chapter12.

advertisement

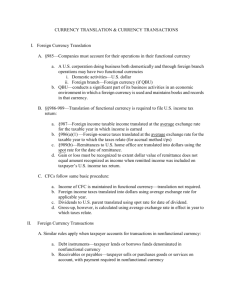

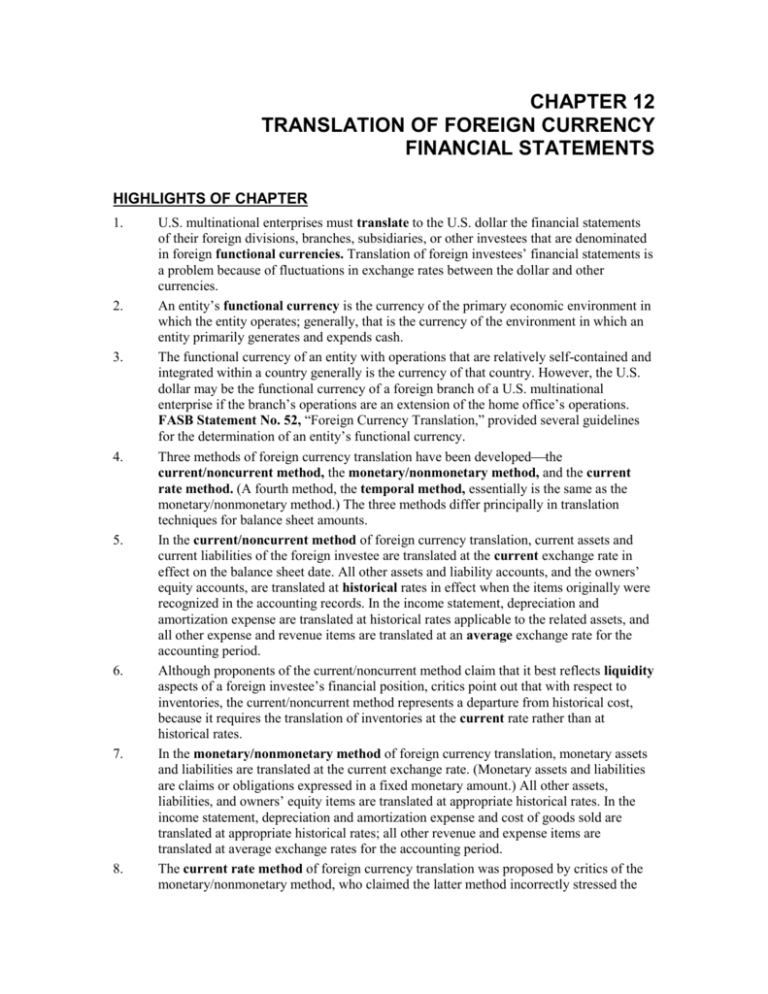

CHAPTER 12 TRANSLATION OF FOREIGN CURRENCY FINANCIAL STATEMENTS HIGHLIGHTS OF CHAPTER 1. 2. 3. 4. 5. 6. 7. 8. U.S. multinational enterprises must translate to the U.S. dollar the financial statements of their foreign divisions, branches, subsidiaries, or other investees that are denominated in foreign functional currencies. Translation of foreign investees’ financial statements is a problem because of fluctuations in exchange rates between the dollar and other currencies. An entity’s functional currency is the currency of the primary economic environment in which the entity operates; generally, that is the currency of the environment in which an entity primarily generates and expends cash. The functional currency of an entity with operations that are relatively self-contained and integrated within a country generally is the currency of that country. However, the U.S. dollar may be the functional currency of a foreign branch of a U.S. multinational enterprise if the branch’s operations are an extension of the home office’s operations. FASB Statement No. 52, “Foreign Currency Translation,” provided several guidelines for the determination of an entity’s functional currency. Three methods of foreign currency translation have been developedthe current/noncurrent method, the monetary/nonmonetary method, and the current rate method. (A fourth method, the temporal method, essentially is the same as the monetary/nonmonetary method.) The three methods differ principally in translation techniques for balance sheet amounts. In the current/noncurrent method of foreign currency translation, current assets and current liabilities of the foreign investee are translated at the current exchange rate in effect on the balance sheet date. All other assets and liability accounts, and the owners’ equity accounts, are translated at historical rates in effect when the items originally were recognized in the accounting records. In the income statement, depreciation and amortization expense are translated at historical rates applicable to the related assets, and all other expense and revenue items are translated at an average exchange rate for the accounting period. Although proponents of the current/noncurrent method claim that it best reflects liquidity aspects of a foreign investee’s financial position, critics point out that with respect to inventories, the current/noncurrent method represents a departure from historical cost, because it requires the translation of inventories at the current rate rather than at historical rates. In the monetary/nonmonetary method of foreign currency translation, monetary assets and liabilities are translated at the current exchange rate. (Monetary assets and liabilities are claims or obligations expressed in a fixed monetary amount.) All other assets, liabilities, and owners’ equity items are translated at appropriate historical rates. In the income statement, depreciation and amortization expense and cost of goods sold are translated at appropriate historical rates; all other revenue and expense items are translated at average exchange rates for the accounting period. The current rate method of foreign currency translation was proposed by critics of the monetary/nonmonetary method, who claimed the latter method incorrectly stressed the 9. 10. 11. 12. 13. parent company aspects of a foreign investee’s financial position and operating results. In the current rate method, all balance sheet items other than owners’ equity are translated at the current exchange rate. Owners’ equity items are translated at historical rates. Revenue and expenses are translated at the current exchange rate if practicable; otherwise, an average rate for the accounting period is used. FASB Statement No. 52, “Foreign Currency Translation,” adopted the current rate method for translating a foreign entity’s financial statements from the entity’s functional currency to the reporting currency of the parent company (the U.S. dollar for a U.S. multinational enterprise). Account balances must be remeasured to the foreign entity’s functional currency if the accounting records are not maintained in the functional currency. Remeasurement essentially is accomplished by the monetary/nonmonetary method described in paragraph 7. If a foreign entity’s functional currency is the U.S. dollar, remeasurement eliminates the need for translation. In the remeasurement of the trial balance of a foreign division or branch, or the financial statements of a foreign subsidiary or other investee, to its U.S. dollar functional currency, the amounts in foreign currency are multiplied by the appropriate exchange rate to obtain the amounts in U.S. dollars. A debit balance (loss) or credit balance (gain) foreign currency transaction gain or loss is computed to balance the remeasured trial balance or financial statements. This foreign currency transaction gain or loss enters into the measurement of combined or consolidated net income. Home office or intercompany accounts may be “remeasured” by substitution of the balance in U.S. dollars of the reciprocal account in the multinational company’s accounting records. In the translation of the trial balance of a foreign division or branch, or the financial statements of a foreign subsidiary or other investee, from a foreign functional currency to U.S. dollars, the amounts in foreign currency are multiplied by the appropriate current exchange rate to obtain the amounts in U.S. dollars. Debit balance or credit balance foreign currency translation adjustments are computed to balance the translated trial balance or financial statements. Foreign currency translation adjustments are displayed in the statement of comprehensive income. Other matters covered in FASB Statement No. 52 include certain foreign currency transaction gains and losses excluded from net income, functional currency in highly inflationary economies, income taxes related to foreign currency translation, and disclosure of foreign currency translation. FASB Statement No. 52 has been criticized for a number of reasons, especially for its alleged establishment of an indefensible distinction between foreign currency transaction gains and losses and foreign currency translation adjustments.