Company Review:

The Caledonian Cheese

Company

A guide to your milk buyer

February 2012

The Caledonian Cheese Company

Company profile

The Caledonian Cheese Company Limited1, The Fresh Milk Company Limited and McLelland

Cheese Packing Limited are all part of the Lactalis McLelland Limited group which is itself owned

by the French dairy company Lactalis. The parent company Lactalis was the third largest dairy

company in the world according to Rabobank’s rankings2. Following its acquisitions of Puleva in

Spain (2010) and Parmalet in Italy (July 2011), however, it now claims to be the largest maker of

dairy products worldwide. Lactalis produces a wide range of dairy products and has access to all

major markets although its main product market is cheese followed by liquid milk. Its main markets

are France and Italy which account for 26% and 18% respectively of its sales revenues.

Lactalis Group has based its external growth on developing its brands and on an active policy

of acquisitions both in France and abroad. Its acquisition strategy is to involve itself with ‘high

visibility brands’ as opposed to dairy commodity products and to purchase strong local brands

to support growth. Its bid to purchase the Swedish dairy business Skånemejerier3, the second

largest dairy co-operative in Sweden, fits into this strategy and provides Lactalis with access to

Scandanavian markets and to extend the product markets it is involved with.

UK activities are consolidated through Lactalis McLelland Limited, which is involved in the

manufacture, import, sale and trade in cheese and other dairy products. Each of the group’s

subsidiaries is responsible for certain dedicated activities within the company. The Fresh Milk

Company Limited is responsible for milk procurement, The Caledonian Cheese Company Limited

is responsible for production, marketing and distribution of cheese and dairy products based in

Stranraer while packaging operations are done through McLelland Cheese Packing Limited. Its

non-manufacturing activities are centralised at its Redhill location.

As part of the Lactalis group, its UK operations benefit from the strong commercial network that

Lactalis has both in the UK and abroad, and from an important source of capital that can be used

for advertising, marketing and investments.

The majority of milk purchased within Britain is used by The Caledonian Cheese Company for

cheese production at its main factory in Stranraer, notably under the Seriously Strong brand. In

addition, it is involved in the production of territorial and goat cheeses at its Lubborn creamery in

Somerset and in a joint venture in the Orkney Cheese Company. It also owns the Rachel’s Organic

brand, which was purchased from Dean Foods in July 2010. In the branded Cheddar market, the

key competitors to Lactalis’ Seriously Strong brand are Cathedral City from Dairy Crest and Pilgrims

Choice from Adams Foods Ltd. For its own-label cheeses, it will compete with the other major

manufacturers of own-label Cheddar and territorial cheeses as well as with imported products.

1

2

3

2

As part of the research for this report, Lactalis McLelland Limited did not participate in an interview, nor provide any information

on its strategy, targets or performance. All of the information within this report has been accessed from published sources, such as

company accounts, websites and press articles unless otherwise indicated. The most recent set of accounts for Lactalis McLelland

Limited and its associated companies are for the year ending 31 December 2010 which were filed at Companies House in

September 2011.

Rabobank International. Global Dairy Top-20. June 2011. Based on valuations in Euros for the 2010 financial year.

At time of writing, the board of Skånemejerier’s council had approved the takeover although the final details had not yet been

agreed.

During 2010, the Cheddar market was significantly impacted by the high level of promotions

used to drive consumer demand. While promotional activity slowed during 2011, the continued

pressure on consumers’ budgets has meant retailers have not been receptive to price increases

and trading conditions in the Cheddar market have continued to be difficult.

Current position:

• Lactalis McLelland is one of the largest producers of Cheddar in Britain and its Seriously

Strong brand is the second largest selling Cheddar brand4.

• Difficult trading conditions during 2010 and 2011 have impacted volume and value retail

sales of its key branded products, although the drop in value was partly offset by increasing

wholesale values of Cheddar.

• The company has diversified its activities within the UK in recent years into soft cheeses and

yogurt through its acquisitions of the Lubborn Creamery (in 2009) and the Rachel’s brand (in

2010), giving the parent company a wider UK presence.

• Lactalis McLelland has access to resources from its global parent in terms of commercial

networks, best practice and a source of funds for investments and marketing. Its global

presence has continued to grow following acquisitions of leading dairy companies in Spain

and Italy.

• The company is mainly involved in added value dairy products, although also sells powders

derived from its cheese-making activities.

• It secures the majority of its raw milk requirements from direct suppliers.

• Centralised non-manufacturing activities to its Redhill offices in 2010, resulting in the closure

of two offices.

Future challenges and opportunities:

• The Lactalis Group’s activities are concentrated on cheese within Western Europe and it aims

to pursue acquisitions which will allow it to pursue growth in milk product markets and in the

emerging markets of Asia and Latin America.

• The UK company is reliant on the performance of Seriously Strong Cheddar and growth of

the UK branded Cheddar market.

• Further investment in marketing or product development for Seriously Strong may be

necessary to achieve brand leadership.

• The potential for increased import competition for its UK operation exists in the longer term if

Ireland is successful in its strategy to increase total milk production following the removal of

quotas.

• UK Cheese markets will remain competitive with the major retailers looking to streamline

4

Based on Kantar Worldpanel data for the 52-week period ending 2 October 2011.

3

their branded cheese category to build market share in own-label products.

• Faces the challenge of passing rising input costs on to retail customers (within the UK) during

a period of low growth and price sensitivity at consumer level.

• Increasing recruitment activities within its milk field (South-West Scotland) may increase

competition for raw milk suppliers, which may impact on milk price paid to direct suppliers.

• Has the opportunity to develop export sales of its Seriously Strong brand through the use of

other operating companies in the Lactalis group.

4

The Caledonian Cheese Company

Procurement analysis

Milk purchases

The table below gives details of Caledonian Cheese’s5 milk supply base for the 2010/11 milk year.

Direct supplies

Third party supplies

Stranraer

Lubborn

Co-operatives and

other brokers

Million litres

270

13

53

Numbers

175

11

Total

Change from

previous year

336

n.c

186

n.c.

Source: AHDB estimates

Lactalis McLelland Ltd has changed its procurement significantly since 2006 when 80% of milk

was supplied by First Milk. The strategy over recent years has been to source around 20% of milk

through brokers with the remainder coming from producers on direct supply contracts. Brokered

milk is sourced from a number of suppliers such as Milk Link, Grahams and Meadow Foods.

Given the good grazing conditions which occurred during the 2010/11 milk year, combined with

the incentives offered by the company to increase production levels, it is likely that milk deliveries

from direct suppliers increased over the period6. Assuming that producers increased production at

the national rate of 4%, total milk purchases will have been 10m litres higher from direct suppliers

to Stranraer and 1m litres more for suppliers to the Lubborn site. It is assumed that purchases from

third party suppliers will have dropped to compensate for the increase in direct supply volumes

as the Stranraer facility was operating near to full capacity in 2009/10. In the absence of an

increase in production capacity at the site, total volume requirements are unlikely to have changed

significantly.

It has been assumed that the number of producers on direct supply contracts did not change

over the period. Direct suppliers to the company were paid one of highest milk prices during the

2010/11 milk year and the company was offering bonus payments for increased production. It

is therefore unlikely that suppliers would leave under those conditions. The total number of direct

suppliers may be different to that reported as the number of new recruits or retirements is unknown.

Recruitment

The Caledonian Cheese Company has a target to increase its processing capacity at the

Stranraer factory to 390m litres of milk by 2015. This would require 70m litres (21.9%) of

additional milk, of which the majority (60m litres) is expected to come from direct suppliers. The

5

6

All milk purchases for Caledonian Cheese are now done through its procurement arm The Fresh Milk Company Limited.

Changes to milk purchases have been estimated as the company did not provide any information on volumes or producer numbers

for the 2010/11 milk year.

5

company offers bonuses for pre-agreed expansion in order to encourage increased production

from its direct suppliers.

Through the procurement company The Fresh Milk Company Limited, milk for Stranraer is sourced

from a radius of approximately 100 miles around the factory, which equates geographically to

all of Dumfries and Galloway and along the West Coast of Scotland as far as Kilmarnock in East

Ayrshire and Carlisle in Cumbria.

There are no minimum or maximum volume requirements for new suppliers and all farm sizes

and production profiles are considered within the defined recruitment area. The average size of

current suppliers is relatively large at 1.5m litres, although there is a wide range of farm sizes

currently supplying the Stranraer facility.

Contracts

The table below summarises the main features of the supply contracts offered by The Fresh

Milk Company Limited7 for suppliers to the Stranraer factory8. There are three contract options:

Standard, Profile and Seasonal. Which option is better will depending on the milk profile of each

producer.

Standard

Profile

Million litres

270

Producer numbers

175

Cheddar cheese and ingredients

End use

Catchment area

Seasonal

South-West Scotland and North Cumbria

(within a 100 mile radius of Stranraer)

Annual average price

2010/11*

24.18ppl

24.79ppl

24.37ppl

Annual average price

as of Sep 11*

27.49ppl

28.17ppl

27.69ppl

Reasons for price

changes

In response to price changes made by competitors – not linked to returns

from commodity markets

*Based on the DairyCo standard litre (see www.dairyco.org.uk/datum for further details).

Note: Figures relate to the milk year 2010/11.

Contracts are negotiated on a yearly basis and all producers are required to provide a 6-month

forward forecast. As the company is actively encouraging increased production from its

contracted farmers, bonus payments for meeting pre-arranged expansion plans are paid.

7

8

6

The Fresh Milk Company Limited is the procurement arm of Lactalis, and purchases all of the milk used by The Caledonian Cheese

Company Limited for use at its Stranraer and Lubborn factories.

No information was provided about the Lubborn contract. However, it concerns less than 15 farmers.

Price Review

Price changes are made as and when necessary by the company and are usually in response to

changes in the milk price made by competitors. Price setting is not linked to commodity markets

and there is no formal negotiation process in place although direct suppliers have input through

meetings between the company and a supplier group committee. Price decreases are never

introduced retrospectively although the company has occasionally paid a retrospective price

increase.

Prices paid on the Caledonian Cheese supply contracts were competitive during the 2010/11

milk year according to the DairyCo standard litre. Average prices paid by the company were

consistently above the average price paid9 on cheese contracts.

In the 2011/12 milk year, there have been three price increases totalling 2.3ppl, keeping the price

near the top of the DairyCo league table for cheese manufacturers. A further increase of 1.23ppl

was implemented effective November 2011, which makes the price paid for milk on a cheese

contract one of the highest in the industry.

Exit policy

Producers are required to give three months notice to exit and can give this at any time of the year

so that it is genuinely three months. This is shorter than what is typically required by milk buyers in

Britain and provides farmer suppliers more flexabililty to change milk buyers.

Additional benefits

To promote increased milk production, The Fresh Milk Company offers bonus payments for volume

expansion. Pre-agreed expansion qualifies for a bonus set at between +0.1ppl and +0.4ppl

depending on the level of expansion10. Direct suppliers also have access to interest free loans in

the form of an advance of up to six months against the monthly milk cheque.

There is a supplier group committee of seven elected producers who meet on a monthly basis with

Caledonian Cheese. Formal issues by suppliers are raised and discussed through this committee.

Caledonian Cheese makes a point of remaining close to its suppliers, with each producer known

and contacted on a personal basis which it states is one of the benefits of being a relatively small

business unit.

9

10

Average price paid on all cheese contracts recorded in the DairyCo league table, based on its standard litre.

For example 0.4ppl is paid out for pre-agreed expansion of 20%.

7

Highlights...

• Caledonian Cheese paid one of the highest prices on a cheese contract in 2010/11

according to the DairyCo league table.

• The company maintained its 80/20 split between contracted milk purchases and

third party purchases in 2010/11.

• There are no specific size or production profile requirements for potential suppliers,

although its milk field for the Stranrear facility is restricted to within 100 miles of

the site.

• The notice period for suppliers to exit their contract is three months which is one of

the lowest in the industry, providing direct suppliers more flexibility to change milk

buyers.

• The company offers added benefits such as bonuses for agreed expansion and

interest free loans.

8

The Caledonian Cheese Company

Production analysis

Product portfolio

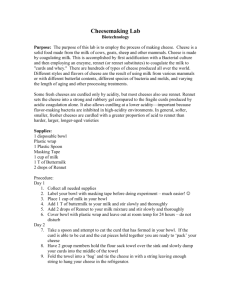

The graph below provides a breakdown of products made at the Stranraer factory. Caledonian

Cheese did not provide updated production figures for the 2010 production year although it can

be assumed that there was no significant increase as the Stranraer facility was already working at

full capacity.

Total milk purchases 320m litres

73%

Cheese

27%

Ingredients

(powders)

10%

Other Cheddar brands

30%

Own-label Cheddar

50%

Seriously Strong Cheddar

10%

Export or food services

While no information was provided by Lactalis on its production portfolio, examination of its

annual accounts and market performance indicate that total cheese production was roughly

equivalent to the previous year.

9

The production capabilities at its main Stranraer facility are currently fully utilised, although

the company aims to improve this through continued investment. It is unknown if there will be

any accompanying increase in drying capacity which would impact on the level of powders

produced.

Production facilities

Stranraer (320m litres)

Facility type

Liquid milk

Cheese

Ingredients/other

Approximation

of milk field

Lubborn (24m litres)

Lactalis McLelland operates two processing plants in the UK located at Stranraer in Scotland

and Lubborn in England. The largest by far is the Stranraer factory which processes Cheddar

cheese and powders, with a capacity to use 320m litres of milk per annum. The Lubborn factory

has a capacity of 24m litres and produces Somerset Brie, Camembert and goats’ cheese. A

third factory in Glan yr Afon was purchased in July 2010 as a joint venture between Lactalis and

Nestlé and produces Rachel’s branded organic yogurts. This factory has a capacity of 15m litres

per year and all of the milk is sourced from milk brokers.

10

According to Caledonian Cheese, the Stranraer plant is running at full capacity at around 1m

litres/day, depending on the time of year. The plant runs at just over 1m litres/day for 8 months of

the year and just under 1m litres/day for the remaining 4 months.

During 2010, £1.4m was invested at the Stranraer factory to improve production efficiencies and

its collection facilities. This follows an investment of £1.3m in the previous year.

Markets

The majority of The Caledonian Cheese Company’s sales are of Cheddar to the GB retail market,

with around 5% sold to the foodservice industry and another 5% exported. Its powders are sold

in both domestic and export markets to the food ingredients sector.

According to Kantar Worldpanel data, the Cheddar retail market was worth in the region of £1.4

billion as of December 2011, with sales volumes up 0.6% and values up 4.7% between December

2010 and 2011. The strength of world commodity markets impacted on cheese prices, driving

prices up at both the retail and wholesale levels. Higher prices, combined with the pressure on

consumer incomes from the economic downturn, impacted on volume sales.

The branded Cheddar segment lost market share to own-label Cheddar in volume terms during

the year ending December 2011, although it gained share in terms of value. Branded Cheddar

had a 46% volume share and 44% value share, losing out on volume sales over the period but

showing growth in total sales value. Own-label Cheddar performed better during the year with

growth in both volume and value sales and finishing the year with a 54% volume share and a

56% value share of the retail Cheddar market.

Lactalis’ portfolio of branded Cheddar products, including its flagship Seriously Strong brand,

performed well in the year ending December 2011, reporting increases in both value and volume

sales according to Kantar Worldpanel data. Its premier brand, Seriously Strong, retained its

position as the second largest branded Cheddar in the GB retail market as of December 2011

and, of the three largest brands, was the only one to show year-on-year growth.

Highlights...

• Caledonian Cheese is dependent on its performance in the Cheddar market which

remained competitive during 2011. However, branded Cheddar products lost market

share to own-label Cheddar during the year.

• Seriously Strong Cheddar gained some market share during the year ending

December 2011, both in terms of value and volume sales and retained its place as

the second largest selling brand.

• Lactalis has opportunities to diversify its income streams with the acquisition of

Lubborn and Rachel’s and through developing export markets through Lactalis’

extensive international network.

11

The Caledonian Cheese Company

Financial analysis

Headline figures

This section looks at the financial performance of Lactalis McLelland Limited as a whole and will

therefore include activities such as the import and sales of continental cheese. Despite this, the

majority of its turnover and profits are generated by UK activities and by the performance of

Caledonian Cheese.

Headline financial figures and ratios have been calculated from the most recent full set of

accounts for Lactalis McLelland Limited. Operating profits do not include gains or losses from

exceptional items, or profits or losses from associated undertakings. The definitions of the financial

figures and ratios are available in the Appendix at the end of the report.

Operating profit...

Profit before tax...

7.0%

5.7%

8.8%

£3.1 million

£38.6 million

£5.5 million

year end 31/12/10

Total equity...

year end 31/12/10

year end 31/12/10

Cash flow...

Cash in: £1.9m

Cash out:£4.0m investments

£6.4m finance

£8.5m

from previous year

• Operating profit for the year ending 31 December 2010 decreased 7.0% from £5.9 million

in previous year.

• While turnover increased sufficiently to cover increasing costs of sales, additional costs

associated with the centralisation of non-manufacturing activities and losses in The

Caledonian Cheese Company Limited impacted on total group profits.

• Pre-tax profits were 5.7% up on the previous year level, due to a combination of lower

financing costs and increased profits from associated businesses.

• Total equity (including pension scheme liabilities) fell by 8.8% compared to last year,

resulting from reduced reserves and increases in borrowings from group undertakings.

12

• Although current assets increased year-on-year, an increase of £44m in long term

borrowings from related companies more than compensated for the £25m reduction in shortterm borrowings.

• Total equity was also impacted by a dividend payout of £2.5 million in 2010. No dividends

had been paid in 2009.

• Cash from operating activities in 2010 was down from £21.8million, a decrease of 92%.

• The reduction in cash from operating activities was mainly due to the increase in stocks (up

£6.9 million), the increase in debtors (up £7.1 million), and a reduction in creditors (down

£7.8 million).

• The payment of £2.5m in dividends on the previous year’s profits also impacted cash flow.

Financial Ratios

Profitability ratios

Gross margin 15.9%

• Gross profit margin

up from 14.9% in

previous year.

• This ratio is

comparable to other

processors with a

similar production

profile.

• Production efficiencies

may have helped to

reduce the impact of

rising costs of raw

materials.

Pre-tax profit

margin 1.7%

• The pre-tax profit

margin ratio has not

changed from 2009

results.

• Indicates that UK

operations did not

generate high returns

during the year,

impacted by the

difficulty in passing

on rising costs to

customers.

• The low net margin

percentage is not

of concern as the

company holds large

reserves and has the

support of its parent

company.

Return on capital

employed (ROCE)

5.2%

• The return on capital

employed has

decreased from the

previous year (9.1%)

as a result of an

increase in long-term

borrowings.

• This ratio shows that

profitability for the

UK division of Lactalis

has declined from the

previous year.

13

Debt ratios

Quick ratio 0.76

Current ratio 2.42

Gearing 63.4%

• The quick ratio has

increased from last

year (0.44) due to the

high value of cheese

stocks.

• The current ratio is

higher than last year

(1.52), impacted by

an increase in the

value of stocks.

• Gearing has

increased significantly

from 34.3% in 2009.

• The ratio indicates

that in the absence

of stocks, short-term

debt obligations

would not be fully met

from available liquid

assets.

• Ratio shows a healthy

liquidity position

when cheese stocks

are included in

current assets.

• Gearing is at a

higher level due to

the large increase in

long-term debt.

• It must be considered

that the majority of

the company’s longterm debt is owed to

group undertakings,

rather than

commercial loans.

Efficiency ratios

Debtor days 49.2

Creditor days 25.2

• This stood at 44.2

days in 2009,

indicating an increase

in trade debt relative

to turnover.

• Creditor days

increased compared

to the previous

year’s figure of 22.0

(not accounting for

amounts owed to

group undertakings

or accruals).

• Trade debt will have

been impacted by

increased wholesale

prices for cheese.

• The ratio is similar

to other companies

within the industry.

14

• Including accruals,

the figure rises to

42.5 (38.1 in 2009),

which remains in

line with industry

averages.

Return on total

assets 3.5

• The return on total

assets has dropped

from 4.1 in the

previous year.

• Indicates that for

every £1 invested

by the company, it

generated £3.50 of

operating revenues in

the financial year.

• The company’s

tangible assets have

not changed year-onyear, while increases

in current assets are

linked to the higher

value of stocks and

trade debt.

Highlights...

• Ratios suggest that profitability has declined. The company’s financial success for the

2010 financial year is likely to have been affected by the challenging conditions in

the Cheddar market.

• Debt levels have increased to support the company’s investments although the

majority of debt is within the Lactalis Group.

• Operating from within a large international dairy business allows the UK enterprise

to continue to invest in production efficiencies and marketing in order to maintain its

competitiveness through challenging economic conditions.

• Stock values and trade debtors both increased in the year in line with higher

wholesale prices for Cheddar. The higher stock value may also be an indication that

stock levels have increased.

15

Annex 1 - Financial ratio calculations.

Financial headline

figures and ratios Calculation

Interpretation

Operating Profit

Turnover less cost

of sales (including

overhead costs). NOT

including exceptional or

non-recurring items.

Profit after cost of

sales and overhead

expenses (not including

exceptional items) but

before interest and tax.

Indicates the efficiency to which

a company generates profits from

operating activities.

Pre-tax Profit

Profit before tax.

Profit after all costs,

including finance costs,

exceptional and nonrecurring items, but

before taxes and not

accounting for actuarial

gains/losses from

pensions.

The profits available to be disbursed

to shareholders or added to reserves

(before tax).

Total Equity/

Member Reserves

Issued capital plus

reserves and revenue

reserves.

Shareholders or

members’ funds.

Needs to be examined in light of the

direction of change over the past two

to three years.

Gross margin

(Gross profit* (Turnover

less cost of sales)/

Turnover) x 100

Shows how much it

costs to get goods and

services ready for sale.

Indicates the amount of money the

company has available for overheads

from its turnover.

Pre-tax profit

margin

(Pre-tax Profit/Turnover)

x 100

Shows how efficient

the company is at

generating profits from

sales.

Indicates the amount of money the

company has available for purposes

of taxes and dividends, and also for

re-investing in the company.

Return on capital

employed (ROCE)

Operating profit

(as above)/Capital

Employed (equity** plus

long term loans)

Measures performance

as a whole, taking into

account all sources of

funding.

Considered a good measure of

efficiency.

Quick Ratio

(Current Assets –

Inventories)/Current

Liabilities

Similar to Current Ratio

but with stocks removed

(stocks are traditionally

less liquid).

As per Current Ratio. Can vary due to

nature of inventories as some are more

available for sale than other (i.e. butter

v. Cheese).

Current Ratio

Current Assets/Current

Liabilities

Indication of business

liquidity.

Values greater than one indicate

sufficient liquidity to meet current

liabilities. Large businesses can operate

at lower levels than smaller businesses.

Gearing

Long term loans/Capital

Employed (equity** plus

long term loans)

Debtor Days

Trade Receivables x

365/Turnover

Measures how long, on

average, it takes for the

company to collect its

debts.

Generally should be lower than

creditor days. If it is rising, raises

questions about the company’s ability

to collect money and may induce cash

flow problems.

Creditor Days

Trade Payables x 365/

Cost of Sales

Measures how long,

on average, it takes for

the company to pay its

creditors.

Generally should be higher than debtor

days.

Return on total

assets

Operating profit x 100/

Fixed assets + Current

assets

Measures how efficient

the company is at

generating revenues

from its assets.

If there is a large gap between Return

on assets and Return on capital

employed, this can indicate that assets

are run down. Should be assessed in

terms of how it has changed over time;

should be increasing as assets should

not be held if they do not generate

revenue. New assets will cause ratio to

fluctuate.

* Not including distribution and administration costs

**For co-operatives, equity is equivalent to member reserves

16

Description

17

18

While the Agriculture and Horticulture Development Board, operating through its DairyCo division, seeks to ensure that the information

contained within this document is accurate at the time of printing, no warranty is given in respect thereof and, to the maximum extent

permitted by law, the Agriculture and Horticulture Development Board accepts no liability for loss, damage or injury howsoever caused

(including that caused by negligence) or suffered directly or indirectly in relation to information and opinions contained in or omitted

from this document.

Copyright, Agriculture and Horticulture Development Board 2012. No part of this publication may be reproduced in any material form

(including by photocopy or storage in any medium by electronic means) or any copy or adaptation stored, published or distributed

(by physical, electronic or other means) without the prior permission in writing of the Agriculture and Horticulture Development Board,

other than by reproduction in an unmodified form for the sole purpose of use as an information resource when DairyCo is clearly

acknowledged as the source, or in accordance with the provisions of the Copyright, Designs and Patents Act 1988. All rights reserved.

AHDB® is a registered trademark of the Agriculture and Horticulture Development Board.

DairyCo® is a registered trademark of the Agriculture and Horticulture Development Board, for use by its DairyCo division.

All other trademarks, logos and brand names contained in this publication are the trademarks of their respective holders. No rights are

granted without the prior written permission of the relevant owners.

19

Agriculture and Horticulture

Development Board

Stoneleigh Park

Kenilworth

Warwickshire

CV8 2TL

T:024 7669 2051

E:info@dairyco.ahdb.org.uk

www.dairyco.org.uk

DairyCo is a division of the Agriculture

and Horticulture Development Board