072-CompInvestI

advertisement

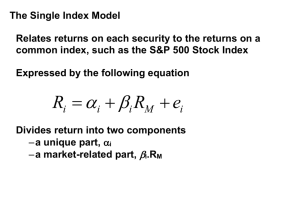

Computational Investing, Part I Dr. Tucker Balch Associate Professor School of Interactive Computing 072: Capital Assets Pricing Model Find out how modern electronic markets work, why stock prices change in the ways they do, and how computation can help our understanding of them. Learn to build algorithms and visualizations to inform investing practice. School of Interactive Computing Recap of CAPM 2 CAPM: Definition of Beta Assume: ri(t) = betai * rm(t) + alphai Use linear regression (line fitting) to find beta and alpha. 3 Beta & Correlation with the Market Online example 4 Beta and Correlation are Different! 5 Beta & Correlation with Market 6 CAPM: Expected Residual = 0 CAPM: ri(t) = betai * rm(t) + alphai ri(t) = betai * rm(t) + random Active Portfolio Management View ri(t) = betai * rm(t) + alphai 7 CAPM: Implications Expected excess returns are proportional to beta. Beta of a portfolio = weighted sum of betas of components. 8

![Cost of Capital - of [www.mdavis.cox.smu.edu]](http://s3.studylib.net/store/data/008952041_1-d815507e779b91930bdfd4a584f3c02a-300x300.png)