LLUB has been able to maintain its market leadership with a 57% share in the lubricant market amidst heavy competition by imported finished lubricants. This has been aided through a wellrecognized global brand, strong principal support by Chevron Corporation USA, aggressive marketing strategy and a widespread distribution network with over 700 service stations, the highest outlet penetration in the industry. Issued Shares (Mn) 120.00 12 Mn High (LKR) 231.00 12 Mn Low (LKR) 160.00 Public Holding 49.00% Well Managed Operations & a Lean Business Model Foreign Holding 23.86% LLUB has a competitive edge over its competitors in terms of quality due to its Principal’s strong technical expertise. The expected plan to source the major raw material, Base Oil directly from the Principle in USA would result in a favorable situation in terms of Cost of Production. Further, the Company’s ability to maintain its GP margins which currently stands at 32% is a critical success factor in their operations. Lean business model with a reduced staff of 87 in 2012 from 382 in year 2000 was also witnessed as a catalyst for the CAGR 16% growth in earnings for the last 5 years together with a CAGR 12% growth for the last 12 years. o Market Cap (LKR Bn) 25.80 Return Comparison 6M 12M 24M ASPI -3.43% 4.74% -20.56% Manufacturing -9.76% -8.98% -37.70% LLUB 13.22% 24.64% 34.21% Source: APSL Research Above Average ROE creating Superior Value Company recorded an exceptional ROE of 55% for FY2012 while expecting to maintain the ratio of 42% by FY2014F due to the relatively low payout ratio amidst high CAPEX but gradually increase the same to 45% -50% in next three years with the gradual rebound in payout ratio. 160.00 1,800.00 140.00 1,600.00 1,400.00 120.00 1,200.00 100.00 o 1,000.00 Lucrative Dividend Yield with a High Payout Ratio 80.00 800.00 60.00 LLUB expects to maintain its current dividend payout ratio of nearly 60% in both FY2013E & FY2014E due to its CAPEX requirement for relocating the blending plant but gradually accelerate the same to 90% by FY2015E. Further, the Dividend Yeild of 5% is considered to be one of the highest in Colombo Market which is expected to be improved up to 9% in FY2015E under the current market price. Equity Research Division 600.00 40.00 400.00 20.00 4-Jan-11 200.00 4-Jul-11 VOL 4-Jan-12 LLUB 4-Jul-12 ASPI 4-Jan-13 MFG 2 21st March 2013 Asha Phillip Securities Ltd Chevron Lubricants Lanka PLC – Corporate Update Shareholding Pattern BUSINESS MODEL 2.13% LLUB is manufacturing, distributing and marketing of lubricant oil and greases in Sri Lanka.The production plant locates in Kolonnawa with an annual production capacity of 40Mn liters of lubricants. The main raw material used in the lubricant manufacturing process is Base Oil which represents approximately 75% of the total cost of production. The entire Base Oil requirement is imported from France & Asia Pacific based countries. Approximately 20% of the cost of production accounts for Additives (Chemicals), which are imported from Singapore. Cost Structure Retail Segment The retail segment comprises primarily of automotive lubricants for passenger cars, vans, trucks, threewheelers and motor cycles. This segment records a 65% share to the total revenue of the company and witnessed a slowdown in 2012 amidst the drop in the vehicle market fueled by high interest rates, increased import tariffs, slower credit growth, depreciated rupee and the fuel price hike. Chevron Ceylon Ltd HSBC Nominees- Lux Aberdeen Global 27.63% 51.00% 2.85% 2.98% 4.55% 8.86% HSBC Nominees - Lux Aberdeen Global-EME HSBC Nominees- Lux Aberdeen Asia Smaller Group Caceis Bank Luxembourg Source: Company, APSL Research Base Oil is extracted from Crude Oil Other 5% Additives 20% Base Oil 75% Source: Company, Company, APSL APSL Research Research Source: Industrial Segment The power generation sector, commercial transportation & construction sector dominates the industrial segment which contributes the balance 35% of the revenue. Trade volumes to the power generation sector curtailed slightly during 2012 due to the high rain falls during the latter part of the year which constrained the thermal power generation. Transport & construction sector recorded a modest performance during the year primarily due to many large scale projects that are underway coupled with the growth in commercial vehicles. Equity Research Division 3 21st March 2013 Chevron Lubricants Lanka PLC – Corporate Update Asha Phillip Securities Ltd Key Business Sectors Export Market Export Sales registers a 6% share to the total revenue while focusing on two main markets of Bangladesh & Maldives. Industrial Sector 35% Bangladesh Restricted non-essential imports were relaxed in the second half of 2012. LLUB has concentrated on retail penetration in Bangladesh and newly ventured into the industrial segment by entering into the highly growing power generation sector. Maldives The Automotive sector in Maldives is one of the fastest growing sectors with attractive growth potential LLUB has a strong presence in high speed diesel power generation and small transport vessels. Automotive Sector 65% Source: Company, APSL Research Export Sales Vs Local Sales Lubricant Industry at a Glance Lubricant Industry in Sri Lanka is estimated to be LKR 19 Bn (0.3% of GDP) by 2012, grew at a CAGR of 13.7% for last 5 years. 70% of total sales volume were contributed by the Automotive sector A regulated industry under the Public Utilities Commission of Sri Lanka, comprising of 13 licensed players Chevron Lubricants PLC & Lanka IOC PLC are the only two lubricant manufacturers, sharing 64% of the local lubricant requirement. Around 87% of the blending is carried out by the LLUB whilst IOC produces the balance 13%. Highly concentrated market – 88% of the market is shared amongst 5 players Export Sales 6% Local Sales 94% Source: Company, APSL Research Equity Research Division 4 21st March 2013 Chevron Lubricants Lanka PLC – Corporate Update Asha Phillip Securities Ltd OPERATIONAL & FINANCIAL OUTLOOK CAPEX to Revenue would Climb Up to 13% in FY2014E but Stabilize at Average 0.5% thereafter LLUB maintains an average CAPEX to Revenue ratio of 0.5% historically. Company currently operates the blending plant in a leased property by Ceylon Petroleum Corporation (CPC) which is scheduled to be expired by June 2014. Therefore, the Company is currently progressing on the construction of a new blending plant on a four and half acre block of land in Sapugaskanda with a CAPEX budget of USD 1.5 Mn (LKR 1.9 Bn) in order to relocate the operations by FY2014. The new plant will accommodate an additional 20% capacity while expecting to commence blending operations by mid FY2014 onwards. Replacement CAPEX to Revenue ratio is expected to be smoothened to average 0.5% thereafter. The entire CAPEX budget of LKR 1.9 Bn is expected to be financed by internally generated funds without hampering the current zero debt capital structure. Market Share Market Share to Maintain at 58% amidst Intense Competition LLUB’s market share experienced a gradual deterioration due to new entrants of lubricant importers via the newly issued licenses during the past 5 years. In 2008, market share stood at 78% and gradually declined to 57% in 2011 mainly owing to the heavy price undercuts by importers. Government budget 2013 provided an additional cushion to lubricant manufactures by imposing a 6% CESS on imported finished lubricants which stamped a tax advantage of 13% for local blenders over the lubricant importers. Therefore, the probability of undercutting the prices for importers to gain market share is highly remote. Therefore, we believe the LLUB’s market share to maintain at 58% with increased advertising budget and growing development in quality conscious lubricants by Original Equipment Manufacturers. Local Lubricant Consumption to Grow by Average 4% YoY Laugfs 5% ExxonM obil 7% CPC 8% Others 12% Lanka IOC 11% LLUB 57% Source: PUCSL, APSL Research Current local lubricant consumption stands at 58,554 KL in 2011, grew by nearly 8% YoY. Further, we expect a flat growth in the overall lubricant market for 2012 due to the slowdown in economic activities amidst the escalated interest rates, depreciated currency, restricted credit growth, upward revision of energy prices etc. Further, the increased import tariffs on motor vehicles resulted a heavy decline in vehicle imports to the country, resulting a challenging period for lubricant companies. Moreover, adverse weather conditions prevailed in the island also affected negatively causing less volumes in the agricultural sector. Given the growth in local infrastructure projects, we expect a boost in commercial vehicles & machinery imports. Further, the gradual increase in lubricant consumption by the imported Equity Research Division 5 21st March 2013 Asha Phillip Securities Ltd Chevron Lubricants Lanka PLC – Corporate Update motor vehicles during past 2 years will result in a moderate growth in local lubricant volumes. Further, the growing demand for power generation in the country will keep the lubricant demand more exciting going forward. Exports to Total Revenue to Accelerate to 8% in FY2013E and to Reach 10% by FY2016E LLUB’s export sales are expected to increase to 8% of total sales from its existing 6% due to the growing power sector in Bangladesh & highly potential automotive sector in Maldives. Given the government’s concessionary corporate tax rate of 12% on Export profits, we believe the LLUB will focus more on export market which will result in the effective tax rate to decline going forward. LLUB is continuing to make significant investments to strengthen branding and manage product development to facilitate the requirements in the Bangladesh market. Base Oil Prices (US$ per MT) 1400 1300 1200 Base Oil Prices to Remain Current Levels amidst Global Uncertainty 1100 The base oil prices are positively correlated to the crude oil prices. Therefore when the demand for crude increases and results in prices increasing the production of base oil is reduced and therefore a shortage in the market leads to the base oil prices to increase in the market. However, producers have become more efficient with the supply chain processes and therefore it could be expected that the future prices will remain within the same range. 1000 5/18/2011 6/18/2011 7/18/2011 8/18/2011 9/18/2011 10/18/2011 11/18/2011 12/18/2011 1/18/2012 2/18/2012 3/18/2012 4/18/2012 5/18/2012 6/18/2012 7/18/2012 8/18/2012 9/18/2012 10/18/2012 11/18/2012 12/18/2012 1/18/2013 2/18/2013 Chevron Corporation, the principal company of Chevron Lubricants Lanka PLC is constructing their own Base Oil refining facility in the current Pascagoula refinery in the US. The facility will manufacture 25,000 barrels per day of premium base oil, the main ingredient in the production of lubricant oil. Chevron will become the world's largest producer of premium base oil with this development. The Construction is scheduled to be completed by year-end 2013. At the same time, LLUB expects to import their entire Base Oil requirement by its parent in the USA from mid-2014 onwards while enjoying a cost advantage comparatively to the existing level. Source: Bloomberg LLUB expects to import the entire Base Oil requirement by its parent in USA by mid2014 onwards with a cost advantage Average Base Oil Prices continued its However the base oil markets around the world have seen a sustained period of sluggish demand, new plants in the Middle East and Asia have injected extra capacity into the market. The inevitable result has been a slide in pricing from mid-2011. The outlook for 2013 does not look much better considering the uncertainty in the market, caused by the on-going economic slowdown that has resulted in the slowdown of the core end user markets such as the automotive sector. Equity Research Division downward trend, falling 16% YoY and 5% QoQ to USD 4.18 per gallon 6 21st March 2013 Asha Phillip Securities Ltd Chevron Lubricants Lanka PLC – Corporate Update Regionally the expectations are the same with European buyers expecting a further fall in prices beyond the first quarter amidst the sellers battling for scares business. In Asia , 2013 started with a bullish sentiment amidst the Lunar New Year especially in China. Base oil prices have been rising since the start of the year however this phenomenon is expected to be short lived and prices are expected to fall by early March. In the long run it is uncertain whether improvements could be seen as global economic recovery is far from certain. EBIT Margin 25.50% 25.11% 25.00% 24.50% 24.00% 24.40% 24.72% 23.92% 23.52% 23.50% 23.27% 23.00% Financial Outlook– Beyond 2013 22.50% Revenue to grow by average 11% for FY2013E – FY2015E amidst expected increase in export sales along with the moderate growth in local lubricant consumption. GP margin to maintain at healthy 32%-33% in FY2013E-FY2015E with the expected rise in average blended price per liter by 3% YoY coupled with the stabilization of exchange rate. Expected flat movement in Base Oil prices will protect steep deterioration in the selling price. EBIT & EBITDA margin is expected to be improved from current 24.72% & 25.09% to 25.11% & 26.07% by FY2015E respectively. However, the EBIT margin is expected to drop to 23.89% in FY2013E & 23.90% in 2014E with the expected plant relocation cost & increased depreciation. 22.00% FY2010 Return on Equity (ROE) to maintain at 45% to 48% during next three years from FY2013EFY2015E. Post-Tax Profit forecast stand at LKR 2.44 Bn for FY2013E (up by 8% YoY) and to record LKR 2.59Bn for FY2014E. Dividend Pay Out ratio to be slowed at 60% for FY2013E & FY2014E mainly owing to the LKR 1.9Bn CAPEX budget on plant relocation which is planned to be financed by internally generated funds. Thereafter, we expect LLUB to push up the payout ratio to 80%-90% in post relocation period. Equity Research Division FY2012 FY2013E FY2014E FY2015E Source: Company, APSL Research Revenue, Net Profit & GP Margin LKR Mn 18,000 33.50% 15,852 16,000 14,638 13,665 14,000 11,040 12,000 FY2011 10,000 11,754 33.00% 32.50% 9,471 32.00% 8,000 6,000 31.50% 4,000 31.00% 2,000 - 30.50% FY2010 FY2011 FY2012 FY2013E FY2014E FY2015E Revenue Net Profit GP Margin Source: Company, APSL Research 7 21st March 2013 Asha Phillip Securities Ltd Chevron Lubricants Lanka PLC – Corporate Update VALUATION & RECOMMENDATION o o o o o We have derived our target price of LKR 233/- based on 50% weighted two stage DCF valuation methodology, with a Cost of Equity of 15% and a conservative terminal growth rate of 1.5% 30% weighted Dividend Discount Model (DDM) with an average payout ratio of 80% for FY2013E to FY2017E 20% weighted Price to Earnings Multiple (PER) based on the FY2013E earnings Further, we arrived the intrinsic value from DCF method under three different scenarios which are weighted accordingly. Currently, the counter trades at 10.6x earnings, 5.1x Book value, 7.9x EV/EBITDA, 1.9x EV/Sales based on one year forward (FY2013E) estimates. Given the relatively high Dividend Payout Ratio, our valuation extended towards the Dividend Discount Model (DDM) too while assigning a weight of 30% to the fair value. Since the average payout ratio stands at 80% Book Value multiples were not taken into account. DCF Value per Share DDM 197.90 309.58 Scenario - 3 Optimistic 58% 4% 3% 8% 130 3% 55% 2% 8% 8% 133 8% 60% 6.5% 4% 10% 125 2% 197.13 172 288 80% 15% 5% Intrinsic Value Weightage Intrinsic Value (Weighted) 197.90 Source: APSL Research 4.51% Tide Water Oil 36.79 11.32 11.32 LLUB 10.67 5.62% Castrol INDIA -8.80% 42.66% -5.33% 50% 30% 20% Dividend Yeild PER 205.44 Potential Potential Scenario- 2 Pesimistic Indian Based Peers vs LLUB 217.00 Intrinsic Value (Weighted) Scenario -1 Best Case Market Share Average local industry Growth Growth in Prices Export Market to Total Revenue USD / LKR Average Base Oil Price Growth PER Current Price ( 18th March 2013) Weights Sensitivity Analysis - DCF 1.62% 232.91 Source: www.moneycontrol.com ,APSL Research 7.3% Source: APSL Research The intrinsic valuation does not accommodate a considerable upside in near future under conservative assumptions. Further, it does not result a downside risk either. Considering the Company’s high payout ratio which result an attractive dividend yield of 5.6% in FY2013E and 9% by FY2015E coupled with the low beta factor which warrant the share to be resilient amidst any market down fall (Safe Counter) , we still believe the counter would be a prospective long term investment with stable returns. Equity Research Division 8 HISTORICAL FINANCIALS & PROJECTIONS Revenue FY2010 9,471,256,226 FY2011 11,039,945,418 FY2012 11,754,046,112 FY2013E 13,664,728,980 FY2014E 14,637,657,683 FY2015E 15,852,165,052 YoY Growth % 8.98% 16.56% 6.47% 16.26% 7.12% 8.30% Cost of Sales (6,426,102,922) (7,565,448,536) (7,949,962,149) (9,276,170,382) (9,899,135,156) (10,580,140,009) Gross Profit 3,045,153,304 YoY Growth % Gross Profit Margin % Other Operating Income Distribution expenses Administration expenses EBIT including non recurring 4,738,522,528 5,272,025,044 15.4% 8.0% 11.3% 32.15% 31.47% 32.36% 32.12% 32.37% 33.26% (373,759,003) 2,267,429,437 31,176,114 12,294,729 (390,500,092) (425,356,670) (389,940,738) (473,547,778) 2,725,232,166 2,917,474,244 2,212,512 (601,248,075) (573,918,617) 3,215,604,418 2,370,043 (658,694,596) (673,332,253) 3,408,865,722 2,566,689 (702,623,146) (589,224,399) 3,982,744,188 1,552,499 31,176,114 12,294,729 2,212,512 2,370,043 2,566,689 2,265,876,938 2,694,056,052 2,905,179,515 3,213,391,906 3,406,495,678 3,980,177,498 EBIT Margin EBITDA - Recurring 4,388,558,598 9.5% 1,552,499 YoY Growth % Depreciation & Amortization 3,804,083,963 14.1% (405,517,363) Non Recurring items EBIT excluding non recurring 3,474,496,882 -1.6% 1.00% 18.90% 7.84% 10.61% 6.01% 16.84% 23.92% 24.40% 24.72% 23.52% 23.27% 25.11% 63,046,919 47,306,892 43,836,111 47,590,280 91,311,541 151,906,121 2,328,923,857 2,741,362,944 2,949,015,626 3,260,982,186 3,497,807,219 4,132,083,619 YoY Growth % 0.10% 17.71% 7.57% 10.58% 7.26% 18.13% EBITDA Margin 24.59% 24.83% 25.09% 23.86% 23.90% 26.07% Finance Expenses / Income Pre tax Profit 66,520,994 42,548,090 193,982,748 38,913,163 41,683,781 63,408,660 2,333,950,431 2,767,780,256 3,111,456,992 3,254,517,582 3,450,549,502 4,046,152,848 YoY Growth % Income Tax (Expense)/Reversal Post tax Profit -0.44% 18.59% 12.42% 4.60% 6.02% 17.26% (832,676,236) (767,164,188) (854,124,891) (813,629,395) (855,736,277) (995,353,601) 1,501,274,195 YoY Growth % Net Profit Margin % Diluted No Shares 2,257,332,101 2,440,888,186 2,594,813,226 3,050,799,247 33.26% 12.83% 8.13% 6.31% 17.57% 15.85% 18.12% 19.20% 17.86% 17.73% 19.25% 120,000,000 120,000,000 120,000,000 120,000,000 120,000,000 12.51 16.67 18.81 20.34 21.62 25.42 2,237,529,316 3,158,145,384 4,125,817,833 5,102,173,108 6,140,098,398 6,750,258,247 18.65 26.32 - - Earnings per Share (LKR) Shareholders' Funds (LKR) 2,000,616,068 0.43% Net Asset Value per share(LKR) Enterprise Value (LKR) 120,000,000 34.38 42.52 51.17 56.25 26,040,000,000 26,040,000,000 26,040,000,000 26,040,000,000 ROE % 67.10% 63.35% 54.71% 47.84% 42.26% 45.20% ROCE % 67.10% 63.35% 54.71% 47.84% 42.26% 45.20% 11.54 10.67 10.04 PER (times) PBV (times) 6.31 EV/EBITDA (times) EV/Sales (times) Dividend Payout Ratio Dividend per Share (LKR) 97.92% 53.98% 12.25 5.10 Dividend Yeild 8.54 3.86 8.82 7.98 7.44 6.30 2.22 1.91 1.78 1.64 60% 60% 58.48% 9.00 4.24 80% 11.00 12.20 12.97 20.34 5.07% 5.62% 5.98% 9.37% Source : Company, APSL Research 10.00% 120.00% 9.00% 100.00% 8.00% 7.00% 80.00% 6.00% 60.00% 5.00% 4.00% 40.00% 3.00% 2.00% 20.00% 1.00% 0.00% 0.00% FY2010 FY2011 FY2012 Payout Ratio FY2013E FY2014E FY2015E Dividend Yeild DISCLAIMER : This document has been prepared and issued by Asha Phillip Securities Ltd, on the basis of publicly available information, internally developed data and other sources believed to be reliable. While every effort has been made to ensure that the data quoted and used for the research behind this document is reliable, there is no guarantee that it is correct. Asha Phillip Securities Ltd, nor any Director, Officer or employee accept no liability whatsoever in respect of any errors or omissions. This document is a piece of economic/Financial research and is not intended to constitute investment advice, nor to solicit dealing in securities or investments. Asha Phillip Securities Ltd may act as a Broker in the investments which are the subject of this document or related investments and may have acted upon or used the information contained in this document, or the research or analysis on which it is based, before its publication. Asha Phillip Securities Ltd, Its Directors, Officers or Employees may also have a position or be otherwise interested in the investments referred to in this document. This is not an offer to sell or buy the investments referred to in this document. RESEARCH DIVISION Thakshila Hulangamuwa Vice President - Business Development thakshi@ashaphillip.net +94 113070494 Pasindu Perera Manager -Research pasindu@ashaphillip.net +94 112429109 Anuradha Basnayake Trainee Research Analyst Nishantha Warnakulasuriya Trainee Research Analyst Lasantha Senanayake Research Analayst lasantha@ashaphillip.net +94 112429137 Ranuka De Silva Research Analyst ranuka@ashaphillip.net +94 112429129 9