Multiple

Mid-sized deals at

the fore of European

buyout market

The exit market in Europe performed very

strongly in 2014. Total exit value was the highest

since 2007. Private equity-backed initial public

offerings remained a popular exit route.

With the level of mid-size deal activity the highest

since 2008, and corporates rejoining the market,

the outlook for 2015 is bright.

Private Equity

Transaction Advisory Services

Issue 1

2015

Welcome

About Multiple

Multiple is a publication summarizing trends in buyouts*

across Europe.

The following analysis and commentary is based on research

recorded by Center for Management Buyout Research (CMBOR)

in January 2015.

Countries covered: Austria, Belgium, Denmark, Finland,

France, Germany, Ireland, Italy, Netherlands, Norway,

Portugal, Spain, Sweden, Switzerland and the UK.

":mqgmlk2;E:GJ\]Õf]kZmqgmlkYkgn]j-(g^k`Yj]k[`Yf_af_gof]jk`ah$

with management or private equity, or both, having a controlling stake upon

deal completion. Equity funding must primarily be from private equity funds

Yf\l`]Zgm_`l%gml[gehYfqemkl`Yn]alkgofÕfYf[af_kljm[lmj]$

e.g., management buyout (MBO) or management buy-in (MBI).

For full details on the CMBOR methodology, please refer to page 15.

Contents

4

Headlines in 2014

5

Outlook for 2015

6

Deal dynamics

7

Corporate divestments to PE

8

Sector insights

10

Trade sales

11

Exits watch

12

Country spotlight

16

Contacts

18

Further insights

“In 2014, private equity (PE)-backed IPOs were at their

highest level since 1998, as financial sponsors continued

to capitalize on strong valuations. The year also recorded

the highest trade sales in exit value terms since 2011 and

the highest ever value of refinancings. It is likely that we

will see less of PE-backed IPOs in 2015, but we can expect

to see more corporates both selling and buying assets.

While this can generate heightened competition on some

M&A deals, it also means an improved exit route for PE

funds, particularly for large assets entered into portfolio

before the global financial crisis.

“Whether the strong momentum will translate into a fully

recovered European PE cycle is yet to be seen, but the

signs are clearly encouraging.”

Sachin Date, Europe, Middle East, India and Africa (EMEIA)

Private Equity Leader, EY

The data in this report covers the

full calendar year 2014.

Multiple |

3

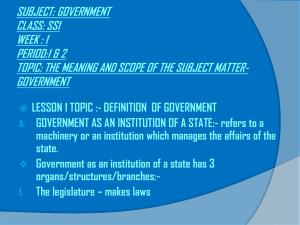

Headlines in 2014

“For Western Europe, 2014 was a very positive year for M&A. We can expect a rise

in strategic sales as companies look to reshape their portfolios, focus on their core

business and divest to invest. Spin-offs and carve-outs look set to be the key trend for

2015. This in turn should help generate greater primary buyout activity.”

Andrea Guerzoni, EMEIA Transaction Advisory Services Leader, EY

Deal activity at highest level

since 2008

Mid-market drives new buyouts

• Total deal value in 2014 was €67.3b,

buyouts has been holding up in 2014

(to €104.7m) compared with 2013. This

is due to the rise in the number of deals

in the €100m–€500m range, which is at

its highest since 2008. At €14.3b in

H2 2014, value in the €100m–€500m

segment was up sharply on the previous

six months (€10.8b). This follows the

pattern of 2013, when H2 was by far

the strongest half. At 63 deals, volume in

H2 2014 was also up on the previous

six months (48).

compared with €59.4b in 2013. At

643 deals, volume in 2014 is also up

on the 563 recorded in 2013. Both deal

value and volume reached levels not

seen since 2008 (when 776 deals were

recorded for a total value of €71.6b).

Improved macroeconomic conditions,

strong fundamentals and capital markets

brought PE executives to the deal table.

Record high for European

IPO exits

• The year saw PE-backed IPOs rise to the

`a_`]kld]n]d]n]j$oal`,+ÖglYlagfk

contributing €44.0b of value in 2014.

Boosted by the revival in the capital

markets, the value of European exits in

2014 has totaled €113b, almost twice the

value of new buyouts (€67.3b).

4

| Multiple April 2015

• The average size of new PE-backed

Nordic region provides top

three deals

• The UK accounted for deals totaling

€19.9b in 2014, followed by Germany’s

€12.6b and France’s €9.4b. The UK was

home to 226 of the year’s 643 deals

across Western Europe. The next biggest

contributor was France, with 87 deals.

The Nordic region led in terms of growth.

It provided the top three deals, with the

two largest deals originating in Norway.

The Netherlands recovered, with deal

volumes at the highest since 2008 and

value also improving (€4.2b in 2014

compared with €1.9b in 2013).

Technology, media and

telecommunications (TMT),

ÔfYf[aYdk]jna[]kYf\

health care make progress

• Afl]jekg^k][lgjk$LEL$ÕfYf[aYd

services and health care have had a

strong year in Europe, with increased deal

value compared with 2013. Value, not

volume, has been making headlines in

2014, with some of the largest buyouts of

l`]q]YjafLELYf\ÕfYf[aYdk]jna[]k&

LEL`Yklghh]\Ò)+&/ZYf\ÕfYf[aYd

services has seen value exceed €6.2b.

Both sectors recorded their highest value

since 2007. Meanwhile, total deal value

for health care was €7.7b — more than

twice that seen in 2013.

Outlook for 2015

“The industry now has an unprecedented amount of dry powder, but investors are

certainly choosy about selecting quality assets. That said, the capital is there to do

deals, and there’s going to be a lot more M&A activity. We’ve seen some large corporate

divestments announced.”

Bridget Walsh, Head of Private Equity for UK & Ireland and Greater China Business Services Leader, EY

Key trends in 2015 should ensure that the European PE deal market remains on target for sustained growth.

Strategic buyers circling

assets

IPOs still a viable exit route

• PE and VC sponsors will remain keen

to exit the investments they made

before the economic downturn in 2007.

Although many of these portfolio

companies listed in 2014, a proportion

j]eYafk$Yf\l`]k]oadd[gflafm]lgÕdl]j

through to the IPO market, albeit on a

smaller scale.

• Transformational acquisitions are high

on the corporate agenda. EY’s 2015

Global Corporate Development Study

j]kmdlkk`goYka_faÕ[Yflaf[j]Yk]afl`]

number of transaction executives who are

considering cross-border transformational

Y[imakalagfkafl`]f]pl)*egfl`kÈ,,

mh^jge*1afl`]dYkl)*egfl`k&

Availability of capital

Megadeal trend will continue

• Global buyout dry powder stood at

• A healthy pipeline suggests €1b-plus deals

are here to stay in 2015. Two new €1b-plus

European buyouts and two €1b-plus exits

(trade sales) have already been announced

in Q1 2015 (as of 20 March 2015,

according to Mergermarket).

Improved macroeconomic

outlook

• After a year of hesitant recovery in 2014,

the Eurozone moves into 2015 supported

by two important growth drivers:

substantially lower oil prices and

quantitative easing. Despite the improving

near-term outlook, management teams

need to be very mindful of emerging

markets and operational improvements.

Top-line growth isn’t going to be achieved

by simply looking at the domestic market.

US$467b as of December 2014, according

to the PE Growth Capital Council. This

demonstrates the amount of capital that

fund managers will be looking to put to

work in the asset class in the near future.

European buyouts — volume and value

Total value (€m)

2009

Total number

Total value (€m)

2012

Total number

9,304

H1

207

11,183

H2

228

2010

23,966

H1

279

35,000

H2

333

2011

30,373

H1

321

33,125

H2

308

26,096

H1

308

28,923

H2

292

2013

23,690

H1

280

35,678

H2

283

2014

27,860

H1

322

39,453

H2

321

Source: CMBOR; Equistone Partners Europe; EY — full calendar year 2014 only

Multiple |

5

Deal dynamics

Mid-sized deals driving the

buyout market

,)&*af*()+lg,*&1af*(),&9dl`gm_`

this is still below the heights seen in 2009,

o`]fd]n]dkg^]imalqmk]\Yn]jY_]\.,$

it remains well above the levels of 2007.

During this boom year, the average

hjghgjlagfg^]imalqoYkbmkl+,&.$Yf\

\]Zl[gehjak]\-0&.g^Ydd\]Ydkljm[lmj]k&

Af*(),$l`]d]n]dg^e]rrYfaf]ÕfYf[af_

used in €100m-plus deal structuring hit a

Õn]%q]Yjdgog^)&*&

Volume and value in the €100m–€250m

segment were up sharply in 2014, to the

highest level since 2008. The year’s 75

deals were up on the 59 seen in this range

in 2013 and 2012. At €12.0b, value in this

range was also up strongly on the previous

year (€9.3b). The €250m–€500m segment

also reached its highest value since 2008.

In the high-value bracket (€500m or

greater), the year saw 33 deals. This is up

on the 29 deals recorded in the previous

year, thanks to the increase in the number

of €1b-plus megadeals.

:ggeaf_j]ÔfYf[af_Y[lanalq

Debt ratio up, mezzanine

subdued

In 2014, the average proportion of debt

mk]\lgÕfYf[]=mjgh]Yf\]Ydkgn]jÒ)((e

oYk-,&/&L`akakmhgfl`]-+&(

recorded in 2013. The percentage of equity

used to fund deals has risen slightly, from

Last year saw the highest value of

j]ÕfYf[af_k]n]jj][gj\]\&NYdm]`Ykegj]

than doubled since 2012, to €52.6b. This

j]hj]k]flkYka_faÕ[Yflaf[j]Yk]gfl`]

period between 2008 and 2012, when the

strongest year recorded a value of €25.1b.

This rise is evidence that companies already

oal`afYhgjl^gdagYj]Õf\af_al]Yka]jlg

acquire debt. Following a strong 2013,

market conditions continued to improve in

*(),&Ghhgjlmfakla[j]ÕfYf[af_ko]j]Y

feature of the market in 2014, as borrowers

have looked to reprice transactions.

Second lien and crossborder loans

After six barren years, 2014 saw second

lien debt reappear, driving leverage on

certain deals up by a multiple of six or

seven. An example is Bureau Van Dijk’s

pre-placed second lien that took total

leverage to around seven times as part of its

buyout by EQT (source: Reuters). Crossborder loans were also on the rise.

European borrowers with US dollar revenue

streams and assets are seeking out what

`Yn]`aklgja[YddqZ]]fegj]Ö]paZd]Yf\

aggressive funding markets in the US,

where higher leverage, lower equity

contribution and fewer (or no) covenants

are all available. BC Partners’ acquisition of

Mergermarket was a perfect example of a

UK-based mid-market borrower accessing

l`]MKeYjc]lk&L`]\]YdoYkYdkgÕfYf[]\

l`jgm_`ÕjklYf\k][gf\da]fljYf[`]k

(source: Debtwire).

Deal size

2011

12

22

94

501

629

€1b plus

13

17

76

494

600

€500m–€1b

2014

2013

2012

€100m–€500m

9

21

88

445

563

Up to €100m

13

20

111

499

643

Total number of deals

Source: CMBOR; Equistone Partners Europe; EY — full calendar year 2014 only

6

| Multiple April 2015

Corporate

divestments to PE

Local divestments value doubled in 2014

lgÒ)1&/ZÈl`]`a_`]klÕ_mj]kaf[]

2007 — as corporates’ activity on the

sell-side picked up. At 123 deals, volume in

2014 was also higher than in 2013 (114).

The value and volume of foreign

divestments also rose in 2014.

Divestments were a deal source for 10 of

the 20 largest new European buyouts in

2014. However, it should be noted that 2 of

those 10 large divestments were partial

secondary buyouts, where PE owners sold

a large subsidiary of one of their portfolio

companies to another PE investor.

Divestment plans are increasing around

the world, as companies realize that

divestments are a key way to fund business

growth. Among the EY 2015 Global

Divestment Studyj]khgf\]flk$,-

recently divested or placed a business on a

watch list if it wasn’t reaching performance

criteria. This trend is set to continue, with

-,g^]p][mlan]k]ph][laf_Yfaf[j]Yk]af

the number of strategic sellers in the next

12 months. Companies also divest for

ghhgjlmfakla[j]Ykgfk&9degklYl`aj\ *1!

of executives say that their last divestment

oYkghhgjlmfakla[$Yf\,*]ph][lYf

increase in unsolicited buyer approaches.

>mjl`]jegj]$,/g^[gehYfa]kkYql`Yl

even if they weren’t looking to divest, they

would consider selling at a premium in the

jYf_]g^)(Ç*( Yf\Yl`aj\g^l`gk]

ogmd\_gZ]dgo)(!&

70

14,000

60

12,000

50

10,000

8,000

30

6,000

20

4,000

2,000

0

2007 2008 2009 2010 2011 2012 2013 2014

Value

Volume

0

35,000

250

30,000

200

25,000

150

20,000

100

15,000

€m

40

10

Private sales to PE also increased in Europe

in 2014 — recording the highest value and

volume since 2008. The improved primary

ZmqgmlY[lanalqeY\]mh^gjYjYl`]jÖYl

secondary buyout market in 2014. This

trend is likely to continue in 2015, as

companies in the Americas, Europe and

]n]f;`afYÕfYddqklYjllgY[[]hll`Yll`]aj

portfolios aren’t in line with the post-crisis

low-growth environment that is here to stay.

Local divestment — volume and value

€m

Volume

Foreign divestment — volume and value

Volume

The march of divestments

continues

10,000

50

0

5,000

2007 2008 2009 2010 2011 2012 2013 2014

Value

0

Volume

Source: CMBOR; Equistone Partners Europe; EY — full calendar year 2014 only

Multiple |

7

Sector insights

The TMT sector has had a strong year in Europe. In 2014, the

sector has seen a total buyout value of €13.7b — the highest since

the €21.9b recorded in 2007. This pickup is largely explained by

the sector accounting for 5 of the 15 largest buyouts completed

across Europe so far this year: Visma (€2.5b), Scout24 (€2.0b),

SkillSoft (€1.7b), Unit4 NV (€1.2b) and TeamViewer (€870m).

Manufacturing was the other standout sector by value, with a total

of €15.1b in 2014. Its 193 deals were up on the 159 recorded last

year. This is almost double the 100 deals contributed by the secondplace sector by volume: business and support services (BSS).

The ÔfYf[aYdk]jna[]k sector totaled €6.2b in 2014. The value of

\]YdÖgoafl`]k][lgjoYkl`]k][gf\`a_`]klafl`]dYkl)(q]Yjk$

behind the €7.9b seen in 2007. However, just three deals

Manufacturing

2014

2013

193

deals

159

deals

accounted for more than half of this total value: the sale of Nets

Holding (€2.3b) to a PE consortium, Banco Santander’s sale of

Altamira Asset Management to Apollo Global Management for

€660m, and the acquisition of Skrill by CVC Capital Partners and

Investcorp for €600m.

DYklq]YjkYoYka_faÕ[Yflaf[j]Yk]afl`]fmeZ]jYf\nYdm]g^

deals in the health care sector. Forty deals, contributing a total

value of €7.7b, were completed, including two €1b-plus secondary

buyouts in France. This compares with €3.4b from 29 deals in

2013. Exit numbers in the health care sector were also boosted by

the largest exit of the year.

Health care

40

€15.1b

2014

deals

€12.9b

2013

deals

TMT

29

€7.7b

€3.4b

Financial services

84

2014

deals

2013

deals

80

31

€13.7b

2014

deals

€7.1b

2013

deals

34

€6.2b

€2.5b

Source: CMBOR; Equistone Partners Europe; EY — full calendar year 2014 only

8

| Multiple April 2015

Sector insights (continued)

“Unlike during the dotcom bubble, today’s disruptive technology businesses are able

to create value rapidly and with real revenue and cash flow growth — not simply

eyeballs, content and site visits. That’s a key reason why current high levels of M&A

are sustainable.”

Jeff Liu, EY Global Technology Leader, Transaction Advisory Services

Largest new buyout deals completed in Western Europe, 2014

Company name

Country

Deal month

Buyer

Sector

Visma

Norway

8

Lindorff

Norway

10

Nets Holding

Denmark

Scout24 Holding

Cinven

TMT

2,524

Nordic Capital

BSS

2,300

7

Advent International, Bain Capital,

ATP Group

Financial services

2,278

Germany

3

Hellman & Friedman

TMT

2,000

SkillSoft

Ireland

5

Charterhouse Capital Partners

TMT

1,669

Ceva Sante Animale

France

6

Temasek, CDH Investment

Health care

1,602

Sebia

France

12

Montagu Private Equity, Astorg

Health care

1,400

GEA Heat Exchangers

Germany

11

Triton Partners

Manufacturing

1,300

Minimax

Germany

8

Intermediate Capital Group, Kirkbi Invest

Manufacturing

1,300

Mauser

Germany

8

Clayton, Dubilier & Rice

Manufacturing

1,200

Unit4 NV

Netherlands

3

Advent International

TMT

1,174

Pizza Express

UK

9

Hony Capital

Food and drink

1,143

Median Kliniken

Germany

Waterland Private Equity

Health care

1,000

ParexGroup

France

6

CVC Capital Partners

Manufacturing

880

TeamViewer

Germany

7

Permira

TMT

870

Bureau van Dijk Electronic Publishing

Netherlands

9

EQT Partners, GS Capital Partners

BSS

845

CABB GmbH

Germany

6

Permira

Manufacturing

800

Trader Media

UK

3

Apax Partners

TMT

741

Arvos/Alstom's Air Preheater & Gas Heater units

Germany

9

Triton Partners

Manufacturing

730

Altamira Asset Management

Spain

1

Apollo Global Management

Financial services

660

12

Value (€m)

Source: CMBOR; Equistone Partners Europe; EY — full calendar year 2014 only

Multiple |

9

Trade sales

“Companies are approaching all deals with increasing rigor and standardized deal

processes in the face of growing competition from PE players and greater focus on

corporate governance by boards and shareholders.”

Jon Clark, EY EMEIA Oil & Gas Leader, Transaction Advisory Services

Strategic buyers are out in force

If corporates were on the sidelines in

previous quarters, activity picked up at the

end of 2014, with trade sales values higher

than before (€18.6b in Q4 2014, compared

with €9.9b in Q3 2014). Eight of the 10

largest trade sales in 2014 were crossborder deals.

H2 2014

112 deals €28.5b

H1 2014

84 deals

€11.9b

H2 2013

Increased IPO and trade sales values made

up for the decrease in secondary buyout

values. While IPO exits dominated the

upper end of the value range, trade sales

offered an improved exit route in 2014.

Strategic buyers demonstrated particular

interest for the bigger assets, as the

average trade sale value in 2014 (€206m)

was the highest since 2011 and marked a

ka_faÕ[Yflaf[j]Yk][gehYj]\oal`*()+

(€113m). This is consistent with the

Õf\af_kg^l`]dYl]kl=QGlobal Corporate

Development Study, a survey of more

than 300 M&A directors and corporate

\]n]dghe]flg^Õ[]jk$km__]klaf_l`Yl$Y^l]j

years of uncertainty and contraction in the

deal market, companies are, once again,

actively seeking to grow through M&A.

82 deals

€11.3b

10 | Multiple April 2015

Corporate development teams are

preparing to spend more time on

acquisitions that will fundamentally change

their businesses. They expect the average

percentage of their time spent on such

transformational acquisitions to increase

afl`]f]pllogq]Yjk$lg*-^jge)/

[mjj]fldqYf\bmkl)*Õn]q]YjkY_g&L`]

klm\qYdkgk`gokYka_faÕ[Yflaf[j]Yk]af

the number of respondents that plan to

enter a new geographic market in the next

)*egfl`kÈ.($mh^jge,+afl`]dYkl

12 months — or acquire new technology —

-+$mh^jge,+afl`]dYkl)*egfl`k&

Exits watch

“In Europe, a combination of strengthening equity markets, the sustained low interest

rate environment and growing investor confidence contributed to a surge in capital

raised in 2014. With continued expectations of quantitative easing by the European

Central Bank and bond yields close to all-time lows, investors yearning for higher

returns shifted toward equities — IPOs in particular.”

Martin Steinbach, EY EMEIA IPO Leader

Largest exits completed in Western Europe, 2014

Company name

Entry

year

Country

2014 exit

month

Alliance Boots

2007

UK

12

Acromas Holdings/Saga & AA

2007

UK

ISS

2005

B & M Retail

2013

Vendor

Exit value

(€m)

Exit type

Kohlberg Kravis Roberts

7,717

Trade sale

6

CVC Capital Partners, Charterhouse

Capital Partners, Permira

4,363

Flotation

Denmark

3

EQT Partners, GS Capital Partners

3,970

Flotation

UK

6

Clayton Dubilier & Rice

3,375

Flotation

3,060

Trade sale

2,524

Secondary buyout

2,470

Flotation

Oak Hill Capital Partners

2,277

Trade sale

CVC Capital Partners

2,200

Trade sale

Kohlberg Kravis Roberts, Investindustrial

1,962

Trade sale

1,900

Flotation

1,669

Secondary buyout

Quadrangle Group, GS Capital Partners

1,653

Trade sale

Friedrich Grohe

2004

Germany

1

Visma

2010

Norway

8

Elior

2006

France

6

Firth Rixson

2007

UK

Flint Group/BASF Drucksysteme GmbH/Aster

2004

Germany

9

Avincis/Inaer Inversiones Aereas

2005

Spain

5

11

L]pYkHY[aÕ[?jgmh$;j]\alKmakk]

First Boston

HgCapital, Montagu Private Equity,

Kohlberg Kravis Roberts

Charterhouse Capital Partners, Intermediate

Capital Group, Chequers Capital

The Carlyle Group, Intermediate

Capital Group

Berkshire Partners, Bain Capital,

Advent International Corporation

Applus Servicios Tecnologicos

2007

Spain

5

SkillSoft plc (SSI Investments III)

2010

Ireland

5

Get AS

2007

Norway

10

Ceva Sante Animale

2007

France

6

NiXEN Partners

1,602

Secondary buyout

Pets at Home

2010

UK

3

Kohlberg Kravis Roberts

1,466

Flotation

Sebia

2010

France

12

Cinven

1,400

Secondary buyout

Avolon

2010

Ireland

12

1,400

Flotation

Monier Group

2009

Germany

7

1,350

Flotation

Diana Ingredients/Diana

2007

France

7

Ardian, Motion Equity Partners

1,300

Trade sale

Minimax

2006

Germany

8

IK Investment Partners

1,300

Secondary buyout

Com Hem

2011

Sweden

6

BC Partners

1,274

Flotation

Anima/Monte Paschi Asset Management

2009

Italy

4

Clessidra SGR

1,260

Flotation

SSP/Select Service Partners & Creative Host

Services

2006

UK

7

EQT Partners

1,258

Flotation

CVC Capital Partners, Oak Hill Capital

Partners, Cinven

Apollo Management, York Capital,

TowerBrook Capital Partners

Source: CMBOR; Equistone Partners Europe; EY — full calendar year 2014 only

Multiple | 11

Country spotlight

UK

2014: €19.9b from 226 buyouts

Largest deal: €1.1b

UK new buyout value totaled €19.9b in 2014, compared with €17.9b in 2013. More than 200 deals (226)

completed in the UK last year, up on the 193 deals in 2013. Over one-third of all European new buyouts (226 out

of 643) have taken place in the UK.

As for the exit activity, the total 2014 value is at a record €44.2b, following 2013’s €27.5b. At €19.9b, IPO value

was the highest since records began. Trade sale value last year was more than triple that of 2013 — €17.2b versus

last year’s €5.5b.

Germany

2014: €12.6b from 74 buyouts

Largest deal: €2.0b

Germany was the second-strongest market in terms of buyout value in 2014. Its 74 deals contributed €12.6b

g^nYdm]È)1g^l`]lglYdkmeg^=mjgh]Yf\]Ydk&L`akoYkkda_`ldqd]kkaflglYd\]YdnYdm]l`Yfl`]Ò)*&0Zk]]f

in 2013. However, 5 of the 13 European megadeals (€1b-plus) were completed in Germany — more than in any

other country.

L`akj]dYlan]dqÖYlnYdm]h]j^gjeYf[]af*(),oYk[gfÕje]\gfl`]]palka\]&Bmkl,/H=]palk[gfljaZml]\YnYdm]

g^Ò)/&+ZÈ)-g^l`]lglYdO]kl]jf=mjgh]YfeYjc]laf*(),&L`akj]hj]k]flkYdegkll`]kYe]]palnYdm]^gj

Germany as in 2013 (€17.2b).

12 | Multiple April 2015

Country spotlight (continued)

“In the context of a dynamic PE market, we are yet to see an increase in French primary

deals activity. PE-backed IPOs remain rare, with only one completed in France in 2014,

compared with over 20 in the UK.”

Laurent Majubert, Partner, Transaction Advisory Services, EY France

France

2014: €9.4b from 87 buyouts

Largest deal: €1.6b

Activity in France has been holding up, with 87 deals completing in 2014. This compares with 99 in 2013 and

102 in 2012. However, France was the second most active European market by volume after the UK (226),

and total value was on the rise compared with 2013 (€8.5b). Those 87 deals accounted for €9.4b, including

2 megadeals completed in the health care sector.

With 64 exits in 2014, the French exits market performed quite well. Again, France was the second most active

market after the UK (200). With only one completed IPO, the total exit value of €12.4b in 2014 improved

ka_faÕ[Yfldq[gehYj]\oal`*()+ Ò0&-Z!$Yf\oYk^YjYZgn]*()* Ò+&0Z!&

Norway

2014: €6.4b from 23 buyouts

Largest deal: €2.5b

The buyout market in Norway posted a record year in 2014. With 23 deals completed, volume was the highest

since 2006, and Norway surged to a new record total value of €6.4b. Value doubled for a second consecutive

year. The two largest European buyouts of the year were Norwegian deals completed in H2 2014, each with a

value over €2.3b.

FgjoYqYdkgkYoYka_faÕ[Yflaf[j]Yk]af]palnYdm]kaf*(),$l`YfcklgYkljgf_k][gf\`Yd^g^l`]q]Yj&

With 14 deals contributing €6.1b, 2014 value reached another record. Norway accounted for 2 of the top

15 exits in 2014.

Multiple | 13

Country spotlight (continued)

Netherlands

2014: €4.3b from 48 buyouts

Largest deal: €1.2b

With €4.3b of total value from 48 deals, the Dutch buyout market has reached a new high since 2008, when

52 deals contributed €6.4b. The largest deal was the €1.2b acquisition of Dutch software company Unit4 NV

Zq_dgZYdH=Õje9\n]flAfl]jfYlagfYd$[gehd]l]\afI)*(),&

=palngdme]\gmZd]\af@**(),lg),&=palk`Yn]jYak]\Ò,&/Zaf*(),&L`akakka_faÕ[Yfldq`a_`]jl`Yfaf*()+$

both in terms of value (€974m) and volume (14 exits), but still below 2012 levels.

Spain

2014: €3.1b from 34 buyouts

Largest deal: €660m

There was a strong uptick in the Spanish buyout market in 2014. The year saw 34 deals completed, compared with

only 21 in 2014, for a total value of €3.1b. This comfortably exceeded 2013 value (€2.1b). The largest transaction

was Banco Santander’s sale of Altamira Asset Management to Apollo Global Management for €660m.

KhYaf`YkYdkgk]]fYka_faÕ[Yflaf[j]Yk]af]palnYdm]kkg^Yjl`akq]Yj&Oal`)0\]Ydk[gfljaZmlaf_Ò1&.Z$*(),

value was at the highest since records began in 2005. Spain accounted for 2 of the top 15 exits in 2014, with the

trade sale of Avincis and the Applus IPO.

14 | Multiple April 2015

CMBOR methodology

The data only includes the buyout stage of the PE market

(MBO, MBI, institutional buyout (IBO) and buy-in

management buyout (BIMBO)), and does not include

any other stage, such as seed, start-up, development or

expansion capital.

Unless otherwise stated, the data includes all buyouts,

whether PE-backed or not, and there is no size limit to

deals recorded.

Afgj\]jlgZ]af[dm\]\YkYZmqgml$gn]j-(g^l`]akkm]\

share capital of the company has to change ownership,

with either management or a PE company, or both jointly,

having a controlling stake upon deal completion.

Buyouts and buy-ins must be either management-led

or led by a PE company using equity capital primarily

raised from one or more PE funds.

Transactions that are deemed not to adhere to the PE,

MBO or MBI model are not included.

Transactions that are funded from other types of funds,

such as real estate and infrastructure, are not included.

<]Ydkafo`a[`YH=ÕjeZmqkhjgh]jlqYkYfafn]kle]fl

are not included.

In order to be included, the target company (the buyout)

emkl`Yn]alkgofk]hYjYl]ÕfYf[af_kljm[lmj]Yf\emkl

not be held as a subsidiary of a parent holding company

after the buyout.

Firms that are purchased by companies owned by a PE

ÕjeYj]lj]Yl]\YkY[imakalagfkYf\Yj]fglaf[dm\]\af

the buyout statistics. However, these deals are recorded

in the “acquisitions by buyout companies” statistics.

All quoted values derive from the total transaction value

of the buyout (enterprise value) and include both equity

and debt.

The buyout location is the location of the headquarters of

the target company and it is not related to the location of

the PE company.

The quarterly data only counts information on transactions

that formally close in that quarter and does not include

announced deal information.

Multiple | 15

Contacts

Sachin Date

EMEIA Private Equity Leader

+ 44 20 7951 0435

sdate@uk.ey.com

Bridget Walsh

United Kingdom and Ireland

+ 44 20 7951 4176

bwalsh@uk.ey.com

Maurice van den Hoek

Netherlands

+ 31 88 40 70434

maurice.van.den.hoek@nl.ey.com

Marc Guns

Belgium

+ 32 2 774 9419

marc.guns@be.ey.com

Michael Kunz

Germany, Switzerland and Austria

+ 49 6196 996 26253

michael.kunz@de.ey.com

Laurent Majubert

France

+ 33 1 55 61 06 29

laurent.majubert@fr.ey.com

Juan López del Alcázar

Spain

+ 34 915 725 195

juan.lopezdelalcazar@es.ey.com

Umberto Nobile

Italy

+ 39 028 066 9744

umberto.nobile@it.ey.com

16 | Multiple April 2015

Marketing:

Pierre Vigouroux

Transaction Advisory Marketing

+ 33 1 55 61 01 33

pierre.vigouroux@fr.ey.com

Michel Eriksson

Nordics

+ 46 8 520 593 54

michel.eriksson@se.ey.com

Olivier Coekelbergs

Luxembourg

+ 352 42 124 8424

olivier.coekelbergs@lu.ey.com

Peter Wells

Central and Southeast Europe

+ 420 225 335 254

peter.wells@cz.ey.com

Leonid Saveliev

Commonwealth of Independent States

+ 7 495 705 9702

leonid.saveliev@ru.ey.com

Demet Ozdemir

Turkey

+ 90 212 368 5264

demet.ozdemir@tr.ey.com

For more information, please visit ey.com/multiple.

Multiple | 17

Further insights

2015 Global Corporate

Development Study

Oal`E9Õjedqj]%]klYZdak`]\YkYjgml]lg

_jgol`$l`]klm\qÕf\kka_faÕ[Yfl[`Yf_]k

in the role and responsibility of the corporate

\]n]dghe]flg^Õ[]j ;<G!&

For more information, visit

ey.com/cdo.

?dgZYd;YhalYd;gfÕ\]f[]:Yjge]l]j

April 2015

The ?dgZYd;YhalYd;gfÕ\]f[]:Yjge]l]j surveyed

a panel of more than 1,600 executives to identify

boardroom trends and practices in the way

companies manage their capital agendas.

For more information, visit

ey.com/ccb.

18 | Multiple April 2015

2015 Global Divestment Study

The 2015 Global Divestment Study highlights

how leading companies view divestments as a

fundamental part of their capital strategy.

For more information, visit

ey.com/divest.

Capital Insights

How can companies combine the best traditional

business methods with innovative approaches to

help shape their destinies?

For more information, visit

capitalinsights.info.

Multiple | 19

EY | Assurance | Tax | Transactions | Advisory

About EY

EY is a global leader in assurance, tax, transaction and advisory services.

The insights and quality services we deliver help build trust and confidence

in the capital markets and in economies the world over. We develop

outstanding leaders who team to deliver on our promises to all of our

stakeholders. In so doing, we play a critical role in building a better

working world for our people, for our clients and for our communities.

EY refers to the global organization, and may refer to one or more, of

the member firms of Ernst & Young Global Limited, each of which is a

separate legal entity. Ernst & Young Global Limited, a UK company limited

by guarantee, does not provide services to clients. For more information

about our organization, please visit ey.com.

About EY’s Transaction Advisory Services

How you manage your capital agenda today will define your competitive

position tomorrow. We work with clients to create social and economic

value by helping them make better, more informed decisions about

strategically managing capital and transactions in fast-changing markets.

Whether you’re preserving, optimizing, raising or investing capital, EY’s

Transaction Advisory Services combine a unique set of skills, insight

and experience to deliver focused advice. We help you drive competitive

advantage and increased returns through improved decisions across all

aspects of your capital agenda.

© 2015 EYGM Limited.

All Rights Reserved.

EYG no. DE0605

BMC Agency

BACS 1001509

ED None

In line with EY’s commitment to minimize its impact on the environment,

this document has been printed on paper with a high recycled content.

This material has been prepared for general informational purposes only and is not intended to

be relied upon as accounting, tax, or other professional advice. Please refer to your advisors for

specific advice.

ey.com/multiple

EY — recognized by

mergermarket as top of the

European league tables for

accountancy advice on

transactions in calendar

year 2013 and 2014

The views of third parties set out in this publication are

not necessarily the views of the global EY organization or

its member firms. Moreover, they should be seen in the

context of the time they were made.