Finance 516

advertisement

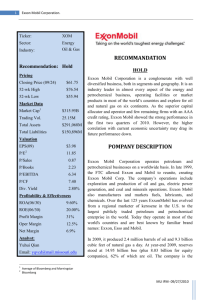

Finance 516: Week 2: Mini Case Assignment 1. Exxon Mobil Corporation (XOM): Major Integrated Oil & Gas [ENERGY] Exxon Mobil Corporation (XOM) is headquartered in Irving Texas; website: www.exxonmobil.com. Exxon Mobil is a member of the Dow Jones Composite Dow Industrials in the Basic Materials Sector as a leading member of the Major Integrated Oil & Gas Industry and/or Energy sector. 2. What are the operating risks of the company? As a global producer of oil, gas, and petrochemical businesses there are risks within and not within the Company’s control which could negatively impact Exxon Mobil Corporation’s business. Risk factors include: Economic, Government and Political, Legal, and Management Effectiveness, and additional operational risks. Management Effectiveness and operational risks being within Exxon’s scope of control consist of exploration and development programs and Exxon’s ability to maintain and grow oil and gas production. Project management and the ability to negotiate ventures, partners, optimize performance, develop markets, limit costs most specifically on third party equipment or services. ExxonMobil’s ability to operate efficiently and manage expenses while improving yield continuing to enhance productivity and manage assets is vital. Each aspect of operations are all potential risks also considerations in research and development, safety, business controls, and environmental risk management, and preparedness for weather events, natural disasters, and human error. i 3. Exxon Mobil Corporation Financial Information: Solvency, and Liquidity. Ratio Current Ratio Debt / Total Capitalization Debt Ratio Debt to Equity Ratio Times-interest-earned Ratio = = = = = 94.14% = 9.58% = 51.44% = 105.95% = 296.59 = Long-term debt Notes and loans payable $ $ Total debt / / / / / Current Liabilities Total debt / (Total SE + Total debt) Total Assets (Total Assets - Total Liabilities) Interest Expenses Total Assets Total Liabilities $ $ 331,052,000,000 170,308,000,000 $ 17,033,000,000 Total Stockholders' Equity Total debt $ $ 160,744,000,000 17,033,000,000 NC interests share (A/L) XOM share of equity debt $ $ Total Capitalization before XYZ $ 177,777,000,000 $ 331,052,000,000 $ 72,963,000,000 $ 170,308,000,000 $ 77,505,000,000 Price as of 12/31/2011 Shares Issued Total Market Capitalization $ Total Assets Total Current Assets Total Liabilities Total Current Liabilities $ 83.18 8,019,000,000 667,020,420,000 Treasury Stock Treasury Stock Value $ 3,285,000,000 273,246,300,000 Market Capitalization $ 393,774,120,000 ii Income before income taxes Interest Expenses 9,322,000,000 7,711,000,000 Current Assets LT Debt + Notes & Loans Payable Total Liabilities Total Liabilities EBIT 7,314,000,000 4,943,000,000 $ 73,257,000,000 $ 247,000,000 4. Exxon Mobil Corporation does not have any preferred stock. 5. Exxon Mobil Corporation Capital Structure: As listed in section 3. Exxon Mobil Corporation capital structure (debt to total capitalization) is 9.58%: $17,033,000,000 (Total Debt) / $177,777,000,000 (Total Stockholders’ Equity + Total Debt). Exxon’s debt situation can be itemized with: Interest Expenses: $247,000,000; Long-Term Debt: $9,322,000,000; Notes and Loans payable: $7,711,000,000. Market capitalization: $393,774,120,000 less Treasury Stock st of $273,246,300,000 make a total of $667,020,420,000 capitalization on December 31 , 2011 at the closing market price of $83.18. Exxon Mobil has 8,019,000,000 shares issued with 4,734,000,000 shares iii outstanding. Additionally, .13% of shares held by insiders, 49.30% held by institutions, 41.29M short (August 31, 2012) and a short ratio of 3.80. 6. What is the company’s current actual Beta? Date S&P 9/4/2012 1465.77 8/1/2012 1406.58 7/2/2012 1379.32 6/1/2012 1362.16 5/1/2012 1310.33 4/2/2012 1397.91 3/1/2012 1408.47 2/1/2012 1365.68 1/3/2012 1312.41 12/1/2011 1257.6 11/1/2011 1246.96 10/3/2011 1253.3 9/1/2011 1131.42 8/1/2011 1218.89 7/1/2011 1292.28 6/1/2011 1320.64 5/2/2011 1345.2 XOM 92.3 87.3 86.29 85.02 78.12 85.2 85.58 85.35 82.18 83.18 78.94 76.18 70.86 72.21 77.33 78.87 80.9 S&P XOM -4.04% -5.42% -1.94% -1.16% -1.24% -1.47% -3.80% -8.12% 6.68% 9.06% 0.76% 0.45% -3.04% -0.27% -3.90% -3.71% -4.18% 1.22% -0.85% -5.10% 0.51% -3.50% -9.72% -6.98% 7.73% 1.91% 6.02% 7.09% 2.19% 1.99% 1.86% 2.57% Exxon Mobil 10.00% y = 0.8757x - 0.0028 R² = 0.5559 8.00% 6.00% 4.00% 2.00% 0.00% -15.00% -10.00% -5.00% -2.00%0.00% Exxon Mobil 5.00% 10.00% Linear (Exxon Mobil) -4.00% -6.00% -8.00% -10.00% Exxon Mobil current beta as calculated from September 1, 2011 to September 4, 2012 is 0.8757. 7. Using the Hamada Formula find the unlevered Beta for Exxon Mobil. BU = B / [1 + (1 – T) (wd / ws)] BU = 0.8757 / [1 + (1 – 0.35) (0.0958 / 0.9042)] BU = 0.8757 / [1 + (0.65) (0.1059500110595001)] BU = 0.8757 / (1 + 0.0688675071886751) BU = 0.8757 / (1.0688675071886751) BU = 0.8192783428352665 = unlevered Beta using Marginal Tax Rate. BU = 0.8757 / [1 + (0.54) (0.1059500110595001)] BU = 0.8757 / (1 + 0.0572130059721301) BU = 0.8757 / (1.0572130059721301) BU = 0.8283099007042342 = unlevered Beta using Exxon Mobil Effective Tax Rate. iv 8. What is the company’s current marginal Tax Rate? The marginal Tax Rate for Exxon Mobil Corporation is 0.35. The effective tax rate for Exxon Mobil Corporation is approximately 0.46 (0.4647983768704032). The effective tax rate was calculated with figures: $36,654,000,000 / $78,860,000,000. (Total income taxes/Total income before taxes) v 9. What is the Cost of Debt, before and after taxes? For our intents and purposes Exxon Mobil Corporation Cost of Debt can be considered 3.54% before vi taxes. Considering a marginal tax rate of 0.35 Exxon Mobil Corporation Cost of Debt after taxes would be = 3.54% (0.65) or 2.30%. The cost of debt was calculated using the following data: Long-term debt 6.250% notes 4.625% notes 5.750% notes 4.900% notes 5.000% notes 5.300% notes 5.650% notes 5.500% notes 6.500% notes 6.100% notes 6.750% notes 6.375% notes .2% interest .3% interest 4.2% interest 3.2% interest 8.625 debentures .1% interest 4.8% interest 8.5% interest Amount Rate Interest $ 698,000,000.00 0.0625 $ 43,625,000.00 $ 145,000,000.00 0.04625 $ 6,706,250.00 $ 346,000,000.00 0.0575 $ 19,895,000.00 $ 260,000,000.00 0.049 $ 12,740,000.00 $ 138,000,000.00 0.05 $ 6,900,000.00 $ 255,000,000.00 0.053 $ 13,515,000.00 $ 222,000,000.00 0.0565 $ 12,543,000.00 $ 402,000,000.00 0.055 $ 22,110,000.00 $ 506,000,000.00 0.065 $ 32,890,000.00 $ 203,000,000.00 0.061 $ 12,383,000.00 $ 317,000,000.00 0.0675 $ 21,397,500.00 $ 241,000,000.00 0.06375 $ 15,363,750.00 $ 972,000,000.00 0.002 $ 1,944,000.00 $ 311,000,000.00 0.003 $ 933,000.00 $ 543,000,000.00 0.042 $ 22,806,000.00 $ 413,000,000.00 0.032 $ 13,216,000.00 $ 248,000,000.00 0.08625 $ 21,390,000.00 $ 2,315,000,000.00 0.001 $ 2,315,000.00 $ 496,000,000.00 0.048 $ 23,808,000.00 $ 260,000,000.00 0.085 $ 22,100,000.00 $ 9,291,000,000.00 non-rated obligations $ 31,000,000.00 total LT debt Cost of Debt Cost of Debt * MT rate $ 328,580,500.00 $ 9,322,000,000.00 3.54% 2.30% In contrast of the simple calculation from the income statement and balance sheet: $247,000,000 / $9,322,000,000 yielding a cost of debt ratio of 2.65% which provides an even less accurate number than above. Unfortunately in my opinion both numbers are highly inaccurate without further analysis unable to be completed before submission of this assignment. This uncertainty is caused by the inability to determine XOM’s “Consolidating and Eliminating Adjustments” of $4,844,000,000 in interest expense. 10. Exxon Mobil Corporation does not have preferred stock. 11. Cost of Equity rs = rRF + (RPM)bi vii Using the 10 year Treasury bond rate for rRF = 1.64% . Given required rate of return = rM = Expected rate viii of return = rM = D1 / P0 + g. Using D1 as 1.93% (S&P 500 current yield rate) and g = .0164 – (-.00637) ix current TIPS 10-year yield + a population growth of .01 & .025. Midpoint = (.01 + .0164 + .00637) & (.025 + .0164 + .00637) = Midpoint (0.03277, 0.04777) = 0.04027. rM = .0193 + .04027 = 0.05957. RPM = rM – rRF = 0.05957 - .0164 = 0.04317. Given bi = 0.8757. rs = 0.0164 + (0.04317) * 0.8757 rs = 0.0164 + 0.037803969 rs = 0.054203969 Cost of Equity = rs = 5.42% 12. Dividend yield Exxon Mobil issued 4 dividends in 2011. Three dividends were issued in the amount of $.47 per share and one in the amount of $.44 per share = $1.85 annual dividends per share. At years end Exxon Mobil Corporation stock price was $83.18. Exxon Mobil Corporation’s dividend yield = $1.85 / 83.18 = 2.22%. 13. Weighted Average Cost of Capital WACC = wdrd(1-T) + wsrs WACC = (0.0958 * 0.0230) + (0.9042 * 0.0542) WACC = 0.0022034 + 0.04900764 WACC = 0.05121104 WACC = 5.12% 14. Price/Earnings Ratio Based on a Net Income attributable to Exxon Mobil of $41,060,000,000 and a shares issued number of 8,019,000,000 less 3,285,000,000 treasury stock equaling 4,734,000,000 the P/E ratio was calculated by dividing $41,060,000,000 by 4,734,000,000 equaling $8.67 EPS. Per Exxon Mobil Corporation’s Notes to x Consolidated Financial Statements note 11 EPS was calculated at $8.43. This EPS was calculated by $41,060,000,000 being divided by the weighted average number of common shares outstanding of 4,870,000,000. In this analysis of XOM an EPS of $8.67 will be considered. 15. Exxon Mobil Corporation five year stock performance: XOM 90 80 70 60 50 40 30 20 10 0 rd rd From January 3 , 2006 to January 3 , 2012 XOM has the following performance: $54.17 on 01/03/06, $65.21 on 01/03/07, $76.76 on 01/02/08, $69.77 on 01/02/09, $60.14 on 01/04/10, $77.34 on 01/03/11, rd rd and $84.16 on 01/03/12. From January 3 , 2006 to January 3 , 2012 XOM’s stock increased 55.36%. th With an adjusted close of $92.30 on September 14 , 2012 XOM continues to have upward momentum. 16. XOM overall risk structure: Operating Risks and Financial Risk As stated in section 2 of this analysis XOM’s operating risks are driven by large exposure to multiple markets, economic, and political bodies. Given these factors Exxon Mobil Corporation has a highly complex capital structure, and tax strategies. With any sophisticated corporation there are financial risks though XOM appears to have a definitive capital management plan leveraging extremely low financing options when available and taking a very long-term approach towards business growth. Exxon Mobil’s capital structure consists of 49.30% held by institutions and approximately 36.50% holdings of treasury stock. Given this information retail investors make an extremely small percentage of ownership in XOM. With a beta of 0.8757 Exxon could be considered a less risky investment than an S&P 500 ETF. With these risks in mind additional research would be recommended into the terms and conditions of the three long-term debt instruments on the balance sheet with .3% interest; totaling $3,598,000,000 and accounting for more than a third of Exxon’s debt. Research into the $.24 EPS variance provided in the financial statements (possibly due to non-controlling interests) and gaining further understanding of Exxon’s tax strategies (theoretical rate: 35% versus effective rate 46%) would be recommended. 17. Investment Recommendation Exxon Mobil Corporation’s financials and continued strength of earnings would warrant a buy recommendation. Using the conservative growth rate of 4.03% the target price for XOM is $97.29. As of th the adjusted close on September 14 , 2012 XOM’s was $92.30 trading $4.99 less than conservative estimates would suggest the stock should be trading. Given the current market conditions and transfer of wealth into stocks Exxon Mobil is poised to continue increasing in value. 18. Bibliography i ITEM 1A. Risk Factors. Edgar Online: 2011 10-K: http://yahoo.brand.edgaronline.com/displayfilinginfo.aspx?FilingID=8435925-17348-31992&type=sect&tabindex=2 ii Information obtained from the “Income Statement” & “Balance Sheet.” Edgar Online: 2011 10-K: IS: http://yahoo.brand.edgar-online.com/displayfilinginfo.aspx?FilingID=8435925-293284296671&type=sect&tabindex=2 & http://yahoo.brand.edgar-online.com/displayfilinginfo.aspx?FilingID=8435925297158-302356&type=sect&tabindex=2 iii Same as endnote ii; with additional information following endnote from: http://finance.yahoo.com/q/ks?s=XOM+Key+Statistics. Some statistics calculated from quarterly reports. All ratios and numbers calculated in this document aside from these are from Edgar Online: 2011 10-K. iv Yahoo Historical Prices: XOM: http://finance.yahoo.com/q/hp?s=XOM&a=08&b=14&c=2011&d=08&e=14&f=2012&g=m & Yahoo Historical Prices: ^GSPC: http://finance.yahoo.com/q/hp?s=^GSPC&a=08&b=14&c=2011&d=08&e=14&f=2012&g=m . v http://www.irs.gov/pub/irs-pdf/i1120.pdf : Tax is 35% for corporations with income greater than: $18,333,333. Additional information from: Edgar Online: 2011 10-K http://yahoo.brand.edgaronline.com/displayfilinginfo.aspx?FilingID=8435925-324357-657181&type=sect&dcn=0001193125-12-078102 Note 18. Theoretical tax rate confirmed and effective rate of 46% obtained. vi 3.54% Cost of Debt calculated by using interest rates provided in section 13 of the Notes to Consolidated Financial Statements: http://yahoo.brand.edgar-online.com/displayfilinginfo.aspx?FilingID=8435925-324357657181&type=sect&tabindex=2 . vii Bankrate.com: http://www.bankrate.com/rates/interestrates/treasury.aspx?ec_id=m1104701&ef_id=bkpO3YmwsGUAAIrb:20120917081005:s viii http://www.multpl.com/s-p-500-dividend-yield/ . ix http://www.treasurydirect.gov/RI/OFNtebnd . x http://yahoo.brand.edgar-online.com/displayfilinginfo.aspx?FilingID=8435925-324357657181&type=sect&tabindex=2 Notes to Consolidated Financial Statements: Information obtained from Note 11.