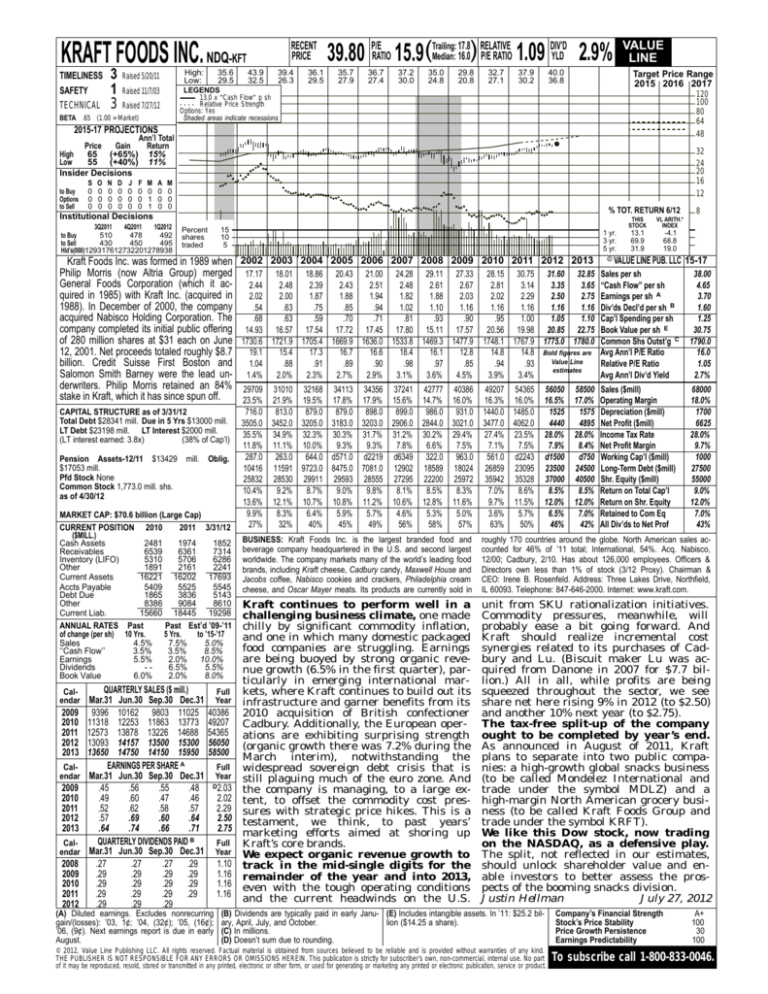

KRAFT FOODS INC. NDQ-KFT

TIMELINESS

SAFETY

TECHNICAL

3

1

3

High:

Low:

Raised 5/20/11

35.6

29.5

RECENT

PRICE

43.9

32.5

39.4

26.3

36.1

29.5

17.8 RELATIVE

DIV’D

Median: 16.0) P/E RATIO 1.09 YLD 2.9%

39.80 P/ERATIO 15.9(Trailing:

35.7

27.9

36.7

27.4

37.2

30.0

35.0

24.8

29.8

20.8

32.7

27.1

37.9

30.2

40.0

36.8

Target Price Range

2015 2016 2017

LEGENDS

13.0 x ″Cash Flow″ p sh

. . . . Relative Price Strength

Options: Yes

Shaded areas indicate recessions

Raised 11/7/03

Raised 7/27/12

BETA .65 (1.00 = Market)

VALUE

LINE

120

100

80

64

48

2015-17 PROJECTIONS

Ann’l Total

Price

Gain

Return

High

65 (+65%) 15%

Low

55 (+40%) 11%

Insider Decisions

to Buy

Options

to Sell

S

0

0

0

O

0

0

0

N

0

0

0

D

0

0

0

J

0

0

0

F

0

0

0

M

0

1

1

A

0

0

0

32

24

20

16

12

M

0

0

0

% TOT. RETURN 6/12

Institutional Decisions

3Q2011

4Q2011

1Q2012

510

478

492

to Buy

to Sell

430

450

495

Hld’s(000)129317612732201278938

Percent

shares

traded

15

10

5

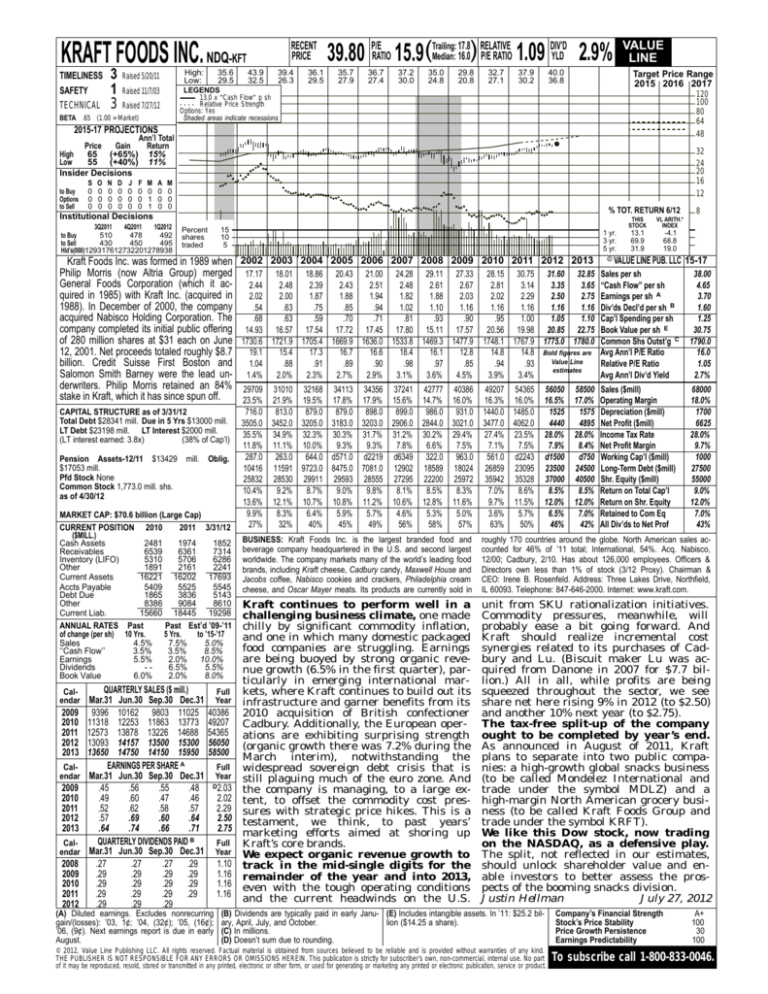

Kraft Foods Inc. was formed in 1989 when

Philip Morris (now Altria Group) merged

General Foods Corporation (which it acquired in 1985) with Kraft Inc. (acquired in

1988). In December of 2000, the company

acquired Nabisco Holding Corporation. The

company completed its initial public offering

of 280 million shares at $31 each on June

12, 2001. Net proceeds totaled roughly $8.7

billion. Credit Suisse First Boston and

Salomon Smith Barney were the lead underwriters. Philip Morris retained an 84%

stake in Kraft, which it has since spun off.

2009

2010

2011

2012

2013

Calendar

2009

2010

2011

2012

2013

Calendar

2008

2009

2010

2011

2012

-4.1

68.8

19.0

© VALUE LINE PUB. LLC

15-17

Sales per sh

‘‘Cash Flow’’ per sh

Earnings per sh A

Div’ds Decl’d per sh B

Cap’l Spending per sh

Book Value per sh E

Common Shs Outst’g C

Avg Ann’l P/E Ratio

Relative P/E Ratio

Avg Ann’l Div’d Yield

38.00

4.65

3.70

1.60

1.25

30.75

1790.0

16.0

1.05

2.7%

29709 31010 32168 34113 34356 37241 42777 40386

23.5% 21.9% 19.5% 17.8% 17.9% 15.6% 14.7% 16.0%

716.0 813.0 879.0 879.0 898.0 899.0 986.0 931.0

3505.0 3452.0 3205.0 3183.0 3203.0 2906.0 2844.0 3021.0

35.5% 34.9% 32.3% 30.3% 31.7% 31.2% 30.2% 29.4%

11.8% 11.1% 10.0%

9.3%

9.3%

7.8%

6.6%

7.5%

287.0 263.0 644.0 d571.0 d2219 d6349 322.0 963.0

10416 11591 9723.0 8475.0 7081.0 12902 18589 18024

25832 28530 29911 29593 28555 27295 22200 25972

10.4%

9.2%

8.7%

9.0%

9.8%

8.1%

8.5%

8.3%

13.6% 12.1% 10.7% 10.8% 11.2% 10.6% 12.8% 11.6%

9.9%

8.3%

6.4%

5.9%

5.7%

4.6%

5.3%

5.0%

27%

32%

40%

45%

49%

56%

58%

57%

49207 54365

16.3% 16.0%

1440.0 1485.0

3477.0 4062.0

27.4% 23.5%

7.1%

7.5%

561.0 d2243

26859 23095

35942 35328

7.0%

8.6%

9.7% 11.5%

3.6%

5.7%

63%

50%

Sales ($mill)

Operating Margin

Depreciation ($mill)

Net Profit ($mill)

Income Tax Rate

Net Profit Margin

Working Cap’l ($mill)

Long-Term Debt ($mill)

Shr. Equity ($mill)

Return on Total Cap’l

Return on Shr. Equity

Retained to Com Eq

All Div’ds to Net Prof

68000

18.0%

1700

6625

28.0%

9.7%

1000

27500

55000

9.0%

12.0%

7.0%

43%

BUSINESS: Kraft Foods Inc. is the largest branded food and

beverage company headquartered in the U.S. and second largest

worldwide. The company markets many of the world’s leading food

brands, including Kraft cheese, Cadbury candy, Maxwell House and

Jacobs coffee, Nabisco cookies and crackers, Philadelphia cream

cheese, and Oscar Mayer meats. Its products are currently sold in

roughly 170 countries around the globe. North American sales accounted for 46% of ’11 total; International, 54%. Acq. Nabisco,

12/00; Cadbury, 2/10. Has about 126,000 employees. Officers &

Directors own less than 1% of stock (3/12 Proxy). Chairman &

CEO: Irene B. Rosenfeld. Address: Three Lakes Drive, Northfield,

IL 60093. Telephone: 847-646-2000. Internet: www.kraft.com.

Kraft continues to perform well in a

challenging business climate, one made

chilly by significant commodity inflation,

and one in which many domestic packaged

food companies are struggling. Earnings

are being buoyed by strong organic revenue growth (6.5% in the first quarter), particularly in emerging international marFull kets, where Kraft continues to build out its

Year infrastructure and garner benefits from its

40386 2010 acquisition of British confectioner

49207 Cadbury. Additionally, the European oper54365 ations are exhibiting surprising strength

56050 (organic growth there was 7.2% during the

58500 March interim), notwithstanding the

Full widespread sovereign debt crisis that is

Year still plaguing much of the euro zone. And

D2.03

the company is managing, to a large ex2.02 tent, to offset the commodity cost pres2.29 sures with strategic price hikes. This is a

2.50 testament, we think, to past years’

2.75

marketing efforts aimed at shoring up

Full Kraft’s core brands.

Year We expect organic revenue growth to

1.10 track in the mid-single digits for the

1.16 remainder of the year and into 2013,

1.16 even with the tough operating conditions

1.16 and the current headwinds on the U.S.

unit from SKU rationalization initiatives.

Commodity pressures, meanwhile, will

probably ease a bit going forward. And

Kraft should realize incremental cost

synergies related to its purchases of Cadbury and Lu. (Biscuit maker Lu was acquired from Danone in 2007 for $7.7 billion.) All in all, while profits are being

squeezed throughout the sector, we see

share net here rising 9% in 2012 (to $2.50)

and another 10% next year (to $2.75).

The tax-free split-up of the company

ought to be completed by year’s end.

As announced in August of 2011, Kraft

plans to separate into two public companies: a high-growth global snacks business

(to be called Mondelez International and

trade under the symbol MDLZ) and a

high-margin North American grocery business (to be called Kraft Foods Group and

trade under the symbol KRFT).

We like this Dow stock, now trading

on the NASDAQ, as a defensive play.

The split, not reflected in our estimates,

should unlock shareholder value and enable investors to better assess the prospects of the booming snacks division.

Justin Hellman

July 27, 2012

mill. Oblig.

QUARTERLY SALES ($ mill.)

Mar.31 Jun.30 Sep.30 Dec.31

9396 10162 9803 11025

11318 12253 11863 13773

12573 13878 13226 14688

13093 14157 13500 15300

13650 14750 14150 15950

EARNINGS PER SHARE A

Mar.31 Jun.30 Sep.30 Dec.31

.45

.56

.55

.48

.49

.60

.47

.46

.52

.62

.58

.57

.57

.69

.60

.64

.64

.74

.66

.71

QUARTERLY DIVIDENDS PAID B

Mar.31 Jun.30 Sep.30 Dec.31

.27

.27

.27 .29

.29

.29

.29 .29

.29

.29

.29 .29

.29

.29

.29 .29

.29

.29

.29

13.1

69.9

31.9

8

28.15 30.75 31.60 32.85

2.81

3.14

3.35

3.65

2.02

2.29

2.50

2.75

1.16

1.16

1.16

1.16

.95

1.00

1.05

1.10

20.56 19.98 20.85 22.75

1748.1 1767.9 1775.0 1780.0

14.8

14.8 Bold figures are

Value Line

.94

.93

estimates

3.9%

3.4%

MARKET CAP: $70.6 billion (Large Cap)

CURRENT POSITION 2010

2011 3/31/12

($MILL.)

Cash Assets

2481

1974

1852

Receivables

6539

6361

7314

Inventory (LIFO)

5310

5706

6286

Other

1891

2161

2241

Current Assets

16221 16202 17693

Accts Payable

5409

5525

5545

Debt Due

1865

3836

5143

Other

8386

9084

8610

Current Liab.

15660 18445 19298

ANNUAL RATES Past

Past Est’d ’09-’11

of change (per sh) 10 Yrs.

5 Yrs.

to ’15-’17

Sales

4.5%

7.5%

5.0%

‘‘Cash Flow’’

3.5%

3.5%

8.5%

Earnings

5.5%

2.0% 10.0%

Dividends

-6.5%

5.5%

Book Value

6.0%

2.0%

8.0%

Calendar

2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013

VL ARITH.*

INDEX

17.17 18.01 18.86 20.43 21.00 24.28 29.11 27.33

2.44

2.48

2.39

2.43

2.51

2.48

2.61

2.67

2.02

2.00

1.87

1.88

1.94

1.82

1.88

2.03

.54

.63

.75

.85

.94

1.02

1.10

1.16

.68

.63

.59

.70

.71

.81

.93

.90

14.93 16.57 17.54 17.72 17.45 17.80 15.11 17.57

1730.6 1721.9 1705.4 1669.9 1636.0 1533.8 1469.3 1477.9

19.1

15.4

17.3

16.7

16.6

18.4

16.1

12.8

1.04

.88

.91

.89

.90

.98

.97

.85

1.4%

2.0%

2.3%

2.7%

2.9%

3.1%

3.6%

4.5%

CAPITAL STRUCTURE as of 3/31/12

Total Debt $28341 mill. Due in 5 Yrs $13000 mill.

LT Debt $23198 mill. LT Interest $2000 mill.

(LT interest earned: 3.8x)

(38% of Cap’l)

Pension Assets-12/11 $13429

$17053 mill.

Pfd Stock None

Common Stock 1,773.0 mill. shs.

as of 4/30/12

1 yr.

3 yr.

5 yr.

THIS

STOCK

(A) Diluted earnings. Excludes nonrecurring

gain/(losses): ’03, 1¢; ’04, (32¢); ’05, (16¢);

’06, (9¢). Next earnings report is due in early

August.

56050

16.5%

1525

4440

28.0%

7.9%

d1500

23500

37000

8.5%

12.0%

6.5%

46%

(B) Dividends are typically paid in early Janu- (E) Includes intangible assets. In ’11: $25.2 bilary, April, July, and October.

lion ($14.25 a share).

(C) In millions.

(D) Doesn’t sum due to rounding.

© 2012, Value Line Publishing LLC. All rights reserved. Factual material is obtained from sources believed to be reliable and is provided without warranties of any kind.

THE PUBLISHER IS NOT RESPONSIBLE FOR ANY ERRORS OR OMISSIONS HEREIN. This publication is strictly for subscriber’s own, non-commercial, internal use. No part

of it may be reproduced, resold, stored or transmitted in any printed, electronic or other form, or used for generating or marketing any printed or electronic publication, service or product.

58500

17.0%

1575

4895

28.0%

8.4%

d750

24500

40500

8.5%

12.0%

7.0%

42%

Company’s Financial Strength

Stock’s Price Stability

Price Growth Persistence

Earnings Predictability

A+

100

30

100

To subscribe call 1-800-833-0046.