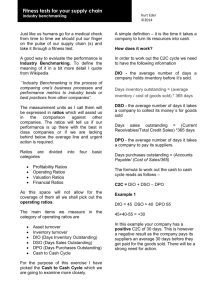

Cash Conversion Cycle (Operating Cycle)

advertisement

Cash Conversion Cycle (Operating Cycle) Definition The cash conversion cycle (CCC, or Operating Cycle) is the length of time between a firm's purchase of inventory and the receipt of cash from accounts receivable. It is the time required for a business to turn purchases into cash receipts from customers. CCC represents the number of days a firm's cash remains tied up within the operations of the business. A cash flow analysis using CCC also reveals in, an overall manner, how efficiently the company is managing its working capital. The cash conversion cycle is also referred to as the cash cycle, asset conversion cycle or net operating cycle. Calculation (formula) The cycle is composed of three main working capital components: Days Inventory Outstanding (DIO), Days sales outstanding (DSO) and Days Payable Outstanding (DPO). The Cash Conversion Cycle (CCC) is equal to the time is takes to sell inventory and collect receivables less the time it takes to pay the company's payables: Cash Conversion Cycle (CCC) = DIO + DSO – DPO Norms and Limits A short cycle allows a business to quickly acquire cash that can be used for additional purchases or debt repayment. The lower the cash conversion cycle, the more healthy a company generally is. Businesses attempt to shorten the cash conversion cycle by speeding up payments from customers and slowing down payments to suppliers. CCC can even be negative; for instance, if the company has a strong market position and can dictate purchasing terms to suppliers (i.e. can postpone its payments).