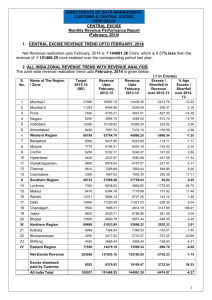

to See the Major detection in the year 2010-2011

advertisement

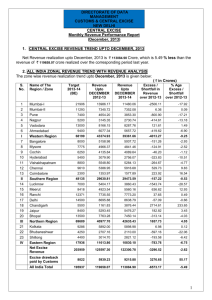

Performance of Anti-Evasion, Noida for the Year 2010-11 (Amounts in Crores) Service Tax Cases Central Excise Cases Detection Recovery Detection Recovery No. of cases Amt. No. of cases Amt. No. of cases Amt. No. of cases Amt. 31 74.5 22 36.79 21 19.22 16 7.59 ********** A BRIEF ON IMPORTANT CASES (INVOLVING AMOUNT OF RS.50 LACS OR MORE) DETECTED BY ANTI-EVASION-NOIDA DURING 2010-11 1. A case of ineligible availment and utilization of Cenvat credit involving Rs. 40.51 Crores (Rs. 31.92 recovered) against a manufacturing unit which was also engaged in trading of bought out goods has been detected. The said unit was availing and utilizing whole of the CENVAT Credit on the common input services used for both trading and manufactured goods in contravention of provisions of CENVAT Credit Rules, 2004. 2. A case of ineligible utilization of CENVAT Credit earned on inputs / input services in the capacity of manufacturer for payment of Service Tax towards output services rendered by another separate and distinct group company situated in adjoining premises has been detected. The manufacturing unit was also ineligibly availing Service Tax Credit attributable to trading goods. The amount detected is Rs. 1.25 Crores, out of which Rs. 0.97 Crores has been recovered. 3. Two cases of non-payment of service tax on construction of residential complex services involving Rs.1.6 Crores and Rs.1.1 Crores were detected. An amount of Rs.1.6 Crore has been recovered. 4. A case of central excise duty evasion by a pan-masala/gutkha manufacturer involving Rs.25.99 Crores by declaring a multi-track FFS Machine as a Single Track FFS Machine has been detected. 5. Two cases of Non-payment/ Short-payment of Service Tax by security service providers for amounts of Rs.2.85 Crores and Rs.1.47 Crores were detected, amounts of Rs. 0.89 Crores and Rs.1.47 Crores has been recovered. 6. A case of Wrong availment of the benefit of SSI Exemption under Notification No. 08/2003 by way of suppressing their actual value of clearances involving duty evasion of Rs.1.25 Crores (Rs.0.79 Crores recovered) has been detected. 7. A case of Non-registration and non-payment of service tax on ‘Construction of Residential and Industrial Complexes’, ‘Erection, Commissioning and Installation’ and ‘Repair and Maintenance’ services by contractor providing these services to Noida Authority/GNIDA involving amounts of Rs1.6 Crores has been detected. 8. A case of irregular availment of input service credit of Rs.0.62 Crores by a manufacturing unit has been detected. The said credit was availed in contravention of Rule 4 (7) of the Cenvat Credit Rules, 2004 according to which they can not avail input service credit before making the payment of the taxable value and service tax payable thereon to the service provider. *****