Nominal Exchange Rates (simply called exchange rate) All

advertisement

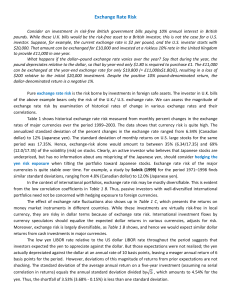

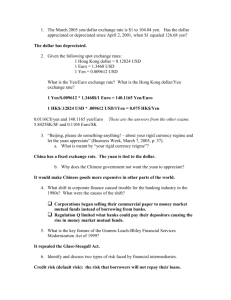

Nominal Exchange Rates (simply called exchange rate) All countries have their own national currencies: The U.S. dollar, the Japanese yen, the British pound, the Brazilian Real... If someone in one country wants to buy goods, services, or assets from someone in another country, normally she will first have to exchange her country´s currency for that of her trading partner´s country. The rate at which two currencies can be traded is the nominal exchange rate between the two currencies. Example: if the nominal exchange rate between the U.S. dollar and the Japanese yen is 110 yen per dollar, a dollar can buy 110 yen (ignoring transaction fees) in the foreign exchange market, which is the market for international currencies. Equivalently, 110 yen can buy 1 dollar in the foreign exchange market. The nominal exchange rate, E, between two currencies is the number of units of foreign currency that can be purchased with one unit of the domestic currency. The dollar-yen exchange rate isn´t constant. The dollar might trade for 110 yen one day, but the next day it might rise in value to 112 or fall in value to 108 yen. Such changes in the exchange rate are normal under a flexible-exchange-rate system (or floating-exchange-rate system). In this system exchange rates are not officially fixed but are determined by conditions of supply and demand in the foreign exchange market. Exchange rates move continuously and respond quickly to any economic or political news that might influence the supplies and demands for various currencies. Fixed-exchange-rate system (Brazil until 1999) Exchange rates are set at officially determined levels, often operated. Usually, these official rates were maintained by the commitment of nations´central banks to buy and sell their own currencies at the fixed exchange rate. Central bank buys the foreign currency at a fixed price of E – c And sells the foreign currency at a fixed price of E+c Where c is the transaction fee. Real Exchange Rates Could we conclude that someone in the Kansas City could visit Tokyo very cheaply? After all, 110 yen for just 1 dollar seems like a good deal. Example: Hamburger costs 2 dollars in Kansas City and 1100 yen in Tokyo. How many dollars are needed to buy a hamburger in Japan? 110 yen cost 1 dollar, the price of a hamburger in Tokyo is 10 dollars (calculated by dividing the price of a Japonese hamburger, ¥1100, by ¥110/$1). The price of a U.S. hamburger relative to a Japanese hamburger is 0.20 Japonese hamburgers per U.S. hamburgers ($2 per US hamburger/$10 per Japanese hamburger). The real exchange rate, e, is the number of foreign goods (Japonese hamburgers) that can be obtained in exchange for one unit of the domestic good (U.S. hamburgers). The general formula for the real exchange rate is e = enomP/PFor = 0.20 enom = the nominal exchange rate (110 yen per dollar) P = the price of domestic goods, measured in the domestic currency (2 dollars per US hamburger) PFor = the price of foreign goods, measured in the foreign currency (1100 yen per Japanese hamburger) assuming that each country produces a single, unique good. In reality countries produce thousands of different goods, so real exchange rates must be based on price indexes (such as the CPI) to measure P and PFor. Thus, the real exchange rate is the rate of exchange between a typical basket of goods in one country and a typical basket of goods in the other country. Changes in the real exchange rate over time indicate that, on average, the goods of the country whose real exchange rate is rising are becoming more expensive relative to the goods of the other country. Apreciation and Depreciation When the nominal exchange rate falls so that, a dollar buys fewer units of foreign currency, we say that the dollar has undergone a nominal depreciation. Dollar has become weaker. If the dollar´s nominal exchange rate rises, the dollar has had a nominal appreciation. It can buy more units of foreign currency and thus has become stronger. An increase in the real exchange rate, e, is called a real appreciation. With a real appreciation, the same quantity of domestic goods can be traded for more of the foreign good than before, because e, the price of domestic goods relative to the price of foreign goods, has risen. A drop in the real exchange rate, which decreases the quantity of foreign goods that can be purchased with the same quantity of domestic goods, is called a real depreciation. Terminology for changes in exchange rates Type for Exchange E increases E decreases Flexible Appreciation Depreciation Fixed Revaluation Devaluation Rate (E) system