Syllabus - College of Business & Public Administration

advertisement

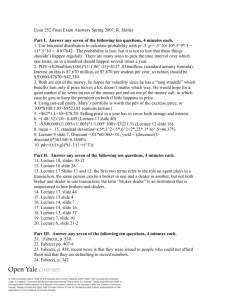

DRAKE UNIVERSITY FIN 284 COLLEGE OF BUSINESS AND PUBLIC ADMINISTRATION SPRING 2008 ANALYSIS OF FIXED INCOME SECURITIES AND RELATED DERIVATIVES www.cbpa.drake.edu/root PROFESSOR: Tom Root E-MAIL: Tom.Root@Drake.edu PHONE: (515) 271-4163 OFFICE HOURS: 9:30-10:30 am Tue & Thur; 5:30-6:00 Tue, Weds, & Thur, 1:30-3:30 Weds OFFICE: 317 Aliber BRIEF COURSE DESCRIPTION: The primary purpose of the course is to provide an introduction to fixed income securities and derivative instruments related to the fixed income market. The class will present an overview of the markets in which fixed income and related derivatives trade; the application of both types of securities by market participants; the economic laws that determine their value; and their application in risk management. TEXTBOOK AND MATERIALS: Fixed Income Analysis, Frank Fabozzi, Second Edition (2007), ISBN 0-470-05221-X, Wiley Publishing CFA Investment Series Fixed Income Analysis Workbook, Frank Fabozzi, 2007, ISBN 0-470-06919-8, Wiley Publishing CFA Investment Series PREREQUISITES: MFM 212, Data Analysis for Decision Making, and MBA/MFM 253, Evaluating Firm Performance, or consent of instructor RULES OF THE GAME: Office Hours The above office hours are when I guarantee that I will be in my office. However, I am in my office the majority of the day on Tuesday, Wednesday, and Thursday. Please feel free to stop by my office anytime; if I am there I am always glad to discuss questions concerning class. I also check e-mail often, feel free to e-mail me at any time. Extra office hours may also be scheduled during the week of an examination. Website An outline of the class notes will be available on the class web site. The notes are not a substitute for attending class (you are expected to be at every class), material will be covered which does not appear in the outline of the notes available on the website. Students are responsible for all material covered in class and in the book. The notes are designed to reduce some of your note taking, not completely replace it, and give you a chance to think in class, in other words, supplement and enhance your notes taken in class. Material covered in class, but not in the notes posted on the website, will not be provided on an individual basis. Homework Format Graded written assignments should be handed in as a well organized “finished product,” points can and will be deducted if answers are difficult to read, grammatically incorrect, or sloppily organized. All assignments are required to be printed (not hand written). Points can and will be deducted if an assignment is hand written. The assignments may require use of spreadsheets, word processing software, and some research outside of the class textbook and material presented in class. Homework will consist of basic problems, involved applications of the course material by financial institutions such as analysis of current economic trends and business conditions. Assignments should be handed in as a paper document in class, not e-mailed as an attachment. Homework Due Dates No late assignments will receive full credit without written documentation from a physician or employer of the EMERGENCY that caused the assignment to be late. Students may turn in assignments late, but will be penalized 20% of the total original points possible for each school day the assignment is late. The tentative assignment due dates are included on the schedule below, assignments are generally passed out over 1 week prior to the due date, plan accordingly. Due dates will not be moved on an individual basis due to “busy schedules.” No late homework is accepted after the answers have been posted on the website or graded assignments have been returned to the class (usually the next class period). A tentative class schedule is attached to this syllabus including due dates for homework. However, homework due dates might change during the semester. It is the responsibility of each student to be aware of schedule changes. Changes in the class schedule ARE NOT an acceptable excuse for late homework. If the university closes because of inclement weather and class is cancelled on the date homework is due, the due date will be moved to the next school day that the university is open (not the next day we have class). DRAKE UNIVERSITY FIN 284 COLLEGE OF BUSINESS AND PUBLIC ADMINISTRATION SPRING 2008 Examinations If an examination is missed without prior approval, the student must have a written University approved excuse. To receive a makeup test, the written excuse should include an explanation and written documentation of the EMERGENCY OR ILLNESS that forced you to miss the exam. Otherwise the score on the test will be recorded as a zero. Make-up exams will usually INCREASE in difficulty from the original examination. Examinations will not be moved due to “busy schedules” (for example multiple exams in one day) or holiday travel plans (mark your calendar now!). A tentative class schedule is attached to this syllabus, including examination dates. However examination dates may change. It is the responsibility of each student to be aware of schedule changes. Changes in the class schedule ARE NOT an acceptable excuse for missed examinations. If the university closes because of inclement weather and class is cancelled on the date an examination is scheduled, the examination will occur in the next scheduled class. Disability Accommodations Any student in this course who has a disability that may prevent him/her from fully demonstrating his/her abilities should contact me personally as soon as possible so we can discuss accommodations necessary to ensure full participation in the course and facilitate your educational process. Requests for test and homework accommodations should be made with the supporting paperwork from disability services at least two weeks prior to the test date or homework due date. Failure to make the request on time may result in the accommodation not being granted. Academic Integrity Policy The College of Business and Public Administration’s Academic Integrity Policy, applies to this course URL http://www.cbpa.drake.edu/aspx/Resources/default.aspx,. Any incidents of academic dishonesty will be reported in writing to the Dean of The College of Business and Public Administration as required by the faculty manual. The consequences of violating this policy vary given my evaluation of the severity of the dishonesty. A violation can result in a grade of zero on the test or assignment, an “F” for the course grade, or even expulsion from the University. Examples of academic misconduct include, but are not limited to: Any misrepresentation of work done by someone else as your own or attempts to alter the work of other students in the class. This includes but is not limited to: Copying homework assignments from other class members or students in previous sections of the class; Allowing other classmates to copy your homework (including sharing your work or e-mailing it to others without the intent of them copying your work); Copying from outside sources (including electronic publications) and presenting it as your own work; Copying during an examination; and Sharing information concerning material on an examination with individuals in other sections of the class. Evaluations Students will be given the opportunity to evaluate the course via a written evaluation during the last two weeks of class. These evaluations are an important part of the course, and routinely result in changes in course policies and procedures. This is your opportunity to influence how this and other courses are taught, students are strongly encouraged to provide thoughtful comments and suggestions on the course. Please turn off your cell phones and pagers during the class. It is disrespectful of and distracting to your fellow classmates for your phone or pager to ring during the class or for you to attempt to talk or type a reply. Additionally, you may miss important information while responding. GRADES: There are 800 points possible in the class, the points are distributed as follows: 6 short papers over readings from the syllabus – 50 points each Semester long Term Paper (groups) Presentation on semester long paper Problem Sets / “Take home Exams” 2 at 125 points each, 1 at 50 points Total 300 points 150 points 50 points 300 points 800 points Grades will be distributed as follows: 720 – 800 points A (90-100%); 640 – 719 points ,B (80 -89.9%); 560 -639 points, C (70-79.9%); 480 – 559 points (60 – 69.9%), D other F. DRAKE UNIVERSITY FIN 284 TENTATIVE CLASS SCHEDULE DATE TOPIC COLLEGE OF BUSINESS AND PUBLIC ADMINISTRATION SPRING 2008 READING(S) 1/22 INTRODUCTION / TERMINOLOGY / CLASSIFICATION Chapter 1 TRADITIONAL VALUATION OF BONDS / INTRO TO RISKS Chapter 2 and Chapter 5 pages 97 - 109 Ilmanen, Antt, “Stock Bond Correlations” Journal of Fixed Income September 2003 1/29 OVERVIEW OF BOND SECTORS (INTRO TO TREASURY ETC) / UNDERSTANDING YIELD SPREADS Chapters 3&4 Varma, Praveen and Richard Cantor. “Determinants of Recovery Rates on Defaulted Bonds and Loans for North American Corporate Issuers 1983-2003” Journal of Fixed Income, March 2005 Chakravarty, Sugato and Asari Sarkr. “Trading Costs in Three US Bond Markets” Journal of Fixed Income June 2003 2/5 VALUATION REVISITED / YIELD MEASURES Chapter 5 pages 109 -117 & Chapter 6 Reading Assignment 1 Due Fisher, Mark “Forces that Shape the Yield Curve” http://www.frbatlanta.org/filelegacydocs/wp0103.pdf What Makes the Yield Curve Move?http://www.sf.frb.org/publications/economics/letter/2003/el2003-15.pdf Gurkaynak, Refet S. Brian Sack and Jonathan Wright “The US Treasury Yield Curve 1961 to Present” Federal Reserve Board Finance and Economics Discussion Series 2006 - 28 http://www.federalreserve.gov/pubs/feds/2006/200628/200628pap.pdf Swanson, Eric. “What we Do and Do Not Know about the Term Premium” FRBSF Economic Letter http://www.frbsf.org/publications/economics/letter/2007/el2007-21.pdf 2/12 INTRO TO MEASUREMENT OF INTEREST RATE RISK Chapter 7 Buetow, Gerald Frank Fabozzi, and Bernd Hanke. “A Note on Common Interest Rate Risk Measures” Journal of Fixed Income September 2003 2/19 TERM STRUCTURE AND VOLATILITY OF INTEREST RATES Chapter 8 Reading Assignment 2 Due Chua, ChoongTxe, Winston TH Koh and Krishna Ramaswamy. “Profiting from Mean Reverting Yield Curve Strategies” Journal of Fixed Income Spring 2006 Riding the Yield Curve: A Variety of Strategies, Journal of Fixed Income September 2005 2/26 VALUING BONDS WITH EMBEDDED OPTIONS Chapter 9 Take Home Exam 1 Due Ederington, Louis and Duane Stock. “Impact of Call Features on Corporate Bond Yields” Journal of Fixed Income September 2002 3/4 MORTGAGE BACKS & ASSET BACKS / VALUATION OF MBS AND ABS Chapters 10, 11, & 12 Reading Assignment 3 Due Bhattacharya, Anand, Aryasomayajula Sekhar and Frank Fabozzi. “Incorporating the Dynamic Link Between Mortgage and Treasury Markets in Pricing and Hedging MBS Journal of Fixed Income Fall 2006 Krianer, John. “Mortgage Innovation and Consumer Choice” FRBSF Economic Letter 2006 http://www.frbsf.org/publications/economics/letter/2006/el2006-38.pdf 3/11 VALUATION OF MBS 3/18 NO CLASS, SPRING BREAK 3/25 DERIVATIVES / VALUATION OF DERIVATIVES Reading Assignment 4 Due 4/1 VALUATION OF DERIVATIVES Take Home Exam 2 Due 4/8 CREDIT ANALYSIS Chapter 15 Reading Assignment 5 Due Turnbull, Stuart. “Unresolved Issues in Modeling Credit Risky Assets” Journal of Fixed Income June 2005 Elizalde, Abel. “Do We Need to Worry About Credit Risk Correlation?” Journal of Fixed Income December 2005 4/15 PORTFOLIO STRATEGIES AND APPLICATIONS Reading Assignment 6 Due 4/22 PRESENTATIONS Take Home Exam 3 Due / Term Papers Due Chapter12 Chapters 13&14 Chapter 14 Chapters 16 17 18 19