Prepare journal entries for the following Sales transactions entered

advertisement

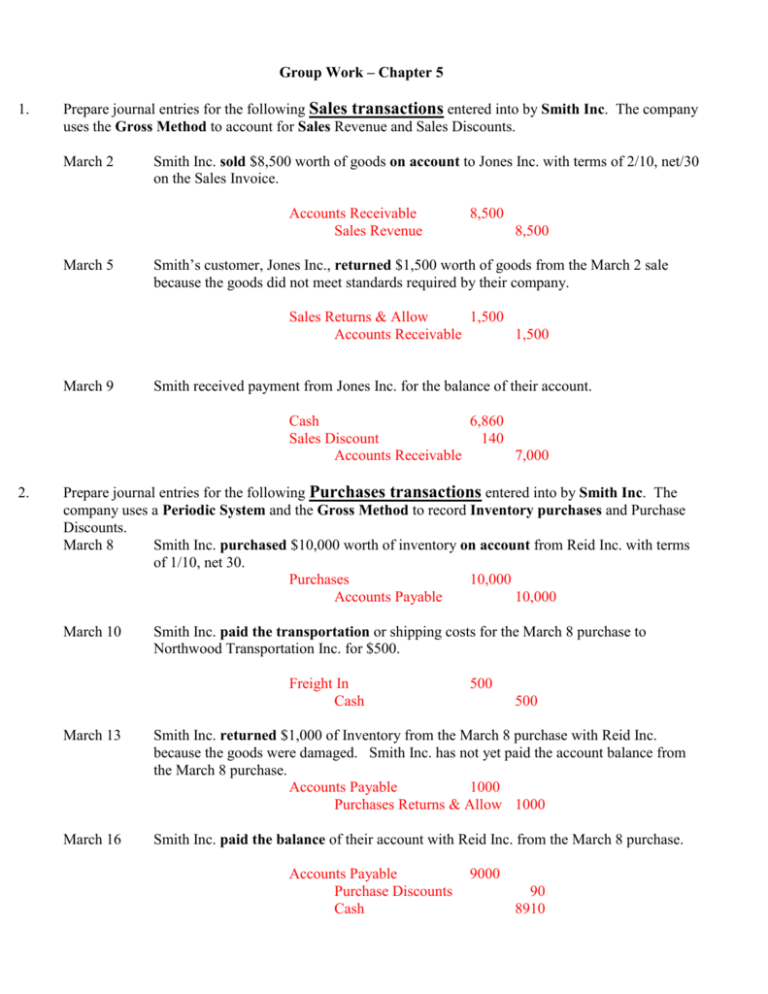

Group Work – Chapter 5 1. Prepare journal entries for the following Sales transactions entered into by Smith Inc. The company uses the Gross Method to account for Sales Revenue and Sales Discounts. March 2 Smith Inc. sold $8,500 worth of goods on account to Jones Inc. with terms of 2/10, net/30 on the Sales Invoice. Accounts Receivable Sales Revenue March 5 8,500 8,500 Smith’s customer, Jones Inc., returned $1,500 worth of goods from the March 2 sale because the goods did not meet standards required by their company. Sales Returns & Allow 1,500 Accounts Receivable 1,500 March 9 Smith received payment from Jones Inc. for the balance of their account. Cash 6,860 Sales Discount 140 Accounts Receivable 7,000 2. Prepare journal entries for the following Purchases transactions entered into by Smith Inc. The company uses a Periodic System and the Gross Method to record Inventory purchases and Purchase Discounts. March 8 Smith Inc. purchased $10,000 worth of inventory on account from Reid Inc. with terms of 1/10, net 30. Purchases 10,000 Accounts Payable 10,000 March 10 Smith Inc. paid the transportation or shipping costs for the March 8 purchase to Northwood Transportation Inc. for $500. Freight In Cash 500 500 March 13 Smith Inc. returned $1,000 of Inventory from the March 8 purchase with Reid Inc. because the goods were damaged. Smith Inc. has not yet paid the account balance from the March 8 purchase. Accounts Payable 1000 Purchases Returns & Allow 1000 March 16 Smith Inc. paid the balance of their account with Reid Inc. from the March 8 purchase. Accounts Payable Purchase Discounts Cash 9000 90 8910 3. For each of the following cases, fill in the missing amounts: Sales Revenue Sales Returns and Allowances Sales Discounts Net Sales $13,500 $1,200 $180 12,120 $22,000 $2,700 $400 18,900 $32,600 4,100 $650 $27,850 Beginning Inventory Purchases (Gross) Purchase Returns and Allowances Purchase Discounts Transportation-In Cost of Goods Available for Sale Ending Inventory Cost of Goods Sold $11,000 $6,000 $800 $120 $500 16,580 $9,950 6,630 18,000 $10,400 $1,550 $230 $900 $27,520 $16,500 11,020 $21,600 14,200 $3,000 $330 $1,250 $33,720 15,000 $18,720 $5,490 $7,880 9,130 Gross Profit 4. The following accounts and balances are on the General Ledger for Smith Inc. through Dec. 31, 2014. Beginning Inventory Ending Inventory Purchase Discounts Purchase Returns and Allowances Purchases (Gross) Sales Discounts Sales Returns and Allowances Sales Revenue Transportation-In $41,500 $38,000 $2,200 $3,150 $60,300 $1,850 $6,200 $71,500 $1,800 1. What would be Net Sales for Smith Inc. in 2014? 63,450 2. What would be Net Purchases for Smith Inc. in 2014? 54,950 3. What is the Cost of Goods Available for Sale for Smith Inc. in 2014? 98,250 4. What would be Cost of Goods Sold for Smith Inc. in 2014? 60,250 5. What would be Gross Profit for Smith Inc. in 2014? 3,200