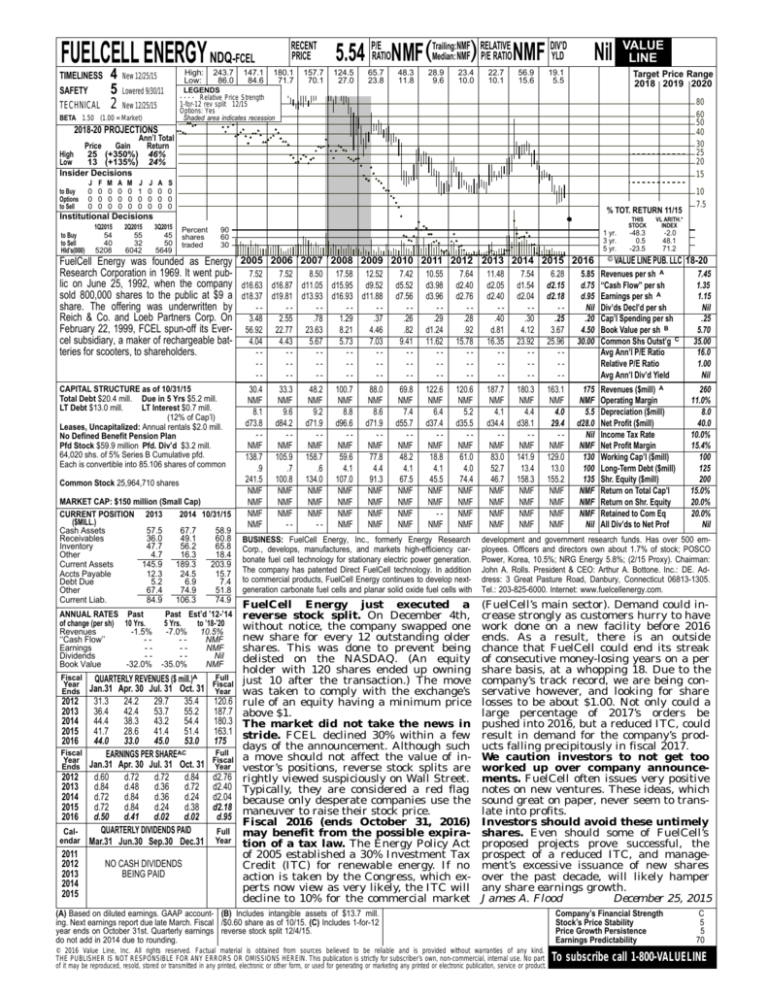

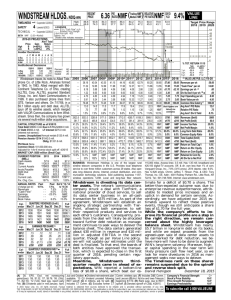

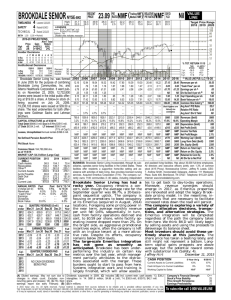

FUELCELL ENERGY NDQ-FCEL

TIMELINESS

SAFETY

TECHNICAL

4

5

2

High:

Low:

New 12/25/15

243.7

86.0

RECENT

PRICE

147.1

84.6

180.1

71.7

157.7

70.1

NMF RELATIVE

DIV’D

Median: NMF) P/E RATIO NMF YLD

5.54 P/ERATIONMF(Trailing:

124.5

27.0

65.7

23.8

48.3

11.8

28.9

9.6

23.4

10.0

22.7

10.1

56.9

15.6

Nil

19.1

5.5

Target Price Range

2018 2019 2020

LEGENDS

. . . . Relative Price Strength

1-for-12 rev split 12/15

Options: Yes

Shaded area indicates recession

Lowered 9/30/11

New 12/25/15

BETA 1.50 (1.00 = Market)

VALUE

LINE

80

60

50

40

30

25

20

15

2018-20 PROJECTIONS

Ann’l Total

Price

Gain

Return

High

25 (+350%) 46%

Low

13 (+135%) 24%

Insider Decisions

to Buy

Options

to Sell

J

0

0

0

F

0

0

0

M

0

0

0

A

0

0

0

M

0

0

0

J

1

0

0

J

0

0

0

A

0

0

0

S

0

0

0

% TOT. RETURN 11/15

Institutional Decisions

to Buy

to Sell

Hld’s(000)

1Q2015

54

40

5208

2Q2015

55

32

6042

3Q2015

45

50

5649

Percent

shares

traded

90

60

30

1 yr.

3 yr.

5 yr.

THIS

STOCK

VL ARITH.*

INDEX

-48.3

0.5

-23.5

-2.0

48.1

71.2

10

7.5

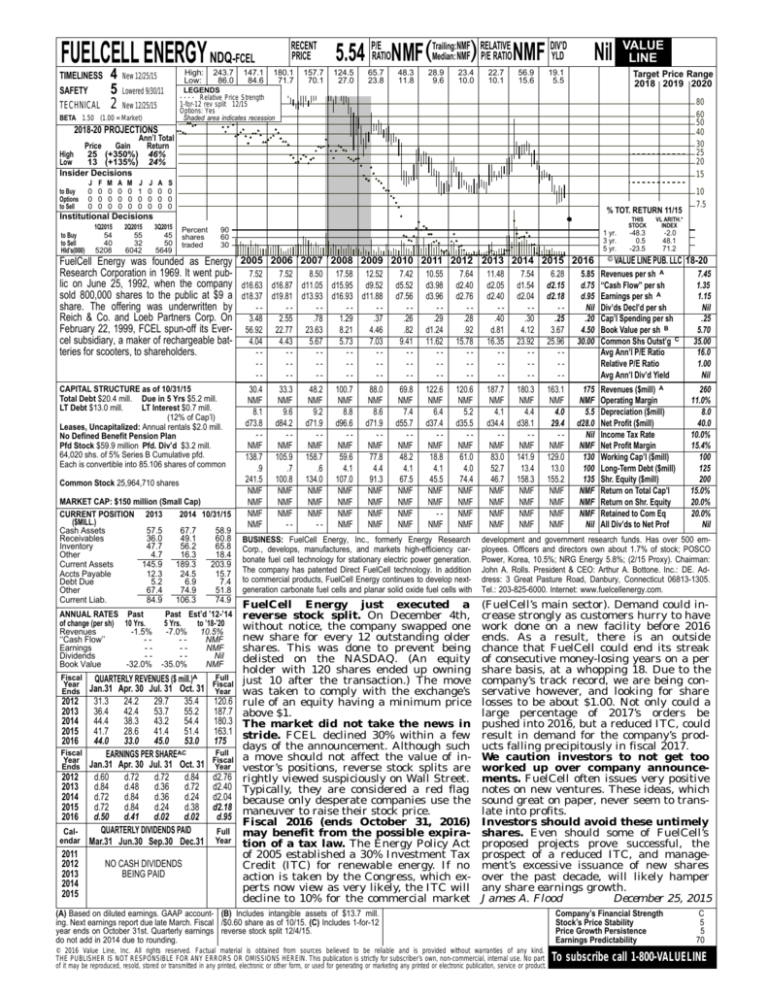

FuelCell Energy was founded as Energy 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 © VALUE LINE PUB. LLC 18-20

Research Corporation in 1969. It went pub- 7.52 7.52 8.50 17.58 12.52 7.42 10.55 7.64 11.48 7.54 6.28 5.85 Revenues per sh A

7.45

lic on June 25, 1992, when the company d16.63 d16.87 d11.05 d15.95 d9.52 d5.52 d3.98 d2.40 d2.05 d1.54 d2.15 d.75 ‘‘Cash Flow’’ per sh

1.35

sold 800,000 shares to the public at $9 a d18.37 d19.81 d13.93 d16.93 d11.88 d7.56 d3.96 d2.76 d2.40 d2.04 d2.18 d.95 Earnings per sh A

1.15

share. The offering was underwritten by

-----------Nil Div’ds Decl’d per sh

Nil

Reich & Co. and Loeb Partners Corp. On 3.48 2.55

.78

1.29

.37

.26

.29

.28

.40

.30

.25

.20 Cap’l Spending per sh

.25

February 22, 1999, FCEL spun-off its Ever- 56.92 22.77 23.63 8.21 4.46

.82 d1.24

.92

5.70

d.81

4.12

3.67

4.50 Book Value per sh B

cel subsidiary, a maker of rechargeable bat- 4.04 4.43 5.67 5.73 7.03 9.41 11.62 15.78 16.35 23.92 25.96 30.00 Common Shs Outst’g C 35.00

teries for scooters, to shareholders.

-----------Avg Ann’l P/E Ratio

16.0

CAPITAL STRUCTURE as of 10/31/15

Total Debt $20.4 mill. Due in 5 Yrs $5.2 mill.

LT Debt $13.0 mill.

LT Interest $0.7 mill.

(12% of Cap’l)

Leases, Uncapitalized: Annual rentals $2.0 mill.

No Defined Benefit Pension Plan

Pfd Stock $59.9 million Pfd. Div’d $3.2 mill.

64,020 shs. of 5% Series B Cumulative pfd.

Each is convertible into 85.106 shares of common

Common Stock 25,964,710 shares

MARKET CAP: $150 million (Small Cap)

CURRENT POSITION 2013

2014 10/31/15

($MILL.)

Cash Assets

57.5

67.7

58.9

Receivables

36.0

49.1

60.8

Inventory

47.7

56.2

65.8

Other

4.7

16.3

18.4

Current Assets

145.9

189.3

203.9

Accts Payable

12.3

24.5

15.7

Debt Due

5.2

6.9

7.4

Other

67.4

74.9

51.8

Current Liab.

84.9

106.3

74.9

ANNUAL RATES Past

of change (per sh) 10 Yrs.

Revenues

-1.5%

‘‘Cash Flow’’

-Earnings

-Dividends

-Book Value

-32.0%

Fiscal

Year

Ends

2012

2013

2014

2015

2016

Fiscal

Year

Ends

2012

2013

2014

2015

2016

Calendar

2011

2012

2013

2014

2015

Past Est’d ’12-’14

5 Yrs.

to ’18-’20

-7.0% 10.5%

-NMF

-NMF

-Nil

-35.0%

NMF

QUARTERLY REVENUES ($ mill.)A

Jan.31 Apr. 30 Jul. 31 Oct. 31

31.3

24.2

29.7

35.4

36.4

42.4

53.7

55.2

44.4

38.3

43.2

54.4

41.7

28.6

41.4

51.4

44.0

33.0

45.0

53.0

EARNINGS PER SHAREAC

Jan.31 Apr. 30 Jul. 31 Oct. 31

d.60

d.72

d.72

d.84

d.84

d.48

d.36

d.72

d.72

d.84

d.36

d.24

d.72

d.84

d.24

d.38

d.50 d.41 d.02 d.02

QUARTERLY DIVIDENDS PAID

Mar.31 Jun.30 Sep.30 Dec.31

NO CASH DIVIDENDS

BEING PAID

Full

Fiscal

Year

120.6

187.7

180.3

163.1

175

Full

Fiscal

Year

d2.76

d2.40

d2.04

d2.18

d.95

Full

Year

---

---

---

---

---

---

---

---

---

---

---

30.4

NMF

8.1

d73.8

-NMF

138.7

.9

241.5

NMF

NMF

NMF

NMF

33.3

NMF

9.6

d84.2

-NMF

105.9

.7

100.8

NMF

NMF

NMF

--

48.2

NMF

9.2

d71.9

-NMF

158.7

.6

134.0

NMF

NMF

NMF

--

100.7

NMF

8.8

d96.6

-NMF

59.6

4.1

107.0

NMF

NMF

NMF

NMF

88.0

NMF

8.6

d71.9

-NMF

77.8

4.4

91.3

NMF

NMF

NMF

NMF

69.8

NMF

7.4

d55.7

-NMF

48.2

4.1

67.5

NMF

NMF

NMF

NMF

122.6

NMF

6.4

d37.4

-NMF

18.8

4.1

45.5

NMF

NMF

-NMF

120.6

NMF

5.2

d35.5

-NMF

61.0

4.0

74.4

NMF

NMF

NMF

NMF

187.7

NMF

4.1

d34.4

-NMF

83.0

52.7

46.7

NMF

NMF

NMF

NMF

180.3

NMF

4.4

d38.1

-NMF

141.9

13.4

158.3

NMF

NMF

NMF

NMF

163.1

NMF

4.0

29.4

-NMF

129.0

13.0

155.2

NMF

NMF

NMF

NMF

Relative P/E Ratio

Avg Ann’l Div’d Yield

175

NMF

5.5

d28.0

Nil

NMF

130

100

135

NMF

NMF

NMF

Nil

Revenues ($mill) A

Operating Margin

Depreciation ($mill)

Net Profit ($mill)

Income Tax Rate

Net Profit Margin

Working Cap’l ($mill)

Long-Term Debt ($mill)

Shr. Equity ($mill)

Return on Total Cap’l

Return on Shr. Equity

Retained to Com Eq

All Div’ds to Net Prof

1.00

Nil

260

11.0%

8.0

40.0

10.0%

15.4%

100

125

200

15.0%

20.0%

20.0%

Nil

BUSINESS: FuelCell Energy, Inc., formerly Energy Research

Corp., develops, manufactures, and markets high-efficiency carbonate fuel cell technology for stationary electric power generation.

The company has patented Direct FuelCell technology. In addition

to commercial products, FuelCell Energy continues to develop nextgeneration carbonate fuel cells and planar solid oxide fuel cells with

development and government research funds. Has over 500 employees. Officers and directors own about 1.7% of stock; POSCO

Power, Korea, 10.5%; NRG Energy 5.8%; (2/15 Proxy). Chairman:

John A. Rolls. President & CEO: Arthur A. Bottone. Inc.: DE. Address: 3 Great Pasture Road, Danbury, Connecticut 06813-1305.

Tel.: 203-825-6000. Internet: www.fuelcellenergy.com.

FuelCell Energy just executed a

reverse stock split. On December 4th,

without notice, the company swapped one

new share for every 12 outstanding older

shares. This was done to prevent being

delisted on the NASDAQ. (An equity

holder with 120 shares ended up owning

just 10 after the transaction.) The move

was taken to comply with the exchange’s

rule of an equity having a minimum price

above $1.

The market did not take the news in

stride. FCEL declined 30% within a few

days of the announcement. Although such

a move should not affect the value of investor’s positions, reverse stock splits are

rightly viewed suspiciously on Wall Street.

Typically, they are considered a red flag

because only desperate companies use the

maneuver to raise their stock price.

Fiscal 2016 (ends October 31, 2016)

may benefit from the possible expiration of a tax law. The Energy Policy Act

of 2005 established a 30% Investment Tax

Credit (ITC) for renewable energy. If no

action is taken by the Congress, which experts now view as very likely, the ITC will

decline to 10% for the commercial market

(FuelCell’s main sector). Demand could increase strongly as customers hurry to have

work done on a new facility before 2016

ends. As a result, there is an outside

chance that FuelCell could end its streak

of consecutive money-losing years on a per

share basis, at a whopping 18. Due to the

company’s track record, we are being conservative however, and looking for share

losses to be about $1.00. Not only could a

large percentage of 2017’s orders be

pushed into 2016, but a reduced ITC, could

result in demand for the company’s products falling precipitously in fiscal 2017.

We caution investors to not get too

worked up over company announcements. FuelCell often issues very positive

notes on new ventures. These ideas, which

sound great on paper, never seem to translate into profits.

Investors should avoid these untimely

shares. Even should some of FuelCell’s

proposed projects prove successful, the

prospect of a reduced ITC, and management’s excessive issuance of new shares

over the past decade, will likely hamper

any share earnings growth.

James A. Flood

December 25, 2015

(A) Based on diluted earnings. GAAP account- (B) Includes intangible assets of $13.7 mill.

ing. Next earnings report due late March. Fiscal /$0.60 share as of 10/15. (C) Includes 1-for-12

year ends on October 31st. Quarterly earnings reverse stock split 12/4/15.

do not add in 2014 due to rounding.

© 2016 Value Line, Inc. All rights reserved. Factual material is obtained from sources believed to be reliable and is provided without warranties of any kind.

THE PUBLISHER IS NOT RESPONSIBLE FOR ANY ERRORS OR OMISSIONS HEREIN. This publication is strictly for subscriber’s own, non-commercial, internal use. No part

of it may be reproduced, resold, stored or transmitted in any printed, electronic or other form, or used for generating or marketing any printed or electronic publication, service or product.

Company’s Financial Strength

Stock’s Price Stability

Price Growth Persistence

Earnings Predictability

C

5

5

70

To subscribe call 1-800-VALUELINE