Risk Management in Export

advertisement

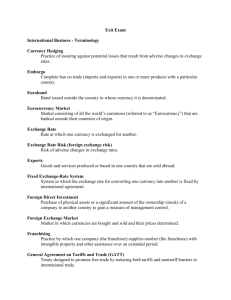

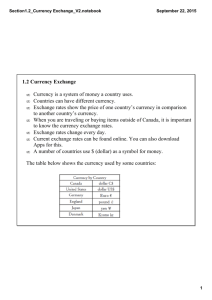

Dr. Bhupinder P S Chahal Risk is a fact of business life, more so of international business. The Management of International business is the management of risk. No manager can make a strategic business decision or enter into important business transaction without a full evaluation of the risks involved. Many of the best business plans have been ruined by a miscalculation or a mistake, or an error in judgment that could have been avoided with proper planning. If the risk cannot be reduced through advance planning and careful execution, perhaps it can be shifted to some other party to the transaction. If the risk cannot be shifted to another party to the transaction, it might be shifted to an insurance company. Many types of risks can be insured against, including the risk of damage to the goods at sea, the risk of loosing an investment in a developing country and many others. (1) Risk Assessment and the Firm’s Foreign Market Entry Strategy: When a firm is considering its entry or expansion in a foreign market, it must consider all options and decide on a course of action commensurate with its objectives, capabilities and its willingness to assume risk. Selling to a customer in another country results in less risk to the firm than licensing trademarks, patents and copyrights there. (2) Managing Distance and Communications: The risks of doing business in a foreign country are different from those encountered at home. A firm doing business in a foreign country would encounter greater distances; problems in communications; language and cultural barriers; differences in ethical, moral and religious codes; exposure to strange foreign laws and government regulations; and different currencies. All these factors affect the risks of doing business abroad. (3) Managing Currency and Exchange Rate Risks: Currency risk is risk a firm is exposed to as a result of buying, selling, or holding a foreign currency. Currency risk includes: (i) Exchange Rate Risk (ii) Currency Control Risk (i) Exchange Rate Risk: Exchange rate risk results from the fluctuations in the relative values of the foreign currencies against each other when they are bought and sold on international financial markets. (ii) Currency Control Risk: Some countries, particularly developing countries where access to ready foreign reserve is limited, put restrictions on currency transactions. In order to preserve the little foreign exchange that is available for international transactions, such as importing merchandise, these countries restrict the amount of foreign currency that they will sell to private companies. This limitation can cause problems for a U.S or any other country exporter waiting for payment from its foreign customer who cannot obtain the dollars needed to pay for the goods. (4) Special Transactions Risks in Contracts for the Sale of Goods: Special risks are inherent in international transactions for the purchase and sale of goods. These transactions present special risks to both the parties because the process of shipping goods and receiving payment between distant countries is riskier than within a country. Such risks are: (i) Payment or Credit Risk (ii) Property or Marine Risk (iii) Delivery Risk (iv) Pilferage and Theft Risk (5) Managing Political Risk: Political Risk is generally defined as the risk to a firm’s business interests arising form political instability or political change in a country in which the firm is doing business. Political Risk includes risk derived from potentially adverse actions of Governments of the foreign countries in which one is doing business or whose laws and regulations one is subject to. It also includes laws and Government policies instituted by the firm’s home country which adversely affect the firms that do business in a foreign country. (6) Risks of Foreign Laws and Courts: Many Acts that are perfectly legal in one country can be illegal in another. Indeed, most travelers to a foreign country could conceivably break a host of laws and not even be aware of it. The same is true for the law of contracts, employment, competition, torts and other business laws. It is virtually impossible to catalog all of the differences between these laws from country to country (7) Commercial Risks: The risks arising from suitability of the product for the market or otherwise change in supply and demand conditions and changes in price. Commercial risks arise due to: (i) Lack of Knowledge (ii) Inability to adapt to the environment (iii) Different kinds of situations to be dealt with (iv) Greater transit time involved (8) Cargo Risk: Transit disasters are an ever present hazard for those engaged in Export-Import business. Every shipment runs the risk of a long list of hazards such as storm, collision, theft, leakage, explosion, spoilage etc. It is possible to transfer the financial losses resulting from perils of and in transit to professional risk bearers known as underwriters. As most goods are transported by marine transport, every exporter should have an elementary knowledge of marine insurance to get the protection at the minimum cost. (1) International Marketing Management-an Indian perspective by R.L Varshney and B.Bhattacharya, Sixth Edition, 2006 published by Sultan Chand and Sons, New Delhi. (2) International Business Law and its Environment by Richard Schaffer, Beverley and Filiberto Augsti, Sixth Edition, 2005 published by Thomson South-Western United States. (3) Manual on Export Documentation published by Commercial Law Publishers (India) Private Limited, NREW Delhi, 2006. (4) International Business Law, Text, Cases and Readings, Fourth Edition, 2004. Published by Prentice Hall, U.S.A (5) International Marketing by Philips R.Cateora and John L. Graham published by Tata McGraw Hill (6) International Business by Charles W.L Hill and Arun K.Jain published by Tata McGraw-Hill Publishing Company Limited, New Delhi. (7) Export and import Management by Aseem Kumar published by Excel Books, 2007