s053.doc

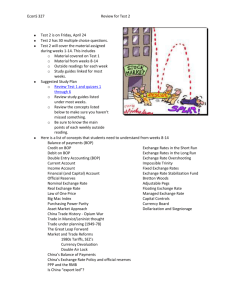

advertisement

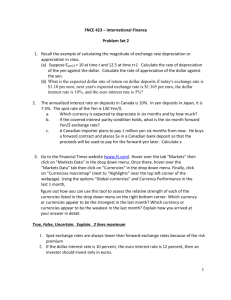

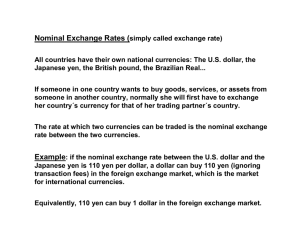

1. The March 2005 yen/dollar exchange rate is $1 to 104.04 yen. Has the dollar appreciated or depreciated since April 2, 2001, when $1 equaled 126.68 yen? The dollar has depreciated. 2. Given the following spot exchange rates: 1 Hong Kong dollar = 0.12824 USD 1 Euro = 1.3468 USD 1 Yen = 0.009612 USD What is the Yen/Euro exchange rate? What is the Hong Kong dollar/Yen exchange rate? 1 Yen/$.009612 * 1.3468$/1 Euro = 140.1165 Yen/Euro 1 HK$/.12824 USD * .009612 USD/1Yen = 0.075 HK$/Yen 0.0116C$/yen and 140.1165 yen/Euro 5.8425SK/SF and 0.1104 Euro/SK These are the answers from the other exams. 3. “Beijing, please do something-anything! – about your rigid currency regime and let the yuan appreciate” (Business Week, March 7, 2005, p. 37). a. What is meant by “your rigid currency reigme”? China has a fixed exchange rate. The yuan is tied to the dollar. b. Why does the Chinese government not want the yuan to appreciate? It would make Chinese goods more expensive in other parts of the world. 4. What shift in corporate finance caused trouble for the banking industry in the 1980s? What were the causes of the shift? Corporations began selling their commercial paper to money market mutual funds instead of borrowing from banks. Regulation Q limited what banks could pay their depositors causing the rise in money market mutual funds. 5. What is the key feature of the Gramm-Leach-Bliley Financial Services Modernization Act of 1999? It repealed the Glass-Steagall Act. 6. Identify and discuss two types of risk faced by financial intermediaries. Credit risk (default risk): the risk that borrowers will not repay their loans. Interest rate risk : Both bank assets and liabilities are interest rate sensitive. If they make 5 year loans and have short term deposits, then the value of their assets and liabilities do not move together as interest rates move. 7. Briefly discuss the moral hazard problem of lending. A borrower is tempted to use borrowed funds in a more speculative venture than the lender agreed to fund, because all the upside potential belongs to the borrow, and much of the downside potential falls on the lender. 8. What is Regulation Q? What was the original intent of Regulation Q? Regulation Q gave the Federal Reserve the responsibility of imposing ceilings on deposit rates. It was designed to insulate intermediaries from interest rate competition. 9. “Exports May be Getting a Lift from Weaker Dollar” (WSJ 2-11-05) Explain how a weaker dollar could contribute to a higher level of exports. It would make U.S. goods cheaper in the rest of the world. 10. “Japanese Officials Vow to Fight Any Excessive Surge in the Yen” (WSJ 1/7/04) Describe how Japanese officials intervene directly in foreign markets to stop the dollar’s fall? The would sell yen and buy dollars. 11. Suppose that on April 1, 2005, a U.S. citizen has excess funds available to invest in either U.S. or British bank time deposits. It is assumed that both types of deposits are credit or default risk free and that the investment horizon is one year. The interest rate available on British pound time deposits, iUK, is 4.5% annually. The spot exchange rate is $1.94 per British pound, and the one year forward rate is $1.957 per British pound. Assume a $1,000 investment. a. If the one year interest rate on time deposits in the U.S. is 3.5%, explain how a U.S. investor might lock in a higher rate than 3.5%? T=0: Convert $ to pounds = 515.4639 Sell pounds (538.6598) on the forward market. Invest in 1 year CD in the UK T=1: CD is worth 515.4639(1.045) = 538.6598 pounds Deliver on the forward contract for 538.6598*1.957 = $1,054.1572. b. What would his return be? Return = (1054.1572/1000)-1 = 5.42% Other exams: 512.8205 pounds *(1.04) = 533.33 Sell on forward market for $1,043.73 Return = 4.37% 515.4639 pounds * 1.04)=536.0825 Sell on forward market for $1049.1134 Return = 4.91%