Study guide

advertisement

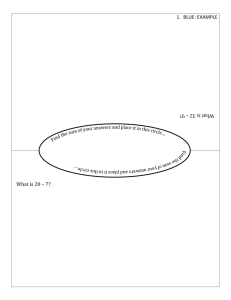

Econ. 474/575 Exam #2 Study Guide Midterm format The content of the exam comes primarily from class lecture. Also, the discussion topics and readings are fair game, particularly the study questions from each chapter that I have put on my webpage. The midterm will be comprised of the following types of questions a. 30% short answer (approximately 2 or 3 questions worth 10 points each) I will give you a concept and you will define it and explain its relevance to Latin America b. 20% essay (one essay worth 20 points). The essay will focus on the broader issues and lessons learned from the Latin American experience. Case studies, chapter questions, and applications of economic theory to a new country are all possible topics. c. 50% technical questions based on the economic theory or models and their application to Latin America. You will have 2 hours to take the exam. There is a class after ours, so papers will be collected promptly at the end of the hour. Please bring a watch and time yourselves according to the number of points. You have roughly 100 minutes to complete the exam, so if a question is worth 10 points, don’t spend more than 10 minutes on it. General information Trade integration Drug war in Latin America informal sector: definition, how it is changing, relative size Concepts and definitions Levels of economic integration: know definition of EACH and example Advantages and disadvantages of trade blocks Trade creation Trade diversion Insights from trade theory Benefits of intraregional trade in Latin America Trends in 21st century Trade triangle: rum Bacardi history and importance of move to U.S. Functioning intraregional trade blocks in Latin America DR-CAFTA, CAN, MERCOSUR, NAFTA, CARICOM Effects of NAFTA in Mexico, U.S. Informal sector costs of being informal costs of being formal why informal sector is characterized by low productivity Case studies Puerto Rican trade integration Puerto Rican rum industry Impact of drug war in Colombia, Mexico, Caribbean Informal sector in Peru Economic models Model of trade creation Model of trade diversion Consumer and producer surplus calculation and definition Effectiveness of U.S. drug interventions based on S & D analysis Three tier analysis of informal sector Sample problem on Trade Diversion Consider the domestic price of t-shirts in these countries: China: $3 Mexico: $4 U.S.: $7 Canada: $8 What would be the net effect of the creation of NAFTA (free trade among Mexico, US, and Canada) on the U.S. market compared to the pre-NAFTA policy of $2 tariff on all imported t-shirts? 1. Pre-NAFTA a. Which country do we import t-shirts from? b. What is the price of t-shirts in the U.S.? c. How much is produced? Domestically? Imported? d. Show regions of CS, PS, and G Revenue 2. NAFTA a. Which country do we import t-shirts from? b. What is the price of t-shirts in the U.S.? c. How much is produced? Domestically? Imported? d. Show regions of CS, PS, and G Revenue e. Show regions of net gain and net loss compared to the pre-NAFTA scenario 3. Cheap Chinese t-shirt scenario Suppose that t-shirts can be produced for $1.50 in China. What would happen to your answer in part 2 (under NAFTA)? SOLUTION 1. Pre-NAFTA NOTE: I only drew the price lines that are relevant to the US. We are not interested in Canadian and Mexican t-shirts because they are more expensive. We are interested in buying Chinese t-shirts, but must add the $2 tariff. a. Which country do we import t-shirts from? China b. What is the price of t-shirts in the U.S.? $5 c. How much is produced? Qc = total quantity produced Domestically? Qb Imported? Qc-Qb = imports d. Show regions of CS, PS, and G Revenue CS: triangle with vertical lines PS: triangle with diagonal lines G Rev: rectangle labeled GOV NOTE: In order to calculate these areas, you would need to be given the exact quantities and know where the Supply and Demand curves intersect the axis. You would calculate the area of a triangle as ½*(Base*Height) and the area or a rectangle as (Length*Width). In this example, you can just shade them in. SUS $7 Schina + t $5 GOV Schina $3 DUS Qb Qc imports t-shirts 2. NAFTA a. Which country do we import t-shirts from? Mexico b. What is the price of t-shirts in the U.S.? $4 c. How much is produced? Qd = total quantity produced Domestically? Qa Imported? Qd-Qa = imports d. Show regions of CS, PS, and G Revenue CS: triangle with vertical lines PS: triangle with diagonal lines G Rev: NONE since there is no tariff with Mexico e. Gains and losses compared to pre-NAFTA Gains: the two little triangles in black were not in the last graph and now they represent CS Loss: the highlighted rectangle is a net loss because we have lost the Gov. revenue from the tariff with China in the last graph. We don’t lose the top section of the rectangle because it is now CS and is shaded in so we are just trading the preNAFTA Gov. Rev. for new CS. But the bottom part of the rectangle is now a net loss. Net Effect: if the loss > the gain, then you have a net loss. This is what is called TRADE DIVERSION through economic integration. SUS $7 SChina + t $5 $4 $3 SMex SChina Loss in G DUS Qa Qb Qc imports Qd t-shirts 3. Cheap Chinese t-shirts a. Which country do we import t-shirts from? China b. What is the price of t-shirts in the U.S.? $3.50 c. How much is produced? Qtotal = total quantity produced Domestically? Qdom Imported? Qtotal-Qdom = imports d. Show regions of CS, PS, and G Revenue CS: triangle with vertical lines PS: triangle with diagonal lines G Rev: rectangle labeled GOV Under NAFTA, we would still have this same outcome. We would not be interested in importing t-shirts duty free from Mexico because they would still be more expensive ($4) compared to the Chinese t-shirts. So sometimes, trade integration has NO EFFECT!!!! SUS $7 SChina + t SMex SChina $3.50 GOV $1.50 DUS Qdom Qtotal imports t-shirts