Arris/Pace - The Capitol Forum

advertisement

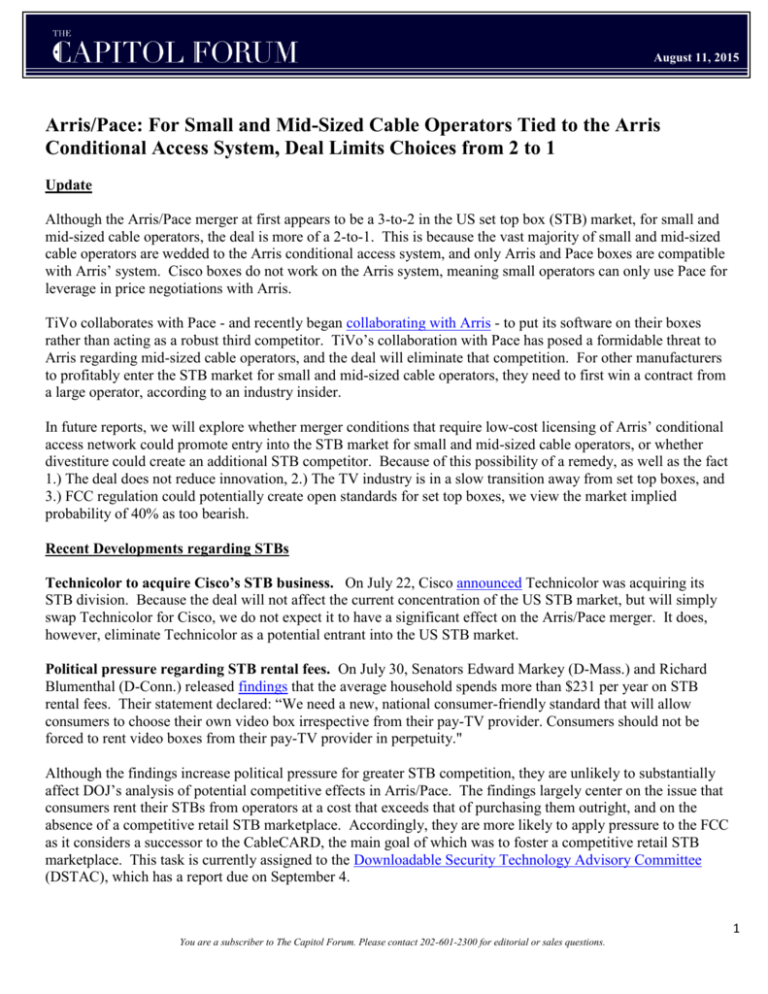

August 11, 2015 Arris/Pace: For Small and Mid-Sized Cable Operators Tied to the Arris Conditional Access System, Deal Limits Choices from 2 to 1 Update Although the Arris/Pace merger at first appears to be a 3-to-2 in the US set top box (STB) market, for small and mid-sized cable operators, the deal is more of a 2-to-1. This is because the vast majority of small and mid-sized cable operators are wedded to the Arris conditional access system, and only Arris and Pace boxes are compatible with Arris’ system. Cisco boxes do not work on the Arris system, meaning small operators can only use Pace for leverage in price negotiations with Arris. TiVo collaborates with Pace - and recently began collaborating with Arris - to put its software on their boxes rather than acting as a robust third competitor. TiVo’s collaboration with Pace has posed a formidable threat to Arris regarding mid-sized cable operators, and the deal will eliminate that competition. For other manufacturers to profitably enter the STB market for small and mid-sized cable operators, they need to first win a contract from a large operator, according to an industry insider. In future reports, we will explore whether merger conditions that require low-cost licensing of Arris’ conditional access network could promote entry into the STB market for small and mid-sized cable operators, or whether divestiture could create an additional STB competitor. Because of this possibility of a remedy, as well as the fact 1.) The deal does not reduce innovation, 2.) The TV industry is in a slow transition away from set top boxes, and 3.) FCC regulation could potentially create open standards for set top boxes, we view the market implied probability of 40% as too bearish. Recent Developments regarding STBs Technicolor to acquire Cisco’s STB business. On July 22, Cisco announced Technicolor was acquiring its STB division. Because the deal will not affect the current concentration of the US STB market, but will simply swap Technicolor for Cisco, we do not expect it to have a significant effect on the Arris/Pace merger. It does, however, eliminate Technicolor as a potential entrant into the US STB market. Political pressure regarding STB rental fees. On July 30, Senators Edward Markey (D-Mass.) and Richard Blumenthal (D-Conn.) released findings that the average household spends more than $231 per year on STB rental fees. Their statement declared: “We need a new, national consumer-friendly standard that will allow consumers to choose their own video box irrespective from their pay-TV provider. Consumers should not be forced to rent video boxes from their pay-TV provider in perpetuity." Although the findings increase political pressure for greater STB competition, they are unlikely to substantially affect DOJ’s analysis of potential competitive effects in Arris/Pace. The findings largely center on the issue that consumers rent their STBs from operators at a cost that exceeds that of purchasing them outright, and on the absence of a competitive retail STB marketplace. Accordingly, they are more likely to apply pressure to the FCC as it considers a successor to the CableCARD, the main goal of which was to foster a competitive retail STB marketplace. This task is currently assigned to the Downloadable Security Technology Advisory Committee (DSTAC), which has a report due on September 4. 1 You are a subscriber to The Capitol Forum. Please contact 202-601-2300 for editorial or sales questions. Apart from Arris, Pace is the only set top box that currently works on the Arris conditional access system. Conditional access systems encrypt the television signal at the cable headend. The STB at the consumer’s home decrypts it. In the late 1990s, cable operators had to choose to use either the Motorola (now Arris) or the Scientific-Atlanta (now Cisco) conditional access systems. “The overwhelming majority chose Motorola,” explained a cable industry insider. The first report of DSTAC working group 2 notes that the Arris system “was tailored primarily for the more rural and less clustered systems,” while the “Scientific-Atlanta (now Cisco) design was tailored primarily for the more urban and clustered systems primarily owned by Time Warner Cable…” Still today, small and mid-sized cable operators are largely dependent on the Motorola/Arris conditional access system. Thus, they can only use STBs that are compatible with that system. For a long time, the only supplier was Motorola, explained the insider. Large cable operators eventually pressured Motorola to license its conditional access system. Pace was the only STB manufacturer that got a license to build a box that would work on the Motorola system, he said. As a result, cable operators utilizing the Motorla/Arris conditional access system had two options for purchasing STBs, Arris and Pace. Changing conditional access systems does not appear to be a viable option for small and mid-sized cable operators, however, as it costs several hundred thousand dollars to do so. The amount of money that the operator would save on having more STB options hence does not justify the cost of changing conditional access systems. In addition, for other STB manufacturers to reposition their products as compatible with the Arris conditional access system would require both Arris's permission, as well as a significant investment in the form of licensing fees. Even in the event of a post-merger price increase to small and mid-sized cable operators (large operators are likely immune to such a price increase), the potential sales volume may not be great enough to motivate such repositioning, however. Despite Pace’s seemingly low market share among small and mid-sized cable operators, operators utilize Pace to obtain lower prices from Arris in price negotiations. We previously reported that our survey of 40 small and mid-sized cable operators did not indicate Pace has a large share of that market, with only 3 operators using Pace. However, we noted that one cable operator told us he used Pace as a stalking horse to obtain lower prices from Arris. We recently spoke to another insider who also believed that the existence of Pace as an option has caused STB prices to go down for small and mid-sized cable operators. Operators have been able to “say to Arris we’re going to look elsewhere,” and, “there’s somewhere else to look,” said the insider. This has led to a “check on Arris’ ability to gouge,” he added. One reason Pace has nonetheless gained only weak market share among small and mid-sized operators, however, is that switching STBs is a sizable effort. Operators need to train their customer service representatives and technicians to support each type of STB used. This makes cable operators more inclined to continue to use the same types of STBs than to switch. TiVo/Pace partnership poses a formidable challenge to Arris; Merger will eliminate that competition. Midsized cable operators that were seeking an additional choice beyond Arris for set top boxes looked to TiVo. TiVo built boxes that work on the Arris system using CableCARDs, which do not require permission from Arris or the payment of licensing fees for Arris’ conditional access system. The TiVo integration was expensive for cable operators, so it was not an option for smaller operators. Although CableCARDs allow for decryption, TiVo still had to make a large investment to build work-arounds that would allow its STBs to fully function on the Arris system. 2 You are a subscriber to The Capitol Forum. Please contact 202-601-2300 for editorial or sales questions. Because TiVo is predominantly a software company, it began putting its software onto Pace STBs, which could be manufactured for a lower price. Largely at the behest of TiVo cable operator customers who were seeking a second STB option, TiVo recently announced a partnership to also put its software on Arris boxes. For TiVo’s current cable customers, which includes RCN, Grande Communications, Suddenlink and Armstrong, the Arris/Pace merger will limit their STB options at 1 instead of 2. Also, since Pace is viewed as the lower cost option in the market, there is concern among TiVo customers that prices could go up, said an industry insider. Because Pace has been willing to work with TiVo for several years, many also view Pace as more innovative than Arris. According to the first report of DSTAC working group 2,“TiVo demonstrated a single user experience that integrated Cable Service, Netflix Service, Amazon Service, and other OTT video services. The user has a choice of launching the OTT Application separately, or watching content from within the TiVo user experience instead.” The TiVo/Pace combination thus was a formidable, lower-priced and more innovative competitor to Arris. Potential entrants likely require a large cable operator contract to enter the small and mid-sized operator market. Small cable operators told The Capitol Forum that manufacturers make STBs for the large operators, and then the small operators largely buy the boxes off the shelf. Pace has been available to small operators primarily because Pace gained a large contract with Comcast. STB manufacturers are not interested in entering only the small and mid-sized cable operator market, according to industry sources, as the costs of integrating with or licensing the Arris conditional access system make entry costly and the potential sales volume is not sufficiently great. Oddly, if Comcast were to award a large STB contract to a different manufacturer, like Samsung or Humax, that manufacturer potentially could then enter the small and mid-sized cable markets. To date, large cable operators like Comcast have not done so, however. As we have reported previously, large cable operators have the option to utilize contract manufacturers because they are getting STBs made to their specifications. DOJ however cannot rely on such entry in its analysis, nor is it possible to know whether a new entrant would undercut Arris on pricing the way that Pace has done. Next Steps In future reports we will explore: 1. Whether merger conditions could create a competitive option for small and mid-sized cable operators, such as divestitures or mandatory licensing of the Arris conditional access system at a sufficiently low rate. 2. Whether changes in the TV industry such as over-the-top TV, the IPTV transition, and the DSTAC recommendation due on September 4 could affect DOJ’s analysis of the deal. Issue Snapshot Outlook: Current Consensus of 40% is Too Bearish Reasons for Challenge/Collapse Most Compelling Narrative The deal would eliminate an aggressive competitor that has shaken up the historic duopoly of the US Reasons for Merger Clearance Most Compelling Narrative Large cable companies have significant buyer power and options for direct manufacturing that could 3 You are a subscriber to The Capitol Forum. Please contact 202-601-2300 for editorial or sales questions. set top box market. Cable operators report that STB prices have decreased as a result of Pace’s entry into the market and that they have used Pace to obtain lower prices in negotiations the incumbents. Smaller cable operators are particularly vulnerable to a post-merger price increase. TiVo’s collaboration with Pace has challenged Arris regarding mid-sized cable operators, and the deal will eliminate that competition. prevent a post-merger price increase to them. To the extent large cable companies rather than STB manufacturers control the level of competition and innovation in the STB market, the Arris/Pace merger may have little competitive consequence. Limited penetration among small and mid-sized cable operators decreases the odds of strong customer opposition. Competitive Analysis -The relevant product market likely will include STBs only, not third party streaming devices that are currently incompatible with cable systems. Competitive Analysis -Buyer power likely will prevent a post-merger price increase to large cable operators. -DOJ will take a close look at pricing data. If Pace’s entry into the US market has had significant price effects for small and mid-sized cable operators, DOJ will view the loss of that competition as problematic. Political and Other Factors -Political pressure for greater STB competition focuses on rental fees and the absence of a retail marketplace. Although not directly related to the Arris/Pace merger, greater consolidation generally runs counter to pressure for greater STB competition. -Large MSOs that provide STB manufacturers with detailed product specifications potentially could utilize contract manufacturers as an alternative in the event of a post-merger price increase. -Because Arris and Pace manufacture STBs according to large cable operators’ specifications, the merger is unlikely to reduce innovation. Political and Other Factors -Current FCC reform efforts may promote standards to create a more open playing field for set top boxes, but it is unlikely such reforms will be timely enough to affect the antitrust analysis of the Arris/Pace merger. -The OTT transition, which may eventually moot set top boxes, similarly is not likely imminent enough to alter DOJ’s analysis of the deal’s price effects. -The merger is unlikely to hamper the transition to OTT video, as Arris and Pace are relatively small players in cloud and network infrastructure. Timeline -The parties announced the acquisition on April 22, 2015. On June 29, the parties announced they had received a second request from DOJ. Next steps for DOJ are speaking to industry participants about potential competitive effects, reviewing documentary evidence the parties they produce, and studying price effects with economic models. 4 You are a subscriber to The Capitol Forum. Please contact 202-601-2300 for editorial or sales questions.