Segment Reporting & Transfer Pricing

advertisement

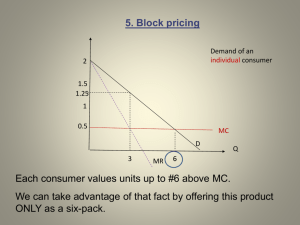

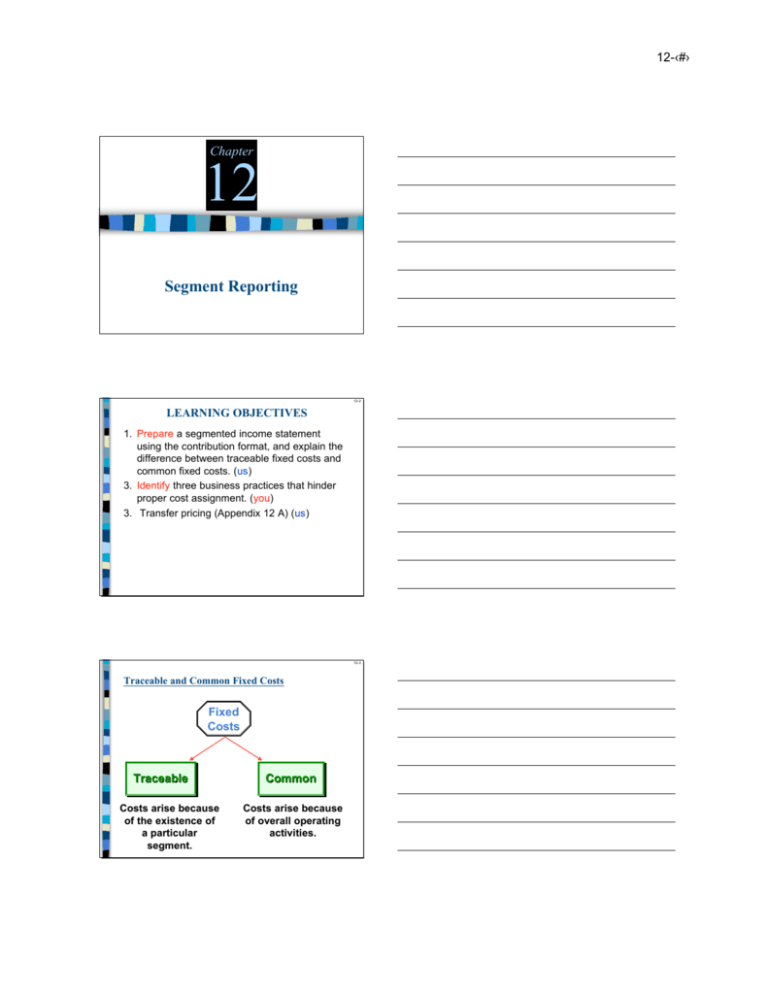

12-‹#› Chapter 12 Segment Reporting 12-2 LEARNING OBJECTIVES 1. Prepare a segmented income statement using the contribution format, and explain the difference between traceable fixed costs and common fixed costs. (us) 3. Identify three business practices that hinder proper cost assignment. (you) 3. Transfer pricing (Appendix 12 A) (us) 12-3 Traceable and Common Fixed Costs Fixed Costs Traceable Costs arise because of the existence of a particular segment. Common Costs arise because of overall operating activities. 12-‹#› 12-4 Hindrances to Proper Cost Assignment Three Problems Omission of some costs in the assignment process. Assignment to segments of costs that are really common costs of the entire organization. Use of inappropriate methods for allocating costs among segments. 12-5 12-15 Appendix 12A Transfer Pricing 12-‹#› 12-7 Transfer Pricing Objectives: Setting transfer prices to motivate the managers to act in the best interest of the overall company: goal congruence Preserve decision making autonomy: fundamental to decentralization Fair treatment to both selling and buying managers More of an issue when there is an external market for the selling division product 12-8 Three Common Approaches: Set transfer price using either: 1. Variable Cost + mark-up 2. Full Cost + mark-up Managers negotiate their own transfer price Set transfer price at market price 12-9 Negotiated Transfer Prices Advantages: • Disadvantages 12-‹#› 12-10 Market Price Advantages: • Disadvantages 12-11 Cost-Based Transfer Pricing Rule Need a rule that will lead to the correct decision regarding internal transfers & the price 12-12 12-21 12-‹#› 12-13 12-28