Presentation about how you plan to live your life debt

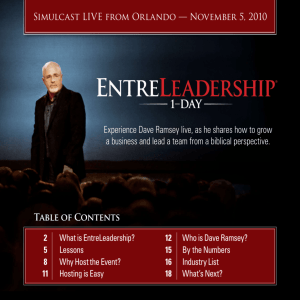

advertisement

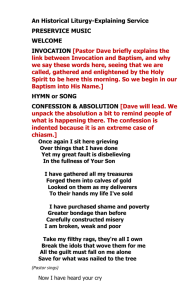

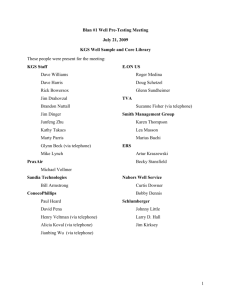

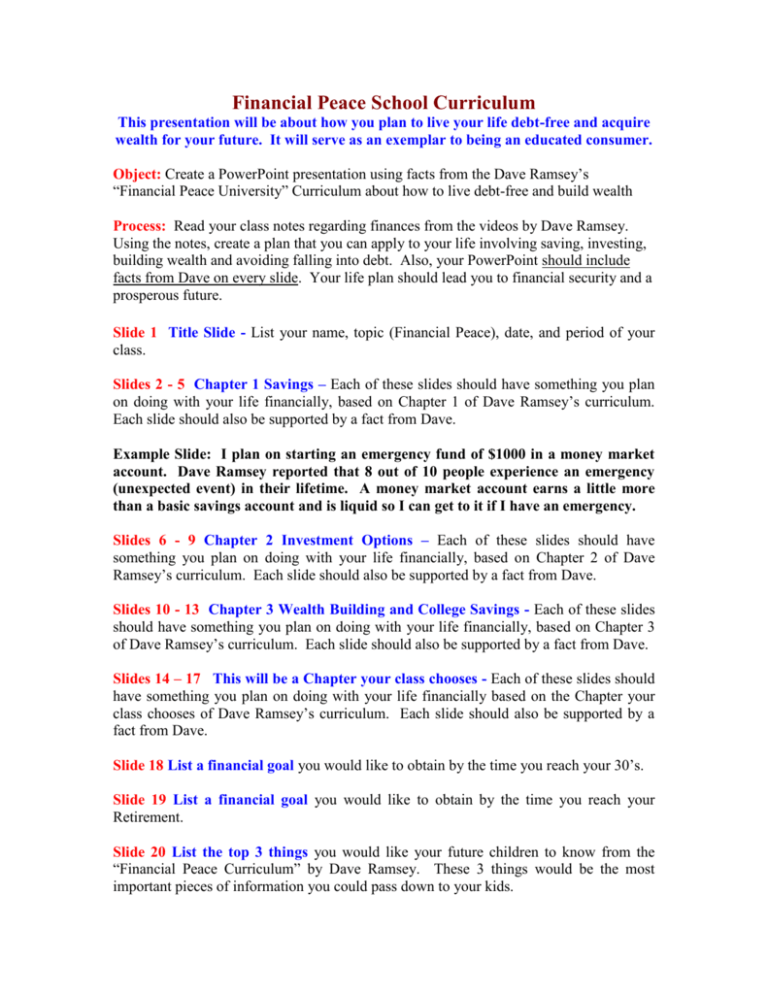

Financial Peace School Curriculum This presentation will be about how you plan to live your life debt-free and acquire wealth for your future. It will serve as an exemplar to being an educated consumer. Object: Create a PowerPoint presentation using facts from the Dave Ramsey’s “Financial Peace University” Curriculum about how to live debt-free and build wealth Process: Read your class notes regarding finances from the videos by Dave Ramsey. Using the notes, create a plan that you can apply to your life involving saving, investing, building wealth and avoiding falling into debt. Also, your PowerPoint should include facts from Dave on every slide. Your life plan should lead you to financial security and a prosperous future. Slide 1 Title Slide - List your name, topic (Financial Peace), date, and period of your class. Slides 2 - 5 Chapter 1 Savings – Each of these slides should have something you plan on doing with your life financially, based on Chapter 1 of Dave Ramsey’s curriculum. Each slide should also be supported by a fact from Dave. Example Slide: I plan on starting an emergency fund of $1000 in a money market account. Dave Ramsey reported that 8 out of 10 people experience an emergency (unexpected event) in their lifetime. A money market account earns a little more than a basic savings account and is liquid so I can get to it if I have an emergency. Slides 6 - 9 Chapter 2 Investment Options – Each of these slides should have something you plan on doing with your life financially, based on Chapter 2 of Dave Ramsey’s curriculum. Each slide should also be supported by a fact from Dave. Slides 10 - 13 Chapter 3 Wealth Building and College Savings - Each of these slides should have something you plan on doing with your life financially, based on Chapter 3 of Dave Ramsey’s curriculum. Each slide should also be supported by a fact from Dave. Slides 14 – 17 This will be a Chapter your class chooses - Each of these slides should have something you plan on doing with your life financially based on the Chapter your class chooses of Dave Ramsey’s curriculum. Each slide should also be supported by a fact from Dave. Slide 18 List a financial goal you would like to obtain by the time you reach your 30’s. Slide 19 List a financial goal you would like to obtain by the time you reach your Retirement. Slide 20 List the top 3 things you would like your future children to know from the “Financial Peace Curriculum” by Dave Ramsey. These 3 things would be the most important pieces of information you could pass down to your kids. Chapter 1 - Savings Chapter 2 – Investment Options Chapter 3 – Wealth Building and College Savings Chapter 4 – Dangers of Debt Chapter 5 – Consumer Awareness Chapter 6 – Credit Bureaus and Collection Practices Chapter 7 – Budgeting 101 Chapter 8 – Bargain Shopping Chapter 9 – Relating with Money Chapter 10 – Career Choices and Employment Taxes Chapter 11 – Ins and Outs of Insurance Chapter 12 – Real Estate and Mortgages Category Quality of the Explanation Your Life Plans Academic Value PowerPoint (Counts twice) 4 3 2 1 Demonstration has a fantastic explanation so that you are convinced that the presenter has prepared for their project well and shows that they have acquired great knowledge of their topic. The person doing the presentation could answer any questions on the project well. It was quite clear that you have a plan regarding each of the topics in your PP. You thoroughly talked about how you intend to deal with each issue. You also based your lifeplan intentions from the facts you presented in your PP. Demonstration has a good explanation and was well researched. Can answer questions from students but not quite confidently or completely. An explanation was provided but not quite a convincing one. The presenter was not sure of them self or their work. They may need help answering any questions from students. Unable to explain the connection between the topic chosen and the model chosen for the presentation. You have acceptable plans regarding each of the topics in your PP. You talked about how you intend to deal with each issue. You also based your life-plan intentions from the facts you presented in your PP. Presentation helped audience to get an understanding of the financial. Students can relate to the presentation. You may have not expressed your personal plan on a few issues listed in the project description. The facts were in the PP but you were missing your plan on a couple topics. Totally unprepared for presentation or student didn't know what was expected in this part of the assignment. No life-plans were given on the topic. Helped the students to retain what they already know but didn't get much out of presentation. Left students confused and unsure about financial planning after presentation. Some color, backgrounds, and pictures were applied to enrich presentation. -Followed the 20slide layout. Not very many additional things were added to the presentation. Mainly text in presentation. -Missing slides from the 20-slide layout. Not very many additional things were added to the presentation. Only text in presentation. -Missing 50% or more of the slides from the 20-slide layout. Audience learned something new about financial planning and helped them as an educated consumer. They now look at the topic differently. Slides were appeasing to the eye and easy to read. Various colors, backgrounds, animations, and pictures were applied to enrich presentation. -Went above and beyond the 20-slide layout.