Brief answers to problems and questions for review

advertisement

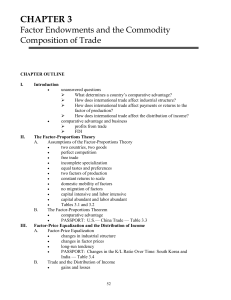

Brief answers to problems and questions for review 1. The factor-proportions theory provides an extension of the trade model presented in Chapter 2 by providing an understanding of why each country has a comparative advantage or disadvantage in various goods. This understanding of the causes of comparative advantage is based on a country’s relative endowment of the factors of production. 2. The assumptions of the factor-proportions theory are as follows: There are two countries, and each country produces two goods. The production and consumption of the goods are conducted under perfect competition in the product and factor markets. This means that firms are price takers and their individual actions cannot influence conditions in their respective markets. The prices of the two goods and the prices paid to the factors of production are determined by supply and demand in each market. In the long run, the prices of the goods are equal to their respective costs of production. There are no transportation costs, tariffs, or other obstructions to the free flow of goods between the two countries. The introduction of international trade does not cause complete specialization in the production of one of the goods in either country. Both countries will continue to produce both goods. Consumers in the two countries have equal tastes and preferences. This means that when the price of machines in terms of cloth is the same in the two countries, both countries will consume the same proportion of the two goods. Both countries are endowed with two homogeneous factors of production, capital (K) and labor (L) and both resources are employed in the production of the two goods. The technology available to produce the two goods is the same in both countries and each good is produced under constant returns to scale. Labor and capital are mobile domestically. This means that within each country labor and capital can flow freely from one industry to the other. As a result, both industries within a country will pay the same wage rate and the same return to capital. Labor and capital cannot move internationally between countries. This allows for differences in wage rates and the return to capital between the two countries. It also rules out the possibility of eliminating wage differences between countries through migration. The production techniques available to produce machines and cloth in both countries are such that the production of machines is everywhere capital intensive and the production of cloth is everywhere labor intensive. 3. A labor-intensive good is one that requires a substantial amount of labor relative to capital or that is produced with a lower capital-to-labor ratio than another good. A labor-abundant country is a country that has a capital-to-labor ratio that is smaller than the capital-to-labor ratio in another country. 4. The basic determinant of comparative advantage and trade in the factor-proportions theory is that a country will have a comparative advantage in and export goods whose production intensively uses its relatively abundant factor of production. Also, a country will have a comparative disadvantage in and import goods whose production intensively uses its relatively scarce factor of production. 5. The capital stock per worker from the Penn World Tables provides information on the relative abundance of capital and labor in various countries. This relative abundance can be used to determine if a country is relatively capital abundant or labor abundant when compared to another country. This information is an empirical estimate of the © 2015 W. Charles Sawyer and Richard L. Sprinkle capital-to-labor ratio in various countries. 6. a. Country C is relatively capital abundant. b. Country B is relatively labor abundant. c. Country C will have a comparative advantage in the production of steel because steel production intensively uses its relatively abundant factor of production. 7. The introduction of international trade sets in motion market forces that cause a change in the relative price of traded goods. As the relative price of the export good increases, this causes a change in the industrial structure of the country. The industry producing the comparative advantage good expands its production. The comparative disadvantage industry would decrease its production. This would cause changes in the prices paid to the factors of production. The price of the abundant factor would increase and the price of the scarce factor would fall. 8. Under the assumption that the factors of production remain fully employed both before and after trade, the real income of the scarce factor and the abundant factor move in the same direction as factor prices. The percentage of national income that the abundant factor receives would increase and the percentage of national income that the scarce factor receives would decrease. As a result, international trade has discernible effects on the distribution of income within a trading country. 9. Almost by definition labor unions represent the scarce factor of production in a developed country. As such, it is usually the case that that labor in a developed country would lose from international trade. It is hardly surprising that labor unions in developed countries would be opposed to free trade. 10. This implies that labor is the scarce factor of production in Country A, since a country will have a comparative disadvantage and import goods whose production intensively uses its relatively scarce factor of production. Relative wages within the country will fall, since as trade opens up the price paid to the abundant factor in a country would rise, and the price paid to the scarce factor would fall. In general, capital owners will support free trade and labor will oppose free trade, since the percentage of national income that the abundant factor receives would increase and the percentage of national income that the scarce factor receives would decrease. 11. Developing countries are usually labor abundant. In this case, international trade would tend to increase the return to the abundant factor, labor. As a result, international trade would tend to increase the incomes of workers in developing countries and provide a partial solution to poverty. 12. The criteria the government uses to determine if a firm and workers have been adversely impacted by imports are that workers have been totally or partially laid off; sales or production have declined; and increased imports have contributed importantly to worker layoffs. 13. The Leontief paradox is the empirical finding that US industries with trade surpluses were more labor intensive than US industries with trade deficits. This finding is © 2015 W. Charles Sawyer and Richard L. Sprinkle contrary to the factor-proportions theory. A number of possible explanations for the perverse result have been given over the years including: some imports are not based on an abundance of labor or capital but depends on the country’s possession of natural resources and US trade policy may have biased the results. The paradox tends to be resolved by considering human capital and technology as separate factors of production. 14. Human capital is the embodiment of education, skills, and training of the workforce in a country. Empirical research on the factor-proportions theory of international trade indicates that many products are human capital intensive. That is, the production of these products requires a large amount of human capital. The result is that human capital can be treated as a separate factor of production. 15. Empirical research in international trade has shown that many products are R&D intensive. This means that the production of these products involves large investments in R&D. In certain industries, R&D is a separate factor of production. It is somewhat analogous to the role that physical capital (K) plays in capital-intensive industries. 16. When a country has specific factors of production used to produce various goods as trade opens up, the effect of specific factors is that the owners of the specific capital used to produce the good in which the country has a comparative advantage benefit as the industry expands production. The owners of the specific factors used to produce the good in which the country has a comparative disadvantage lose as production contracts. The income effect on the mobile or variable factor is indeterminate and depends on the consumption pattern of society. 17. Fifty years ago, South Korea was a relatively poor, labor abundant country that was not particularly open to international trade. At this point, South Korea is an OECD country that has left its developing country status behind. Partially because of trade, wages in the country have risen. Also, the capital stock has risen to the point that South Korea is now a capital abundant country. 18. The existence of specific factors can help explain why some groups resist free trade. In general, owners of the abundant factor of production in a country should be in favor of freer international trade, while owners of the scarce factor of production would favor trade restrictions. With specific factors of production, both capital and labor in the industry with a comparative disadvantage suffer losses and may resist free trade. © 2015 W. Charles Sawyer and Richard L. Sprinkle 19. a. Wheat C Argentina F B H G Brazil 2 A J E 1 D Wine b. Argentina will export wheat to Brazil. As a result, the price of wheat will rise in Argentina. As the wheat industry expands in Argentina, the wine industry will contract. Since Argentina is capital abundant, the expansion of the wheat industry will drive up the price of capital and lower the price of labor. These effects will increase the percentage of national income going to capital and reduce the percentage received by labor. These effects would be the reverse in Brazil. The price of wine will rise and the wine industry will expand. The price of wheat will fall and the wheat industry will contract. This will increase the price of labor and reduce the price of capital. The percentage of national income received by labor will rise and the percentage received by capital will fall. 20. a. Trade will not change the fraction of the labor force that is employed in the food and cloth sectors if all factors are immobile. Trade will increase the wage in the clothing sector and lower the wage in the food sector. b. Trade will cause labor to move from the food sector into the cloth sector. As labor moves from one sector to the other the wages paid in the cloth sector will decline and wages paid in the food sector will increase until they become equal. c. Relative wages will fall and relative rents will rise if all factor are mobile between the sectors. © 2015 W. Charles Sawyer and Richard L. Sprinkle