Daily Call

advertisement

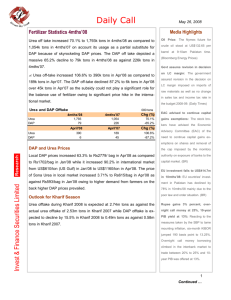

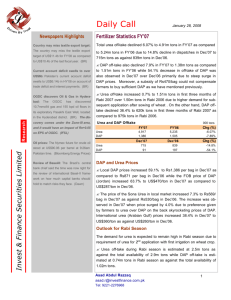

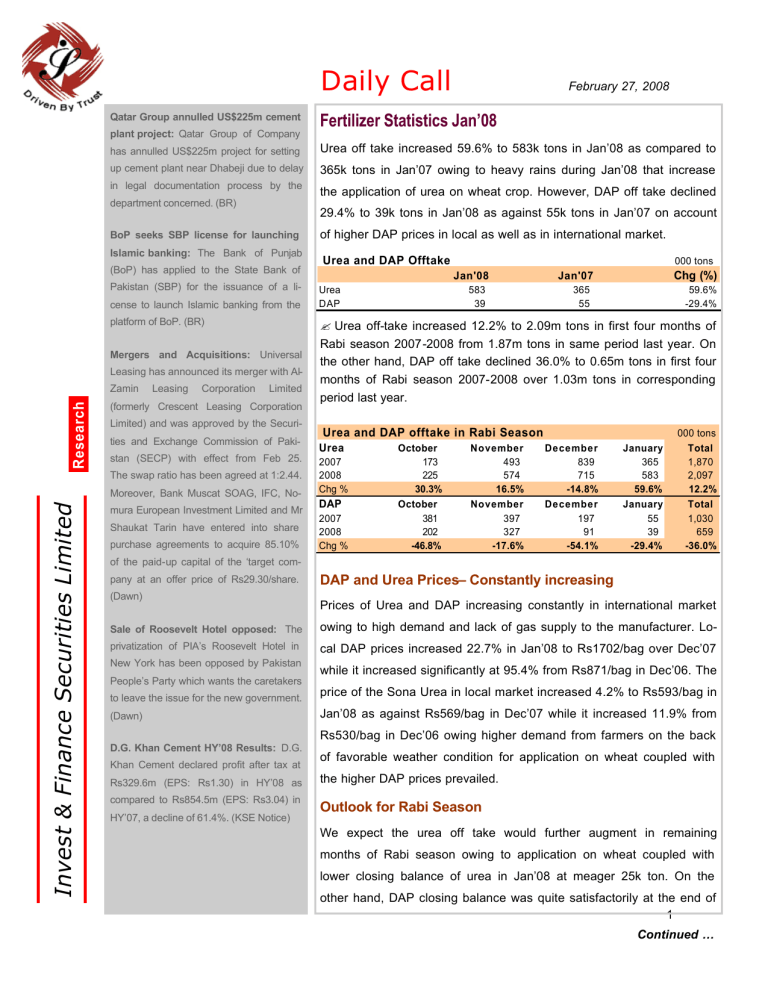

Daily Call Qatar Group annulled US$225m cement plant project: Qatar Group of Company Urea off take increased 59.6% to 583k tons in Jan’08 as compared to up cement plant near Dhabeji due to delay 365k tons in Jan’07 owing to heavy rains during Jan’08 that increase department concerned. (BR) Islamic banking: The Bank of Punjab (BoP) has applied to the State Bank of Pakistan (SBP) for the issuance of a license to launch Islamic banking from the platform of BoP. (BR) Mergers and Acquisitions: Universal Leasing has announced its merger with AlZamin Leasing Corporation the application of urea on wheat crop. However, DAP off take declined 29.4% to 39k tons in Jan’08 as against 55k tons in Jan’07 on account BoP seeks SBP license for launching Research Fertilizer Statistics Jan’08 has annulled US$225m project for setting in legal documentation process by the Limited (formerly Crescent Leasing Corporation Limited) and was approved by the Securities and Exchange Commission of Pakistan (SECP) with effect from Feb 25. The swap ratio has been agreed at 1:2.44. Moreover, Bank Muscat SOAG, IFC, No- Invest & Finance Securities Limited February 27, 2008 mura European Investment Limited and Mr Shaukat Tarin have entered into share purchase agreements to acquire 85.10% of higher DAP prices in local as well as in international market. Urea and DAP Offtake 000 tons Jan'08 Urea DAP 583 39 Chg (%) Jan'07 365 55 59.6% -29.4% ? Urea off-take increased 12.2% to 2.09m tons in first four months of Rabi season 2007-2008 from 1.87m tons in same period last year. On the other hand, DAP off take declined 36.0% to 0.65m tons in first four months of Rabi season 2007-2008 over 1.03m tons in corresponding period last year. Urea and DAP offtake in Rabi Season Urea 2007 2008 Chg % DAP 2007 2008 Chg % October 173 225 30.3% October 381 202 -46.8% November 493 574 16.5% November 397 327 -17.6% December 839 715 -14.8% December 197 91 -54.1% January 365 583 59.6% January 55 39 -29.4% 000 tons Total 1,870 2,097 12.2% Total 1,030 659 -36.0% of the paid-up capital of the ‘target company at an offer price of Rs29.30/share. (Dawn) DAP and Urea Prices– Constantly increasing Prices of Urea and DAP increasing constantly in international market Sale of Roosevelt Hotel opposed: The owing to high demand and lack of gas supply to the manufacturer. Lo- privatization of PIA’s Roosevelt Hotel in cal DAP prices increased 22.7% in Jan’08 to Rs1702/bag over Dec’07 New York has been opposed by Pakistan while it increased significantly at 95.4% from Rs871/bag in Dec’06. The People’s Party which wants the caretakers to leave the issue for the new government. (Dawn) price of the Sona Urea in local market increased 4.2% to Rs593/bag in Jan’08 as against Rs569/bag in Dec’07 while it increased 11.9% from Rs530/bag in Dec’06 owing higher demand from farmers on the back D.G. Khan Cement HY’08 Results: D.G. Khan Cement declared profit after tax at Rs329.6m (EPS: Rs1.30) in HY’08 as compared to Rs854.5m (EPS: Rs3.04) in HY’07, a decline of 61.4%. (KSE Notice) of favorable weather condition for application on wheat coupled with the higher DAP prices prevailed. Outlook for Rabi Season We expect the urea off take would further augment in remaining months of Rabi season owing to application on wheat coupled with lower closing balance of urea in Jan’08 at meager 25k ton. On the other hand, DAP closing balance was quite satisfactorily at the end of 1 Continued … Jan’08 and stood at 303k tons. Urea off-take during Rabi season is estimated at 2.71m tons as against the total availability of 3.04m tons while DAP off-take is estimated at 0.75 tons in Rabi season as against the total availability of 0.99m tons. Asad Abdul Razzaq asad.r@investfinance.com.pk Tel: 9221-2276968 2 Market Statistics KSE Statistics Market Capt. US$74.46b KSE-100 Index 26-Feb-08 Rs 4633.06b 12 m 15,056.1 Amount (Rs b) Last Closing 14,947.5 Volume (m) 54.6 606.4 108.6 Average Rate 0.7% 11.3% 12 mths Chg % 28.8% NBP 8.1b, 11.1% PPL 5.2b, 11.1% 15,056.1 AHSL 4.3b, 11.1% 12 mths Low 10,899.7 BOP 3.9b, 11.3% Futures 66.5 Total 3.5b, 11.2% Futures 265.7 332.2 Open Int. (Rs b) 11.9 Last Day Open Int. (Rs b) 10.6 Open Int. (m sh.) 78.6 YTD Average 241.4 Top Gainers 12 mths Average 258.4 SNL Top Losers (+ 6.0%) BIPL (- 1.9%) ENGRO (+ 5.0%) TRG (- 1.5%) 12 mths High 524.6 DSL (+ 5.0%) AHL (- 0.9%) 12 mths Low 59.1 NML (+ 5.0%) NIB (- 0.7%) Global Markets Index Origin DOW JONES New York NIKKIE-225 Tokyo DAX Frankfurt FTSE-100 London CAC-40 Paris SSEC Shanghai SMSI Madrid SENSEX Mumbai KS11 Seoul IPC Mexico AORD Sydney BVSP São Paulo RTS Moscow OXMS Stockholm Hang Seng Hong Kong Strait Times Singapore KLSE Kuala Lumpur MERVAL Buenos Aires CCSI Cairo 10.49% 90.62 978.23 Top Inflows USA 10.71% Amount (b), Rate 12 mths High Ready YTD Flow 10.13% 10.25% FY'07 Flow 6 months Kibor 12 months Kibor 10.2% Trading Volume Feb'07 3 months Kibor 10.26% YTD Chg % 13,203.6 POL SCRA Position (m US$) Current Top 5 CFS Stocks (last day) 12 mths Average Interest Rates Continuous Funding System Current Closing Chg Chg % 49.0% Other Domestic Market Indicators 10.91% 3 years PIB 419.33 Kuwait 44.84 Luxembourg 15.71 10.15% 9.75% Camyan Island 10.55% 9.85% Top Outflows 6.10 5 years PIB 10 years PIB 11.15% 10.03% Exchange Rates Feb'07 Current Chg % US Dollar 62.53 2.91% UK (237.42) B.V Island 49.87 Important Board Meetings OGDC 27-Feb-08 Atlas Honda 60.76 27-Feb-08 PTCL 27-Feb-08 The Bank of Punjab 28-Feb-08 Euro 92.85 79.65 16.57% Sui Southern Gas Yen 0.58 0.51 Pak Suzuki Motor Co. 28-Feb-08 13.33% National Bank 29-Feb-08 Yuan 8.78 7.85 11.85% 28-Feb-08 Allied Bank Ltd. 29-Feb-08 Commodities Current 4,321.8 13,824.7 6,986.0 6,087.4 4,973.0 4,973.1 1,455.0 17,806.2 1,709.1 30,288.1 5,745.8 65,183.0 2,096.3 318.6 23,714.8 3,077.8 1,375.4 2,151.4 3,659.8 Last 12 mths Chg Chg 1.0% -0.6% -0.6% -24.1% 1.5% -0.6% 1.5% -5.4% 1.1% -13.7% 13.8% 63.6% 2.0% -11.8% 0.9% 30.5% 0.0% 16.3% 0.9% 7.8% 0.8% -4.6% 0.3% 41.1% 0.8% 6.4% 1.9% -19.7% 1.9% 15.6% 0.4% -7.0% 0.3% 8.1% 1.4% -3.0% 1.2% 44.6% Index Origin Gold London Silver London Copper London Oil OPEC Basket Natural Gas Nymex Coal South Africa Wheat India Sugar Belgaum Cotton Karachi Urea Black Sea Current 934.00 1,812.00 8,270.00 93.63 9.20 114.59 1,108.40 1,372.35 3,175.00 329.00 Last 12 mths Chg Chg -1.4% 0.3% 0.3% 1.1% 0.2% -2.8% 0.2% 0.0% 0.0% 0.3% 36.5% 24.3% 32.3% 64.4% 42.0% 122.4% -5.5% -9.9% 25.7% 8.9% Invest & Finance Securities Limited 12th Floor, Corporate Towers, Technocity Building, Hasrat Mohani Road, Off. I.I. Chundrigar Road. Karachi. Tel: 9221- 2276932-35 Fax: 9221- 2276969 website: www.investfinance.com.pk 3 Disclaimer: This report is for information purposes only and we are not soliciting any action based upon it. The material is based on information we believe to be reliable but we do not guarantee that it is accurate and complete. Invest & Finance Securities Ltd. will not be responsible for the consequence of reliance upon any opinion or statement herein or for any omission.