Introduction to Financial Management

advertisement

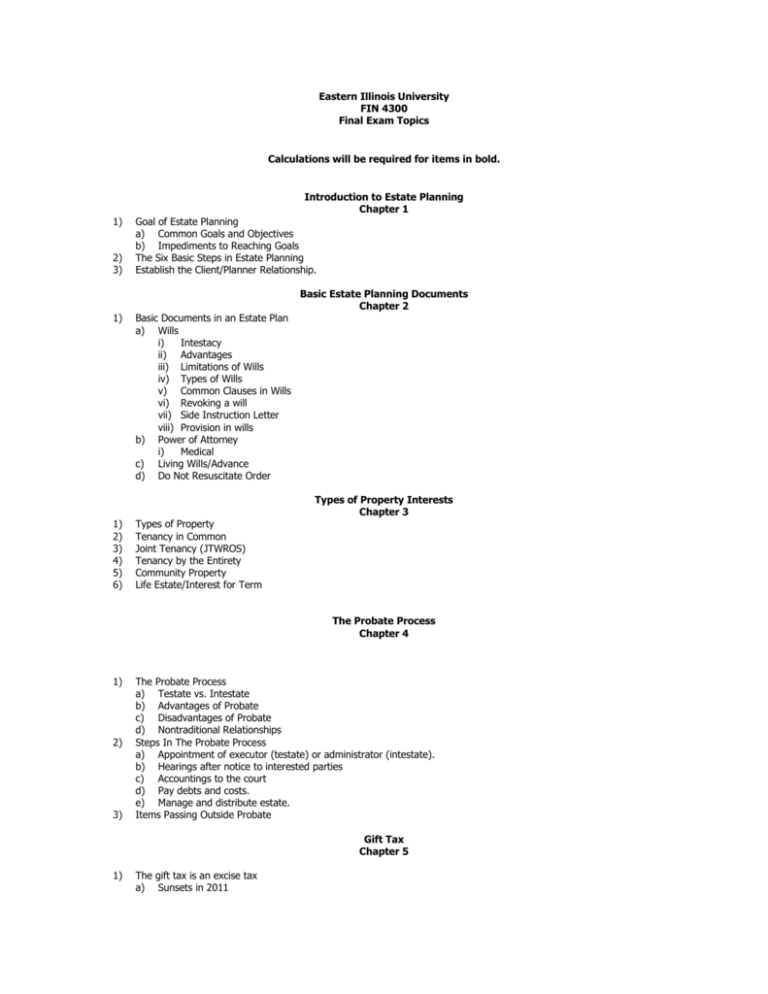

Eastern Illinois University FIN 4300 Final Exam Topics Calculations will be required for items in bold. Introduction to Estate Planning Chapter 1 1) 2) 3) 1) 1) 2) 3) 4) 5) 6) Goal of Estate Planning a) Common Goals and Objectives b) Impediments to Reaching Goals The Six Basic Steps in Estate Planning Establish the Client/Planner Relationship. Basic Documents in an Estate Plan a) Wills i) Intestacy ii) Advantages iii) Limitations of Wills iv) Types of Wills v) Common Clauses in Wills vi) Revoking a will vii) Side Instruction Letter viii) Provision in wills b) Power of Attorney i) Medical c) Living Wills/Advance d) Do Not Resuscitate Order Types of Property Tenancy in Common Joint Tenancy (JTWROS) Tenancy by the Entirety Community Property Life Estate/Interest for Term Basic Estate Planning Documents Chapter 2 Types of Property Interests Chapter 3 The Probate Process Chapter 4 1) 2) 3) The Probate Process a) Testate vs. Intestate b) Advantages of Probate c) Disadvantages of Probate d) Nontraditional Relationships Steps In The Probate Process a) Appointment of executor (testate) or administrator (intestate). b) Hearings after notice to interested parties c) Accountings to the court d) Pay debts and costs. e) Manage and distribute estate. Items Passing Outside Probate Gift Tax Chapter 5 1) The gift tax is an excise tax a) Sunsets in 2011 2) 3) 4) 5) 6) 7) 8) 9) 10) 11) 12) 13) 14) 15) 16) 17) 18) 19) Parties to a Gift a) Donor (person who makes a gift) b) Donee (person who receives a gift) Definition of Gifts Direct Gifts Indirect Gifts Bonic-Market Loan Complete vs. Incomplete Gifts Reversionary Interests Valuation of a Gift Annual Exclusion a) Non-U.S. citizen spouses Split Gifts Gifts of a Present Interest a) Crummey Provision b) 5/5 Lapse Rule Qualified Transfers A qualified transfer is a payment for someone else paid directly to a: Payments for Support Gifts to Spouses Charitable Gifts Income Tax Issues Gifting Strategies Estate Tax Chapter 6 1) 2) 3) 4) 5) 6) 7) 8) 9) 10) 11) 12) 13) Estate Tax Formula The Gross Estate a) 2033 – Property Owned at Death b) 2035 – Three-Year Lookback c) 2036 – Transfers with a Retained Interest d) 2037 – Transfers Taking Effect at Death e) 2038 – Revocable Transfers f) 2039 – Annuities g) 2040 – Jointly Owned Property h) 2041 – Powers of Appointment i) 2042 – Proceeds of Life Insurance j) 2044 – QTIP Property Appraisals a) Closely held business b) Valuation discounts i) Minority discount ii) Lack of marketability discount iii) Blockage discount iv) Key person discount c) Financial Securities d) Alternate Valuation Date Deductions from the Gross Estate a) Funeral expenses b) Last medical expenses c) Administration expenses d) Debts e) Losses during administration Adjusted Gross Estate Less Marital deduction Less Charitable deduction Equals Taxable Estate Plus Post ‘76 gifts Equals Tentative Tax Base Tentative Tax Credits a) Applicable estate tax credit b) Prior transfer credit Estate Tax Liability Transfers During Life and at Death Chapter 7 1) 2) 3) 4) Installment sale – note from buyer to seller. Transfers Not Subject to Gift Tax a) Legal Support b) Qualified Transfers c) Transfer to Spouses d) Some Bonic-Market Rate Loans Lifetime Transfers a) Intrafamily loans b) Gifts Outright and in Trust c) Partial Sale-Gift Transactions Full Consideration Transfers/Sales a) Private Annuities b) SCIN c) Grantor Retained Annuity Trust (GRAT) d) Qualified Personal Residence Trust (QPRT) e) Family Limited Partnerships (FLP) Trusts Chapter 8 1) 2) 3) 4) 5) Parties a) Trustee i) Duty of loyalty and care b) Beneficiary i) Income – right to income. ii) Remainder – right to property when trust terminates. Uses a) Management b) Creditor protection c) Split interests in property d) Avoid probate (living trust) Trust Duration – The Rule Against Perpetuities Taxation of Trust a) Simple trust – mandates distribution of income. b) Complex trusts – permits accumulation of income. Classification of Trust Arrangements a) Revocable trusts b) Irrevocable trusts c) Testamentary trusts d) Standby trust e) Pourover trust f) Grantor trust g) Trusts Used in Estate Planning i) Inter Vivos Revocable ii) Inter Vivos Irrevocable iii) Life Insurance (ILIT) iv) Power of Appointment Trust v) Qualified terminable interest property (QTIP) trust vi) Grantor Retained Income/Interest Trusts (GRITs) vii) GRATS, GRUTS, QPRTS, TPPTs. viii) Dynasty Trusts ix) Trusts for minors – Sec. 2503(b) and Sec. 2503(c) trusts. x) Charitable trusts xi) Totten trusts xii) POD accounts (not really trusts). xiii) Blind trusts xiv) Revocable trust used when self management might be a conflict of interest (e.g., a politician). Charitable Giving Chapter 9 1) Charitable contributions a) Qualified organizations 2) 3) 4) 5) 6) b) Public charity: charitable, religious, education, government c) Private charity: foundation Lifetime Charitable Gifts Amount deductible a) Cash i) 50%: public charity ii) Carryover for five years b) Capital gain property: deduct FMV i) 30%: public charity ii) Elect 50% limit if use basis instead of FMV c) Tangible personal property i) Related use (car to car museum): deduct FMV ii) Unrelated use: deduct cost Substantiation a) Noncash contributions i) Over $500: attach Form 8283 including description ii) Over $5,000: must have qualified appraisal IRA Contributions Charitable Trusts a) CRAT b) CRUT c) Pooled income fund Unlimited Marital Deduction Chapter 10 1) 2) 3) 1) 2) 3) 4) 5) 6) 7) 8) 9) Unlimited Marital Deduction a) Advantages b) Disadvantages Exceptions to terminable interest rule a) Survivorship clauses b) If spouse holds power of appointment over assets c) Charitable Remainder Trusts d) QTIP: qualifies for marital deduction i) Requirements e) QDOT: Non-citizen spouse i) Requirements Bypass Trusts Life Insurance Chapter 11 Term insurance Universal life a) Variable universal life Whole life Objectives of Life Insurance Parties to a Life Insurance Policy Income Tax Treatment of Life Insurance a) Policy exchanges 1035 b) Accelerated death benefits Gift Tax Treatment of Life Insurance Federal Estate Tax Treatment of Life Insurance a) I.R.C. Sec 2033 – Life insurance on someone else’s life b) I.R.C. Sec. 2035 – The three year rule Life Insurance Trust (ILIT) Special Needs and Post Mortem Planning Chapter 12 1) 2) Liquidity Needs a) Last medical costs b) Funeral costs c) Transition or adjustment period costs d) Administrative costs e) Income, estate and generation skipping transfer taxes Liquidity Sources and Implications 3) 4) 5) 6) 7) 8) 9) 10) 11) 12) 13) a) Sale of assets b) Life insurance c) Tax advantaged accounts – qualified plans, IRAs d) Corporate redemption from closely held businesses e) Loans for payments of taxes and other costs Joint or Separate Final Income Tax Return a) Surviving spouse b) Passive and Capital Losses c) Expense Elections Selection of tax year Expense Elections Waiver of Executor’s Fees Charitable bequests Gift Tax Issues Valuation of assets a) Alternate valuation date Installment Payments of Estate Tax (6166, 6161) Special Use Valuation (2032A) Disclaimers QTIP Election Generation Skipping Transfers Chapter 13 1) 2) 3) 4) 5) 6) 7) 8) Parties Involved in Generation Skipping Transfers Types of Taxable Transfers Exclusions a) Annual Exclusion b) Split gifts GST Exemption Applicable Rate Inclusion Ratio Applicable Fraction Dynasty Trusts a) Basic Structure and Types of Dynasty Trusts Enter your answers for the following questions on a separate sheet of paper with your name on it and bring this paper to class. These answers will be collected at the start of class prior to the review. Questions: 7,12,24,27,57,68,77,90,104,117 1) Which of the following statements is correct? a) To die intestate is to die without a valid will. b) A simultaneous death clause provides an assumption of the oldest spouse dies first in the event that both spouses die simultaneously. c) A no contest clause allows property to pass from one party to another without gift tax consequences. d) Merman Malburg has willed his business, which he owns JTWROS with his sister Mary, to his son, Merbert. When Merman dies, Merbert will inherit half of the business. 2) Which of the following is not an estate-planning objective? a) Fulfill client’s property transfer wishes. b) Minimize taxes. c) Increase the size of the probate estate. d) Provide needed liquidity. 3) A handwritten will dated and signed by the testator is a __________ will. a) holographic b) nuncupative c) statutory d) testamentary 4) Which of the following is true regarding powers of attorney? a) A general power of attorney creates a taxable gift to the holder of the general power of attorney b) The powers are revocable. c) The power continues after death. d) The principal giving the power of attorney must be approved by the probate court. 5) Which of the following generally details the testator’s wishes regarding the disposition of tangible possessions, the disposition of the decedent’s body, and funeral arrangements? a) Will. b) Codicil. c) Side instruction letter. d) Tangible possession trust. 6) Which of the following is not a duty of an executor? a) Locates and proves the will. b) Notifies creditors of the death of the decedent. c) Receives letters testamentary from court. d) Petitions court for his or her appointment. e) Witnesses the will. 7) Which of the following is a community property state? a) New York. b) Ohio. c) Illinois. d) Oregon e) California. 8) Malph Malburg has the assets listed below. Which assets will go through probate? (i) Life insurance; beneficiary is his wife Molanda. (ii) IRA; no beneficiary (iii) Personal residence; in a living trust. (iv) Auto; Mr. Malburg is the sole owner. a. ii only. b. iv only. c. ii and iv. d. ii, iii, and iv. e. i, ii, iii, and iv. 9) Which of the following assets would be part of Gravy Grady’s probate estate: a home owned by him as an individual; a car in joint tenancy with his wife; common stock held as an equal tenant in common with his brother; and land held in a revocable living trust. (i) Home (ii) Car (iii) Stock (iv) Land a. (i), (ii), and (iv) only are correct. b. (ii) and (iv) only are correct. c. (i) and (iii) only are correct. d. (iv) only is correct. e. All are correct. 10) Phog E. Park purchases a vacation condo for $150,000, taking title in joint tenancy with his two children. What would be the total taxable gifts shown on Park’s gift tax return? a) $126,000 b) $100,000 c) $74,000 d) $37,000 e) $24,000 11) If Mr. Park died when the condo was worth $240,000, insofar as the condo is concerned what value would be included in his gross estate? a) $50,000 b) $80,000 c) $120,000 d) $160,000 e) $240,000 12) Which of the following is not a transfer tax? a) Gift tax b) Federal estate tax c) Income tax d) GSTT 13) Which of the following is generally not one of the members of the estate planning team? a) attorney b) loan officer c) CPA d) life insurance consultant e) trust officer 14) Which of the following is not correct? a) If a trust is created inter vivos, it is created “at death.” b) A revocable trust will avoid the costs and process of probate, but will not reduce federal estate taxes. c) A grantor trust is a trust in which the grantor transfers property into a trust but the grantor retains some right of enjoyment of the property. d) The assets selected for a QTIP trust qualify for the unlimited marital deduction. 15) Which of the following is correct? a) The valuation of property included in the gross estate is either the fair market value at the date of death, or if properly elected, the value for the alternate valuation date (nine months from the date of death). b) A general power of appointment is a power to appoint assets to anyone, including the power holder. c) both a) and b) d) neither a) or b) 16) Which of the following is correct? a) At the end of the QPRT term, the residence reverts back to the grantor. b) A charitable lead trust (CLT) is a split interest trust where a charity is the income beneficiary and there is a non-charitable remainderman. c) both a) and b) d) neither a) or b) 17) Which of the following is not a feature of a testamentary trust? a) It is created by the will. b) It will shift an income tax burden to a lower-bracket taxpayer. c) It is included in the gross estate. d) It does not avoid probate. 18) Sally Seelhoefer gave the following gifts during the current year: Son $25,000; Daughter $8,500; Ex-Husband $20,000. What is the amount of taxable gifts Ms. Seelhoefer made? a) $7,000 b) $12,000 c) $14,500 d) $19,000 e) $19,500 19) Gladys and George Gallaher made the following gifts during the current year: $27,000 to their daughter; $6,000 to their son; $33,000 to their granddaughter. If the Gallahers split gifts, what would their taxable gifts be? a) 0 b) $2,000 c) $8,000 d) $26,000 e) $60,000 20) Which of the following is correct regarding the annual exclusion? a) To qualify for the annual exclusion, the gift must be a completed gift, either of a future or present interest. b) The annual exclusion can be increased to $26,000 if gift splitting of community property is elected. c) Gifts to all individuals must be $13,000 or less to not be taxable. d) Including a Crummey withdrawal provision in a trust will permit contributions to the trust to qualify for the annual exclusion. 21) Which of the following is true regarding a QTIP Trust? a) A QTIP must be used if the surviving spouse is a nonresident alien. b) Trust income must be paid to the spouse or beneficiary designated by the spouse at least annually. c) The trust assets will be included in the gross estate of the surviving spouse. d) The surviving spouse determines the remainder beneficiaries. 22) Which of the following is not correct regarding the credit equivalency trust? a) The remainder beneficiary is generally the children. b) The assets are not taxed in the estate of the first spouse to die. c) In 2012, assets of $5,120,000 would be transferred to a credit equivalency trust. d) The income beneficiary can invade the trust after they reach the age of 591/2. 23) Harley Park, a wealthy widow, is interested in reducing her gross estate. Which of the following techniques would be least likely to help her accomplish her goal? a) Placing Apple stock which is expected to increase in value into a GRAT. b) Selling land currently valued at $50,000 but expected to greatly appreciate to a child in an installment sale. c) Utilizing gifts of $13,000 to transfer property to a grandchild. d) Establishing a POD account with her children as the beneficiaries. 24) Monda Malburg, age 64, lives with her husband Malph in Illinois. Rhonda inherited a vacation home in Maine from her uncle, Pork Chop Park. Which of the following forms of ownership would you recommend for the vacation home? a) tenants in common b) living trust c) sole ownership d) community property 25) Balice and Banvil Bonic, life-long residents of Dime Box, Texas, paid $100,000 for their home five years ago. Its fair market value when Banvil died last week was $150,000. What is Balice’s basis in the home after the Banvil’s death? a) $50,000 b) $75,000 c) $100,000 d) $125,000 e) $150,000 26) Syrtle and Sarvin Seelhoefer, residents of Effingham, Illinois, own 40 acres of farmland as joint tenants with rights of survivorship. Myrtle owns a $250,000 certificate of deposit in her name only and Marvin owns a $100,000 in his name only. The Seelhoefer have no debts. Mrs. Seelhoefer’s last will provided “all of my assets at death shall be divided in three equal portions among my children and my husband”. If Mrs. Seelhoefer dies today, leaving Mr. Seelhoefer and their two children as heirs, which of the following statements is correct? a) the children will inherit two-thirds of the $250,000 CD and one-third of the farm. b) the children will inherit two-thirds of the $250,000 CD and no interest in the farm. c) the children will inherit two-thirds of the $250,000 CD and one-half of the farm. d) the children’s share of the $250,000 CD and the one-third interest in the farm will be subject to probate. e) Mr. Seelhoefer can elect to take against the will and receive all of his wife’s assets 27) Two weeks after Syrtle’s death, Sarvin is killed by a stampeding elephant at a circus. His will provides that “I hereby give all my real property to my brother Misfit and I give all my personal property to my children equally”. Which of the following statements is true? a) The children will receive Mr. Seelhoefer’s CD and the farm. b) The children will receive neither the CD nor the farm. c) Mr. Seelhoefer’s CD is subject to probate but the farm is not. d) None of Mr. Seelhoefer’s assets are subject to probate. e) The children will inherit the CD and Misfit Seelhoefer will receive the farm. 28) Although he has a vast fortune, Moger Malburg has decided not to prepare an estate plan because he believes that his surviving family members will divide up his assets appropriately. Which of the following is not a risk associated with failing to plan an estate? a) Malburg’s estate will incur excessive transfer taxes. b) Malburg’s favorite Corvette will not be transferred to his girl friend, Mallet, who owns the car with Moger as tenants in common c) Malburg’s insurance policy on his own life will not be paid out to the named beneficiary. d) Malburg’s current wife, Mucille, will not provide for Malburg’s children from a previous marriage. 29) Mellie Malburg, who is not a licensed attorney, recently started her own financial planning practice. Which of the following activities would be considered the unauthorized practice of law? a) Preparing a side instruction letter for her clients. b) Helping clients to identify their financial planning goals. c) Preparing an ILIT for prospective clients. d) Referring clients to her brother, Mack, who happens to be a licensed attorney. 30) Pabby Park is getting ready for her first meeting with her new financial planner, Merbert Malburg. What information does Park not need to bring to this meeting? a) Previously filed income tax and gift tax returns. b) A copy of her current will. c) A detailed list of Park’s assets and liabilities. d) A copy of Pabby’s birth certificate. 31) Under which of the following circumstances would the decedent be considered to have died intestate? a) The decedent handwrote a will, but did not sign or date it. b) The decedent was not of “sound mind” when he signed his statutory will. c) The decedent failed to prepare a last will and testament. d) All of the above. 32) Harlow Harris recently prepared a last will and testament in which he left all of his assets to his girlfriend H. Mo. Harris and H. Mo broke up last night and now Harris wants to leave all of his worldly possessions to his best friend, Horace. What can Harris do to prevent L. Mo from receiving any of his assets? a) Harris can shred the will under which H. Mo receives all of his assets. b) Harris can send H. Mo an email telling her that he is cutting her out of his will. c) Harris can tell Horace that he plans to write a new will. d) Harris can give the will to Horace. 33) Rom Reardanz is considering having his attorney prepare a general power of attorney in which his gives his friend, Chainsaw, the power to handle his finances. Why should Reardanz include such a document in his overall estate plan? a) In the event that Reardanz becomes disabled, Chainsaw will be able to pay Reardanz’s bills. b) Chainsaw can make decisions regarding Reardanz’s health care. c) Chainsaw is only 16 years old and Rom woul like to adopt him. d) Reardanz wants to reduce his probate estate. 34) Megbert Malburg, a real estate mogul, dies owning a great deal of real property. Which of the following would be included in Malburg’s probate estate? a) A building owned fee simple by Malburg’s wife. Malburg and his wife do not live in a community property state. b) A vacant lot owned joint tenancy with rights of survivorship by Malburg and his brother. c) A beach house owned tenancy in common by Malburg and his mother. d) An office building owned tenancy by the entirety by Malburg and his wife. 35) Madys Malburg, age 86, and Buffo Biceps, age 23, have been in a long-term relationship. Malburg wants to make sure that if she dies first, Biceps will be provided for. Which of the following would you be likely to recommend to fulfill Malburg’s goal of transferring assets to Biceps at Malburg’s death? a) Name Biceps as the beneficiary of Malburg’s retirement plan. b) Transfer the ownership of Malburg’s real estate investments into Tenancy by the Entirety. c) Advise Malburg against writing a will that specifically bequeaths assets to Biceps. d) Recommend that Malburg and Biceps move to a community property state. 36) Putty Park, age 84, owns a farm jointly with rights of survivorship in Coles County with his wife FiFi, age 19. The farm was originally purchased by Putty in 1942 for $10,000. In 2009, when the farm was valued at $900,000, Putty changed the ownership of the farm to joint ownership with his charming new wife. Three days later, Putty died when FiFi accidentally ran over Putty with a combine. What amount will be included in Putty’s probate estate for the farm land? a) 0 b) $10,000 c) $450,000 d) $900,000 37) What amount will be included in Putty’s taxable estate for the farm land? a) 0 b) $10,000 c) $450,000 d) $900,000 38) Seven months after Putty’s death, the grieving FiFi sells the farm for $1,150,000. What is the capital gain for FiFi as a result of this sale? a) 0 b) $250,000 c) $695,000 d) $700,000 e) $1,140,000 39) Gladys Gallaher, age 84, owns a farm in Sacramento, California with her husband, Gimp, age 19. The farm was purchased by the Gallahers in 2006 for $710,000. In 2007, when the farm was valued at $870,000, Gladys died when Gimp thought she was a wild turkey and he accidentally shot her. Seven months after her death, the grieving Gimp sells the farm for $930,000. What is the capital gain for Gimp as a result of this sale? a) 0 b) $60,000 c) $140,000 d) $220,000 40) The a) b) c) d) first step in the estate planning process includes: Meeting with the client and discussing the client’s assets, family structure, and desires. Prioritizing the client’s goals. Developing a formal written estate plan. Identifying key areas of concern in relation to the client’s plan - taxes, cash on hand, etc. 41) Melly Malburg does not want to write a will. It upsets her to contemplate her own death and she simply desires to avoid the estate planning process. Which of the following is not a risk Melly’s estate may face because of Melly’s inaction? a) Melly’s property transfers contrary to her wishes. b) Melly’s estate may face liquidity problems. c) Melly’s estate faces increased estate administration fees. d) Melly’s estate faces increased debt payments for outstanding debts at death. 42) Honcho Harris, a resident of Tuscola, Ilinois, died without a will. She is survived by a son, a cousin and her grandmother. Who will inherit her assets she owned individually? a) her son b) her cousin c) her grandmother d) her son, cousin, and grandmother will receive one-third of the assets e) the state of Illinois 43) Rellie Reardanz is married and owns and manages several rental properties. She is concerned that if she became incapacitated, the properties would not be properly managed and her tenants would be upset. Of the following arrangements, which one could fulfill Reardanz’s desire to plan for the management of her rental properties in the case of his unanticipated physical or mental incapacity? a) A durable power of attorney. b) Owning the property as tenants in common with her husband. c) Owning the property as tenancy by the entirety. d) All of the above. 44) After listening to a popular radio financial planning talk show, Leroy Harris decided to grant a durable power of attorney to her neighbor, Shredder. All of the following statements regarding the durable power of attorney are correct except? a) At the creation of the durable power of attorney, Harris must be at least 18 years old and competent. b) The power can spring at a certain age or event. c) After Grady death, the power remains in force. d) If Harris becomes disabled, the power remains in force. 45) Greasy Grady’s cousin Gobo gave her a general power of appointment over his assets. Disregarding any fidicuary problems, which of the following is not true regarding the power? a) Greasy can pay for her own groceries with her cousin’s money. b) Greasy can pay for Gobo’s groceries with Gobo’s money. c) Greasy’s gross estate will include Gobo’s assets if Greasy dies before Gobo. d) The general power of appointment only allows Greasy to appoint Gobo’s assets for expenditures related to health, education, maintenance, or support. 46) Which of the following documents appoints a surrogate decision-maker for health care? a) Durable power of attorney for health care. b) General power of appointment. c) Life insurance beneficiary designation. d) All of the above. 47) Which type of will is handwritten and does not generally require a witness? a) Holographic. b) Oral. c) Nuncupative. d) Statutory. 48) While he was in the hospital, Sam Seelhoefer told his wife that if he died he wanted to give his fishing tackle to his son, Skip; his golf equipment to his son, Scoop; his truck to his daughter, Scotch; and everything else to her (his wife). Seelhoefer died the next day without writing anything that he told his wife, but a nurse and another patient were in the room and heard his declarations. What type of will does Seelhoefer have, if any? a) Holographic. b) Nuncupative. c) Statutory. d) Seelhoefer does not have a will. 49) Gravel Grady’s will leaves her car to her brother, her boat to her sister, and her vacation home to her cousin. Her will directs the remainder of her assets to be divided equally amongst her two children. Grady’s will directs all debts and taxes to come from the children’s assets. Of the following, which are included in Grady will? (1) Residuary clause. (2) Specific bequests. (3) Payment of debts and taxes clause. (a) 1 only. (b) 3 only. (c) 1 and 3. (d) 1, 2, and 3. 50) Sailfish Seelhoefer’s will leaves all of his property to his wife. If she does not survive him by more than six months, the property will transfer to Seelhoefer’s only son. Seelhoefer dies on April 13th and his wife dies the following October 10th. Of the following statements, which is true? a) Seelhoefer’s property will transfer to his son. b) Seelhoefer’s property will transfer to his wife and qualify for the unlimited marital deduction. c) Seelhoefer’s property will transfer to his wife, but the property will not be eligible for the unlimited marital deduction in Seelhoefer’s estate. d) Seelhoefer’s property will transfer to his wife and the property will be eligible for the unlimited marital deduction in Seelhoefer’s estate. 51) Which of the following statements regarding joint tenancy with rights of survivorship is correct? a) Each tenant may bequeath their interest in the property at their death. b) Joint tenancy with rights of survivorship is the same as community property. c) Only spouses can establish joint tenancies. d) Each tenant under a joint tenancy with rights of survivorship has an undivided interest in the property. 52) Which of the following statements regarding community property is not correct? a) If one spouse inherits property during the marriage, that property is generally not considered community property. b) Assets acquired by either spouse before marriage generally become community property upon their marriage. c) Community property assets are included in probate. d) If one spouse utilizes his paycheck from work performed during the marriage to purchase property, the property is community property. 53) At the death of either partner, a same-sex couple would like to ensure that all property, insurance policies, and retirement plans transfer to the surviving partner. Which of the following will NOT accomplish the couple’s goal? a) Each partner is listed as the beneficiary of the other partner’s life insurance policy. b) Each partner is listed as the beneficiary of the other partner’s qualified pension plan. c) Each partner is a joint tenant in all of the couple’s property owned joint tenancy with rights of survivorship. d) State intestacy laws. 54) In 2003, Hobo and Hap Harris, having been married for three years, agree to purchase some real property and title it joint tenancy with right of survivorship. At the time of the purchase, Hobo did not have any cash, so Hap paid the $50,000 purchase price himself. Over the next five years, Hap and Hobo allocated the income and expenses of the property equally, and luckily for them the value of the property increased to $350,000. In 2012 Hap dies, how much will his executor include in his federal gross estate as the value of this real property? a) $50,000. b) $175,000. c) $300,000. d) $350,000. 55) A no contest clause: a) requires payments of estate taxes out of specific bequest b) is designed to prevent an heir from contesting the will c) both a) and b) d) neither a) or b) 56) In 2012 Mucous Malburg loaned his son $10,000 at zero percent interest so he could purchase a watch and arrive at class on time. He also gave his son $20,000 to pay his tuition at Eastern Illinois University. What is the amount of taxable gifts made by Mucous in 2012? a) 0 b) 7,000 c) 8,000 d) 18,000 e) 30,000 57) Rudolph Reardanz has several pieces of property valued at $100,000 that he would like to give away. He wants to make gifts that sense for both himself and the recipient. He wants to give gifts to his mother, Rosie, her only source of income is Social Security; his brother, Ratface; his daughter, Radish; and to Eastern Illinois University. He has the following assets: Intel stock valued at $100,000 and an adjusted basis of $145,000. The stock has a dividend yield of 0% and is expected to appreciate at 4% Ameren stock valued at $100,000 and an adjusted basis of $35,000. The stock has a dividend yield of 4% and is expected to appreciate at 6% Google stock valued at $100,000 and an adjusted basis of $55,000. The stock has a dividend yield of 1% and is expected to appreciate at 11% Ford bonds valued at $100,000 with an adjusted basis of $98,000. The bond has a coupon of 7% and is not expected to appreciate. Real estate valued at $100,000 and an adjusted basis of $88,000. The real estate is expected to appreciate at 9%. Which of the above assets should Mr. Reardanz keep for himself? a) Intel stock b) Ameren stock c) Google stock d) Ford bonds e) Real estate 58) Which of the above assets should Mr. Reardanz give to Eastern Illinois University? a) Intel stock b) Ameren stock c) Google stock d) Ford bonds e) Real estate 59) Which of the above assets should Mr. Reardanz give to Rosie? a) Intel stock b) Ameren stock c) Google stock d) Ford bonds e) Real estate 60) Which of the above assets should Mr. Reardanz give to Radish? a) Intel stock b) Ameren stock c) Google stock d) Ford bonds e) Real estate 61) Hobo Harris gave her cousin, Harley, 2,000 shares of General Motors. Harris had an adjusted basis of $20,000 for the shares and the fair market value at the date of the gift was $60,000. Since earlier in the year Harris had given Harley a 1989 Dodge Caravan with a value of $13,000, Harris paid gift tax of $9,000 on the gift to Harley. If Harley sells the stock two months later after receiving the gift for $62,000, what is her capital gain/loss? a) 2,000 b) 6,000 c) 36,000 d) 42,000 62) Which of the following is not included in the decedent’s gross estate? a) Gift tax paid in the last three years b) A life insurance policy sold two years ago c) Corporate stock transferred to a revocable living trust d) A refund of medical expenses incurred paid two months before death. The refund check was received three weeks after death. e) Property in a QTIP established by a predeceased spouse 63) Retchen Reardanz owns sixty percent of the outstanding shares of Mattoon Mop Sales, a family owned business. Her estate could reduce the value of her shares using which of the following valuation discounts? a) Minority b) Lack of marketability c) Both a) and b) d) Neither a) or b) 64) Sam Seelhoefer owns an IRA valued at $30,000, a home valued at $32,000 and a cow valued at $1,000. Which of the following assets can be valued using the alternate valuation date? a) IRA b) Home c) Both a) and b) d) Neither a) or b) 65) Which of the following is added to the taxable estate to determine the tentative tax base? a) Gift taxes paid in the last three years b) Administrative expenses c) Taxable gifts d) Debts of the decedent 66) The a) b) c) d) credit for prior transfers applies when: Taxable gifts were made in the last three years by the decedent Gift taxes were paid the last three years by the decedent Estate taxes were paid in the last 10 on property included in the estate Generation skipping tax was paid in the last 10 years 67) In 2012, decedents with a taxable estate over $5,120,000 will pay estate tax equal of up to __ of their taxable estate. a) 15% b) 35% c) 45% d) 55% 68) In March 2012, Steamboat Seelhoefer contributed Microhard stock he had purchased in 1992 for $3,000 to Eastern Illinois University. At the time of the contribution the stock had a value of $210,000. Mr. Seelhoefer’s adjusted gross income for 2012 is $500,000 and his taxable income is $400,000. What is the amount Mr. Seelhoefer can deduct on his 2012 Federal income tax return as a result of this contribution? a) 3,000 b) 120,000 c) 150,000 d) 200,000 e) 210,000 69) Madys Malburg, age 72, contributed Microhard stock she had purchased in 1995 for $20,000 to a charitable remainder trust. At the time of the contribution the stock had a value of $200,000. Ms. Malburg will receive an annual annuity payment of $10,000 per year for her 15 year life expectancy then the assets will go to Eastern Illinois University at the time of her death. Ms. Malburg’s adjusted gross income for 2008 is $400,000 and her taxable income is $300,000. What is the amount Ms. Malburg can deduct on her 2008 Federal income tax return as a result of this contribution if the Section 7520 rate is 1.4%? a) 65,547 b) 134,453 c) 150,000 d) 200,000 70) Rom Reardanz transferred Microhard stock valued at $30,000 to a revocable trust. His son Romato is the beneficiary of the trust. a) The stock will be included in Reardanz’s probate estate b) The stock will be included in Reardanz’s federal gross estate c) a) and b) d) neither a) or b) 71) Which of the following clauses in a trust prevents creditors from accessing funds in a trust to satisfy claims against a trust beneficiary? a) disclaimer b) remainder interest c) Crummey d) spendthrift e) prudent man 72) Which of the following statements concerning trusts is correct? a) Income from a simple trust will be included in the beneficiary’s taxable income b) Revocable trusts are included in the decedent’s probate estate c) Irrevocable trusts are included in the decedent’s taxable estate d) Inter vivos trusts are created in a decedent’s will e) Life insurance proceeds in an ILIT are subject to estate tax 73) Which of the following assets should be gifted to Eastern Illinois University by an individual over age 70 1/2? a) A Roth IRA with a value of $100,000 b) A home valued at $100,000 c) A Traditional IRA with a value of $100,000 d) A farm with a value of $100,000 which was purchased two years ago for $256,000 74) Which of the following statements regarding a CRAT is not correct? a) The CRAT must pay the income beneficiary annually at least five percent of the initial value of the trust b) Assets can be added to a CRAT up to five years after is has been established c) The assets remaining in the trust at the death of the income beneficiary will be transferred to the charity d) A CRAT should not be established by an individual who is in poor health and is expected to only live a few months 75) In 2012, Madys and Moofy Malburg own Malburg Moose, a business with a value of $40,000,000, as tenants in common. They have one child Mabby, age 23. Which of the following strategies would you recommend for the Malburgs? a) Madys and Moofy should each have a will that leaves all of their assets to the surviving spouse b) Madys and Moofy should each have a will that leaves all of their assets to a bypass trust which provides income to the surviving spouse c) Madys and Moofy should each have a will that leaves all of their assets to Flabby d) Madys and Moofy do not need a will since the business will not be included in their probate estate e) Madys and Moofy should purchase a second to die life insurance policy if they want to their moose to Mabby 76) Private annuities: a) Require payments until the annuitant reaches his life expectancy b) Eliminate income tax on the sale of the asset c) Must be secured with collateral d) Increase the seller’s probate estate e) Should be used only if the seller is in poor health 77) A surviving spouse can receive: a) Income from a bypass trust b) Assets from a bypass trust to provide for her health care needs c) Both a) and b) d) Neither a) or b) 78) Which of the following individuals has the greatest need for whole life insurance? a) Ressie Reardanz, age 83, who is married to Rebar, age 20. The Reardanz’s only source of income is a single life annuity purchased by Ressie that pays the Reardanz’s $10,000 per year for the remainder of Ressie’s life. b) Merbert Malburg, single, age 42, who owns 100,000 shares of Malburg Mops’ stock worth $4,000,000. c) Sam Seelhoefer, age 22, who just married Millie McGuire, age 47. They have are both successful attorneys and have nine children, ages 3 to 12. d) Melly Malburg, age 7, a college student. She is a Cardinals fan. 79) Which of the following statements is correct? a) A life insurance policy can be exchanged tax-free for another life insurance policy b) Proceeds from a viatical settlement are not taxable to the seller of the policy c) Changing the beneficiary on a life insurance policy creates a taxable gift d) An ILIT should be required to pay estate taxes as a result of the insured’s death 80) To qualify for surviving spouse filing status, a widow a) Must remarry b) Must maintain a home for dependent child c) Both a) and b) d) Neither a) or b) 81) Sam Seelhoefer owns an IRA valued at $30,000, a home valued at $32,000,000 and a car valued at $1,000. He died at a local hospital and incurred $17,000 in medical expenses. The medical expenses should be deducted on his: a) Estate tax return b) Federal income tax return c) Both a) and b) d) Neither a) or b) 82) Pelle Park should waive her fee as an executor if: a) The taxable estate is $12,456 b) She is a Cubs fan c) She has a marginal income tax rate of 15% d) She is one of 13 heirs 83) Disclaimers must: a) Be made within nine months of the date of death b) Can not specify who will receive the assets c) Both a) and b) d) Neither a) or b) 84) Installment payments of estate taxes can be made if: a) The deceased owned a publicly traded stock which comprises more than 75% of his estate b) The deceased had an estate of $2 million c) Both a) and b) d) Neither a) or b) 85) Which of the following gifts made by Putty Park, age 94, is subject to GSTT? a) A gift of $18,000 to his grandmother, Very Putty, age 117. b) Payment of education expenses of $17,000 to the Collinsville School of Cosmetology, for his secretary, Zsa Zsa Zebra, age 22, to study bicep implants c) A gift of $9,000 to his charming wife Buffy, age 21. d) A gift of $14,000 to his very charming neighbor FiFi, age 18. e) A gift of $23,000 to his business partner, Chopper, age 61. 86) What is the maximum amount of gifts Pauper Park, age 83, can make to his wife, Which Witch, age 21, in 2012 and pay no GSTT? a) 13,000 b) 1,013,000 c) 5,120,000 d) 5,133,000 e) unlimited 87) What assets are generally transferred to a dynasty trust? a) Family business b) Real estate c) Retirement accounts d) Life insurance 88) Gerb Gallaher believes her fog machine business will appreciate rapidly in the future. The current 7520 rate is 2.6%. Which of the following would be best suited for accomplishing Gerb’s objectives? a) FLP b) QPRT c) CRAT d) CRUT e) GRAT 89) Which of the following clauses should generally not be included in a dynasty trust? a) General power of appointment b) Trust protector c) Spendthrift d) Distribution 90) Sally Seelhoefer and Mabel Malburg both died after suffering heart attacks at a Looters’ restaurant during an educational expedition sponsored by a prestigious university located in Charleston, Illinois. The Coles County Coroner was unable to determine if the cause of death was the consumption of $174 of dead chickens at lunch washed down by beverages made from hops or the sight of scantily clad male waiters in short shorts and low cut shirts that caused the students’ heart attacks. During lunch, Ms. Seelhoefer, age 87 and a resident of Illinois, made an irrevocable transfer of her whole life insurance policy to Marvin Malburg, age 21, a waiter at Looters. a) Sally has made a taxable gift to Marvin b) The life insurance proceeds from the policy will be included in Sally’s taxable estate c) Both a) and b) d) Neither a) or b) 91) Ms. Seelhoefer had created trust for the benefit of a charity which shelters abandoned llamas. She will receive six percent of the annual ending value of the trust assets for the remainder of her life. Upon her death the llama shelter will receive the assets remaining in the trust. This is an example of a: a) CLAT b) CRAT c) CLUT d) CRUT 92) If Ms. Seelhoefer wants to make additional contributions to a charitable trust which pays income to the abandoned llamas charity for 11 years and then distributes the remaining trust assets to Seelhoefer’s boyfriend Lapdog Harris, which type of trust should she have created if she wanted to maximize her income? a) CLAT b) CRAT c) CLUT d) CRUT e) Bypass trust 93) Ms. Malburg, was married to a 18 year-old citizen of Russia, Boris Malburg, she had recently met on an internet dating site. To qualify for the marital deduction, Ms. Malburg would need to create what type of trust for the benefit of her husband? a) CLAT b) QTIP c) QDOT d) Bypass e) CRUT 94) The Malburgs were residents of California and had accumulated a community property estate of $3,000,000. Just prior to her death, Mrs. Malburg amended her will to make a specific bequest of $1,400,000 to her favorite waiter, Spanky, at Looters. Her will also created a bypass trust to receive property equal to any remaining applicable estate tax credit after specific bequests. The bypass trust gives income for life to Boris and then leaves the remainder of the trust to her surviving children. The residual of her estate was left to Boris. What is the marital deduction on Mabel’s federal estate tax return in 2012? a) 0 b) $100,000 c) $600,000 d) $1,900,000 e) $2,000,000 95) Edith and Egbert Edgar, age 53, and 24, respectively, are married and file a joint return for 2012. Edith earned $103,000 as an elephant washer at Evansville Elephant Wash, Inc. during the year and contributed $11,000 to the company’s 401(k) plan. Mrs. Edgar owns all of the common stock of Evansville Elephant Wash, Inc., valued at $10 million. Egbert owns a dishwasher. The Edgars have come to you for estate planning advice. In 2012 the Edgars gave their nephew Elias $5,000 to open a Roth IRA, $8,000 to buy a cow and paid his parking fines of $20,000 directly to Eastern Illinois University. During the year the Edgars also paid $30,000 to Bush League Hospital for a brain transplant for Elias’ girlfriend Boom Boom. Assuming the Edgars elect to split gifts, what is the amount of the taxable gifts to Elias and Boom Boom in 2012? a) 0 b) 7,000 c) 24,000 d) 50,000 e) 63,000 96) Edith is in great health and is expected to live sixty more years. Which of the strategies should be considered? a) A private annuity sale of Evansville Elephant Wash to the Edgar’s son, Edict b) Transfer of the Edgar’s home to a QPRT with a 10 year term c) Both a) and b) d) Neither a) or b) 97) Which of the following strategies should be considered? a) Transferring the company’s stock to a revocable trust b) Transferring shares of Evansville Elephant Wash to Egbert valued at $5 million to Egbert c) Both a) and b) d) Neither a) or b) 98) Theodore and Tanna Ticole Reardanz were married on December 31, 2005. It was the second marriage for Theodore, age 22, and the tenth marriage for Tanna Ticole, age 93. At the time of the marriage Theodore owned a bicycle valued at $39 and Tanna Ticole owned 3,000 acres of farm land valued at $15,000,000 jointly with rights of survivorship with her oldest son Trainwreck; a home in Joliet, Illinois valued at $1,500,000 which was held by Tanna Ticole Reardanz Living Trust, 10,000 shares of Google valued at $4,000,000 owned as tenants in common with her oldest son Topless; and a Traditional IRA with a value of $5,200,000. The Reardanzs have resided in the home in Illinois since their marriage. Mr. Reardanz earns $3,000 per year cleaning the teeth of elephants at the Joliet Zoo. Mrs. Reardanz receives $569,000 annual income from her investments and retirement accounts and a $89,000 salary as a consultant to the Chicago Flubs. During 2007, Mr. and Mrs. Reardanz purchased a vacation home in Mattoon, Illinois for $40,000 as tenants by the entirety. Theodore has one son, ToTo, age 2 who resides with his mother in Buffalo, New York. Mrs. Reardanz has eight children from her prior marriages ranging in age from six to seventy five years old. The couple just signed their wills last week. Mr. Reardanz’s will leaves all of his assets to his son Toto. Mrs. Reardanz’s will leaves a dishwasher to Mr. Reardanz with the remainder of her property to be divided equally among her surviving children. At the time the farm land was purchased Mrs. Reardanz paid the entire purchase price of $340,000 even though Trainwreck is an equal owner of the land. Which of the following statements is true? i) At the time the farm land was purchased, Tanna Ticole made a gift of $340,000 to Trainwreck ii) If Tanna Ticole dies today, the $15,000,000 value of the farm land would be included in her probate estate iii) If Trainwreck dies today, the $15,000,000 value of the farm land would be included in his taxable estate unless he can prove Tanna Ticole paid the entire purchase price (a) i) only (b) ii) only (c) iii) only (d) i), ii) and iii) (e) ii) and iii) 99) The beneficiary of Tanna’s Traditional IRA is her second son, Treetop. He predeceased her three years ago. There is no contingent beneficiary. Who will receive the proceeds of the Tanna’s Traditional IRA? a) Tanna Ticole’s children b) Theodore’s child c) The state of California d) Treetop’s children 100) The a) b) c) d) Traditional IRA will be: Included in Tanna Ticole’s probate estate Included in Tanna Ticole’s taxable estate Both a) and b) Neither a) or b) 101) The a) b) c) d) dishwasher Tanna Ticole is leaving to her husband Theodore is an example of: a spousal bequest an intestacy transfer separate property a specific bequest 102) If Tanna Ticole predeceases Trainwreck, who will receive her interest in the farmland? a) Trainwreck b) Theodore c) all of her surviving children d) Theodore and Trainwreck 103) If Tanna Ticole predeceases Topless, who will receive her shares of Google? a) Topless b) Theodore c) all of her surviving children d) Theodore and Topless 104) Which of i) ii) iii) the following will be included in Tanna Ticole’s probate estate if she dies today? the farmland her Traditional IRA the Google stock (a) i) only (b) iii) only (c) ii) and iii) (d) i), ii) and iii) 105) Which of i) ii) iii) the following will be included in Tanna Ticole’s taxable estate if she dies today? the farmland her Traditional IRA the Google stock (a) i) only (b) iii) only (c) i) and iii) (d) i), ii) and iii) 106) If the Reardanzs gift the vacation home to Tanna Ticole’s charming ex-husband Termite in 2012 when the home has a value of $30,000, how much income is taxable if Termite sells the home in 2012 for $55,000? a) $25,000 of capital gain b) $25,000 of ordinary income c) no taxable income d) $15,000 of capital gain e) $15,000 of ordinary income 107) Assume the vacation home has a value of $100,000 at the time of Tanna Ticole’s death. If the home is sold for $102,000 shortly after her death, how much income is taxable from this sale? a) $32,000 of capital gain b) $62,000 of ordinary income c) no taxable income d) $62,000 of capital gain e) $2,000 of capital gain 108) Saxine Strache, age 57, contributed $4,000 to a Roth IRA on March 3, 2008, for the 2007 tax year when she was 57. Assuming no further contributions are made, when is the first year Strache could take a distribution of $3,000 from her Roth IRA and pay no ordinary income tax or penalty? a) 2008 b) 2010 c) 2011 d) 2012 e) 2013 109) Pacey Park, single and age 73, had the following items of income: Rent Income: $693,200 Bonus: $600 Wages: $3,400 Interest Income: :$389,700 What is the maximum contribution Park can make to a Roth IRA for 2021? a) 0 b) $3,400 c) $4,000 d) $4,400 e) $6,000 Alimony: $1,000 Capital Loss: $-100 110) Not So Putty Park, a single 28 year old, earned $100,000 as a cocktail waitress during 2012. She contributes $11,000 to her employer’s 401(k) plan in 2012. What is the amount of Social Security and Medicare taxes that will be withheld from her wages in 2012? a) $5,450 b) $6,809 c) $7,650 d) $12,400 e) $15,300 111) Mabel Malburg, age 55, is employed by Seelhoefer Saddle Company as a tire repair specialist. He earns $82,000 per year and owns four percent of the stock of the company. Malburg received an allocation of $39,000 to his employer-provided profit sharing plan for the year. If the NHC (peon) employees contributed 4.5% to the company’s 401(k) plan, what is the maximum amount Malburg can defer to his 401(k) account for the 2012 plan year? a) $11,000 b) $11,830. c) $16,380 d) $17,000. e) $22,500. 112) Mildred Malburg, age 55, is employed by Seelhoefer Saddle Company as a tire repair specialist. She earns $282,000 per year and owns no stock of the company. Malburg received an allocation of $9,000 to her employer-provided profit sharing plan for the year. If the NHC (peon) employees contributed 4.5% to the company’s 401(k) plan, what is the maximum amount Malburg can defer to his 401(k) account for the 2012 plan year? a) $15,925 b) $16,250 c) $17,000 d) $18,330 e) $22,500. 113) Oliver Odom, a single 29 year old, earned $427,500 as a cocktail waiter during 2012. His employer does not sponsor a qualified plan. What is the maximum deductible IRA contribution Odom can make during 2012 to a Traditional IRA assuming his only income was his salary? a) $0. b) $1,000 c) $4,000 d) $5,000. e) $6,000 114) Which of i) ii) iii) iv) the following statements are true? The federal government can only invest Medicare funds in corporate and municipal bonds. Medicare is currently expected to exhaust its funds before Social Security will. Social Security benefits are forfeited by individuals who commit a crime Medicare pays for the cost of long-term care in a nursing home for individuals with no assets (a) i) and iii). (b) ii) and iv).` (c) ii) only (d) iii) only (e) iv) only 115) Which of the following statements are true? i) Individuals who retire at age 62 are eligible for Medicare Part A coverage if they earn less than $14,160 in 2012 ii) Individuals pay a monthly premium for Medicare Part B coverage. iii) Medicare Part B pays 100% of the cost of medical equipment such as scooters (a) i) and iii). (b) ii) and iii). (c) ii) only (d) iii) only (e) none of the above 116) Mad E. Malburg individually owns 1,000 shares of Jones Soda stock she purchased for $617 in 2002. While driving her scooter down the frozen food aisle at Wal-Mart Ms. Malburg checks the value of her portfolio on her smart phone and discovers the value of her Jones Soda stock has risen to $89,500. Ms. Malburg suffers a heart attack and drives her scooter head on into a frozen food case and she is fatally crushed by falling frozen lima beans. The will of Ms. Malburg leaves all of her assets to her cousin, Wilmer Gallaher. After a front page article in the Chucktown Times Blurrier discloses that Jones Soda cherry surprise soda is manufactured using pureed grass carp from the Embarrass River, Mr. Gallaher sells the 1,000 shares of Jones Soda six months after Malburg’s death for $657. Mr. Gallaher will report: a) A long-term capital gain of $40 b) A short-term capital gain of $40 c) A long-term capital loss of $88,843 subject to a $3,000 annual limitation d) A short-term capital loss of $88,843 subject to a $3,000 annual limitation e) Neither a capital gain or loss 117) Honey Honiotes owns a brick collection valued at $30,000,000, a home valued at $32,000 and a cow valued at $1,000. Her husband, Horseface, owns a toaster oven valued at $3. Horseface is crushed by Honey’s brick collection when he sneezes and 4.2 tons of bricks cascade down on him. If his will, Horseface left his toaster oven to Honey. Which of the following statements are true? a) If Horseface files an estate tax return, Honey can use Horseface unused $5,119,997 exemption b) Honey and Horseface should purchase a second to die insurance policy if they would like to leave the brick collection to their son Hopper c) Both a) and b) d) Neither a) or b) 118) Which of the following statements regarding variable annuities are true? a) the investors funds are placed in subaccounts b) the investor can select allocate his funds among different asset classes in the sub accounts c) both a) and b) d) neither a) or b) 119) Which of the following statements regarding fixed annuities are true? a) the term certain feature of fixed annuities guarantees the investor a minimum number of payments b) withdrawals from a fixed annuity prior to age 59 ½ are subject to a 10% early withdrawal penalty c) both a) and b) d) neither a) or b) 120) Roger Reardanz, age 84, owns 13,000,000 shares of Apple stock. Her husband, Klepto, age 21, owns a can opener. They have four children, ages 2 - 15. They both have wills which leave all of their assets to their surviving spouse if they survive the decedent spouse by two months. Which of the following statements is true? a) If Roger dies in 2012, Klepto can use Roger’s unused unified credit on her estate tax return if he dies later in 2012. b) If Klepto dies before Roger, Roger should disclaim the can opener. c) both a) and b) d) neither a) or b) 121) Claude and Claudia Centeno, age 53, and 24, respectively, are married and file a joint return for 2012. Mrs. Centeno earned $250,000 as a cow washer at Collinsville Cow Wash, Inc. during the year and contributed $6,000 to a Traditional IRA. Mrs. Centeno owns all of the common stock of Collinsville Cow Wash, Inc., valued at $100 million. Claude owns a lawn mower. The Centenos have come to you for estate planning advice. In 2012 the Centenos paid $20,000 to Eastern Illinois University for their nephew Clodhooper’s room and board and gave Clodhopper $40,000 to pay his tuition at Eastern Illinois University. During the year the Centenos paid $30,000 to Dr. Chainsaw Chu for the medical bills of Clodhopper’s girl friend, Chopper. Assuming the Centenos elect to split gifts, what is the amount of the taxable gifts to Clodhopper in 2012? a) 14,000 b) 27,000 c) 34,000 d) 44,000 e) 47,000 122) Claudia is in great health and is expected to live forty years. Which of the strategies should be considered? a) A private annuity sale of Collinsville Cow Wash to the Centeno’s son, Chewy b) Transfer of the Centeno’s home to a QPRT with a 10 year term c) Both a) and b) d) Neither a) or b) 123) What ownership method would allow Claudia to continue to control Collinsville Cow Wash while transferring her ownership interest in the company to her children at reduced valuations? a) A QPRT b) A QTIP c) A FLP d) A GRAT with a 10 year term 124) You recommend Claudia establish a GRAT with a three year term and transfer company stock valued at $20,000,000 to the trust since the current Section 7520 rate is 1.4%. Claudia will receive annual payments of $6,850,000. Claudia’s son Cabbage will be the beneficiary of the trust. What is the amount of the taxable gift when Claudia transfers the stock to the trust? a) 0 b) 12,251 c) 550,000 d) 6,850,000 e) 19,987,749 125) Unfortunately Claudia dies before you can set up the GRAT and her only assets are the stock of the company, which she leaves to her husband Claude and her IRA, valued at $10,000,000. Chewy is the primary beneficiary and Claude is the contingent beneficiary for the IRA. How much Federal estate tax will be payable in 2012 as a result of Claudia’s death? a) 0 b) $1,708,000 c) $1,750,000 d) $3,500,000 e) $3,850,000