Ch03

CHAPTER 3

Factor Endowments and the Commodity

Composition of Trade

CHAPTER OUTLINE

I. Introduction

unanswered questions

What determines a country’s comparative advantage?

How does international trade affect industrial structure?

How does international trade affect payments or returns to the

factor of production?

How does international trade affect the distribution of income? comparative advantage and business

profits from trade

FDI

II. The Factor-Proportions Theory

A. Assumptions of the Factor-Proportions Theory

two countries, two goods

perfect competition free trade

incomplete specialization equal tastes and preferences two factors of production constant returns to scale domestic mobility of factors no migration of factors capital intensive and labor intensive capital abundant and labor abundant

Tables 3.1 and 3.2

B. The Factor-Proportions Theorem

comparative advantage

PASSPORT: U.S.— China Trade — Table 3.3

III. Factor-Price Equalization and the Distribution of Income

A. Factor-Price Equalization

changes in industrial structure changes in factor prices long-run tendency

India — Table 3.4

PASSPORT: Changes in the K/L Ratio Over Time: South Korea and

B. Trade and the Distribution of Income

gains and losses

52

Factor Endowments and the Commodity Composition of Trade 53

small effects

PASSPORT: Trade Adjustment Assistance

IV. The Specific Factors Model

mobile vs. specific factors

increases gains to the specific factor in the comparative advantage industry increases losses to the specific factor in the comparative disadvantage industry

The price of the mobile factor increases but its welfare is indeterminate.

Figure 3.1

PASSPORT: Patterns in U.S. Trade — Figure 3.2 and Table 3.5

V. Empirical Evidence on the Factor-Proportions Theory

A. The Leontief Paradox

Leontief found that U.S. exports were labor intensive

result still holds for a two-factor test

B. Explanations of the Leontief Paradox

natural resources

trade barriers human capital

R&D

PASSPORT: Relative Factor Endowments for Selected Countries —

Table 3.6

C. International Trade Not Explained by the Factor-Proportions Theory

TEACHING NOTES AND TIPS

I. Introduction

Notes

The introduction does two things. It emphasizes that Chapter 3 is a continuation of Chapter 2.

Chapter 2 left us vague on what causes a country to have a lower opportunity cost in this or that product. The purpose of the chapter is to explain international differences in opportunity costs.

Teaching Tip

Go back a step and emphasize that the theory to be covered will help explain the world pattern of production or what is produced where . Once you know this, then the world pattern of trade is just an extension of that. As a result, this is one of the more “practical” chapters in the book.

II. The Factor-Portions Theory

Notes

The section starts with the standard assumptions of the factor-proportions theory. There are some terms to define such as constant returns to scale, capital intensive, labor intensive, capital abundant, labor abundant, and the K/L ratio. From the assumptions, the basic factor-proportions theory almost explains itself. The Passport and Table 3.5 on “Patterns in U.S. Trade” add some data to the theory. Finally, you can emphasize that comparative advantage can change as the

54 Chapter 3 relative supplies of factors of production change as in the boxed feature Passport: “Changes in the K/L Ratio Over Time: South Korea and India.”

Teaching Tip

Take some class time to carefully look at the factor endowment data in Table 3.2. It not only helps to explain trade patterns but as a bonus, it helps to explain the world distribution of income. A substantial part of the difference between rich and poor countries is the abundance of capital with which each country is endowed.

III. Factor-Price Equalization and the Distribution of Income

Notes

The first part of the section extends the example used in explaining the factor-proportions theory to factor-price equalization. Trade causes changes in industrial structure . As resources move from the contracting industry to the expanding industry, the K/L ratio mismatch influences the returns to capital and labor. The abundant factor gains and the scarce factor loses. It’s a short step from here to the Stopler-Samuelson theorem and changes in the distribution of income.

Trade Adjustment Assistance is a logical political reaction to the process.

Teaching Tip

The processes described in the section work, just much more slowly. What is usually going on here is as follows. Profits in the comparative disadvantage industry start declining which reduces the amount of capital flowing into the industry. As the capital eventually is depreciated the owners of capital close the plants. This process may take decades, not months. At the same time, capital is flowing freely into the comparative advantage industry and it is expanding.

Labor slowly drifts out of the comparative disadvantage industry into other occupations and new workers are moving into the expanding comparative advantage industry.

IV. The Specific-Factors Model

Notes

In this section the students get a chance to see what happens if factors cannot easily move from one part of the economy to another. Not unrealistically, the example focuses on breaking capital into two sector-specific types. You easily get the result that the capital that is sector specific in the comparative disadvantage industry is worse off even in a capital-abundant country.

Teaching Tip

This section can be used to introduce why owners of capital in comparative disadvantage industries fight so hard for government assistance. If they could just pick up their capital and move to the comparative advantage industry, they wouldn’t worry about government help.

V. Empirical Evidence on the Factor-Proportions Theory

Notes

The section starts with the puzzle introduced by the Leontief Paradox. The discussion of the resolution of the paradox focuses on the empirical problems caused by the assumption that labor is homogeneous. The resolution of the paradox is mostly about separating out the role of human

Factor Endowments and the Commodity Composition of Trade 55 capital. R&D is discussed as a separate factor of production. Data on various resource endowments for developed countries is given in Table 3.6 to put some numbers with the concepts.

Teaching Tip

This is a perfect example of how economic knowledge accumulates. A logical theory fails an empirical test. Further tests of the theory reveal that the basic thinking isn’t incorrect but the theory is incomplete. The theoretical and empirical work lead to a deeper understanding of the phenomenon being studied.

BRIEF ANSWERS TO PROBLEMS AND QUESTIONS FOR REVIEW

1. The factor-proportions theory provides an extension of the trade model presented in

Chapter 2 by providing an understanding of why each country has a comparative advantage or disadvantage in various goods. This understanding of the causes of comparative advantage is based on a country’s relative endowment of the factors of production.

2. The assumptions of the factor-proportions theory are as follows: There are two countries, and each country produces two goods. The production and consumption of the goods are conducted under perfect competition in the product and factor markets. This means that firms are price takers and their individual actions cannot influence conditions in their respective markets. The prices of the two goods and the prices paid to the factors of production are determined by supply and demand in each market. In the long run, the prices of the goods are equal to their respective costs of production. There are no transportation costs, tariffs, or other obstructions to the free flow of goods between the two countries. The introduction of international trade does not cause complete specialization in the production of one of the goods in either country. Both countries will continue to produce both goods. Consumers in the two countries have equal tastes and preferences. This means that when the price of machines in terms of cloth is the same in the two countries, both countries will consume the same proportion of the two goods.

Both countries are endowed with two homogeneous factors of production, capital (K) and labor (L) and both resources are employed in the production of the two goods. The technology available to produce the two goods is the same in both countries and each good is produced under constant returns to scale. Labor and capital are mobile domestically. This means that within each country labor and capital can flow freely from one industry to the other. As a result, both industries within a country will pay the same wage rate and the same return to capital. Labor and capital cannot move internationally between countries. This allows for differences in wage rates and the return to capital between the two countries. It also rules out the possibility of eliminating wage differences between countries through migration. The production techniques available to produce machines and cloth in both countries are such that the production of machines is everywhere capital intensive and the production of cloth is everywhere labor intensive.

3. A labor-intensive good is one that requires a substantial amount of labor relative to

56 Chapter 3 capital or that is produced with a lower capital-to-labor ratio than another good. A laborabundant country is a country that has a capital-to-labor ratio that is smaller than the capital-to-labor ratio in another country.

4. The basic determinant of comparative advantage and trade in the factor-proportions theory is that a country will have a comparative advantage in and export goods whose production intensively uses its relatively abundant factor of production. Also, a country will have a comparative disadvantage in and import goods whose production intensively uses its relatively scarce factor of production.

5. The capital stock per worker from the Penn World Tables provides information on the relative abundance of capital and labor in various countries. This relative abundance can be used to determine if a country is relatively capital abundant or labor abundant when compared to another country. This information is an empirical estimate of the capital-tolabor ratio in various countries.

6. a. b. c.

Country C is relatively capital abundant.

Country B is relatively labor abundant.

Country C will have a comparative advantage in the production of steel because steel production intensively uses its relatively abundant factor of production.

7.

The introduction of international trade sets in motion market forces that cause a change in the relative price of traded goods. As the relative price of the export good increases, this causes a change in the industrial structure of the country. The industry producing the comparative advantage good expands its production. The comparative disadvantage industry would decrease its production. This would cause changes in the prices paid to the factors of production. The price of the abundant factor would increase and the price of the scarce factor would fall.

8. Under the assumption that the factors of production remain fully employed both before and after trade, the real income of the scarce factor and the abundant factor move in the same direction as factor prices. The percentage of national income that the abundant factor receives would increase and the percentage of national income that the scarce factor receives would decrease. As a result, international trade has discernible effects on the distribution of income within a trading country.

9. This implies that labor is the scarce factor of production in Country A, since a country will have a comparative disadvantage and import goods whose production intensively uses its relatively scarce factor of production. Relative wages within the country will fall, since as trade opens up the price paid to the abundant factor in a country would rise, and the price paid to the scarce factor would fall. In general, capital owners will support free trade and labor will oppose free trade, since the percentage of national income that the abundant factor receives would increase and the percentage of national income that the scarce factor receives would decrease.

10. The criteria the government uses to determine if a firm and workers have been adversely impacted by imports are that workers have been totally or partially laid off; sales or

Factor Endowments and the Commodity Composition of Trade 57 production have declined; and increased imports have contributed importantly to worker layoffs.

11. When a country has specific factors of production used to produce various goods as trade opens up, the effect of specific factors is that the owners of the specific capital used to produce the good in which the country has a comparative advantage benefit as the industry expands production. The owners of the specific factors used to produce the good in which the country has a comparative disadvantage lose as production contracts.

The income effect on the mobile or variable factor is indeterminate and depends to the consumption pattern of society.

12 The existence of specific factors can help explain why some groups resist free trade. In general, owners of the abundant factor of production in a country should be in favor of freer international trade, while owners of the scarce factor of production would favor trade restrictions. With specific factors of production, both capital and labor in the industry with a comparative disadvantage suffer losses and may resist free trade.

13. The Leontief paradox is the empirical finding that U.S. industries with trade surpluses were more labor intensive than U.S. industries with trade deficits. This finding is contrary to the factor-proportions theory. A number of possible explanations for the

*

3.

2.

* perverse result have been given over the years including: some imports are not based on an abundance of labor or capital but depends on the country’s possession of natural resources and U.S. trade policy may have biased the results. The paradox tends to be resolved by considering human capital and technology as separate factors of production.

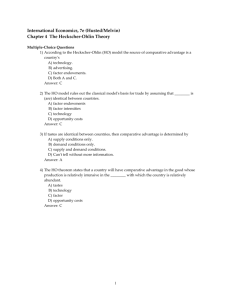

MULTIPLE-CHOICE QUESTIONS

1. Constant returns to scale implies: a. as the amount of labor and capital doubles the resulting output remains the same.

* b. c. as the amount of labor and capital doubles the resulting output more than doubles. as the amount of labor and capital doubles the resulting output doubles. d.

as the amount of labor and capital doubles the resulting output increases by a very small amount.

Which of the following is not an assumption of the factor-proportions theory? a. b. c.

The same technology in both countries

Constant returns to scale

Complete specialization d.

Equal tastes and preferences in both countries

Which of the following is not an assumption of the factor-proportions theory? a. b. c. d.

Perfect competition in the product and factor markets

Homogeneous labor and capital in both countries

Different tastes and preferences between countries

Constant returns to scale

58 Chapter 3

*

4. When we say that steel is capital intensive with respect to wheat, this means that: a. b. c. d. more capital is used in the production of steel than for wheat. less labor is used in the production of steel than for wheat. a lower capital-to-labor ratio is used in the production of steel than wheat. a higher capital-to-labor ratio is used in the production of steel than wheat.

5.

*

6.

*

7.

When we say that wheat is labor intensive with respect to automobiles, this means that: a. more capital is used in the production of automobiles than wheat. b. c. d. less labor is used in the production of automobiles than wheat. a lower capital-to-labor ratio is used in the production of automobiles than wheat. a higher capital-to-labor ratio is used in the production of automobiles than wheat.

A country is said to be relatively abundant in capital if it has: a. b. c. d. a greater absolute amount of capital. a smaller absolute amount of labor. a higher capital-to-labor ratio. a lower capital-to-labor ratio.

Which of the following statements is false? a. b.

Poor countries tend to have a low K/L ratio.

Rich countries tend to have a high K/L ratio. c. d.

The K/L ratio is important in determining the productivity of labor.

The productivity of labor rises as the K/L falls. *

8. The factor-proportions theory of international trade predicts: a. who benefits and who loses from trade. b. c. d. which factors are abundant. the income distribution effects of trade. which goods will be exported. *

9.

*

The factor-proportions theory identifies the source of comparative advantage as: a. differences in relative factor endowments between countries. b. c. d. similarities in tastes. identical production methods. similar factor endowments.

10. According to the factor-proportions theory, the source of comparative advantage is a country’s: a. physical size.

* b. c. population. advertising. factor endowments. d.

*

Factor Endowments and the Commodity Composition of Trade 59

11. In the factor-proportions theory, international trade is caused by country differences in: a. technology. b. tastes and preferences. factor endowments. the degree of competition. c. d.

12. The factor-proportions theory is a simplification of international trade between countries because it is explained using: a. b. two countries. two goods.

* c. d. two factors of production. all of the above

13. In the factor-proportions theory: a. the production possibilities frontier is bowed in toward the origin. b. c. labor is the only factor of production.

* d. the country with the largest amount of labor will have a comparative advantage in labor-intensive products. the country’s comparative advantage depends on its relative endowment of

* the various factors of production.

14. The factor-proportions theory states that a country will have a comparative advantage in and produce the product whose production is relatively intensive in the: a. b. c. d. tastes and preferences in which the country is relatively abundant. technology in which the country is relatively abundant. factor of production in which the country is relatively abundant. advertising in which the country is relatively abundant.

15. The factor-proportions theory of international trade implies that countries would tend to: a. export products that intensively utilize their scarce factor of production.

* b. c d.

16. The factor-proportions theory of international trade states that: a. a country should export the good with the highest output per unit of labor.

* b. c. d. import products that intensively utilize their abundant factor of production. export products that intensively utilize their abundant factor of production. import products that intensively utilize their unknown factor of production. a country will export the good that requires more intensive use of its abundant factor. a country should import the good that uses capital most intensively. a country should export the factor that receives a higher wage in the other country.

60 Chapter 3

17. Assume that the U.S. is relatively capital abundant and Mexico is relatively labor abundant. Further, assume that the production of wheat is capital intensive and the production of iron is labor intensive. Which of the following would be true?

* a. b.

Mexico would tend to export wheat.

Mexico would tend to import wheat. c. d.

The U.S. would tend to export iron.

The U.S. would tend to import wheat.

18. If a country is well endowed with labor relative to capital, the factor-proportions theory

* predicts that it will: a. b. export labor-intensive goods and import capital-intensive goods. import labor-intensive goods and export capital-intensive goods. c. d. neither import nor export capital-intensive goods. neither import nor export labor-intensive goods.

19. If a country is abundant in labor then it would tend to:

*

20. If the production of widgets is inherently capital intensive then: a. widgets would tend to be exported from labor-abundant countries.

* a. b. c. d. import labor-intensive products. export labor-intensive products. export capital-intensive products. both export and import labor-intensive products. b. c. d. widgets would tend to be imported by labor-abundant countries. widgets would tend to be exported from countries with a lot of bauxite. widgets would tend to be imported by capital-abundant countries.

21. The abundance of a particular factor of production in a country tends to make that factor: a. more costly relative to the cost of the same factor in other countries. b. more costly relative to other factors within the country.

* c. less costly relative to the cost of the same factor in other countries. d.

very cheap in dollar terms.

22. A country will have a comparative disadvantage in goods whose production: a. uses its relatively most abundant resource. b. c. has a higher wage rate than the other country. is not in high demand relative to other countries products.

*

* d. intensively uses its relatively scarce factor of production.

23. A country will have a comparative advantage in goods whose production: a. b. c. d. uses its relatively most abundant resource. has a higher wage rate than the other country. is not in high demand relative to other countries products. intensively uses its relatively scarce factor of production.

Factor Endowments and the Commodity Composition of Trade 61

24. If the amount of capital and labor in Country A are $100 million and 100 million workers, and the amount of capital and labor in Country B are $50 million and 25 million workers, then:

* a. b.

Country A is capital abundant compared to Country B.

Country B is capital abundant compared to Country A. c. d.

Country B is labor abundant compared to Country A. both a and c

25. Countries tend to have a comparative advantage in and export goods: a. that employ the country’s scarce resource.

* b. that employ the country’s relative abundant resource. c. that the other country has in abundance. d.

that the other country is counterfeiting.

26. Countries tend to have a comparative disadvantage in and import goods:

* a. that employ the country’s scarce resource. b. that employ the country’s relative abundant resource. c. that the other country has in abundance. d. that the other country copies.

*

27. A country that is capital abundant relative to another country will have which one of the following advantages? a. A larger capital stock b. c. d.

Absolutely cheaper capital

Relatively cheaper capital

Faster access to capital

*

28. A country that is labor abundant relative to another country will have which one of the following advantages? a. A larger labor force b. c. d.

The price paid to labor will be absolutely cheaper.

Relatively cheaper labor

Faster access to labor

29. If the U.K. is labor abundant (capital scarce) and Nigeria is capital abundant (labor

* scarce), which of the following statements is true? a. The U.K. would tend to have a comparative advantage in capital-intensive b. c. products.

Nigeria would tend to have a comparative advantage in labor-intensive products.

The U.K. would tend to import capital-intensive products.

Nigeria would tend to import capital-intensive products. d.

62 Chapter 3

30. Which of the following industries would be an example of comparative advantage based on the relative abundance of physical capital? a. pharmaceuticals b. c. d. brooms canned peas steel *

31. Suppose that Bolivia is labor abundant and the production of trinkets is labor intensive.

Which of the following statements would be false? a. The relative price of labor would tend to be low in Bolivia.

* b. c. d.

Bolivia would tend to export trinkets.

Bolivia does not have a comparative advantage in trinkets.

Bolivia has a comparative advantage in trinkets.

32. The effect of international trade on the price of the goods traded:

* a. long-run changes. b. are short-run changes. c. d. are nonexistent and should not be considered. are secondary effects and only partially beneficial to both countries.

33. Assume that there are two factors, capital and land, and that the U.S. is relatively capital abundant while Chile is relatively land abundant. According to the factor-proportions model:

* a. b. c. d.

Chilean landowners should support U.S.-Chile free trade.

Chilean capitalists should support U.S.-Chile free trade.

U.S. capitalists should oppose U.S.-Chile free trade.

U.S. capitalists and Chilean capitalists both oppose free trade.

34. In the factor-proportions theory, international trade tends to reduce country differences in:

* a. b. c. d. relative but not absolute factor prices. absolute but not relative factor prices. relative and absolute factor prices. neither relative nor absolute factor prices.

35. If a capital-abundant country freely trades with a labor-abundant country, there will be a tendency for:

* a. b. wages to rise relative to the price paid to capital in the capital-abundant country. wages to fall relative to the price paid to capital in the capital-abundant country. c. d. wages to rise relative to the price paid to capital in both countries. wages to fall relative to the price paid to capital in both countries.

Factor Endowments and the Commodity Composition of Trade 63

36. International trade tends to: a. have no effect on factor prices. b. c. cause all factor prices to fall. cause the price of the scarce factor to rise and the price of the abundant factor to fall.

* d. cause the price of the scarce factor to fall and the price of the abundant factor to rise.

37. Which theory explains how international trade affects factor prices? a. b. c. d.

The Leontief paradox

The factor-proportions theory

The Stopler-Samuelson theory

The factor-price equalization theory *

38. Factor-price equalization means that:

* a. trade will have a tendency to equalize the prices of factors of production b. c. d. among countries that trade. international trade theory has nothing to do with reality. international trade will tend to only equalize the price of labor among countries. international trade has no influence on the prices of factors of production in countries that trade.

39. Industrial structure refers to:

* a. the percentage of output that is accounted for by each industry within a country. b. c. the output that is accounted for by each industry within a country. the types of industries in a country. d. the percentage of industries that account for a country’s exports.

40. Changes in industrial structure:

* a. b. cause changes in the returns to the factor of production. cause changes in the price of the traded goods. do not cause changes in the distribution of a country’s income. c. d. cause changes in a country’s comparative advantage.

41. Suppose that Ecuador is a labor-abundant country and Chile is a capital-abundant

* country. If Ecuador and Chile trade with one another then: a. b. labor would tend to get more expensive in Ecuador. capital would tend to get more expensive in Ecuador. c. d. labor would tend to get more expensive in Chile. capital would tend to get cheaper in Chile.

64 Chapter 3

42. Assume that Mexico is labor abundant and the U.S. is capital abundant. Trade between

Mexico and the U.S. would tend to:

* a. lower the price of capital in Mexico. b. c. d. raise the price of capital in Mexico. raise the price of labor in the U.S. lower the price of capital in the U.S.

43. Assume that Mexico is a labor-abundant country and capital is scarce. The result of international trade would be that: a. both labor and capital would get more expensive.

* b. c. d. labor would get more expensive. capital would get more expensive. both labor and capital would get cheaper.

44. If country A is labor abundant and country B is capital abundant, then with trade wages will tend to _____ in country A and _____ in country B. a. fall; fall b. c. d. rise; rise fall; rise rise; fall *

45. The effect of international trade on the prices paid to the factors of production:

* a. are long-run changes. b. c. d. are short-run changes. are non-existent and should not be considered. are secondary effects and only partially beneficial to both countries.

46. According to factor price equalization, if Country B is labor abundant as international trade occurs then: a. labor should be opposed to international trade.

* b. c. the owners of capital should be opposed to international trade. both labor and the owners of capital should be opposed to international trade. d. both labor and the owners of capital should be in favor of international trade.

47. Which of the following statements is true?

* a. b. c. d.

Per capita GDP in India is higher than it is in South Korea.

The capital/labor ratio is higher in India than it is in South Korea.

The openness index is higher for India than it is for South Korea.

Per capita GDP in South Korea now is higher than it is in India.

Factor Endowments and the Commodity Composition of Trade 65

48. The Stopler-Samuelson theorem states that with international trade the: a. scarce factor receives a larger piece of the economic pie and the abundant factor tends to receive a smaller piece. b. c. larger factor receives a larger piece of the economic pie and the smaller factor tends to receive a smaller piece. smaller factor receives a larger piece of the economic pie and the larger factor

*

* d. tends to receive a smaller piece. abundant factor receives a larger piece of the economic pie and the scarce factor tends to receive a smaller piece.

49. Which theory explains how international trade affects the distribution of income? a. The Leontief paradox b. The factor-proportions theory c. d.

The Stopler-Samuelson theory

The factor-price equalization theory

50. The Stopler-Samuelson theorem predicts: a. the level of productivity in export-oriented industries.

* b. c. which factors of production are abundant. the income distribution effects of trade. d. which goods will be exported.

51. Which factor stands to gain most from free trade? a. b.

The factor that is used intensively to produce an import competing good

The factor that is used intensively to produce a non-traded good

* c. d.

The factor that is used intensively to produce an exported good

The relatively scarce factor

52. The U.S. government program designed to assist workers who have lost their jobs due to competition from imports is known as: a. b. the Stopler-Samuelson Act. the Factor-Price Relief Act.

* c. d.

Trade Adjustment Assistance. the Extended Unemployment Compensation and Education Act.

53. If a factor of production cannot easily move from one sector of the economy to another

* then it is referred to as: a. b. c. d. a capital-intensive factor. a labor-intensive factor. a stuck factor. a specific factor.

66 Chapter 3

54. In the specific-factors model: a. owners of the specific factor should be in favor of international trade in all cases. b. c. owners of the specific factor should be opposed to international trade in all cases. owners of the specific factor in the comparative disadvantage industry should be in favor of international trade.

* d. owners of the specific factor in the comparative advantage industry should be in favor of international trade.

55. After trade opens, the short-run impact on the income of the specific factor used to

* produce exports will be: a. b. c. d. a decrease. an increase. indeterminate, income effects are not known. zero.

56. As a test of the _____ theory, Leontief found (in the 1950s) that American exports

* embodied a _____ K/L ratio than American imports. a. Stopler-Samuelson; higher b. factor-proportions; lower c. d.

Ricardo; higher

Schumpeter; lower

57. The empirical result that U.S. exports seem to be labor-intensive if only capital and labor are used as factors of production is known as the:

* a. b. c. d.

Leontief Paradox.

Smith’s riddle.

Ricardo’s advantage.

Krugman’s puzzle.

58. Initial empirical tests of the factor-proportions theory of international trade showed that

*

U.S. exports tended to be labor intensive. This perverse empirical result is known as: a.

Krugman’s puzzle. b. c.

Ricardo’s problem.

Adam Smith’s dilemma. d. the Leontief Paradox.

59.

Leontief’s factor-proportions study found that U.S.: a. imports were more labor intensive than exports.

* b. c. d. imports were more capital intensive than exports. imports were primarily agricultural products. exports were not internationally competitive.

Factor Endowments and the Commodity Composition of Trade 67

60. The Leontief paradox refers to the empirical result that: a. U.S. exports were more capital intensive than U.S. imports, even though the U.S. is regarded as a capital abundant country.

* b. c.

U.S. exports were more labor intensive than U.S. imports, even through the U.S. is regarded as a capital abundant country.

U.S. exports were more capital intensive than U.S. imports, even though the U.S. d. is regarded as a labor abundant country.

U.S. exports were more labor intensive than U.S. imports, even through the U.S. is regarded as a labor abundant country.

61. Leontief found that: a. U.S. exports are neither labor nor capital intensive. b. U.S. exports are capital intensive relative to U.S. imports.

*

* c. d.

U.S. imports are capital intensive relative to U.S. exports.

U.S. trade conforms perfectly to the predictions of the factor-proportions model.

62.

Leontief’s results were considered paradoxical because the U.S. was believed to be: a. labor abundant relative to the rest of the world. b. c. capital abundant relative to the rest of the world. technologically superior to the rest of the world d. both labor and capital abundant relative to the rest of the world.

63. In the 1950s, Leontief found that U.S. imports utilize _____ K/L ratio than America’s

* exports. a. a higher b. c. a lower the same d. a smaller

64. The Leontief paradox provided:

* a. b. c. d. support for the specific-factors model. support for the factor-proportions theory. evidence against the factor-proportions theory. evidence against the Stopler-Samuelson theorem.

65. Which of the following is not a potential explanation for the Leontief paradox? a. The U.S. imposed high tariffs on labor-intensive products.

* b. c. d.

U.S. exports are intensive in the use of skilled labor.

The U.S. exports products that intensively use high technology.

The U.S. is a relatively labor-abundant country.

66. Investment in the labor force that increases the productivity of labor is known as: a. physical capital.

* b. c. d. the Leontief Paradox. human capital.

K/L capital.

68 Chapter 3

67. If comparative advantage in an industry is based mostly on the amount of education and training embodied in the work force, then we would say that the industry is: a. unskilled-labor intensive.

* b. c. d. physical-capital intensive. human-capital intensive. all of the above

68. Which of the following industries would be an example of comparative advantage based primarily on R&D? a. bourbon b. c. d. leather footwear apparel pharmaceuticals *

TRUE FALSE QUESTIONS

1. T If Canada is relatively capital abundant and Mexico is relatively labor abundant, this means that the capital-to-labor ratio in Canada is greater than the capital-to- labor ratio in

Mexico.

2. T If capital per worker in a country is relatively high, then it is probably true that GDP per capita is relatively high as well.

3. T GDP per capita is positively correlated with the K/L ratio.

4. F A capital-intensive good is one with a low K/L ratio.

5. F A country will tend to have a comparative advantage in goods that intensively use their scarce factor of production.

6. T The factor-proportions theory predicts that the pattern of trade is determined mostly by country differences in factor endowments.

7. F The factor-proportions theory predicts that the pattern of trade is determined mostly by country differences in tastes and preferences.

8. F If country A is labor abundant relative to another country, then country A must have a larger labor force than the other country.

9. F A country will have relatively lower costs of production in goods where production calls for smaller quantities of the abundant factor of production and greater quantities of the scarce factor of production.

10. F The capital-to-labor ratio is only important in the context of international trade.

11. T If a country is labor abundant, it will tend to import products with a high K/L ratio.

Factor Endowments and the Commodity Composition of Trade 69

12. F The factor-proportions theory was formulated by Adam Smith and David Ricardo.

13. F In the factor-proportions theory, both countries start with the same factor endowments.

14. T The factor-proportions theory is built around differences in factor endowments and different input requirements for each good.

15. T The factor-proportions theory states that a country will have a comparative advantage in the good whose production is relatively intensive in the factor in which the country is relatively abundant.

16. T The factor-proportions theory of international trade states that countries would tend to export products that intensively utilize their abundant factor of production.

17. F Countries would tend to export products that intensively utilize their scarce factor of production.

18. T Countries will tend to export products that intensively utilize their abundant factor of production.

19. T The factor-proportions theory of international trade predicts that countries would tend to import products that intensively utilize their scarce factor of production.

20. F A country that is capital abundant would tend to import capital-intensive products and export labor-intensive products.

21. T Labor-abundant countries tend to export labor-intensive goods.

22. T International trade would tend to equalize the prices of factors of production between countries that trade with one another.

23. T Countries engaging in international trade would tend to see their abundant factor of production get more expensive and their scarce factor of production get cheaper.

24. T International trade causes the price paid to the abundant factor of production to rise and the price paid to the scarce factor of production to fall.

25. T International trade would tend to make the scarce factor of production in a country cheaper.

26. F International trade improves the welfare of trading countries and the benefits of trade are distributed evenly across all segments of society.

27. T International trade impacts the economy by changing its industrial structure.

70 Chapter 3

28. T International trade would tend to increase the percentage of national income going to the abundant factor of production.

29. T International trade tends to raise the amount of national income received by the abundant factor of production.

30. F International trade tends to lower the amount of national income received by the abundant factor of production.

31. F International trade tends to raise the amount of national income received by the scarce factor of production.

32. T International trade tends to lower the amount of national income received by the scarce factor of production.

33. F Specialization and trade tend to decrease the employment and incomes of workers in the export industries.

34. T According to the Stopler-Samuelson theorem, the scarce factor of production in a country should oppose international trade.

35. F According to the Stopler-Samuelson theorem, the abundant factor of production in a country should oppose international trade

36. T The Stopler-Samuelson theorem gives us an explanation for why certain groups in a society are opposed to free trade.

37. F There is no tendency for international trade to change the distribution of income in a country.

38. F No member of society ever loses because of international trade.

39. T In general, the owners of the abundant factor of production should be in favor of freer international trade.

40. F Trade Adjustment Assistance is common in other countries but has never been available to American workers.

41. F In general, owners of the abundant factor of production in a country would be opposed to free international trade.

42. F Empirical testing does not apply to economics as all economic theories are derived from real life experiences, and therefore there is no need to test them.

43. T The empirical tendency for U.S. exports to appear to be labor intensive is known as the

Leontief Paradox.

Factor Endowments and the Commodity Composition of Trade 71

44. F The Leontief tests of the 1950s confirmed the factor-proportions theory in explaining the commodity composition of U.S. trade.

45. F The empirical study by Leontief provided support for the factor-proportions theory.

46. F Leontief showed that U.S. exports were capital intensive relative to U.S. imports.

47. T. According to the Leontief paradox, U.S. industries with trade surpluses were more labor intensive than industries with a trade deficit.

48. T U.S. exports appear to be labor intensive because they contain a large amount of human capital.

49. T International trade patterns may be influenced by a country’s endowment of relatively skilled workers.

50. F The factor-proportions theory of international trade perfectly explains all trade patterns using only capital and labor as variables.

7.

8.

5.

6.

3.

4.

51. F The basic theory of comparative advantage can explain all types of international trade.

SHORT ANSWER ESSAY

1. List the assumptions of the factor-proportions theory of international trade.

2. Assume that the U.S. is labor abundant relative to Japan and that Japan is capital abundant relative to the U.S. What does this mean for international trade between the two countries?

Discuss how international trade tends to change the industrial structure of a country.

Why would international trade have a tendency to equalize the prices of the factors of production between two countries that trade with one another?

Why are factor prices so similar in the U.S. and Canada?

Discuss the role of international trade in the economic development of India and South

Korea.

Describe the effects that international trade has on the distribution of income.

How could international trade improve the standard of living in developing countries that are relatively labor abundant?

9. Suppose that capital in a comparative disadvantage industry cannot move out of that industry in the short run. Describe what happens to the return to capital in the comparative disadvantage and comparative advantage industries.

72 Chapter 3

10. Describe what Leontief found when he tested the factor-proportions theory for the first time.

11. What explanations have been given for the Leontief Paradox?

BRIEF ANSWERS TO SHORT ANSWER ESSAY

1. The factor-proportions theory is based on the following assumptions: 1) two countries; two goods; and two factors of production; 2) both countries have the same technology and each good is produced under constant returns to scale; 3) both countries have perfectly competitive product and factor markets and prices of the two goods and factors of production are determined by supply and demand; 4) there are no transportation costs, tariffs, or other obstructions to free trade between countries and after the introduction of international trade neither country completely specializes in producing a particular good;

5) consumers in the two countries have equal tastes and preferences for each of the two

2.

3.

4.

5.

6. goods; 6) labor and capital are assumed to be mobile domestically but not internationally;

7) the production techniques available to produce the two goods are such that one good is everywhere capital intensive and the production of the other good is everywhere labor intensive; and 8) the resources of both countries are fully employed both before and after trade.

The factor-proportions theory states that a country has a comparative advantage in, and exports, the good that intensively uses the country's abundant factor of production. The

U.S. will have a comparative advantage in labor-intensive goods and Japan will be a comparative advantage in capital-intensive goods.

Industrial structure refers to the percentage of output that is accounted for by each industry within a country. Without trade, a country would have a certain percentage of their total industrial capacity devoted to producing various goods. By allowing international trade, each country specializes its production and changes the percentage of its production that is allocated to produce exports and import competing goods.

The introduction of international trade sets in motion market forces that cause a change in the relative price of exports and imports. These changes in the prices of the goods cause changes in the industrial structure of the country. This change in industrial structure causes changes in the prices paid to the factors of production. As a result, the price paid to the abundant factor of production increases and the price paid to the scarce factor of production decreases. Finally, the relative factor prices between countries tend to converge.

Factor prices in the U.S. and Canada are similar because U.S. and Canadian factor endowments are very similar.

A country’s comparative advantage can change over time. South Korea is a good example of a country changing its factor endowments and its comparative advantage. In

Factor Endowments and the Commodity Composition of Trade 73

7. the mid 1960s, the capital stock per worker in South Korea was approximately $2,000.

By the early 1990s it was nearly $18,000. Less than 40 years ago, South Korea was a very poor developing country. GDP per capita at the end of the Korean War was less than

$800. In less than 40 years, GDP per capita had increased to $7,251. Some of this progress can be attributed to the relative openness of the Korean economy. In the early

1950s exports plus imports as a percentage of GDP were a little more than 10 percent.

By 1990 they were more than 60 percent. India is a good study in contrast. In the 1950s,

India's GDP per capita was only slightly lower than South Korea's. India, like South

Korea, was a labor-abundant country with a low capital stock per worker. The level of openness in the two economies was also similar in the early 1950s. Today India is still a poor, labor-abundant economy for many reasons. However, at least part of the story can be found by contrasting the rates at which the two economies opened themselves up to trade over the last 40 years.

As trade opens up between countries, the price paid to the abundant factor of production rises, and the price paid to the scarce factor of production falls. If we assume that labor and capital remain fully employed both before and after trade, the real income of labor and capital moves in the same direction as factor prices. International trade has discernible effects on the distribution of income. This effect is known as the Stolper-

Samuelson theorem, and states that the abundant factor tends to receive a larger share of

8. the income pie and the scarce factor tends to receive a smaller share of the income pie.

As trade opens up, the price paid to the abundant factor of production (labor) would rise, and the price paid to the scarce factor of production (capital) would fall. International trade will change the distribution of income. Labor would tend to receive a larger share of the income pie and capital would tend to receive a smaller share of the income pie.

9. In this case, capital is called a specific factor because its use is specific to the production of various goods. When trade opens up, the industry with a comparative advantage expands and the industry with comparative disadvantage contracts; if all capital is immobile, owners of the specific capital used to produce exports gain as the industry expands production. The owners of the specific capital used to produce import competing goods lose as production contracts. However, the income effect on the mobile or variable factor labor is indeterminate.

10. Wassily Leontief conducted the first and most famous empirical test of the factorproportions theory in 1954. What Leontief found was surprising. Leontief reasoned that when compared to its trading partners, the U.S. was a capital-abundant country, and given the factor-proportions theory, the U.S. should export goods that are capital intensive and import goods that are labor intensive. To test this hypothesis, he calculated how much capital and labor - the K/L/ ratio- various U.S. industries used in their production. He then compared the K/L ratios of the industries that had a net trade surplus

-the net exporters- to the K/L ratios of the industries having a net trade deficit - the net importers. He expected that U.S. industries with a trade surplus would have a high K/L ratio relative to U.S. industries with a trade deficit. What Leontief found was the reverse.

Industries with trade surpluses were more labor intensive than industries with a trade deficit. This result has been called the Leontief Paradox.

74 Chapter 3

11. There are a number of possible explanations for Leontief's results. One is that some imports are not based on an abundance of labor or capital, but depend on the possession of natural resources, such as oil, diamonds, bauxite, and copper. Many of these naturalresource industries use highly capital-intensive production techniques to extract the product and since the U.S. imports many natural resources, this would help to explain why U.S. imports are capital intensive. Second, U.S. trade policy may have biased the results. Many of the most heavily protected industries in the U.S. are labor-intensive.

The effect of imposing trade restrictions on certain labor-intensive goods would be to diminish U.S. imports of labor-intensive products and reduce the overall labor intensity of U.S. imports. Third, Leontief’s test, which found that U.S. exports were labor intensive, was based on the simple two-factor version of the factor-proportions model.

This simple model assumes that labor is homogeneous or that one unit of labor is like any other unit of labor. However, much of the U.S. labor force is highly skilled or possesses human capital. When human capital is taken into account, U.S. exports do not appear to be labor intensive, but appear to be human-capital intensive. Fourth, U.S. exports also appear to be intensive in technology, which is somewhat different from capital, labor, or human capital. U.S. exports have been shown to be intensive in research and development (R&D). The level of R&D in an industry is a coarse measure of the level of technology. As a result of this research, we can use the factor-proportions theory with some confidence. Most empirical evidence indicates that the basic reasoning embodied in the factor-proportions theory is correct. We just need to broaden the concept of factors of production to include factors other than capital and labor.