Measuring Beta

advertisement

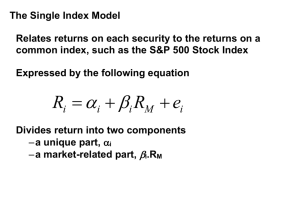

CHAPTER 12 RISK, RETURN, AND CAPITAL BUDGETING CHAPTER IN PERSPECTIVE This chapter continues to build the bridge between asset investment, capital budgeting, and financial markets. This chapter continues the focus of the risk/return tradeoff, starting with calculation of beta. Students with their new financial/statistical calculator are able to crank out a regression line. Just give them a worksheet with the numbers. Ask them to plot the regression line and be surprised at the variety of graphics packages located in computers in the student dorms or at the part-time job site. The concepts of the risk/return tradeoff are cemented in this chapter. Later in the chapter, risk and capital budgeting concepts are combined in a short but important discussion of the project cost of capital. In your chapter presentation, this last section is the connecting link of CAPM to the asset side of the balance sheet. Help the student make the connection! CHAPTER OUTLINE 12.1 MEASURING MARKET RISK Measuring Beta Betas for Amazon.com and Wal-Mart Total Risk and Market Risk Portfolio Betas 12.2 RISK AND RETURN Why the CAPM Makes Sense The Security Market Line 106 How Well Does the CAPM Work? Using the CAPM to Estimate Expected Returns 12.3 CAPITAL BUDGETING AND PROJECT RISK Company versus Project Risk Determinants of Project Risk Don’t Add Fudge Factors to Discount Rates TOPIC OUTLINE, KEY LECTURE CONCEPTS, AND TERMS 12.1 MEASURING MARKET RISK A. Only “macro” events affect the value of the market portfolio, or a portfolio of all assets in the economy. B. A broad market base, such as the S&P Composite, is often used as a proxy for the market portfolio. C. Firm specific or unique risk are averaged out or diversified away when considering the market portfolio. D. A measure of a stock’s risk relative to the risk of the market portfolio is called the stock’s beta, and is expressed as the Greek letter, . Measuring Beta A. Investors with diversified portfolios are not concerned about the specific or unique risk of a stock, only the impact of the stock on the risk of the entire portfolio. B. The relative risk of the stock compared to the portfolio risk or beta is the relevant risk to consider when a new stock is added to the portfolio. C. Defensive stocks historically tend to vary less than the market portfolio; aggressive stocks have a history of more variation relative to the market portfolio. D. Beta is the slope of the regression line of the individual stock returns relative to the market portfolio returns. If the slope indicates a change in historical stock returns similar to the market (-1 to +1), the beta has a value of 1. If the variation in the stock return, given a 1 percent variation in the market returns, is less than the market variation, the beta is less than 1 and the stock is noted as a “defensive” stock. If the slope of the line through the points found by plotting the stock’s returns relative to a 1 percent change in the market portfolio is greater than 1, the 107 beta has a value greater than 1. E. Any stock’s return is comprised of two parts. The first is explained by the macro events in the market or the market rate of return. The second part of the return is related to the specific or unique risk of the stock relative to the market rate of return, or the stock beta. F. The beta is calculated by (1) observing monthly rates of return for the stock and the market; (2) plotting the observations as in Figures 12.2 and 12.3; and (3) fitting a regression line showing the average returns to the stock (dependent variable) at different market returns (independent variable). The slope of the line, beta, relates the change in stock returns, given a change in market return. Betas for Amazon.com and WalMart A. Betas for Amazon.com and WalMart are calculated in Figure 12.2. The months’ return of the stocks and market are plotted and a regression line is calculated and drawn. B. The beta is the “b” in the (a + bx) function of the straight line drawn or the slope of the line. It indicates the change in the stock return, given a change in the market rate of return. C. Amazon.com had a beta of 2.49, or a stock variation 249% higher than the market variability over the period (2.49% change for every 1% change in market rate of return). ExxonMobil tended to vary less than the market in the same period (beta of .41 or .41% for any 1% change in the market rate of return). 108 Total Risk and Market Risk A. The standard deviation of the returns on a firm stock, which is the toal variability of the stock, is not the same as market risk (see Tables 11.6 and 12.1). B. Table 11.6 shows the standard deviations for selected common stocks for a specific period. C. Table 12.1 lists popular stocks and their betas for the same specific period. 109 Portfolio Betas A. Diversification decreases the variability from unique risk but not from market risk. B. The beta of a portfolio is an average of the betas of the securities in the portfolio, weighted by the investment in each security. C. A large portfolio of diversified stocks would approximate the market index and have a portfolio beta around one. An index mutual fund is a “market portfolio” of stocks with a beta close to the value of one. 12.2 RISK AND RETURN A. U.S. Treasury bills have very low risk and a beta of zero, or no relationship with the variations of the market portfolio of stocks, which has a beta of 1.0. B. The difference between the return on the market and the T-bill rate is called the market risk premium, or the risk premium demanded by investors to hold the market portfolio rather than T-bills. C. Over the past century, the market risk premium has averaged 7.6 percent per year; the market, 11.6%; and T-bills, 4.0% (From Chapter 11). See Figure 12.4(a). D. The expected rate of return on any portfolio combining T-bills and the market portfolio lies on a straight line between T-bills and the market portfolio. See Figure 12.4(b). 110 E. The risk premium is proportional to the portfolio beta. A portfolio with one-half T-bills and one-half the market portfolio of stocks would have a beta of .5, and a risk premium of one-half the market portfolio risk premium. F. The market risk premium is the market return less the return on T-bills, or: Market Risk Premium = rm - rf = 10% - 3% = 7% G. Beta measures risk of the stock relative to the market. The expected risk premium on an individual stock is the stock return less the risk-free rate or beta times the market risk premium, or: Risk Premium on any asset = r - rf = (rm - rf) H. The total expected return on a stock is the risk-free rate plus the risk premium of the stock or: Expected Return on stock = risk-free rate + risk premium, or: r= rf + (rm - rf) I. The above formula relating the expected return as the sum of the risk-free rate plus the risk premium is called the capital asset pricing model (CAPM). The rate of return on an individual stock is dependent upon the risk-free rate and the risk premium, which is related to the market risk premium and the risk of the stock relative to the market risk premium, its beta. 111 Why the CAPM Works A. The CAPM assumes well-diversified investors; market risk is the only relevant risk. B. The expected return on a portfolio is equal to the risk-free interest rate plus the expected portfolio risk premium. The Security Market Line A. A plot of expected rates of return of varied risk (beta) portfolios is called the security market line. B. According to the CAPM, expected rates of return for all securities and all portfolios lie on this line. C. The required risk premium for any investment is given by the security market line. D. A stock with a given beta that is expected to earn a return higher than that on the security market line will be purchased by investors, bidding up the stock price and lowering the expected rate of return to the security market line. Investors keep expected returns on the security market line. E. The security market line is the risk-return trade-off of investors. F. The CAPM states that the expected risk premium on an investment should be proportional to its beta. How Well Does the CAPM Work? A. The CAPM explains the risk-return trade-off well in the period 1931 to 2006, though the SMA tends to understate low risk returns and overstate high beta portfolio returns. B. Value stocks are those with high ratios of book value to market value. Growth stocks are those with low ratios of book to market. Since 1926 the average annual difference between returns on value and growth stocks has been 5.3%. C. The CAPM, though not the only model of the risk-return trade-off, is a good practical rule of thumb. It presents a simplified approach noting that extrarequired returns are required by investors to take added risk, and investors are primarily concerned with market risk that cannot be diversified away. 112 Using the CAPM to Estimate Expected Returns A. To estimate expected investor returns for a selected stock, three numbers are needed: (1) the risk-free rate of interest, (2) the expected market risk premium, and (3) the beta of the stock, or the historical variation in stock risk premium relative to the market risk premium. B. The CAPM may also be used to estimate the discount rate for new capital investments when calculating net present value. The security market line provides a standard for investment project acceptance. If the internal rate of return on a project exceeds the opportunity rate of return (investor returns in a portfolio of equal risk securities), the firm should make the investment. C. For any risk level or beta, project returns below the security market line are unacceptable and have negative NPVs. 12.3 CAPITAL BUDGETING AND PROJECT RISK Before the CAPM, financial manager’s intuition indicated that riskier projects are less desirable than safe projects and that riskier investments must have higher expected rates of return relative to safe projects. Company versus Project Risk A. The estimated required rate of return of investors on a firm’s securities is called the company cost of capital. The cost of capital is the discount rate used in calculating the NPV of investment projects and is the minimum acceptable rate of return when compared to the internal rate of return (IRR). B. The cost of capital is determined by average risk of a company’s assets and operations. The cost of capital is applicable as a discount rate only on projects with the average risk of the business. C. The project cost of capital is a risk-adjusted minimum acceptable rate of return used as a discount rate on a specific project. The project cost of capital depends on project risk, not the company cost of capital, representing an average risk project. 113 Determinants of Project Risk A. Project risk is usually assumed to be associated with the variability of cash flow of the project itself, but what matters is the relationship between the project’s cash flows and the total firm (portfolio) variability or the project’s beta. B. Projects that tend to have high operating leverage (high fixed costs) tend to have high project betas. Don’t Add Fudge Factors to Discount Rates A. Concern over the downside features of risk encourages managers to add risk premiums to discount rates in project analyses, thus forsaking many valuecreating projects. B. Special risk factors should be incorporated into the cash flow estimation, not the discount rate. Special risks are often unique risks, which are diversified away with other projects. PEDAGOGICAL IDEAS General Teaching Note - The security market line, presented in Figure 12.5, is often referred to as the risk/return trade-off. What is the relevance of the line and why might that be the “path” of the risk/return trade-off? Consider taking a point above and/or below the security market line. Why does the market tend to price the security back to the line? With a higher return than securities with the same risk, investors will quickly bid the price up and the yield down to the security market line. Student Career Planning - Encourage your students to take a trip to a financial center, where financial market places such as exchanges are located. Many will provide them tours and lectures. Alumni contacts are useful for providing tours and hosting student organization trips. While technology is lessening the geographic importance of financial services, there is always a concentration of financial firms in urban areas. Encourage the urban trip with a career planning focus. The Wall Street Journal Focus - We often tell our students that the concepts they learn in their financial management class are applicable to their personal lives. The WSJ has a regular column, called “Your Money Matters,” which focuses on personal financial issues, from insurance, auto leasing, home equity borrowing, etc. These timely and relevant topics focus on personal financial decision making. Students will have personal incomes exceeding a million dollars over their career, and they have the opportunity or challenge to spend it, save it, allocate it, etc. This frequent column offers good advice to anyone interested in wise expenditure, saving for the future, and getting the most out of personal income. 114