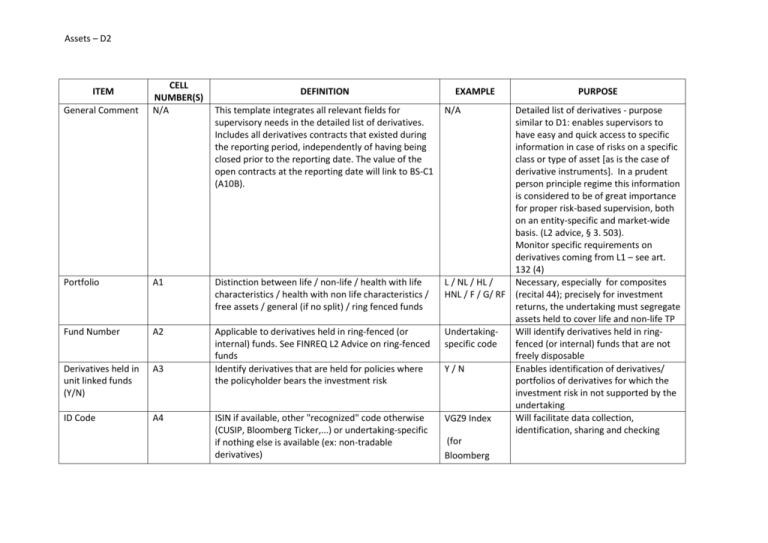

ITEM

advertisement

Assets – D2 General Comment CELL NUMBER(S) N/A Portfolio A1 Distinction between life / non-life / health with life characteristics / health with non life characteristics / free assets / general (if no split) / ring fenced funds Fund Number A2 Derivatives held in unit linked funds (Y/N) A3 Applicable to derivatives held in ring-fenced (or internal) funds. See FINREQ L2 Advice on ring-fenced funds Identify derivatives that are held for policies where the policyholder bears the investment risk ID Code A4 ITEM DEFINITION This template integrates all relevant fields for supervisory needs in the detailed list of derivatives. Includes all derivatives contracts that existed during the reporting period, independently of having being closed prior to the reporting date. The value of the open contracts at the reporting date will link to BS-C1 (A10B). ISIN if available, other "recognized" code otherwise (CUSIP, Bloomberg Ticker,...) or undertaking-specific if nothing else is available (ex: non-tradable derivatives) EXAMPLE N/A PURPOSE Detailed list of derivatives - purpose similar to D1: enables supervisors to have easy and quick access to specific information in case of risks on a specific class or type of asset [as is the case of derivative instruments]. In a prudent person principle regime this information is considered to be of great importance for proper risk-based supervision, both on an entity-specific and market-wide basis. (L2 advice, § 3. 503). Monitor specific requirements on derivatives coming from L1 – see art. 132 (4) L / NL / HL / Necessary, especially for composites HNL / F / G/ RF (recital 44); precisely for investment returns, the undertaking must segregate assets held to cover life and non-life TP UndertakingWill identify derivatives held in ringspecific code fenced (or internal) funds that are not freely disposable Enables identification of derivatives/ Y/N portfolios of derivatives for which the investment risk in not supported by the undertaking Will facilitate data collection, VGZ9 Index identification, sharing and checking (for Bloomberg Assets – D2 Ticker) ID Code type A5 Type of ID Code used for the “ID Code” item Counterparty ID A6 Counterparty group (code) Contract name A7 A8 Identification of the counterparty of the derivative contract (derivatives exchange or other for OTC derivatives). [This probably will be in a form of a (standard) code] Group (parent undertaking) of counterparty. [This probably will take the form of a (standard) code] Name of the derivative contract Basis instrument A9 Assets underlying the derivative contract Currency A10 Currency of the derivative (e.g.: option labeled in USD) CIC A11 Possible CEIOPS Code used to classify securities (description in template “Assets – D1”) Use of derivative A13 Describe use of derivative (micro / macro hedge, efficient portfolio management) ISIN, CUSIP, Bloomberg, Undertakingspecific Eurex, BNP, CGD Identify what type of code is the ID Code Allianz SE Very important to assess risk concentration Have the “commercial” name of the derivative Important to assess basis risk “DJ Eurostoxx 50 Futures” “DJ Eurostoxx 50 Index”, “IBM equity” EUR, GBP, SEK, USD (ISO 4217 Code) DE51 (Future on equity index, listed in Germany); FR62 (Call option on bonds, listed in France); XT81 (OTC IRS) Micro hedge / macro hedge / Identify the counterparty, in order to assess risks (counterparty default, concentration) Important to assess currency risk (share of portfolio in foreign currencies) & ALM currency matching Combines securities characteristics with risk exposure Assess whether the derivative is used for risk mitigation or risk exposure => Assets – D2 Delta A14 Notional amount A15 Long or short position Premium paid/received to date Profit and loss to date A16 Number of contracts A19 Contract dimension A17 EPM Measures the rate of change of option value with respect to changes in the underlying asset's price The amount covered or exposed to the derivative. For 1000000 (€, futures and options corresponds to contract size etc.) multiplied by the number of contracts and for swaps and forwards corresponds to the contract amount Only for futures and options and swap contracts L/S The payment received (if I sold) or paid (if I bought), for options and also up-front amount paid / received for swaps. Amount of profit and loss arising from the derivative since inception (not profit and loss accounted for in financial statements). For closed / matured contracts corresponds to the realized profit or loss at the closing/maturing date. Number of derivative contracts in the portfolio 15300 (€, etc.) A20 Number of underlying assets in the contract (e.g. for equity futures it is the number of equities to be delivered per derivative contract at maturity) Only for futures and options 10 Trigger value A21 24.89 €, 0.89 £/€, 5% IRS paid interest A22 Reference price for futures, strike price for options, currency exchange rate or interest rate for forwards, etc. (except for Interest rate and currency swaps) Interest rate delivered under the swap contract A18 see art. 132 (4) of L1 text Assesses the effectiveness of coverage of an asset by the derivative Identify the value under coverage for a given derivative, and assess the hedge or the potential risk Identify net positions 1000 (€, etc.) Important to assess the financial effect of the hedge or exposure arising from the derivative 1000 Assess the liquidity of derivative (ie possible to sell part of a large number of contracts with small amounts, but impossible to split one contract with a large amount) Assess number of assets covered in portfolio (in case of hedging) (example : compare that 10 given shares are hedged out of a total of 50 shares in portfolio) Compare with value of underlying asset (eg to assess whether option will be exercised or not) EUR6M+1.5% Similar to trigger value Assets – D2 rate IRS received interest rate Swap delivered currency Swap received currency Trade date A23 A24 A25 A26 Maturity date A27 SII value A28 Valuation method SII A29 CIC table (in Assets-D1) Forth position Call and Put options (only for Interest rate swaps) Interest rate received under the swap contract (only for Interest rate swaps) Currency of the swap price (only for currency swaps) Currency of the swap notional amount (only for currency swaps) Date of the trade of the derivative contract Date of close of the derivative contract, whether at maturity date, selling date, closing by assuming a symmetric position, exercise of call or put, etc. SII value of the derivative as of the reporting date (zero if closed) 3 possibilities : Mark to market, mark to market with similar instruments, mark to model Classification of options according to its main risk coverage (or exposure). Includes, among others, plain vanilla options, exotic options, credit default options, credit spread options, etc. 3% Similar to trigger value USD Identifies the currency of the price of the currency swap contract Identifies the currency of the notional amount of the currency swap contract Allows for assessing a better understanding of the profit & loss to date since inception along with its time frame Assess how long the position is covered (if hedging) or how long the risk exists EUR 15/06/2018 31/12/2019 154,589 (€, etc.) MktMk / MktMkS / MktMd Reconcile with Balance Sheet valuation Understand valuation used for SII Assess risk coverage and exposure in SCR market risk framework