No Slide Title - Piper Jaffray

U.S. Bancorp Piper Jaffray

Technology/Communications M&A Weekly

November 18, 2002

Technology/Communications Mergers & Acquisitions

David Jacquin - Managing Director, Group Head, 415-277-1505, djacquin@pjc.com

Hugh Hoffman - Managing Director, 612-303-6319, hhoffman@pjc.com

Jason Hutchinson - Managing Director, 415-277-1510, jhutchinson@pjc.com

Steve Rickman - Managing Director, 612-303-6258, srickman@pjc.com

Eric Nicholson - Principal, 612-303-6378, enicholson@pjc.com

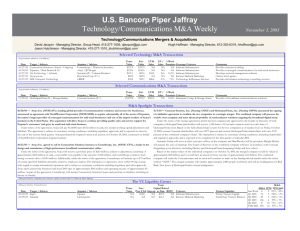

Selected Technology M&A Transactions

(Approximate valuations, $ in millions)

Date Target / Advisor

11/12/02 InterTrust Technologies Corp

11/15/02 Consumer Network Services (EDS)

11/13/02 Terraspring Inc

11/12/02 American Management-Energy

11/13/02 Inktomi-Search Software / CSFB

*Assumes enterprise value equal to equity value.

Acquiror / Advisor

Fidelio Acquisition Co LLC

Fiserv (#)

Sun Microsystems Inc (#)

Wipro Ltd / MSDW

Verity Inc / SG Cowen

Trans.

Value

$448.6

$320.0

$35.0

$26.0

$25.0

Ent.

Value

LTM

Sales

$323.8

$11.7

$320.0 * $150.0

NA

NA

NA

NA

NA

NA

EV /

Sales

NM

2.1x

NA

NA

NA

1-Week

Premium Universe

30.8% Technology and Business Services

NA Technology and Business Services

NA Software Infrastructure

NA Other

NA Software Applications

Comments

Sony and Phillips acquire intellectual property holder InterTrust.

Provide electronic fund transfer (EFT) services.

Developer of infrastructure automation software.

Acquisition enhances Wipro's Energy & Utility IT service offerings.

Verity purchases Inktomi's enterprise search software business.

Selected Communications M&A Transactions

(Approximate valuations, $ in millions)

Date Target / Advisor

11/12/02 Corning Prec. Lens/JPM/Goldman

11/17/02 Asia Global Crossing

11/13/02 Arris Interactive LLC-Cert Ast

Acquiror / Advisor

3M Co / Lehman Brothers

China Netcom

Scientific-Atlanta Inc (#)

Trans.

Value

$850.0

$270.0

$37.5

Ent.

Value

NA

NA

NA

LTM

Sales

NA

NA

NA

EV /

Sales

NA

NA

NA

1-Week

Premium Universe

NA Optical & Electronic Manufacturing Tech

NA Communication Services

NA Packet Infrastructure & Applications

Comments

3M purchases Corning Precision Lens for $850 million.

China Netcom investor group purchases Asia Global Crossing out of bankruptcy.

Scientific-Atlanta purchases Network Technologies business of Arris.

M&A Spotlight Transactions

11/13/02 - Fidelio Acquisition Company, LLC, a company formed by Sony Corporation of America, a subsidiary of Sony Corporation

(NYSE: SNE), Royal Philips Electronics (AEX: PHI, NYSE: PHG) and certain other investors, has executed a definitive agreement to acquire InterTrust Technologies Corporation (NASDAQ: ITRU). As a result of the transaction, Fidelio will acquire all of the outstanding common stock of InterTrust for approximately $453 million on a fully diluted basis or $4.25 per share.

The most important objective of the transaction is to enable secure distribution of digital content by providing wider access to InterTrust's key

Digital Rights Management (DRM) intellectual property on a fair and reasonable basis. InterTrust is a leading holder of intellectual property in

DRM. The company holds 26 U.S. patents and has approximately 85 patent applications pending worldwide. InterTrust's patent portfolio covers software and hardware technologies that can be implemented in a broad range of products that use DRM, including digital media platforms, web services and enterprise infrastructure.

InterTrust's Board of Directors has unanimously approved the acquisition and has determined that the transaction is advisable and in the best interest of its shareholders. All InterTrust board members owning shares, including Victor Shear, Founder and Chairman of the board of directors, have agreed to tender all their shares of InterTrust common stock, representing approximately 20% of the outstanding common stock, in favor of the transaction. The acquisition, which is subject to customary closing conditions, including regulatory approvals, is expected to close in early 2003.

"Throughout Sony on a global scale, we operate with a keen awareness that the future growth of the consumer electronics, computer and entertainment industries will be heavily influenced by the ability to transmit digital content in a secure environment," said Nobuyuki Idei,

Chairman and Chief Executive Officer of Sony Corporation. "This acquisition will significantly accelerate the ability to ensure secure delivery of digital content. This in turn will enable the development of many exciting new services for consumers and businesses."

"Sony is committed to creating an environment where digital content can be securely distributed and enjoyed," said Robert Wiesenthal,

Executive Vice President and Chief Strategy Officer of Sony Broadband Entertainment, Sony Corporation of America. "Through this transaction

InterTrust's important DRM patents will be more widely available on a fair and reasonable basis."

11/12/02 - 3M announced that it has entered into a definitive agreement to acquire Corning Precision Lens Inc., a wholly owned subsidiary of Corning Incorporated, for a gross price of $850 million in cash. Corning Precision Lens is the largest worldwide manufacturer of lens systems for rear projection televisions.

"This transaction affirms our strategy of accessing fast-growing markets by acquiring companies with strong market positions and technologies that we can leverage with our own strengths to drive faster long-term organic growth," said W. James McNerney, Jr., 3M chairman and CEO. "Combining this business with 3M Optical Systems Division will broaden our technology position in the global display industry."

"Adding Corning Precisions Lens' technology for rear projection televisions to 3M's full spectrum of display technologies enhances our business, and will accelerate our growth in the current and next generation consumer television applications," said Andy Wong, division vice president, 3M Optical Systems Division. "Lens systems for large-screen, rear-projection televisions are a great complement to our strong optical film capabilities, which are well-suited to the emerging consumer LCD television segment."

3M believes display components represent a multibillion-dollar growth opportunity. Digital videodiscs (DVDs) and high definition televisions (HDTVs) are driving the growth in this industry as more consumers purchase large-screen, rear-projection TVs to create a home theater experience. In 2002, CRT-based projection televisions represented 98 percent of unit sales in the large-screen, rearprojection television segment, which is expected to grow at a 35 percent compound annual growth rate through 2006; LCD televisions are expected to grow at a compound annual growth rate of 56 percent through this same period, according to the DisplaySearch

Quarterly Worldwide Flat Panel Forecast Report, Q2'02.

3M's expertise in display technology is reflected in its line of Vikuiti brand light management products that include proprietary microreplicated and multilayer display enhancement films for applications in electronic displays, such as LCD televisions, mobile phones, desktop monitors and notebook computers. 3M also supplies touch screens and systems, high-performance projection screens and precision optical components for a wide range of display applications.

(Data provided by company press releases, equity research, and U.S. Bancorp Piper Jaffray)

(Data provided by VentureSource)

Date Target / Advisor

11/11/02 TidalWire Inc / Covington Assoc.

11/12/02 Chip Engines

11/14/02 Lightwave

11/12/02 Evant

11/12/02 Revenio

11/12/02 OnRamp

11/11/02 Personify

11/11/02 Versient

Acquiror / Advisor

Network Engines Inc / Needham

Alliance Semiconductor Corp

Looking Glass Networks

Nonstop Solutions

Vignette (#>)

Onset Technologies

Accrue Software

Shamrock Companies

The VC Liquidity Corner

Trans.

Last

Total

Capital Raised

Value Post $ Val.

Step-up to Date ROIC

$20.0

NA

NA

NA

NA

NA

NA

NA

NA

$17.5

NA

NA

NA

NA

NA

NA

NA

NA

NA

NA

NA

NA

NA

NA

NA

$8.4

NA

$12.0

$43.0

$14.5

$48.0

$10.0

NA

NA

NA

NA

NA

NA

NA

NA

Universe

Technology and Business Services

Computer Hardware & Semiconductors

Communication Services

Software Applications

Software Applications

Wireless Equipment

Software Infrastructure

Technology and Business Services

Venture Capitalist

Ascent Venture Partners

Alliance Venture Mgmt

Management

Mobius Venture Capital

Comdisco Ventures

Intel Comm. Fund

ABS Ventures

Abell Venture Fund

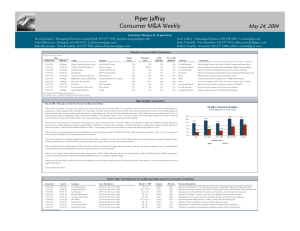

Last Week

Q1 2002

Q2 2002

Q3 2002

Q4 2002

YTD 2002

M&A

8

79

83

76

44

282

IPO

1

5

10

1

3

19

M&A

/ IPO Split

89% / 11%

94% / 6%

89% / 11%

99% / 1%

94% / 6%

94% / 6%

U.S. Bancorp Piper Jaffray

Technology/Communications M&A Weekly

November 18, 2002

Technology/Communications Mergers & Acquisitions

David Jacquin - Managing Director, Group Head, 415-277-1505, djacquin@pjc.com

Hugh Hoffman - Managing Director, 612-303-6319, hhoffman@pjc.com

Jason Hutchinson - Managing Director, 415-277-1510, jhutchinson@pjc.com

Steve Rickman - Managing Director, 612-303-6258, srickman@pjc.com

Eric Nicholson - Principal, 612-303-6378, enicholson@pjc.com

Private Equity/LBO Analysis

Spre ad (LIBOR) Fo r Leverag ed Buyo uts Senior Bank Loans

By De al Size

400

$70

$60

Buyout Funds Rais ed

$63.3

$55.4

350

344

334

363

351

$50

$36.9

300

306

294

316

309

$40

$30

$34.5

$34.5

250

277

251

264

242

257

238

$20

$11.7

$18.4

$23.2

$19.3

$5.3

$6.0

200

$10 $6.50

1996 1997 1998

Less than $100 Million

1999 2000

$100 Million to $250 Million

2001 2002 Q2

$0

1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 YTD Q2

2001

YTD Q2

2002

(Data Per U.S. Bancorp Piper Jaffray)

Key M&A Valuation Statistics

Note: Multiples have been changed to median values.

2.5x

2.0x

1.5x

1.0x

0.5x

0.0x

1.8x

1.4x

Technology Transactions

2.2x

1.6x

1.2x

1.9x

1.9x

100%

80%

60%

40%

20%

0%

4.0x

3.0x

2.0x

1.0x

0.0x

1.7x

1.3x

Communications Transactions

2.6x

2.3x

1.3x

0.7x

1.2x

100%

80%

60%

40%

20%

0%

Q1 01 Q2 01 Q3 01 Q4 01 Q1 02 Q2 02 Q3 02 Q1 01 Q2 01 Q3 01 Q4 01 Q1 02 Q2 02 Q3 02

100%

80%

60%

40%

20%

0%

71%

Venture Backed Tech/Comm M&A

70%

54%

52%

46%

22%

35%

100

75

50

25

0

Q1 01 Q2 01 Q3 01 Q4 01 Q1 02 Q2 02 Q3 02

(Data Per U.S. Bancorp Piper Jaffray)

Market Overview

Equity Capital Markets Activity: There were 16 transactions completed in the equity capital markets last week raising a combined

$4.3 billion. Deal activity consisted of 2 IPOs, 10 follow-on offerings, and 4 convertible transactions. The IPOs both traded flat for the week. Follow-on activity consisted of 7 shelf takedowns and 3 marketed transactions. On average, marketed transactions lost 9% in registration while shelf takedowns traded down 6% from shelf amendment filing. In the aftermarket, follow-on offerings overall traded up 3% on their first day and finished the week up 4% from offer price.

Russell 2000

Fundamental Market Overview : Brian Belski, U.S. Bancorp Piper Jaffray's Fundamental Market Strategist, made the following comments on the broader market: While the current five-week stock market recovery has provided the first positive light for equities in several months, we remain concerned about both its longevity and fundamental validity. Longevity = In our opinion, seasonality is the most positive fuel the rally has in its corner right now. However, with the Q4 and FY02 pre-announcement period unfolding in early

December, and geopolitical plots thickening, we believe the rally is likely to lose steam sooner rather than later. Fundamental Validity =

While the market’s traditional discounting mechanism is well documented, discounting techniques and strategies have failed over the past two years in aggregate. Yes, they have worked out from deeply discounted price conditions. However, growth has been unable to materialize, leaving investors with higher multiples and limited visibility. The $64,000 question remains the same: “Where and when does growth materialize?”

120

110

100

90

80

70

60

50

40

30

NASDAQ

DJIA

S&P 500

Russell 2000

Philadelphia Semiconductor Index

S&P Software Index

S&P Comm Equipment Index

Close as of Weekly YTD LTM

11/15/02 % Change % Change % Change

1,411

8,579

910

386

320

416

126

3.8

0.5

1.7

1.8

6.6

4.2

11.0

(27.6)

(14.4)

(20.8)

(21.0)

(38.8)

(21.5)

(39.1)

(25.8)

(13.1)

(20.3)

(14.1)

(39.9)

(20.6)

(46.2)

12/31/011/23/02 2/13/02 3/07/02 3/28/02 4/19/02 5/10/02 6/03/02 6/24/02 7/16/02 8/06/02 8/27/02 9/18/0210/09/0210/30/02

NASDAQ

Russell 2000

S&P Comm Equipment Index

DJIA

Philadelphia Semiconductor Index

S&P 500

S&P Software Index

U.S. Bancorp Piper Jaffray

Technology/Communications M&A Weekly

November 18, 2002

Technology/Communications Mergers & Acquisitions

David Jacquin - Managing Director, Group Head, 415-277-1505, djacquin@pjc.com

Hugh Hoffman - Managing Director, 612-303-6319, hhoffman@pjc.com

Jason Hutchinson - Managing Director, 415-277-1510, jhutchinson@pjc.com

Steve Rickman - Managing Director, 612-303-6258, srickman@pjc.com

Eric Nicholson - Principal, 612-303-6378, enicholson@pjc.com

The following disclosures apply to stocks mentioned in this report if and as indicated: (#) U.S. Bancorp Piper Jaffray (USBPJ) was making a market in the Company’s securities at the time this research report was published. USBPJ may buy and sell the Company’s securities on a principal basis. (^) A USBPJ analyst who follows this Company or a member of the analyst’s household has a financial interest (a long equity position) in the Company’s securities. (@) Within the past 12 months, USBPJ was a managing underwriter of an offering of, or dealer manager of a tender offer for, the

Company’s securities or the securities of an affiliate. (>) USBPJ has either received compensation for investment banking services from the Company within the past 12 months or expects to receive or intends to seek compensation within the next three months for investment banking services. (~) A USBPJ analyst who follows this Company, a member of the analyst’s household, a USBPJ officer, director, or other USBPJ employee is a director and/or officer of the Company. (+) USBPJ and its affiliates, in aggregate, beneficially own 1% or more of a class of common equity securities of the subject Company. (=) One or more affiliates of U.S. Bancorp, the ultimate parent company of USBPJ, provided commercial banking services (including, without limitation, loans) to the Company at the time this research report was published. (*) A registration statement relating to these securities has been filed with the Securities and Exchange Commission but has not yet become effective.

These securities may not be sold nor may offers to buy be accepted prior to the time the registration statement becomes effective. This communication shall not constitute an offer to sell or the solicitation of an offer to buy nor shall there be any sale of these securities in any state in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state. (**) These companies have conducted initial public offerings of their securities and are currently in the “Quiet Period.” As a result, there is no research available on these companies. This communication shall not constitute an offer to sell or the solicitation of an offer to buy any securities of these companies.

Nondeposit investment products are not insured by the FDIC, are not deposits or other obligations of or guaranteed by U.S. Bank National Association or its affiliates, and involve investment risks, including possible loss of the principal amount invested.

This material is based on data obtained from sources we deem to be reliable; it is not guaranteed as to accuracy and does not purport to be complete. This information is not intended to be used as the primary basis of investment decisions. Because of individual client requirements, it should not be construed as advice designed to meet the particular investment needs of any investor. It is not a representation by us or an offer or the solicitation of an offer to sell or buy any security. Further, a security described in this release may not be eligible for solicitation in the states in which the client resides. U.S. Bancorp and its affiliated companies, and their respective officers or employees, or members of their families, may have a beneficial interest in the Company's securities and may purchase or sell such positions in the open market or otherwise. This report is a communication made in the United Kingdom by U.S. Bancorp Piper Jaffray to market counterparties or intermediate customers and is exclusively directed at such persons; it is not directed at private customers and any investment or services to which the communication may relate will not be available to private customers. In the United Kingdom, no persons other than a market counterparty or an intermediate customer should read or rely on any of the information in this communication. Securities products and services offered through U.S. Bancorp Piper Jaffray, member SIPC and NYSE, Inc., a subsidiary of U.S. Bancorp.

www.Gotoanalysts.com

© 2002 U.S. Bancorp Piper Jaffray, 800 Nicollet Mall, Suite 800, Minneapolis, Minnesota 55402-7020

Additional information is available upon request.