ExamTutorials BUS 630 Week 3 DQ 1 Allocating

advertisement

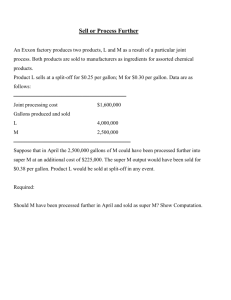

Allocating Joint Costs Describe the three methods used to allocate joint costs. What are the advantages/disadvantages of each allocation method? Which method would you recommend? Why? Support your position with evidence from the text or external sources. Your initial post should be 200-250 words. There are three methods of allocating joint costs. The first method is the physical measures of output, where joint costs are allocated in proportion to a respective product’s output measure (Schneider, 2012). Essentially, if there is product A, B, and C, the allocation to product A would be (A / (A + B + C)) * Total Costs. The advantage of this method is the simplicity of the design. However, there are numerous disadvantages. First, the outputs could have different units of measurement (Schneider, 2012). For instance, one product may be measured by tons, while another is measured by gallons. Second, the physical measures of output may be unrelated to the profitability of the other joint products (2012). For example, suppose a factory uses corn to make animal feed, seed, canned corn, and ethanol products. Based on production, animal feed may have the most costs allocated and ethanol the lowest; but based on revenue, ethanol may make the most money and animal feed the least. Thus, since ethanol is the motivating factor to spend, it should have more costs allocated to it (2012). Essentially, the physical measures of output method do not take into account the revenue-producing ability of each product (Fabozzi, Polimeni, & Drake, 2008). If the allocation is based solely on pounds, technically one pound of seed would have the same unit cost as one pound of canned corn, even though one brings in more revenue than the other (2008). The second method is relative sales value; joint costs are allocated in proportion to total sales values at the split-off point (Schneider, 2012). The advantage of this theory is that the revenue portion lacking from the previous method is now addressed. Furthermore, analysts argue since the price of a product is driven by the cost to create the product, then the revenues made off the product should be addressed in allocating joint costs (Fabozzi, Polimeni, & Drake, 2008). A potential disadvantage of the method is sales prices may not be readily available, and there may not be a market for one of the joint products at the split-off point (2012). Thus, the final method is the net realizable value (NRV), where approximations of the sales value are used, and then total sales revenue minus separable costs equal NRV (Schneider, 2012). The advantage of this method is it addresses the weaknesses of both the physical measures of output and relative sales value methods. Furthermore, the method addresses raw materials as the split-off point, so the proper product (that with highest revenues) is appropriately allocated the most costs (Fabozzi, Polimeni, & Drake, 2008). However, the disadvantages of the method are fluctuations in market value can create fluctuation in costs assigned even though production has not changed, and also the fact that sales revenues are being assumed rather than known (2008). So which method should be recommended? I would recommend the relative sales value for numerous reasons. First, the approach allocates the costs based on proportion of sales (Schneider, 2012). This eliminates the problem of a raw material splitting-off and becoming one product of ‘pounds’ and another of ‘gallons’. Second, the product which has the highest revenue receives the majority of the joint cost allocations, which is logical since a firm is going to invest more direct materials, direct labor, and overhead into the more profitable product (Fabozzi, Polimeni, & Drake, 2008). Finally, Davis (2011) argued the method allows for an even representation of expected gross profits, as the proportions allow for easy calculations of the distribution of profits and also aid in quick calculations if a new product is added at the split-off point. The one weakness of the method is the price at split-off must be known (Schneider, 2012). The net realizable value recognizes and addresses this issue, but does so with assumptions. I am not comfortable with assuming revenues, because these are based on forecasts which may grossly under- or over-estimate the revenues, thus biasing and skewing joint cost allocations. And as the saying goes about assuming… Therefore, I believe relative sales value is the best method. Fabozzi, Polimeni, and Drake agreed, stating this is the most popular method due to the direct relationship between cost and known selling prices based on current market values (2008). Thus, I would recommend relative sales values to most businesses. References Davis, M.K. (2011). Accounting for real estate transactions: A guide for public accountants and corporate financial professionals (2nd Ed.). Hoboken, NJ: Wiley. Fabozzi, F.J., Polimeni, R.S., & Drake, P.P. (2008). Complete CFO handbook: From accounting to accountability. Hoboken, NJ: Wiley. Schneider, A. (2012). Managerial accounting: Decision making for the service and manufacturing sectors. San Diego, CA: Bridgepoint Education.