Homework 1 DUE FEB 22nd

advertisement

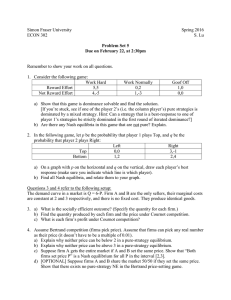

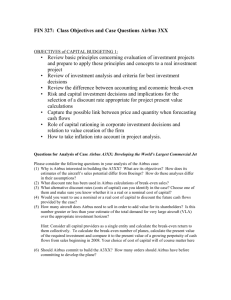

Economics 100 Spring 2011 HOMEWORK (I) 25 points Due at the beginning of class February 22nd Please write legibly and staple any sheets that you hand in together. You will be marked down if I cannot read your work. Remember, your homework is an important part of your overall grade. 1. Define the term capitalism. Describe the ways in which capitalism brought about rapid and dramatic change. In particular, give three examples of its effect on production. (5 points) 2. What is meant by the following terms? (i) Complete Contracts (ii) Constant Returns to Scale (iii) Pareto Optimality Explain, using examples. (5 points) 3. A tailoring shop uses a sewing machine and workers to produce shirts. Each machine can be rented for $10 an hour and each worker hired to run a machine is paid $20 an hour. The manager of the firm notices over time that in the shop, with more workers and more machines, the workers are able to learn from each others mistakes and become more efficient at their own work. As a result, the following table describes the outputs and inputs of the firm as it grew larger. Sewing Persons Machines 1 2 3 Shirts 1 2 3 1 5 10 Calculate the cost of production per shirt when the firm has 1, 2 and 3 workers (for an example, look at the class notes from week 2). Is this an example of increasing or non increasing returns to scale? (ii) In the tailoring shop down the street, the workers are separated by cubicles and hence cannot learn from each others mistakes. As a result, the manager of the firm down the street notices the following pattern as the firm hires more workers and machines. Sewing Persons Machines 1 2 3 Shirts 1 2 3 1 2 3 Calculate the cost per shirt when the firm has 1, 2 and 3 workers. Is this an example of increasing or non increasing returns to scale? (iii) If the production technology is more like in the first case than in the second, what do you expect to see in the market: a few large firms, or many small firms? Why? (5 points) 4. Nash Equilibrium Consider the rivalry between Airbus and Boeing to develop a new commercial jet aircraft. Suppose Boeing is ahead in the development process, and Airbus is considering whether to enter the competition. If Airbus decides to enter and develop the rival airplane, then Boeing has to decide whether to accommodate Airbus peaceably or to wage a price war (i.e. cut prices). Thus there are two strategies for each. Airbus can be out or in and Boeing can have a price war or be peaceful If Airbus stays out, it earns zero profit while Boeing enjoys a monopoly and earns a profit of $1000 million if it keeps its peaceful price, or $500 million if it cuts its price to the price it would if there was a price war. In the event that Airbus enters and they compete peacefully, each firm will make $300 million. If there is a price war, each will lose $100 million because the prices of airplanes will fall so low that neither firm will be able to recoup its development costs. Fill in the payoffs in the normal form game below. Is there a Nash Equilibrium? If so, explain why there is one. Boeing Strategy Price War Peace Airbus Strategy Out In (5 points) 5. What is the ultimatum game? Explain why it challenges the simple notion of Homo Economicus. (5 points)