Japan - Marietta College

advertisement

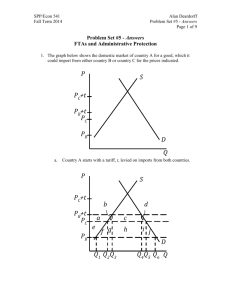

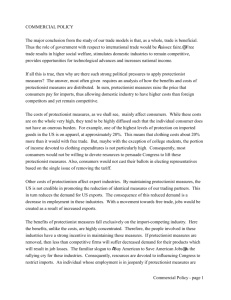

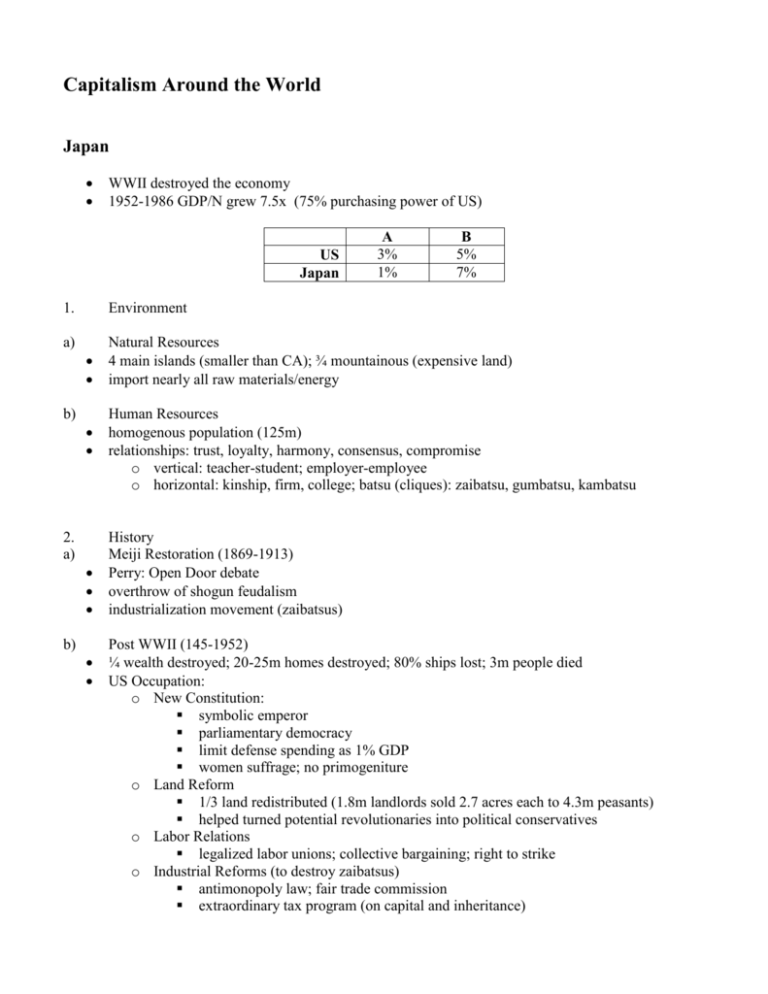

Capitalism Around the World Japan WWII destroyed the economy 1952-1986 GDP/N grew 7.5x (75% purchasing power of US) US Japan 1. A 3% 1% B 5% 7% Environment a) b) 2. a) b) Natural Resources 4 main islands (smaller than CA); ¾ mountainous (expensive land) import nearly all raw materials/energy Human Resources homogenous population (125m) relationships: trust, loyalty, harmony, consensus, compromise o vertical: teacher-student; employer-employee o horizontal: kinship, firm, college; batsu (cliques): zaibatsu, gumbatsu, kambatsu History Meiji Restoration (1869-1913) Perry: Open Door debate overthrow of shogun feudalism industrialization movement (zaibatsus) Post WWII (145-1952) ¼ wealth destroyed; 20-25m homes destroyed; 80% ships lost; 3m people died US Occupation: o New Constitution: symbolic emperor parliamentary democracy limit defense spending as 1% GDP women suffrage; no primogeniture o Land Reform 1/3 land redistributed (1.8m landlords sold 2.7 acres each to 4.3m peasants) helped turned potential revolutionaries into political conservatives o Labor Relations legalized labor unions; collective bargaining; right to strike o Industrial Reforms (to destroy zaibatsus) antimonopoly law; fair trade commission extraordinary tax program (on capital and inheritance) 3. Economic Structure a) Labor Relations i) Lifetime Employment tenure! mostly in large firms only Benefits: low turnover; lower training costs; less worker resistance to tech change; more loyalty Costs: shirking; less dynamic change b) ii) Seniority Based Wages and Bonuses to encourage loyalty eroding over time due to shortage of young people iii) Enterprise Unions 25% LF covered Financial System i) Economy relies heavily on banks to allocate funds from net savers to borrowers Japanese firms have higher Debt/Equity ratios: US 60% stock; Japan 65% debt BOJ: policy arm of Ministry of Finance ii) Gov’t kept interest rates below market levels iii) Credit has been rationed: quotas on loans downpayments taxbreaks subsidies iv) High savings rates postal savings accounts low access to credit c) undeveloped welfare system Industrial Structure dualism o large, modern K-intensive with extensive subcontracting o small, L-intensive i) Keiretsu (enterprise groups): bank trading company several enterprises cross-holding of equity; interlocking directorates; informal channels Benefits: diversify risks access to secure credit shared info/experience political lobbying power Costs: ii) d) insulated from “market for corporate control” soft budget constraint entry barriers for innovators contagion effects Trading Companies specialize in buying and selling market research technical advise storage transportation insurance absorbs exchange rate risk Economic Policy Economic Planning Agency o indicative plan: forecasts; information; communication MITI (Ministry of International Trade and Industry) o industrial policies develop new industries modernization assist declining industries o policy levers import barriers: quotas, tariffs; foreign exchange controls; informal (red tape, quality standards) credit/fiscal control: low cost loans; accelerated depreciation; tax breaks, subsidies other: patent access; plant location; quality audits European Capitalism A) post WWII economic development initiated by Marshall Plan laissez faire vs mercantilist (dirigiste) history of France France Indicative Planning: to improve the planning process by providing better economic info avoid public goods problem avoid coordination failure forecasts and targets are voluntary; boosterism? (self-fulfilling prophesies?) Keynesianism? concertation with interest groups: gov't & business & labor & greens & seniors ??? coherence Problems: incentive incompatibility: producers may overstate their needs in order to strategically manipulate input prices plans are subject to exogenous shocks; open economies more susceptible collusion among producers: US steel industry example extensive state involvement creates a dependency mindset 5 - year Plans: First Plan: Reconstruction: basic industries (steel, coal, electricity, transport, agriculture, cement) Second/Third Plans: macro forecasting and modernization Third Plan: Social concerns and regional goals Nationalization (Mitterand's 1980s: Renault, banks, utilities, gas, coal, public transport; 25% of industrial output in public hands) Privatization and European integration (1990s) French Outlook: rising unemployment? shorter work week earlier retirement aging population? B) Germany Social Market Economy Economic Goals: price stability; stable currency; full employment; trade balance; stable growth Social Goals: social equity; social security; social progress German Reunification absorption into existing infrastructure; unlike other Soviet satellites that were forced to create new institutions; social safety net in place; supply of entrepren.; access to markets; 1) Monetary union: 1-OM = 1DM (black market rate was 12-OM = 1DM) WG: worker earns 20DM EG: worker earns 10-OM (at black market rates, this is worth about 0.83 DM) parity conversion led to over-priced EG workers (they had very low productivity) Output collapse in GDR: overvalued worker led to unemployment; old K; cheap WG goods; loss of CMEA markets 2) Privatization: Treuhand chose rapid approach with minimal reorganization/investment note: Privatization Strategies 1. vouchers 2. IPOs 3. Auctions 4. Negotiated sales chosen by THA (political corruption?) EG firms were excessively large (EOS?) many inefficient firms were ultimately closed: Trabant total assets sales were less than 25% of total transfer payments to the East! (Not a good "leveraged buyout"!) Costs of Reunification higher taxes and interest rates for WG Inflation Environmental damage The European Union A) History of EU impetus for change after WWII was damage due to nationalism Marshall Plan & Organization for EE Cooperation European Coal and Steel Community (1951) [FTA] France, Germany, Benelux, Italy form common market in coal and steel European Economic Community (Common Market; 1957) [CU] allow greater competition and specialization; economies of scale argument for national firms labor markets and agricultural markets were areas of difficulty Maastricht Treaty: 3 Pillars: economic matters; monetary union; environment, energy, agric, transport, R&D common foreign and security policy common justice and home affairs: crime, drugs, immigration, etc Subsidiarity: issues are to be handled at the lowest level that can effectively deal with them; coordinating hunting seasons? Future expansion? Eastern Europe Note: 1. Free Trade Area: limited tariffs and quotas [NAFTA] 2. Customs Union: common external tariff [MERCOSUR: Arg, Braz, Para, Uru, Chile, Bol] 3. Common Market: free movement of factors of production within member states B) Institutions European Council: 15 heads of state; 6mo turns at presiding over agendas European Commission: Brussels bureaucracy; 20 commissioners European Parliament: Strasbourg; 626 elected members; symbolic Council of Ministers: 87 votes; based on economic size; qualified majority rule required (62 votes by at least 10 different states) 15 countries: Table 9.1 B) Welfare Effects of the Common Market 1. Static Effects Pt Pb Pc Q1 Q2 A: domestic country B: neighbor and partner C: low cost producer at Pc Note: at Pc, all of A's imports come from C: imports = Q3 - Q1 tariff raises domestic price to Pt imports fall; domestic production rises CS falls PS rises DWL is customs union eliminates tariff on B, but maintains tariff on C imports from C are eliminated; imports now come from B Trade diversion (from C to B) Trade creation (from A to B) Consumption effect (due to lower Pb < Pt) DWL is reduced, but still exists expanded market allows greater specialization and division of labor 2. Dynamic Effects effects of competition and innovation Q3 C) External Trade Policy of EU 1. Developed Nations 2. D) 1. 2. GATT: MFN status Common External Tariff for EU Extended Free Trade Areas: eastern and central Europe; Turkey Trade Wars: primarily in agriculture Developing Nations ACP agreements: preference given to former colonies; Banana war (Ecuador) Single Currency EMS: fixed exchange rates within Europe; required central bank coordination German reunification problem: heavy borrowing lead to higher r and mark appreciation; other countries had to raise their r Maastricht convergence criteria: low inflation; interest rate targets; low public debt and deficit targets; stable exchange rate Benefits reduced transactions costs: currency conversion end to exchange rate uncertainty: encourage trade and more efficient resource allocation elimination of currency holdings seigniorage Costs elimination of exchange rate policy as means of responding to economic shocks exposure to asymmetrical shock: adjustment costs will be localized and take the form of lower standards of living: lower real wages causing labor to migrate Note: European Central Bank independent: 8-yr nonrenewable terms; president of ECB serves 4 yr term E) 1. 2. Fiscal Policy Sources of Revenue agricultural levies customs duties VAT: 1.4% GDP levy: 1.27% Expenditures Common Agriculture Policy (CAP): price supports Structural Funds: regional economic development for social cohesion F) Industrial Policy national champions that complete on basis of EOS: use of nontariff barriers and subsidies policy based on promoting successful competitive strategies and that comparative advantage can be created by policy initiative rather than factor endowments foster collaborative R&D: public goods aspect; standards setting Competition policy merger reviews: Boeing and McDonnell Douglas; strings attached market for corporate control requires publicly traded companies rather than closely held companies or banks G) Social Policy 1. Unemployment a) Causes collective bargaining system: EU has more industry-wide wage agreements compared to US (control hierarchy); introduces more inflexibility high reservation wages: generous income support programs nonwage costs: payroll taxes fragmented labor markets: regional, cultural, language differences? antiemployment bias of growth 2. Redistribution Policies Economics Impact of Tariff and Customs Union S Pt Pb Pc D Q4 Q1 Imports before tariff: Imports with tariff on all: Imports under customs union: Before CS PS Welfare DWL Tariff on all Customs Union