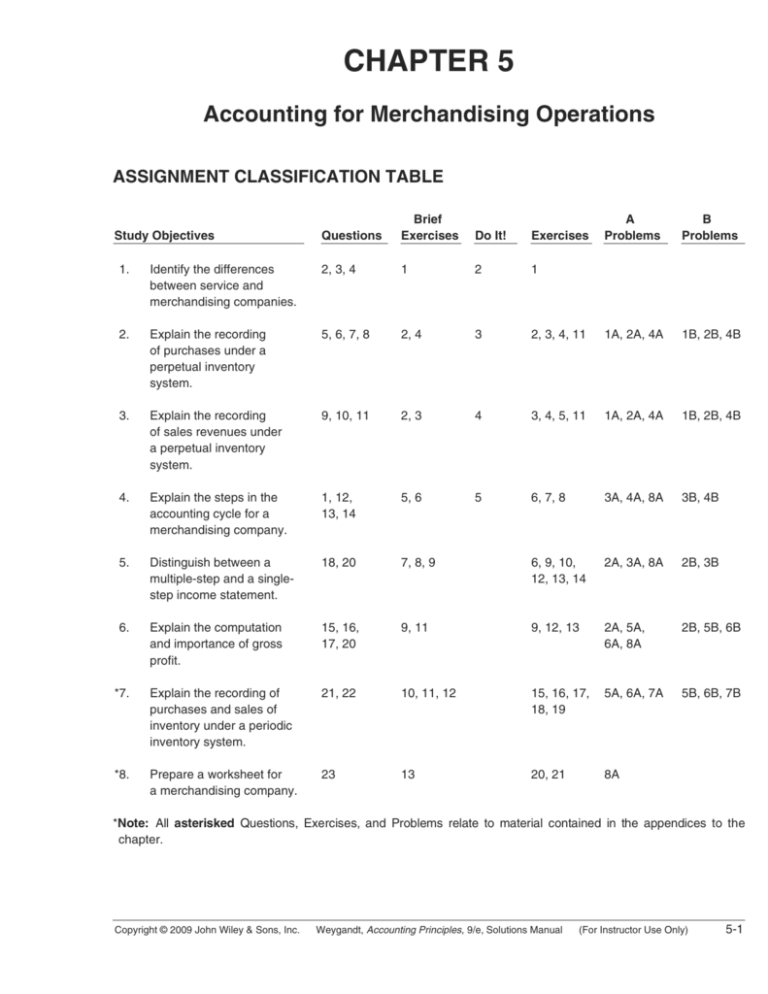

chapter 5 - IT Services

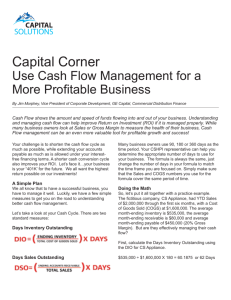

advertisement