Taxation of Foreigners in Indoesia

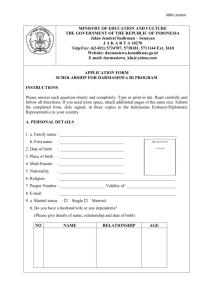

advertisement