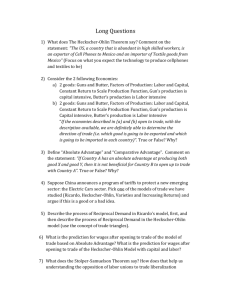

Additional Cases - McGraw Hill Higher Education

advertisement