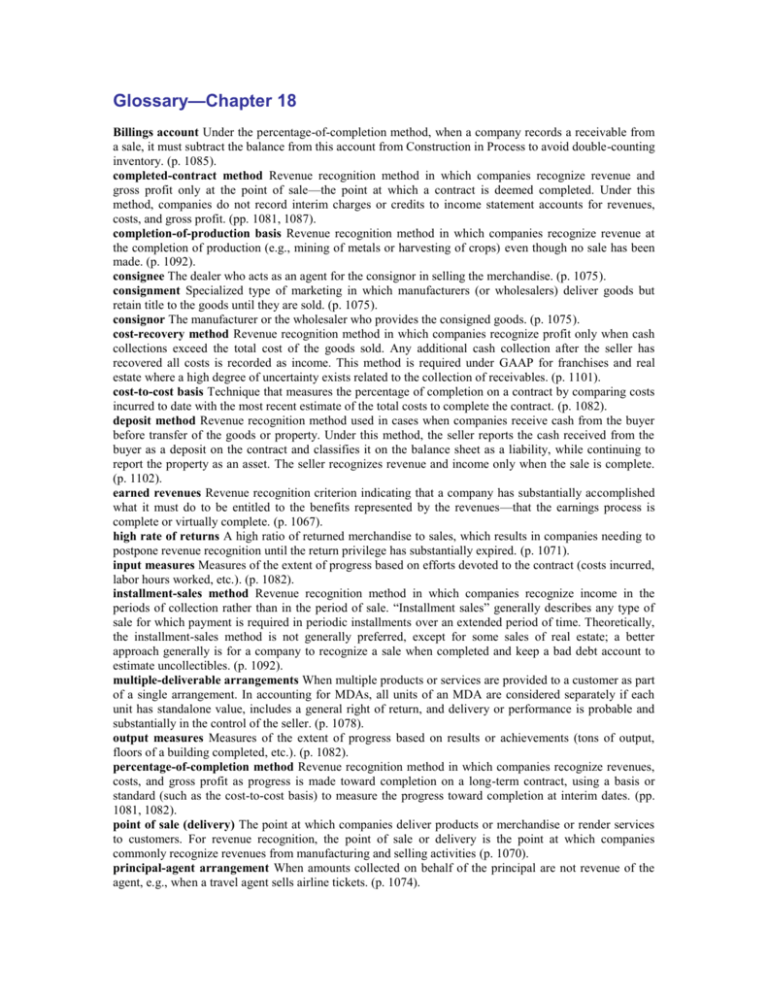

Glossary—Chapter 18

advertisement

Glossary—Chapter 18 Billings account Under the percentage-of-completion method, when a company records a receivable from a sale, it must subtract the balance from this account from Construction in Process to avoid double-counting inventory. (p. 1085). completed-contract method Revenue recognition method in which companies recognize revenue and gross profit only at the point of sale—the point at which a contract is deemed completed. Under this method, companies do not record interim charges or credits to income statement accounts for revenues, costs, and gross profit. (pp. 1081, 1087). completion-of-production basis Revenue recognition method in which companies recognize revenue at the completion of production (e.g., mining of metals or harvesting of crops) even though no sale has been made. (p. 1092). consignee The dealer who acts as an agent for the consignor in selling the merchandise. (p. 1075). consignment Specialized type of marketing in which manufacturers (or wholesalers) deliver goods but retain title to the goods until they are sold. (p. 1075). consignor The manufacturer or the wholesaler who provides the consigned goods. (p. 1075). cost-recovery method Revenue recognition method in which companies recognize profit only when cash collections exceed the total cost of the goods sold. Any additional cash collection after the seller has recovered all costs is recorded as income. This method is required under GAAP for franchises and real estate where a high degree of uncertainty exists related to the collection of receivables. (p. 1101). cost-to-cost basis Technique that measures the percentage of completion on a contract by comparing costs incurred to date with the most recent estimate of the total costs to complete the contract. (p. 1082). deposit method Revenue recognition method used in cases when companies receive cash from the buyer before transfer of the goods or property. Under this method, the seller reports the cash received from the buyer as a deposit on the contract and classifies it on the balance sheet as a liability, while continuing to report the property as an asset. The seller recognizes revenue and income only when the sale is complete. (p. 1102). earned revenues Revenue recognition criterion indicating that a company has substantially accomplished what it must do to be entitled to the benefits represented by the revenues—that the earnings process is complete or virtually complete. (p. 1067). high rate of returns A high ratio of returned merchandise to sales, which results in companies needing to postpone revenue recognition until the return privilege has substantially expired. (p. 1071). input measures Measures of the extent of progress based on efforts devoted to the contract (costs incurred, labor hours worked, etc.). (p. 1082). installment-sales method Revenue recognition method in which companies recognize income in the periods of collection rather than in the period of sale. “Installment sales” generally describes any type of sale for which payment is required in periodic installments over an extended period of time. Theoretically, the installment-sales method is not generally preferred, except for some sales of real estate; a better approach generally is for a company to recognize a sale when completed and keep a bad debt account to estimate uncollectibles. (p. 1092). multiple-deliverable arrangements When multiple products or services are provided to a customer as part of a single arrangement. In accounting for MDAs, all units of an MDA are considered separately if each unit has standalone value, includes a general right of return, and delivery or performance is probable and substantially in the control of the seller. (p. 1078). output measures Measures of the extent of progress based on results or achievements (tons of output, floors of a building completed, etc.). (p. 1082). percentage-of-completion method Revenue recognition method in which companies recognize revenues, costs, and gross profit as progress is made toward completion on a long-term contract, using a basis or standard (such as the cost-to-cost basis) to measure the progress toward completion at interim dates. (pp. 1081, 1082). point of sale (delivery) The point at which companies deliver products or merchandise or render services to customers. For revenue recognition, the point of sale or delivery is the point at which companies commonly recognize revenues from manufacturing and selling activities (p. 1070). principal-agent arrangement When amounts collected on behalf of the principal are not revenue of the agent, e.g., when a travel agent sells airline tickets. (p. 1074). realizable revenues Part of the first test of the revenue recognition principle, revenues are realizable when assets received or held are readily convertible into cash or claims to cash—that is, when they are salable or interchangeable in an active market at readily determinable prices without significant additional cost. (p. 1067). realized revenues Part of the first test of the revenue recognition principle, revenues are realized when a company exchanges goods and services for cash or claims to cash (receivables). (p. 1067). repossessions Merchandise that the seller has taken back when the purchaser failed to meet payment requirements. The seller would remove both the account receivable and the applicable deferred gross profit from the ledger, using a Repossessed Merchandise (inventory) account. (p. 1097). revenue recognition principle One of the basic principles of accounting, which dictates that companies recognize revenue when it is realized or realizable and when it is earned–that is, when assets are salable or interchangeable in an active market at readily determinable prices without significant additional cost and when the company substantially accomplishes what it must do to be entitled to the benefits represented by the revenues. Generally, recognition at the time of sale provides a uniform and reasonable test. (p. 1067). Appendix 18A: continuing franchise fees Payment received in return for the continuing rights granted by the franchise agreement and for providing such services as management training, advertising and promotion, legal assistance, and other support. (p. 1107). franchisee The party who operates the franchised business. (p. 1105). franchisor The party who grants business rights under the franchise. (p. 1105). initial franchise fee Payment for establishing the franchise relationship and providing some initial services, such as employee and management training. (p. 1106). substantial performance The point at which the franchisor has no remaining obligation to refund any cash received or excuse any nonpayment of note from the franchisee, and has performed all the initial services required under the contract. (p. 1106).